Guide To Buying A Luxury Home

This home-buying guide provides a plethora of easily accessible luxurious real estate. But if your objective is to buy a dream home rather than just a big, expensive asset, you need educate yourself on the processes involved in buying a luxury home.

2 views • 3 slides

Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expect

4 views • 21 slides

Home Buying Interest Rates | thehomeloanarranger.com

Find the best home buying interest rates with thehomeloanarranger.com. Let us help you make your dream home a reality. Get started now!\n\n\/\/thehomeloanarranger.com\/

4 views • 1 slides

Loan Payment Examples and Scenarios

Explore various loan payment scenarios including changing interest rates, additional payments, and different repayment schemes. Calculate amounts, interest rates, and payment adjustments for loans taken out by investors like Salma Alsuwailem, Rachael, Bob, and Ben. Dive into the details of effective

0 views • 9 slides

Understanding Interest Rates and Valuation in Financial Markets

Explore the meaning and significance of interest rates in financial valuation, focusing on the concept of yield to maturity as a crucial measure. Learn how present value calculations and different types of credit market instruments play a role in determining interest rates and influencing investment

3 views • 29 slides

Understanding Student Loans: Options, Interest Calculation, Daily Interest Formula

Explore the various options available for student loans, learn how to calculate interest in different loan scenarios, and apply the simplified daily interest formula. Discover key terms like FAFSA, EFC, federal loans, private loans, and more. Dive into examples of interest accrual during school and

0 views • 19 slides

Understanding the Importance of Time Value of Money

Explore the significance of time value of money in financial decisions through topics like interest rates, types of interest, compound interest, future values, and comparing simple versus compound interest. Learn how time allows for earning interest, postponing consumption, and increasing the value

0 views • 41 slides

Computation of Machine Hour Rate: Understanding MHR and Overhead Rates

Computation of Machine Hour Rate (MHR) involves determining the overhead cost of running a machine for one hour. The process includes dividing overheads into fixed and variable categories, calculating fixed overhead hourly rates, computing variable overhead rates, and summing up both for the final M

4 views • 18 slides

Understanding Buying Motives in Consumer Behavior

Buying motives are the underlying reasons that drive consumers to make purchasing decisions. This article explores the meaning, features, classification, significance, and distinction between buying motives and selling points. Learn how buying motives influence product planning, pricing policies, pr

0 views • 10 slides

Understanding Compound Interest and Simple Interest Formulas

Interest rates play a crucial role in financial transactions. Compound interest is earned on both the principal and accumulated interest, while simple interest is earned solely on the principal amount. Different compounding frequencies affect the overall interest earned. Learn how to calculate simpl

1 views • 14 slides

Understanding Compound Interest and Future Value Calculations

Explore the concept of compound interest, its comparison with simple interest, and key formulas to calculate future values. Learn how to calculate interest rates, compounding periods, future values of investments, and present values of money. Understand the significance of periodic rates of interest

1 views • 39 slides

New Mexico Graduation Rates 2018-2019 Analysis

The New Mexico Public Education Department utilizes a Shared Accountability Model to calculate graduation rates, considering students' time enrolled at each school. Graduation rates are calculated after a two-step verification process, with on-time graduates in focus. Historical data shows a positiv

0 views • 13 slides

Understanding Simple Interest: Calculations and Examples

Explore the concept of simple interest, including its definition, types, terminology, and calculations. Learn how to calculate interest based on principal, rate, and time with practical examples. Discover how to determine interest earned, balance, and interest rates in various scenarios involving de

0 views • 9 slides

Understanding Compound Interest in Class VIII Mathematics

In this chapter, students will learn about simple interest and compound interest, memorize their formulas, derive compound interest formula from simple interest concept, calculate compound interest with different compounding frequencies, understand growth and depreciation concepts, and derive formul

1 views • 29 slides

Understanding Interest Rate Calculation in Financial Mathematics

This course covers the formula for finding unknown factors of interest rates, such as compound amount, compound interest, and simple interest. Students learn to calculate interest rates based on given values and examples are provided for better understanding.

0 views • 22 slides

Accounting Entries in Hire Purchase System for Credit Purchase with Interest Method

In the Credit Purchase with Interest Method of Hire Purchase System, assets acquired on hire purchase basis are treated as acquired on outright credit basis with interest. This method involves initial entries for recording the asset acquisition, down payments, interest on outstanding balance, instal

0 views • 10 slides

Understanding Interest Rates and Time Value of Money

This chapter delves into interest rate measurement, defining the force of interest, simple interest, and variable force of interest, along with the concept of time value of money. It explains amount functions, compound interest, effective rate of interest, and includes examples to illustrate calcula

0 views • 20 slides

Understanding Exchange Rate Behavior with Negative Interest Rates: Early Observations by Andrew K. Rose

In this study, Andrew K. Rose examines the exchange rate behavior in economies with negative nominal interest rates, focusing on the impact and implications of such rates on exchange rates. The findings suggest limited observable consequences on exchange rate behavior, with similarities in shocks dr

0 views • 42 slides

Overcoming the Zero Bound on Interest Rate Policy by Marvin Goodfriend

Exploring the zero bound problem in interest rates, the paper discusses the challenges of negative nominal interest rates, their impact on the economy's stability, and proposed solutions such as carry taxes on money, open market operations, and monetary transfers. Factors affecting real interest rat

0 views • 33 slides

Understanding Interest Rates: Key Concepts and Impacts Explained

Interest rates play a crucial role in financial decisions, affecting borrowing costs, savings, and overall financial success. Learn about compound interest, the impact of rates on payments, and how interest can work for or against you. Gain insights into the complexities of interest and how it influ

0 views • 13 slides

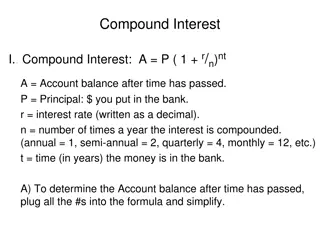

Understanding Compound Interest Formulas and Examples

Compound interest is a powerful concept in finance that calculates the growth of an investment over time. This summary explains the formula for compound interest, how to calculate account balances and interest earned, and examples for various scenarios. You'll also learn how to solve for the princip

0 views • 7 slides

Understanding Compound Interest: A Practical Guide

Compound interest is a powerful financial concept that can significantly impact your savings and investments. This guide explains how compound interest works using geometric series and provides a step-by-step solution to a compound interest problem. Learn about the types of interest, the difference

0 views • 26 slides

Understanding Compound Interest in Advanced Financial Algebra

Compound interest refers to earning interest on both the principal amount and the accumulated interest. This concept is explored through examples of annual, quarterly, and daily compounding, showing how money grows over time based on different compounding frequencies. The formulas and calculations d

0 views • 13 slides

Understanding Compound Interest in Mathematics

This detailed content explains the concept of compound interest in mathematics, covering key terms like moneylender, borrower, principal, rate, and amount. It also delves into simple interest, types of interest, and provides formulas for calculating compound interest based on different scenarios. Pr

0 views • 12 slides

Understanding the Significance of Financial Markets and Institutions

Studying financial markets and institutions is crucial as it facilitates the efficient transfer of funds, promotes economic growth, impacts personal wealth, influences business decisions, and plays a significant role in determining interest rates. Debt markets, including bond markets, enable borrowi

0 views • 15 slides

Guide to Home Buying Essentials

This comprehensive guide covers essential topics for prospective homebuyers, including course objectives, financial considerations, advantages and disadvantages of homeownership, the home buying process, household finances, saving strategies, and budgeting basics. From understanding your rights to p

0 views • 28 slides

DEBRA Initiative: Mitigating Tax-Induced Debt-Equity Bias in Corporate Investment

DEBRA is an EU proposal to address the bias towards debt financing over equity in corporate investment decisions by allowing deductibility of notional interest on equity. The initiative aims to create a level playing field, encourage equity-based investments, and combat tax avoidance practices. By h

0 views • 9 slides

Understanding the Loanable Funds Market and Interest Rates

In the loanable funds market, equilibrium interest rates are determined by the interaction of supply and demand. Businesses decide to borrow based on the rate of return, affecting the quantity of loanable funds demanded. Lenders, driven by profit opportunities, supply funds at varying interest rates

0 views • 11 slides

Outcome of AEG Consultation on Treatment of Negative Interest Rates by Real Sector Division IMF Statistics Department

A detailed analysis of the outcome of the AEG consultation on the treatment of negative interest rates by the Real Sector Division IMF Statistics Department. The summary includes members' agreement with the proposed treatment, the closure of the consultation, feedback received, and the need for furt

0 views • 5 slides

Impact of Negative Nominal Interest Rates on Bank Performance: Cross-Country Insights

Examining the effects of negative nominal interest rates on bank performance reveals challenges in maintaining profitability, with concerns around reduced interest rate margins and disruptions to monetary transmission mechanisms. Empirical evidence suggests a reluctance among banks to impose negativ

0 views • 43 slides

Renting vs. Buying a Home: Key Differences and Considerations

Understanding the choice between renting and buying a home is essential for anyone looking to enter the real estate market. This overview covers key terms, reasons for each choice, expenses, implications for short and long-term financials, and ideal candidates for renting or buying a home. Additiona

0 views • 22 slides

Understanding Interest Rates and Percent Growth

Explore the concepts of interest rates, percent growth, and lending deals through scenarios with Pete the troll under the Brooklyn Bridge. Learn about different lending options, how interest impacts finances, and ways to maximize returns when lending money. Discover equations and methods to calculat

0 views • 7 slides

Impact of Negative Nominal Interest Rates on Bank Performance

Negative nominal interest rates, implemented following the financial crisis, have had a limited effect on bank performance globally. While low rates reduce profitability, banks have shown resilience through adjustments in funding allocations and non-interest income sources. Studies suggest that resp

0 views • 34 slides

Student Interest Group Policy Changes Overview

Student Interest Group Policy Changes involve implementing new criteria for student interest groups, setting membership requirements for preclinical and clinical years, consolidating existing groups, and establishing new interest groups. The policy includes guidelines on events, fundraisers, faculty

0 views • 9 slides

Understanding Interest Rates and APR: A Comprehensive Guide

Explore the world of interest rates, APR, and effective annual rates in this detailed guide. Learn about interest rate quotes, adjustments, real vs. nominal rates, the yield curve, and how to convert APR to EAR. Dive into the nuances of financial calculations and the impact of compounding periods on

0 views • 28 slides

Understanding Interest Rates and Real Growth in Finance

Explore the dynamics of interest rates, real growth theory, inflation's impact on purchasing power, the Fisher equation, and the theory of interest by J.R. Hicks. Learn about ex-ante vs. ex-post real interest rates and the term premium in fixed income markets. Understand how credit spreads and defau

0 views • 22 slides

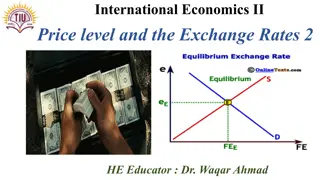

Understanding the Effects of Monetary Policy on Exchange Rates

Explore the interconnected relationship between money supply, interest rates, and exchange rates in international economics. Learn how changes in domestic and foreign money supplies impact currency depreciation, appreciation, and interest rate fluctuations. Gain insights into the long-run effects of

0 views • 26 slides

Understanding Simple Interest in Banking and Finance

Explore the concept of simple interest and its application in banking and finance. Learn how to calculate simple interest using the formula and solve examples to understand its practical implications. From earning interest on savings to owing interest on loans, grasp the fundamental principles of in

0 views • 23 slides

Understanding Interest and Calculating Simple Interest

In the realm of financial education, interest plays a crucial role both in savings and debt. Interest on savings helps you earn money, while interest on debt results in paying back more than borrowed. This article explains the concept of interest, how to calculate simple interest, and the difference

0 views • 8 slides

Understanding Interest Rates: A Comprehensive Guide

Explore the terminology, calculation, and importance of various interest rates in our lives and the economy. Learn about measuring interest rates, real versus nominal rates, and the distinction between rates and returns. Dive into finance fields, debt concepts, time value of money, and investment va

0 views • 48 slides