Understanding Interest and Calculating Simple Interest

In the realm of financial education, interest plays a crucial role both in savings and debt. Interest on savings helps you earn money, while interest on debt results in paying back more than borrowed. This article explains the concept of interest, how to calculate simple interest, and the differences between simple and compound interest using practical examples like Homer and Professor Frink. Explore the dynamics of interest to make informed financial decisions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Financial Education - Interest OLI To understand the term interest and calculate simple interest.

Interest to your savings * If you pay 100 into the bank they may tell you that if you leave the money in the bank they will add to it. * They will give you a percentage of your savings. This is called interest. * For example: Save 100. Interest rate is 3% 100 divided by 100 = 1 (1%) x 3 = 3 (3%) 100 + 3 = 103 You have earned 3 interest on your savings.

Interest added to debt When we borrow money, the lender (bank, credit card company etc) will add interest to the amount that we pay them back. This is so they can make money and so it will cost you to borrow money from them. The interest will be a percentage of the amount you borrowed. You then add it on to find the total amount you have to repay. For example, if I borrowed 1000 from my bank (this is called a loan) and the interest rate was 2% I would do the following calculation: Find 2% of 1000 1000 divided by 100 = 10 (1%) x 2 = 20 (2%) 1000 + 20 = 1020

In basic terms Interest on savings is good because you will make money. Interest on debt is bad because you will need to pay back more money that you borrowed.

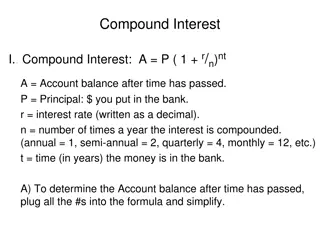

Simple and Compound Interest There are two types of interest: COMPOUND. SIMPLE and

Simple Interest Homer has 10% simple interest on his 200. Each year he will get 10% of his 200. ( 20) Here s how the first 5 years look: Start (year 0)= Year 1= Year 2= Year 3= Year 4= Year 5= 200 220 240 260 280 300 + 20 + 20 + 20 + 20 + 20

Compound Interest (Extra Hot only) Professor Frink has 10% compound interest on his 200. Each year the money in his account will increase by 10%. This will be 10% of the amount of money at the end of each year instead of it being 10% of the initial amount of money. http://realhousewivesrealprofessor.files.wordpress.com/2012/08/professor-frink.gif?w=265h=300 Start (year 0)= Year 1= Year 2= Year 3= Year 4= Year 5= 200 220 242 266.20 292.82 322.10 + 10% of 200 + 10% of 220 + 10% of 242 + 10% of 266.20 + 10% of 292.82

Homer (simple) Frink (compound) Start (year 0)= Year 1= Year 2= Year 3= Year 4= Year 5= 200 220 240 260 280 300 200 220 242 266.20 292.82 322.10 Which is better for savings? Which is better for loans?