Implementation Plan for E-Invoicing in Malaysia

E-Invoicing is being phased in across Malaysia to improve tax administration. It involves electronic issuance and receipt of invoices, crucial for income recognition and expense records. The implementation timeline is set by annual turnover, with fines for non-compliance. The process includes steps for e-Invoice creation, submission, validation, and notification between suppliers and buyers. Various transmission methods and mechanisms are detailed, catering to different business sizes and volumes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

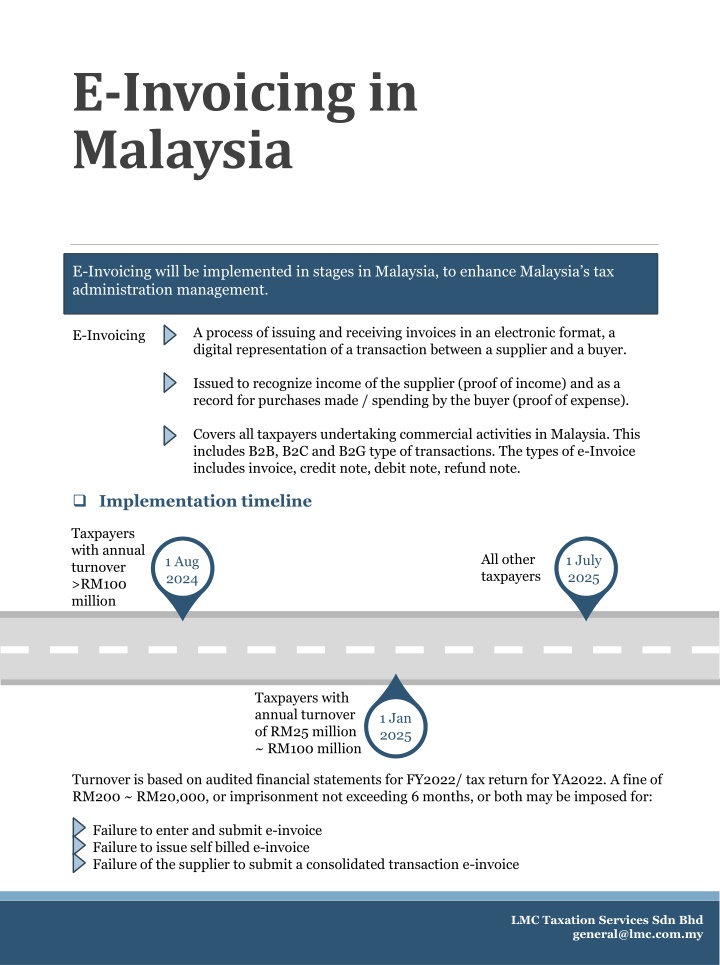

E-Invoicing in Malaysia E-Invoicing will be implemented in stages in Malaysia, to enhance Malaysia s tax administration management. A process of issuing and receiving invoices in an electronic format, a digital representation of a transaction between a supplier and a buyer. E-Invoicing Issued to recognize income of the supplier (proof of income) and as a record for purchases made / spending by the buyer (proof of expense). Covers all taxpayers undertaking commercial activities in Malaysia. This includes B2B, B2C and B2G type of transactions. The types of e-Invoice includes invoice, credit note, debit note, refund note. Implementation timeline Taxpayers with annual turnover >RM100 million All other taxpayers 1 July 2025 1 Aug 2024 Taxpayers with annual turnover of RM25 million ~ RM100 million 1 Jan 2025 Turnover is based on audited financial statements for FY2022/ tax return for YA2022. A fine of RM200 ~ RM20,000, or imprisonment not exceeding 6 months, or both may be imposed for: Failure to enter and submit e-invoice Failure to issue self billed e-invoice Failure of the supplier to submit a consolidated transaction e-invoice LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 E-Invoice overview workflow Rejection/ cancellation must be done within 72 hours from time of validation E-Invoice mechanism MyInvois portal hosted by IRB Requires upfront investment and adjustments to existing systems. Ideal for large businesses with substantial transaction volume. API transmission methods include: (i) Direct integration of taxpayers Enterprise Resource Planning (ERP) system with MyInvois system (ii) Through Peppol service providers (iii) Through non-Peppol providers Free and accessible to all. Has the option for batch generation through spreadsheet upload for multiple transactions. Back-up option when API connection is unavailable. Types of e-Invoice transmission mechanism Application Programming Interface (API) LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 The first step is always to get confirmation from the buyer if an e-invoice is required. If not required, supplier can consolidate and submit to IRB within 7 days after month end. E-Invoice model workflow steps A Digital Certificate will be issued by the IRB serving as taxpayer's identifier for online transactions and communications. The digital signature will verify that the submitted e- invoice originates from a specific taxpayer. The following outlines the key steps for both mechanisms of e-Invoice: API MyInvois Portal Supplier to create e-invoice and submit via the MyInvois Portal, either individually or by batch. E-Invoice can be submitted via 3rd party technology solutions e.g. Point-of-Sale (POS) system / web portal / mobile app that are integrated with the IRB's MyInvois System. Supplier to attach digital signatures to e- invoices. Creation and submission Supplier will receive a validated e-Invoice and a visual representation in PDF if successful. Otherwise, a resubmission is required. API response will be sent to the supplier. Supplier to include QR code with validation link. Validation IRB can notify supplier and buyer via the notification API. IRB will notify both supplier and buyer via the MyInvois Portal for successful invoice validation, invoice clearance and buyer's rejection. and buyer's rejection. IRB will notify both supplier and buyer via the MyInvois Portal for successful invoice validation, invoice clearance Notification Buyer can directly access validated e-invoice via web portal / mobile app, or from the supplier. Supplier is required to share the validated e-invoice with the buyer. Sharing Activities that require e-Invoice to be issued for each transaction (consolidation not allowed): Licensed betting and gaming Construction Automotive and aviation Payments to agents/ dealers/ distributors Luxury goods and jewellery Wholesalers/retailers of construction materials LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 Employment perquisites, benefits or expenses paid on behalf of employer Employees are required to request for e-Invoices to serve as proof of expense and submit for claims (e.g. club membership, gym membership, professional subscriptions, parking etc). The e-Invoices can be issued in the name of the employee, the employer or the existing document format issued by the supplier. This is not applicable for foreign suppliers as the IRB will accept foreign supplier s receipts/ bills/ invoices directly as proof of expense. Self-billed e-Invoice The buyer should issue e-Invoice on his own (self-billed) for the following transactions: E-commerce (issued by platform providers) Interest payment Purchase of goods / services from a foreign seller Acquisition of goods or services from individual taxpayers who are not conducting a business Profit distribution (e.g. dividend). Exemption allowed for companies not entitled to deduct tax under S108 of the Income Tax Act 1967 and listed companies Payout to all betting and gaming winners (casino and gaming machines related are exempted until further notice) Payment / credit to taxpayers recorded in a statement / bill issued on a periodic basis (e.g. rebate) Payments (monetary or otherwise) to agents/ dealers/ distributors Recipient is required to issue e-Invoice within the same month for all foreign income (e.g. foreign profits, dividend etc) receivedin Malaysia as proof of income. Disbursement and reimbursement Where taxpayer incurs disbursement and reimbursement, it should present these separately (e.g. one line for service fee charges and another line for disbursement / reimbursement) in the e-invoice. Where taxpayer only pays on behalf and the supplier had issued e-invoice directly to the buyer. The taxpayer is not required to issue a separate e-invoice on such payment on behalf. LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 Field requirements in e-Invoice There are 55 data fields, and the following table summarises the fields for various scenarios: e-Invoice for Self billed e-Invoice Consolidated e-Invoice individual/business customers Basic details Supplier's name Malaysian i) Business - Full name of business Non-Malaysian i) Business - Full name of business Malaysian i) Business - Full name of business Non-Malaysian i) Business - Full name of business General Public Buyer's name ii) Individual - Full name as per IC /MyTentera ii) Individual - Full name as per passport /MyPR /MyKAS number ii) Individual - Full name as per IC/MyTentera ii) Individual - Full name as per passport/MyPR /MyKAS number Supplier's tax identification number (TIN) TIN TIN TIN Option 1: TIN Option 2: Input EI00000000030 TIN Supplier's registration / identification / passport number i) Business - registration number i) Business - registration number i) Business - Business registration number i) Business - Business registration number Business registration number ii) Individual - IC /MyTentera number ii) Individual - Passport /MyPR /MyKAS number ii) Individual - IC / My Tentera number ii) Individual - Passport /MyPR /MyKAS number NA if information not available for purchases from foreign sellers Supplier's SST registration number Supplier's tourism tax registration Supplier's email SST number or "NA" if not registered Tourism tax registration number of "NA" Supplier email address Option 1: email address Option 2: Input NA Option 1: MSIC code Option 2: Input 00000 Option 1: email address Option 2: Input NA Option 1: MSIC code Option 2: Input 00000 Supplier email address Supplier's Malaysia Standard Industrial Classification (MSIC) code MSIC code - refer IRB schedule MSIC code - refer IRB schedule LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 Field requirements in e-Invoice The following table summarises the basic fields required in e-Invoice for various scenarios: e-Invoice for Self billed e-Invoice Consolidated e-Invoice individual/business customers Basic details Supplier's business activity description Malaysian Business activity description Non-Malaysian Malaysian Non-Malaysian Option 1: Business activity description Option 2: Input NA Business activity description Buyer's TIN Option 1: TIN Option 2: EI00000000010 i) Business - Business registration number Option 1: TIN Option 2: Input EI00000000020 i) Business - Business registration number Option 1: TIN Option 2: EI00000000010 i) Business - Business registration number Option 1: TIN Option 2: Input EI00000000020 i) Business - Business registration number Input EI0000000- 0010 NA Buyer's registration / identification / passport number ii) Individual Option 1: IC/ MyTentera number Option 2: Input 000000000000 ii) Individual Option 1: Passport /MyPR /MyKAS number Option 2: Input 000000000000 ii) Individual Option 1: IC/ MyTentera number Option 2: Input 000000000000 ii) Individual Option 1: Passport /MyPR /MyKAS number Option 2: Input 000000000000 Buyer's SST registration number [where applicable] Buyer's email SST number or "NA" if not registered NA Buyer's email address Buyer's email address Option 1: email address Option 2: NA i) Business - Business addresss Option 1: email address Option 2: NA i) Business - Business addresss NA Supplier's address i) Business - Business addresss i) Business - Business addresss Supplier's address ii) Individual - Residential address Buyer's address NA ii) Individual - Residential address ii) Individual - Residential address ii) Individual - Residential address Supplier's contact number Buyer's contact number Supplier contact no. Buyer contact no. NA LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 Field requirements in e-Invoice The following table summarises the additional fields required in e-invoice: Invoice details e-Invoice version e-Invoice type (invoice / credit note/ debit note / refund note) e-Invoice code / number Remarks Invoice version based on IRB's schedule Invoice type based on IRB's schedule Reference number of the invoice/bill/receipt/dividend voucher issued by supplier (if applicable) Where applicable. IRB's unique identifier number of original invoice e-Invoice original reference number (for debit note, credit note, refund note) e-Invoice date and time Issuer's digital signature Invoice currency code Currency exchange rate Frequency of billing Billing period Classification Description of product / services Sale or transaction date and time e.g., 31/10/2023 14:30:59 To be provided by IRB Invoice currency code based on IRB's schedule Where applicable. Numerical values with four (4) decimal places. Optional, where applicable. Input based on IRB's schedule. Optional, where applicable. Input based on months or "-". 3 digit classification code based on IRB schedule. For consolidated e-Invoice, the following methods are allowed: i) Summary of each receipt as separate line item ii) List of receipts (in a continuous receipt number) is presented as line items. Where there is a break of the receipt number chain, the next number shall be included as a new line item. iii) Each branch or location adopting either (i) or (ii) above. [receipt reference number that made up to the total sales are required to be included in the description breakdown] Numerical values with two (2) decimal places. Sales tax / service tax / tourism tax / withholding tax etc. Applicable for both line item and invoice level Numerical values with two (2) decimal places. Unit price Tax type Tax rate (%) Tax amount (MYR) Numerical values with two (2) decimal places. Applicable for both line item and invoice level Applicable for items with tax exemption. Numerical values with two (2) decimal places. Details of tax exemption Amount exempted from tax Subtotal Numerical values with two (2) decimal places. Amount of each individual item / service within the invoice, excluding any taxes, charges or discounts, applicable for line item only. Total excluding tax Numerical values with two (2) decimal places. Sum of amount payable (inclusive of applicable discounts and charges), excluding applicable taxes. Applicable for both line item and invoice level. Total including tax Numerical values with two (2) decimal places. Sum of amount payable inclusive of total taxes chargeable, applicable for invoice level only. LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 Field requirements in e-Invoice The following table summarises the additional fields required in e-invoice: Total net amount Sum of total amount payable (inclusive of applicable line item and invoice level discounts and charges), excluding applicable taxes. Applicable for invoice level only. Optional, where applicable. Sum of amount payable (inclusive of total taxes chargeable) excluding any amount paid in advance and any rounding adjustment, applicable at invoice level only. Total payable amount Rounding amount Rounding amount added to the amount payable, applicable at invoice level only. Optional, where applicable. Sum of amount chargeable for each tax type, applicable for invoice level only. Optional, where applicable. Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable. Input based on IRB's schedule. Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable Optional, where applicable Total taxable amount per tax type Quantity Measurement Discount rate Discount amount Fee / charge rate Fee / charge amount Payment mode Supplier's bank a/c number Payment terms Prepayment amount Prepayment date Prepayment reference number Bill reference number LMC Taxation Services Sdn Bhd general@lmc.com.my

E-Invoicing in Malaysia | 2024 Field requirements in e-Invoice The following tables summarises the fields required in the annexure of e-Invoice. This following is applicable to transactions where goods are shipped to a different recipient and /or address (i.e. different from buyer's details): Details Shipping recipient's name Shipping recipient's address Shipping recipient's TIN Shipping recipient's registration number Remarks Registered business name. Registered business address. Business TIN. Business registration number / IC number / MyTentera / Passport number/ MyPR / MYKAS identification number The following is applicable to import and export of goods Details Reference number of Customs Form No.1, 9 etc Incoterms Remarks Based on reference number by the Customs Based on rules issued by the International Chamber of Commerce e.g. CIF The following are additional optional fields to be included in Annexure to the e-invoice Details Product tariff code Free trade agreement Authorisation number for certified exporter For export only, if applicable. Based on requirements of the Ministry of Investment, Trade and Industry (MITI) Reference number of Customs Form No.2 Based on reference number by the Customs Country of origin Based on IRB's schedule. Details of other charges Based on requirements of Customs Remarks Only applicable to goods. Based on HS code. For export only, if applicable LMC Taxation Services Sdn Bhd general@lmc.com.my