Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expect

4 views • 21 slides

Grossmont Wellness Interest Survey Results & Workplace Wellbeing Insights

Survey results from the Grossmont Wellness Interest Survey show high interest in health and wellness among respondents, with a significant percentage expressing willingness to participate in workplace wellness programs. The data highlights top wellbeing activities, wellness topics of interest, prefe

5 views • 12 slides

Understanding Student Loans: Options, Interest Calculation, Daily Interest Formula

Explore the various options available for student loans, learn how to calculate interest in different loan scenarios, and apply the simplified daily interest formula. Discover key terms like FAFSA, EFC, federal loans, private loans, and more. Dive into examples of interest accrual during school and

0 views • 19 slides

Understanding the Importance of Time Value of Money

Explore the significance of time value of money in financial decisions through topics like interest rates, types of interest, compound interest, future values, and comparing simple versus compound interest. Learn how time allows for earning interest, postponing consumption, and increasing the value

0 views • 41 slides

Understanding Compound Interest and Simple Interest Formulas

Interest rates play a crucial role in financial transactions. Compound interest is earned on both the principal and accumulated interest, while simple interest is earned solely on the principal amount. Different compounding frequencies affect the overall interest earned. Learn how to calculate simpl

1 views • 14 slides

Understanding Compound Interest and Future Value Calculations

Explore the concept of compound interest, its comparison with simple interest, and key formulas to calculate future values. Learn how to calculate interest rates, compounding periods, future values of investments, and present values of money. Understand the significance of periodic rates of interest

1 views • 39 slides

Understanding Simple Interest: Calculations and Examples

Explore the concept of simple interest, including its definition, types, terminology, and calculations. Learn how to calculate interest based on principal, rate, and time with practical examples. Discover how to determine interest earned, balance, and interest rates in various scenarios involving de

0 views • 9 slides

Understanding Compound Interest in Class VIII Mathematics

In this chapter, students will learn about simple interest and compound interest, memorize their formulas, derive compound interest formula from simple interest concept, calculate compound interest with different compounding frequencies, understand growth and depreciation concepts, and derive formul

1 views • 29 slides

Understanding Interest Rate Calculation in Financial Mathematics

This course covers the formula for finding unknown factors of interest rates, such as compound amount, compound interest, and simple interest. Students learn to calculate interest rates based on given values and examples are provided for better understanding.

0 views • 22 slides

Understanding Interest Groups in Texas

Explore the role and influence of interest groups in Texas politics, including theories, types of groups, activities, and the impact of lobbying. Learn about incentives for joining, the free rider problem, and the various benefits interest groups offer. Discover the different types of interest group

0 views • 15 slides

Understanding Monetary Policy Effectiveness in the IS-LM Framework

The relative effectiveness of monetary policy in influencing investment, employment, output, and income depends on the shape of the LM curve and the IS curve. A steeper LM curve signifies higher effectiveness as it indicates less interest elastic demand for money, resulting in significant changes in

0 views • 24 slides

Understanding the Role of Interest Groups in Politics

Interest groups are organizations with shared policy goals that influence the policy process. They differ from political parties as they focus on specific policies. Theories of interest group politics include pluralist, elite, and hyperpluralist perspectives. Hyperpluralism suggests that groups beco

0 views • 22 slides

Conflict of Interest Guidelines Learning Module

This learning module created by the Dominion Leadership and Development Committee explores conflicts of interest in the context of organizational decision-making. It defines conflicts of interest, outlines when conflicts arise, and differentiates between real, potential, and apparent conflicts. Addi

5 views • 8 slides

Understanding the Time Value of Money: Simple vs Compound Interest

Explore the importance of time in financial decisions, the difference between simple and compound interest, and how it affects the future value of your investments. Learn about the formulas for simple interest, examples of its application, and the significance of compound interest for maximizing ret

1 views • 60 slides

Accounting Entries in Hire Purchase System for Credit Purchase with Interest Method

In the Credit Purchase with Interest Method of Hire Purchase System, assets acquired on hire purchase basis are treated as acquired on outright credit basis with interest. This method involves initial entries for recording the asset acquisition, down payments, interest on outstanding balance, instal

0 views • 10 slides

Strong vocational interest blank

Strong Vocational Interest Blank, introduced in 1927 by Edward Kellog Strong Jr., assesses individuals' career preferences based on their likes and dislikes across various dimensions. The Strong-Campbell Interest Inventory, a revised version, includes 124 occupational scales and 23 Basic Interest Sc

0 views • 12 slides

2018 Capital Market Committee Meeting Update on Non-Interest Capital Market Products and Developments

The 2018 Capital Market Committee meeting focused on utilizing Non-Interest Capital Market products like Sukuk for infrastructural financing, regulatory challenges hindering market growth, and promoting financial inclusion. Recent developments include CBN's Exposure Draft on National Financial Inclu

1 views • 6 slides

Understanding Investment Accounts and Transactions in Financial Accounting

Investment accounts involve transactions such as purchasing and selling bonds, debentures, and stocks, with considerations for interest payments, market prices, and accrued interest. Differentiating between Ex-Interest and Cum-Interest transactions is crucial in determining the capital cost of inves

0 views • 7 slides

Cronyism and Special Interests: A Rothbardian Analysis of the Constitutional Convention

Explore how the U.S. Constitution was influenced by cronyism and special interests through the lens of Murray Rothbard's analysis. The presentation delves into how Federalists at the 1787 Constitutional Convention secured privileges, passed special interest legislation, and shaped key clauses to ben

0 views • 23 slides

Understanding Interest Rates and Time Value of Money

This chapter delves into interest rate measurement, defining the force of interest, simple interest, and variable force of interest, along with the concept of time value of money. It explains amount functions, compound interest, effective rate of interest, and includes examples to illustrate calcula

0 views • 20 slides

Enhancing Citizen Engagement for Public Interest

Explore the paradigm shift towards citizen engagement that bridges democracy and public interest. Understand the differences between public and private organizations in serving societal needs. Learn strategic steps for survey research and investment decisions, focusing on building trust and prioriti

0 views • 15 slides

Overcoming the Zero Bound on Interest Rate Policy by Marvin Goodfriend

Exploring the zero bound problem in interest rates, the paper discusses the challenges of negative nominal interest rates, their impact on the economy's stability, and proposed solutions such as carry taxes on money, open market operations, and monetary transfers. Factors affecting real interest rat

0 views • 33 slides

Understanding Interest Rates: Key Concepts and Impacts Explained

Interest rates play a crucial role in financial decisions, affecting borrowing costs, savings, and overall financial success. Learn about compound interest, the impact of rates on payments, and how interest can work for or against you. Gain insights into the complexities of interest and how it influ

0 views • 13 slides

Understanding Derivatives for Managing Interest Rate Risks in Indian Insurance Industry

Exploring the use of derivatives in hedging interest rate risks and their significance in the Indian insurance sector. The seminar delves into interest rate risk management, derivatives market dynamics, challenges, and the impact on insurers. Insights are provided on the investment strategies of ins

0 views • 45 slides

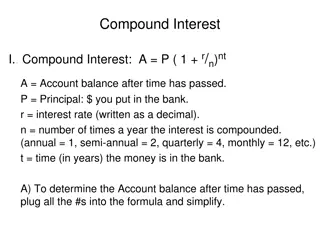

Understanding Compound Interest Formulas in Advanced Financial Algebra

Compound interest involves earning interest not only on the principal amount but also on the accumulated interest. This concept allows money to grow faster over time. By using formulas for periodic compounding, you can calculate the ending balance of investments with different compounding frequencie

0 views • 8 slides

Understanding Compound Interest Formulas and Examples

Compound interest is a powerful concept in finance that calculates the growth of an investment over time. This summary explains the formula for compound interest, how to calculate account balances and interest earned, and examples for various scenarios. You'll also learn how to solve for the princip

0 views • 7 slides

Understanding Compound Interest: A Practical Guide

Compound interest is a powerful financial concept that can significantly impact your savings and investments. This guide explains how compound interest works using geometric series and provides a step-by-step solution to a compound interest problem. Learn about the types of interest, the difference

0 views • 26 slides

Understanding Compound Interest in Advanced Financial Algebra

Compound interest refers to earning interest on both the principal amount and the accumulated interest. This concept is explored through examples of annual, quarterly, and daily compounding, showing how money grows over time based on different compounding frequencies. The formulas and calculations d

0 views • 13 slides

Understanding Compound Interest in Mathematics

This detailed content explains the concept of compound interest in mathematics, covering key terms like moneylender, borrower, principal, rate, and amount. It also delves into simple interest, types of interest, and provides formulas for calculating compound interest based on different scenarios. Pr

0 views • 12 slides

DukeShift User Group and Special Codes Overview

Explore the DukeShift user group details featuring Julia Bambach, Tiffany McNeill, Bernard Rice, John Dale, and updates for February 2023. Learn about new special codes for virtual nursing, quick special code review, VA and SC special codes, and reporting on special codes. Dive into essential topics

0 views • 11 slides

Understanding Financial Conflicts of Interest in Research

In this content, the focus is on the significance of Financial Conflicts of Interest (FCOIs) in research, specifically in academic medical institutions like Jefferson. The IRB's role in reviewing and managing FCOIs to protect research participants and ensure informed consent is highlighted. Areas of

0 views • 20 slides

DEBRA Initiative: Mitigating Tax-Induced Debt-Equity Bias in Corporate Investment

DEBRA is an EU proposal to address the bias towards debt financing over equity in corporate investment decisions by allowing deductibility of notional interest on equity. The initiative aims to create a level playing field, encourage equity-based investments, and combat tax avoidance practices. By h

0 views • 9 slides

Understanding the Loanable Funds Market and Interest Rates

In the loanable funds market, equilibrium interest rates are determined by the interaction of supply and demand. Businesses decide to borrow based on the rate of return, affecting the quantity of loanable funds demanded. Lenders, driven by profit opportunities, supply funds at varying interest rates

0 views • 11 slides

Impact of Negative Nominal Interest Rates on Bank Performance: Cross-Country Insights

Examining the effects of negative nominal interest rates on bank performance reveals challenges in maintaining profitability, with concerns around reduced interest rate margins and disruptions to monetary transmission mechanisms. Empirical evidence suggests a reluctance among banks to impose negativ

0 views • 43 slides

Understanding Interest Rates and Percent Growth

Explore the concepts of interest rates, percent growth, and lending deals through scenarios with Pete the troll under the Brooklyn Bridge. Learn about different lending options, how interest impacts finances, and ways to maximize returns when lending money. Discover equations and methods to calculat

0 views • 7 slides

Student Interest Group Policy Changes Overview

Student Interest Group Policy Changes involve implementing new criteria for student interest groups, setting membership requirements for preclinical and clinical years, consolidating existing groups, and establishing new interest groups. The policy includes guidelines on events, fundraisers, faculty

0 views • 9 slides

Understanding Interest Rates and APR: A Comprehensive Guide

Explore the world of interest rates, APR, and effective annual rates in this detailed guide. Learn about interest rate quotes, adjustments, real vs. nominal rates, the yield curve, and how to convert APR to EAR. Dive into the nuances of financial calculations and the impact of compounding periods on

0 views • 28 slides

Maryland Special Education Parent Involvement Survey FAQ

The Maryland Special Education Parent Involvement Survey aims to assess parental engagement with schools in supporting special education students. Parents/guardians of children aged 3 to 21 receiving special education services are required to complete the survey either online or on paper. Feedback f

0 views • 9 slides

Understanding Simple Interest in Banking and Finance

Explore the concept of simple interest and its application in banking and finance. Learn how to calculate simple interest using the formula and solve examples to understand its practical implications. From earning interest on savings to owing interest on loans, grasp the fundamental principles of in

0 views • 23 slides

Understanding Interest and Calculating Simple Interest

In the realm of financial education, interest plays a crucial role both in savings and debt. Interest on savings helps you earn money, while interest on debt results in paying back more than borrowed. This article explains the concept of interest, how to calculate simple interest, and the difference

0 views • 8 slides