STATE OF TENNESSEE

The Tennessee State Office of Criminal Justice Programs (OCJP) for an open office hours session where they will discuss common issues related to the OCJP Grants Manual, using your contract budget, amendments, and invoicing. Get answers to your questions and find helpful resources.

2 views • 21 slides

Key requirements and case studies of Subaward Agreements

Learn about the key requirements and case studies of subaward agreements in NIH grants, including the role of the prime recipient, setting up the agreement, written agreement elements, and invoicing and reimbursement. Gain insights from experts in the field.

3 views • 16 slides

Easy Ways To Grow Your Computer Shop

India's best GST invoicing & billing software. Ideal for retail, electronic shops & small businesses. Affordable cloud-based accounting for India's needs.\nContact Us:-\n\nAlign Info Solutions PVT. LTD.\n\nWebsite:- https:\/\/alignbooks.com\/accounting-softwares\n\nAddress: - 801-804 Assotech Tower

5 views • 5 slides

CA Core Presentation AlignBooks Solution

India's best GST invoicing & billing software. Ideal for retail, electronic shops & small businesses. Affordable cloud-based accounting for India's needs.\nContact Us:-\n\nAlign Info Solutions PVT. LTD.\n\nWebsite:- https:\/\/alignbooks.com\/accounting-softwares\n\nAddress: - 801-804 Assotech Tower

2 views • 21 slides

Buy Verified Square Account

Buy Verified Square Account\nhttps:\/\/reviewinsta.com\/shop\/buy-verified-square-account\/\nSquare Account is a financial services platform that provides a variety of tools for businesses to manage their finances. With a Square account, users can accept credit and debit card payments, track sales a

3 views • 16 slides

Use Busy Accounting Software on Your PC or Laptop from Anywhere, Anytime.

https:\/\/bsoft.co.in\/busy-on-cloud\/\nCall For Free Demo : 91 9990-46-9001\nEmail: info@bsoft.in\n\nBusy Accounting Software allows you to manage your finances conveniently from anywhere, anytime. Whether you're using your PC or laptop, you can access the software easily. With its user-friendly i

2 views • 3 slides

Essential Features of a Sales System for Business

A sales system for business is a digital platform that helps track key metrics, customer information, and sales-related material to achieve sales goals. Features include Invoicing, Inventory Management, Customer Orders, Supplier Orders, and Integrated Supplier Purchases. Managing these aspects effic

0 views • 9 slides

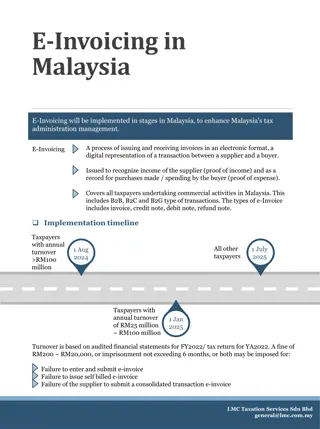

Implementation Plan for E-Invoicing in Malaysia

E-Invoicing is being phased in across Malaysia to improve tax administration. It involves electronic issuance and receipt of invoices, crucial for income recognition and expense records. The implementation timeline is set by annual turnover, with fines for non-compliance. The process includes steps

0 views • 9 slides

Grant Management Training: Post-Award Basics Workshop

This comprehensive workshop covers post-award basics in grant management, including contracts and grants accounting, new fund requests, grant budgets, personnel actions, purchase order management, financial reporting, and closeout processes. Key steps in the post-award process are detailed, such as

0 views • 37 slides

Summer 2023 GCA Forum Updates and Award Structures Presentation

Welcome to the Summer 2023 GCA Forum where updates from GCA, award structures in Workday, and unique elements of awards are discussed. Topics include handling backlog in award setup, manual invoicing issues, delayed reporting, and more. Join us for insights from Vince Gonzalez, Associate Director of

1 views • 21 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

1 views • 5 slides

Mastering Invoice Creation in QuickBooks_ A Step-by-Step Guide

Learn how to create an invoice in QuickBooks with our detailed guide. Whether you're using QuickBooks Online or Desktop, we'll walk you through each step, from setting up customers to customizing invoice templates and sending out professional invoices. Our guide ensures you can efficiently manage yo

1 views • 4 slides

QuickBooks Online Login_ A Smooth Start to Your Finances (1)

In the realm of digital finance management, QuickBooks Online stands out as a leading cloud-based accounting solution tailored for businesses of all sizes. Its accessibility and robust features make it a preferred choice for managing finances, invoicing, expenses, and more. This article explores the

1 views • 6 slides

Create an Invoice in QuickBooks

Creating an invoice in Quickbooks is a fundamental aspect of business operations, essential for billing customers and tracking revenue. QuickBooks, developed by Intuit, offers powerful tools to streamline the invoicing process, whether you're using QuickBooks Online or QuickBooks Desktop.

1 views • 6 slides

Streamlining the UNC Health Care System Contracts Process

This document provides an overview of the UNC Health Care System's new contract process, policies, and procedures. It outlines the necessary steps for approval, invoicing, and contract execution, emphasizing the importance of following standardized guidelines. The revised policy aims to standardize

1 views • 24 slides

Vendor Invoicing Process Overview

Detailed presentation slides outlining the vendor invoicing process for the Department of Rehabilitation. Topics covered include multi-factor authentication, authorization procedures, invoice processing steps, and submitting invoices through the VRC Portal for expedited processing.

1 views • 15 slides

Streamlining Payment Process for Covid-19 Vaccination Programme

The Price Per Dose (PPD) payment mechanism simplifies and accelerates the payment process for Covid-19 vaccination providers and organizations. By automating payment processing based on vaccination records, it eliminates the need for manual invoicing, ensuring swift and accurate payments. To start P

5 views • 17 slides

G-Invoicing Implementation at USDA

G-Invoicing is an online portal facilitating electronic information exchange for interagency agreements among Federal agencies. The system streamlines invoicing processes, standardizes transactions, and enhances communication for reimbursable activities. The implementation at USDA involves mandatory

0 views • 26 slides

Overview of Funding for Practice Placements in Healthcare Education

This presentation by Ben Whistance provides an in-depth overview of the recent changes in funding for practice placements in healthcare education, detailing the shift from invoicing practices to direct payments from Health Education England (HEE). It covers the new tariff rates for Nursing, Allied H

0 views • 7 slides

Efficient Supplier Portal for GE Transportation/Wabtec iSupplier Training

GE Transportation/Wabtec offers a user-friendly iSupplier Portal (iSP) for suppliers to manage invoices, payments, and orders efficiently. Learn how to register, receive system updates, and ensure compliance for seamless transactions. Access web invoicing, credit card processing, and ERS settlement

0 views • 16 slides

Federal Aid Process for Transportation Projects Overview

Federal funding for transportation projects is sourced from the Highway Trust Fund and General Fund, with states and local agencies implementing projects within federal programs like MAP-21. The process involves various roles and responsibilities, project authorization phases, agreements, accounting

0 views • 22 slides

Update on Invoice Processing Platform (IPP) Implementation

The Invoice Processing Platform (IPP) is a web-based system provided by the U.S. Treasury for tracking invoices from award to payment notification. This update outlines the scope, schedule, and implementation overview, including phases and actions needed for successful invoicing. Vendors are require

0 views • 8 slides

South Dakota DOE Mentor Program Overview

The South Dakota Department of Education Mentor Program was established by the S.D. Legislature in 2016 to support new teachers in the profession. The program aims to increase the number and retention of new teachers, enhance instructional quality, build a strong educator community in South Dakota,

0 views • 12 slides

Alleged Fake Invoicing Scandal Unveiled in GST Case Study Panel Discussion

ABC Ltd, a steel manufacturing company, is embroiled in an alleged fake invoicing scandal involving multiple parties. The Managing Director's shocking confession on social media revealed inflated invoicing practices, triggering investigations and potential repercussions for the parties involved. The

5 views • 34 slides

Purchasing Operations and Guidelines at Irving ISD

Director Jerome oversees purchasing operations at Irving ISD, detailing the process, rules, and primary functions. The purchasing process includes obtaining quotes, creating purchase orders, and handling delivery and invoicing. Rules emphasize the importance of following proper procedures to avoid p

0 views • 14 slides

iNEISTM Billing and Collection System Overview

iNEISTM is an integrated system for managing billing, invoicing, and collection processes in educational institutions. The system allows users to efficiently handle tuition calculations, student transactions, ad-hoc charges, and report generation. With features like automatic calculation and manual

0 views • 69 slides

Manage Student Invoicing and Payment in iNEISTM Training Slides

Training slides for managing student invoices, billing, collection, fee charging procedures (automatic and manual), correcting fees, collecting payments, reversing incorrect payments, and handling excess payments or refunds in the Integrated National Education Information System (iNEISTM).

0 views • 9 slides

Important Updates and Reminders for CalHOPE Support Program Office

Stay informed with the latest updates for the CalHOPE Support Program Office, including a request for proposal extension, funding options, invoicing guidelines, program reporting requirements, mental health resources, and details for the next office hours meeting. Ensure compliance and readiness for

4 views • 7 slides

Highlights of 54th GST Council meeting held on 9 September 2024

The 54th GST Council meeting introduced crucial GST rate changes on goods and services, new RCM rules, and updates on Section 128A. The Council also recommended B2C e-invoicing rollout and clarified the taxability of various ancillary services.

0 views • 3 slides

National Conference on GST at National Library, Kolkata - 7th Oct 2023

Join CA Venugopal Gella at the 2-day National Conference on GST to delve into topics such as e-invoice, litigative issues, e-way bill, legal provisions, notifications, rules, and exemptions. Explore relevant dates, persons exempted, and transactions covered by e-invoicing. Gain insights on important

1 views • 54 slides

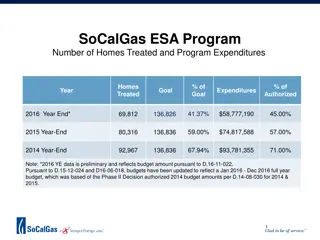

SoCalGas Energy Savings Assistance Program Overview

SoCalGas Energy Savings Assistance program aims to treat homes in Southern California, with significant progress made in recent years. The program focuses on achieving energy savings goals, with intensified efforts in designated areas. Positive developments include paperless invoicing and mobile pil

0 views • 16 slides

Alabama Department of Transportation Local Master Calendar Planning Schedule 2022

The schedule outlines various tasks to be completed by the Alabama Department of Transportation for the year 2022, including urban funds reporting, performance measures tracking, certification reviews, archival tasks, cube voyager invoicing, reporting to MPOs, and work program calculations. The deta

1 views • 61 slides

Streamlining VA Invoicing Process with New Innovations

Maximizing efficiency in the VA invoicing process through the implementation of new innovations such as detailed rotation definitions, block schedules, and accurate billing components. These advancements lead to improved capturing of rotations, streamlined reporting for CMS and Medicaid, and simplif

0 views • 12 slides

Mental Health Medi-Cal Administrative Activities Invoice Training Overview

This training covers the essential components of Mental Health Medi-Cal Administrative Activities Invoice, including learning objectives, schedule details, purpose, source data requirements, documentation, and review processes. Participants will gain a thorough understanding of reporting time, staff

0 views • 31 slides

Streamlining Invoicing Process with PayPaw in BuyWays - May 2017

PayPaw is a new workflow introduced for invoicing through BuyWays to streamline the Procure to Pay process, improve accuracy, and ensure payments are directed to the correct supplier. By scanning invoices directly into BuyWays, manual data entry is eliminated, enhancing efficiency and reducing proce

0 views • 15 slides

Semantic Data Model of Electronic Invoicing Core Elements

Presentation by Fred van Blommestein on the EN16931-1 semantic data model of core elements in electronic invoicing, covering invoice processes, core invoice design, semantic model details, business rules, and invoicing principles. The model includes 160 elements in 33 groups, with mandatory elements

0 views • 13 slides

IPP Rollout and Support Training Overview

The Invoice Processing Platform (IPP) rollout and support training on November 2, 2017, aimed to introduce a secure, web-based service developed by the Department of the Treasury that facilitates cradle-to-grave government invoicing. The platform is integrated with the OFF 12.1.3 environment, mandat

0 views • 33 slides

Tax Invoices, Debit Notes, and Credit Notes in Goods and Services Tax

This content covers the basic concepts of supply, invoicing obligations, tax invoices under Section 28, removal of goods for supply, and scenarios where removal does not result in a supply. Learn about the different types of taxes and when tax invoices should be issued for taxable goods and services

0 views • 28 slides

Comprehensive Contact Details and E-Invoice Information for UPM Suppliers

Obtain detailed contact information for UPM invoicing addresses and e-invoicing processes. Learn how to reach the FS Contact Center for inquiries and service requests. Explore additional details on e-invoicing with Basware and registration to the Basware portal.

0 views • 4 slides

HIV Integrated Planning Council Spending Report FY2020-2021

The HIV Integrated Planning Council's Second Quarter Spending Report for FY2020-2021 highlights underspending challenges in Philadelphia due to late invoicing, vacancies, and delays in leveraging funding sources. COVID-19 has impacted the invoicing process for various service categories, leading to

1 views • 12 slides