Understanding Compound Interest in Class VIII Mathematics

In this chapter, students will learn about simple interest and compound interest, memorize their formulas, derive compound interest formula from simple interest concept, calculate compound interest with different compounding frequencies, understand growth and depreciation concepts, and derive formulas for them. The chapter also explores the historical background of money, banking systems, borrowing with simple and compound interest, and the types of interest. Images and detailed explanations enhance the learning experience.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

COMPOUND INTEREST CLASS-VIII

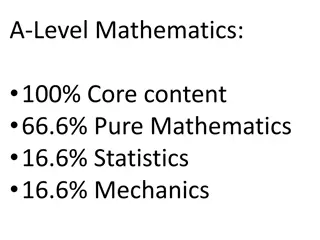

LEARNING OBJECTIVES In this chapter the students will be able to : Define simple interest and compound interest. Memorize the formula of simple interest and compound interest . Derive the formula of compound interest applying the concept of simple interest. Calculate compound interest when the interest is compounded annually , half- yearly and quarterly. Know the concepts of growth and depreciation. Derive the formula of growth and depreciation applying the concept of amount in different situations.

INTRODUCTION Before people began using money , purchase and sell of goods used to be performed through direct exchange of goods. As there was no uniformity of various goods under this system , the values of all goods were converted in terms of money , thus ensuring that a proper value is paid for the goods purchased. Once the monetary system became a standard method of value exchange , the necessity to ensure the safety of money came into existence. With an intension to safeguard money , an also to facilitate availability of money to everyone in the society , gradually the banking system developed.

INTRODUCTION (CONTD) When we need money we normally go to banks , post offices, insurance corporations and other financial companies which lend money and accept deposits. Sometimes we borrow money either paying simple interest or compound interest. When money is borrowed on simple interest then the interest is calculated uniformly on the original principal through out the loan period. In case of compound interest both the borrower and the lender agree to fix a certain unit of time, say one year or a half-year or one quarter of a year to settle the account.

INTRODUCTION (CONTD) When money is borrowed on compound interest , the interest accrued during the first unit of time is added to the original principal and the amount so obtained at the end of the first unit of time is taken as the principal for the second unit of time. The amount of this principal at the end of the second unit of time becomes the principal for the third unit of time and so on. After a certain specified period , the difference between the amount and the money borrowed is called the compound interest (CI).

TYPES OF INTEREST THERE ARE TWO TYPES OF INTEREST SIMPLE INTEREST COMPOUND INTEREST

SIMPLE INTEREST Simple interest is the interest which is calculated on the principal portion of a loan uniformly throughout the loan period.

FORMULA FOR FINDING SIMPLE INTEREST Simple Interest = ? ? ? Where P is Principal R is rate of interest T is time period 100 Amount = Principal + S.I

COMPOUND INTEREST Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. Thought to have originated in 17th century in Italy, compound interest can be thought of as "interest on interest," and will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount.

Lets Watch this. COMPOUND INTEREST.mp4

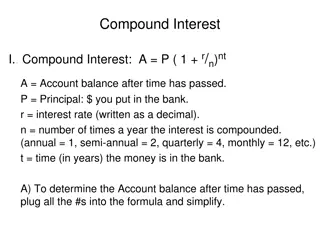

COMPOUND INTEREST Compound interest can be calculated in three different ways : 1- COMPOUNDED ANNUALLY 2- COMPOUNDED HALF YEARLY 3- COMPOUNDED QUARTERLY

INTEREST COMPOUNDED HALF YEARLY Rate of interest =R% p.a=? 2% ??? ???? ???? Time(n)= 2n Half years 2? = P 1 + 2? A=P 1 +?/2 ? 100 200

INTEREST COMPOUNDED QUARTERLY Rate of interest =R% p.a =? 4% ??? ?????? Time(n)= 4n quarters 4? = P 1 + 4? A=P 1 +?/4 ? 100 400

GROWTH AND DEPRECIATION Some quanties such as population , weight, height of a human increase over a period of time under normal condition . The relative increase is called growth. Growth per unit of time is called the rate of growth. Let P be the population at the beginning of a year.

CASE - I If the population growth is constant for all the given number of years ,then population after n years = P 1 + 100 ? ?

CASE - II If the population growth variates for the given number of years . Let it be say, a% for the first year, b% for the second year, then population after two year = P 1 + ? ? 1 + 100 100

CASE - III If the population decreases constantly for the given number of (n) years by R % then population after n years= P 1 ? ? 100

Example 1: What will be the compound interest on Rs. 4000 in two years when rate of interest is 5% per annum? Solution: Given details are, Principal (p) = Rs 4000 Rate (R) = 5% Time = 2years By using the formula, ? 2 ? 5 =4000 105 100 105 A = P 1 + = 4000 1 + 100 100 100 =4000 21 20 21 20= 4410 Compound Interest = A P = Rs 4410 Rs 4000 = Rs 410

Example 2: Find the compound interest on Rs. 1000 at the rate of 8% per annum for 1 years when interest is compounded half yearly. Ans- Given details are, Principal (p) = Rs 1000, Rate (R) = 8% Time = 1 years = 3/2 2 = 3 half years By using the formula, A = P (1 + R/200)n = 1000 (1 + 8/200)3 = 1000 (208/200)3 = Rs 1124.86 Compound Interest = A P = Rs 1124.86 Rs 1000 = Rs 124.86

EXAMPLE 3: Find the compound interest on Rs. 160000 for one year at the rate of 20% per annum, if the interest is compounded quarterly? Ans Given details are, Principal (p) = Rs 160000 Rate (r) = 20% = 20/4 = 5% (for quarter year) Time = 1year = 1 4 = 4 quarters By using the formula, A = P (1 + R/100)n = 160000 (1 + 5/100)4 = 160000 (105/100)4 = Rs 194481 Compound Interest = A P = Rs 194481 Rs 160000 = Rs 34481

EXAMPLE 4: What will Rs. 125000 amount to at the rate of 6%, if the interest is calculated after every four months? Ans - Given details are, Principal (P) = Rs 125000, Rate (R) = 6% per annum, Time (T) = 1 year Since interest is compounded after 4months, interest will be counted as 6/3 = 2% and Time will be 12/4 = 3quarters By using the formula, A = P (1 + R/100)n = 125000 (1 + 2/100)3 = 125000 (102/100)3 = Rs 132651 Amount is Rs 132651

EXERCISE FOR PRACTICE 1- Find the compound interest at the rate of 5% for three years on that principal which in three years at the rate of 5% per annum gives Rs. 12000 as simple interest. 2- On what sum will the compound interest at 5% per annum for 2 years compounded annually be Rs 164? 3- A sum amounts to Rs. 756.25 at 10% per annum in 2 years, compounded annually. Find the sum. 4- What sum will amount to Rs. 4913 in 18 months, if the rate of interest is 12 % per annum, compounded half-yearly? 5- At what rate percent per annum will a sum of Rs. 4000 yield compound interest of Rs. 410 in 2 years? 6-The present population of a town is 28000. If it increases at the rate of 5% per annum, what will be its population after 2 years? 7- Find the compound interest on Rs. 64000 for 1 year at the rate of 10% per annum compounded quarterly. 8-Mr. Dhoni purchases a boat for Rs. 16000. If the total cost of the boat is depreciating at the rate of 5% per annum, calculate its value after 2 years.

POINTS TO REMEMBER In case of simple interest, the interest is calculated on the initial principal where as compound interest is calculated on the principal and the interest on it after every conversion period. The period after which interest is added to the principal is called conversion period and the interest so obtained after a number of conversion periods is called compound interest . If the conversion period is one year, the interest is said to be compounded annually.

POINTS TO REMEMBER ?and compound interest ? Amount A= P 1 + 100 ? 100 ? C.I=A P= P 1 + is the rate of interest per annum and n is the number of conversion period (years). Increase in certain quantities over a period of time is called growth. Decrease in the value of some asset over a period of time is depreciation. 1 , where P is the principal , R

LEARNING OUTCOMES At the end of this chapter the students will be able to Distinguish between simple interest and compound interest. Calculate compound interest from amount. Derive the formula for finding out the compound interest when it is calculated annually , half-yearly and quarterly. Apply the concept of compound interest in their day to day activities. Analyze the growth and depreciation applicable in various situations.

CONCEPT MAP INTEREST SIMPLE INTEREST (SI) COMPOUND INTEREST (CI) Without using formula Using formula I=PRT/10 0 SI= SI is same every year PRT/100 A = P (1 + R/100)n P changes every year New P = Previous year s P + Interest