Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expectations of interest rate movements. Credit and repricing risks also play a significant role in financial contracts. Various alternatives such as floating-rate loans, refinancing, and forward rate agreements are available to mitigate interest rate risk effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chapter 14 Interest Rate and Currency Swaps 1

Interest Rate and Currency Swaps Interest rate risk management Interest rate swaps Use of interest rate swaps and cross-currency swaps to manage both foreign exchange and interest rate risk simultaneously 2

Interest Rate Risk All firms are sensitive to interest rate movements The largest interest rate risk of a non-financial firm is debt service (liability management) For an MNE, differing currencies have differing interest rates thus making this risk a larger concern The second most prevalent source of interest rate risk is its holding of interest sensitive securities (asset management) Whether it is on the left or right hand side of the balance sheet, the reference rate of interest calculation is important The reference rate is the rate of interest used in a standardized quotation, loan agreement, or financial derivative valuation Most common reference rate is LIBOR (London Interbank Offered Rate) 3

Management of Interest Rate Risk The management dilemma is the balance between risk and return Since most treasuries do not act as profit centers, their management practices are typically conservative Before treasury can take any hedging strategy, it must first form an expectation or a directional and/or volatility view Once management has formed its expectations about future interest rate levels and movements, it must then choose the appropriate implementation of a strategy 4

Credit and Repricing Risk Credit Risk or roll-over risk is the possibility that a borrower s creditworthiness at the time of renewing a credit, is reclassified by the lender This can result in higher borrowing rates, fees, or even denial Repricing risk is the risk of changes in interest rates charged (earned) at the time a financial contract s rate is being reset 5

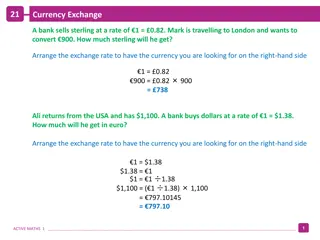

Floating-Rate Loans If a firm wants to manage the interest rate risk associated with a loan, it would have a number of alternatives Refinancing The firm could go back to the lender and refinance the entire agreement Forward Rate Agreements (FRAs) The firm could lock in the future interest rate payment in much the same way that exchange rates are locked in with forward contracts Interest Rate Futures Interest Rate Swaps The firm could swap the floating rate note for a fixed rate note with a swap dealer 6

Forward Rate Agreements (FRAs) A forward rate agreement is an interbank-traded contract to buy or sell interest rate payments on a notional principal Example: If a firm wishes to lock in a debt payment which is currently floating (LIBOR + 0.50%) it can buy an FRA which locks in a total interest payment at 5.50% If LIBOR rises above 5.00%, then the firm would receive a cash payment from the FRA seller reducing their LIBOR payment to 5.0% If LIBOR falls below 5.00% then the firm would pay the FRA seller a cash amount increasing their LIBOR payment to 5.00% 7

Interest Rate Futures Interest Rate futures (Treasury bonds, notes, and bills futures): high liquidity of interest rate futures markets simplicity in use standardized interest rate exposures Traded on an exchange; two most common are the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT) The yield is calculated from the settlement price (Treasury Bills futures only, contract size is $1mil for 90-day Treasury Bills) Example: March 2XX9 contract with settlement price of 97.36 gives an annual yield of 2.64% (100 97.36) 8

Interest Rate Futures If a firm wants to hedge a floating rate payment due in April 2XX9 it would sell a futures contract, or short the contract If interest rates rise, the futures price will fall and the firm can offset its interest payment with the proceeds from the sale of the futures contracts If interest rates fall, the futures price will rise and the savings from the interest payment due will offset the losses from the sale of the futures contracts 9

Strategies Using Interest Rate Futures Strategies Using Interest Futures Futures price falls; Short earns profit Future price rises; Short earns a loss Futures price falls; Long earns a loss Futures price rises; Long earns profit If rates go up Paying interest in the future Sell futures (Short) If rates go down Earning interest in the future If rates go up Buy futures (Long) If rates go down 10

Interest Rate Swaps Swaps are contractual agreements to exchange or swap a series of cash flows If the agreement is for one party to swap its fixed interest payment for a floating rate payment, its is termed an interest rate swap If the agreement is to swap currencies of debt service it is termed a currency swap A single swap may combine elements of both interest rate and currency swap The swap itself is not a source of capital but an alteration of the cash flows associated with payment 11

Interest Rate Swaps If firm thought that rates would rise it would enter into a swap agreement to pay fixed and receive floating in order to protect itself from rising debt-service payments If firm thought that rates would fall it would enter into a swap agreement to pay floating and receive fixed in order to take advantage of lower debt-service payments The cash flows of an interest rate swap are interest rates applied to a set amount of capital, no principal is swapped only the coupon payments 12

Interest Rate Swaps Borrower Counterparty A Counterparty B Difference Rating BBB AAA Fixed-Rate 8.50% 7.00% 1.50% Floating-Rate LIBOR + 0.50% LIBOR 0.50% Counterparty A wants to borrow fixed and Counterparty B wants to borrow floating. Counterparty A is at disadvantage in the Fixed-Rate market, so it should avoid borrowing Fixed-Rate. Counterparty A borrows five-year floating at LIBOR + 0.50%. Counterparty B borrows fixed at 7.00%. Counterparty A pays 7.35% to Swap Bank and Swap Bank pays LIBOR to Counterparty A. Counterparty B pays LIBOR to the Swap Bank and Swap Bank pays 7.25% to Counterparty B. 13

Interest Rate Swaps Swap Bank's Spread (Profit) = 0.10% 7.35% 7.25% Counterparty A Swap Bank Counterparty B LIBOR LIBOR LIBOR + 0.50% 7.00% $100 million loan and 5-year maturity $100 million loan and 5-year maturity Floating Rate Lenders Eurobond Market Lenders Net Cost - (LIBOR + 0.5%) -7.35% LIBOR -7.85% Net Cost -7.00% - LIBOR 7.25% - LIBOR + 0.25% <-------------Pay Due To Borrowing-----------> <---------------Pay Due To Swap--------------> <-------------Receive Due To Swap------------> <-------------Net Cost After Swap------------> 14

Swapping Dollars and Swiss Francs Chow Chemical is trying to hedge the Franc exposure by borrowing at a floating rate in Switzerland while Celin is in need of Dollar financing at a fixed rate in the US. Term of the loans is 3 years for $200 mil. and the current exchange rate is Sfr4.9100/$. Floating Fixed Borrower Chow Chemical Celin Basic strategy: Chow Chemical borrows in the US and Celin borrows in Switzerland. After that they enter into a swap agreement. Currency Franc Franc Rate Currency US $ US $ Rate 7.50% 7.70% LIBOR + 0.35% LIBOR + 0.125% 15

Swapping Dollars and Swiss Francs Fixed-Rate US $ Debt Floating-Rate Franc Debt Interest LIBOR + 0.125% Sfr982 million in 3 years $200 million in 3 years $200 million Today Sfr982 million Today Interest at 7.50% $200 million in 3 years Interest at 7.50% Sfr982 million Today Chow Chemical Celin $200 million Today Interest at LIBOR + 0.125% Sfr982 million in 3 years 16

Unwinding Swaps As with the original loan agreement, a swap can be entered or unwound if viewpoints change or other developments occur Assume that the three-year contract (creating the franc exposure for Chow Chemical) with the Swiss customer terminates after one year, the firm no longer needs the currency swap Unwinding a currency swap requires the discounting of the remaining cash flows under the swap agreement at current interest rates then converting the target currency back to the home currency 17

Unwinding Swaps If Chow has one payment of Sfr50,327,500 (LIBOR + 0.125% where LIBOR is 5%) and another one of Sfr1,032,327,500 (interest plus principal in year three) remaining and the 2 year fixed rate for francs is now 6.50%, the PV of Chow s commitment in francs is Sfr1,032,3 ) . ( 065 1 Sfr50,327, 500 1 27,500 2 065 = + = PV(Sfr) Sfr957,416 ,991 1 ( . ) 18

Unwinding Swaps At the same time, the PV of the remaining cash flows on the dollar-side of the swap is determined using the current 2 year fixed dollar rate which is now 6.20% 0 $15,000,00 PV(US$) 1 + = $215,000,0 00 = 04,753,494 2 $ 2 . 1 ( 062 ) . 1 ( 062 ) 19

Unwinding Swaps Chow s currency swap, if unwound now, would yield a PV of net inflows of $204,753,494 and a PV of net outflows of Sfr957,416,991. If the current spot rate is Sfr4.8010/$ the net settlement of the swap is Sfr957,416 ,991 = = Settlement $204,753,4 94 Sfr4.8010/ $ = 199 $ 420 , 327 , $204,753,4 94 Chow receives a cash payment of $5,333,167 from the swap dealer to terminate the swap 20

Counterparty Risk Counterparty Risk is the potential exposure any individual firm bears that the second party to any financial contract will be unable to fulfill its obligations A firm entering into a swap agreement retains the ultimate responsibility for its debt-service In the event that a swap counterpart defaults, the payments would cease and the losses associated with the failed swap would be mitigated The real exposure in a swap is not the total notional principal but the mark-to-market value of the differentials 21