Renting vs. Buying a Home: Key Differences and Considerations

Understanding the choice between renting and buying a home is essential for anyone looking to enter the real estate market. This overview covers key terms, reasons for each choice, expenses, implications for short and long-term financials, and ideal candidates for renting or buying a home. Additionally, it details the steps to take when buying a home, highlighting the importance of personal and financial goals, resources, credit history, and other crucial factors.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

HOUSING: TO BUY OR RENT?

Agenda Overview Rent vs. Buy? Steps to buying a home

Terms to know Interest The cost of borrowing money Principal The amount of the actual loan (money obtained by customer) What is real estate? Ownership of retail or business property What is a mortgage? A loan to purchase real estate in which the property serves as the collateral

Reasons for making a home choice Personal and financial goals Financial resources and readiness Credit history Real estate prices Location preference Expected length of stay in a particular place

What is renting? Renting is the cost of using someone else's property Security Deposit- an advance payment to cover wear and tear on the unit Lease- a legal contract between the tenant and the landlord

What is home ownership? Home ownership means the buyer has purchased a housing unit as property. Home ownership is typically made possible through a mortgage loan, and down payment

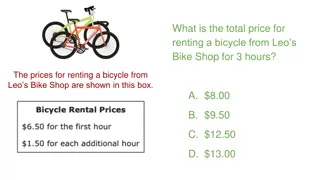

Expense comparison Renting Monthly Rent Security Deposit Utilities Renter's insurance Owning Monthly mortgage payments Down payment Utilities Homeowners insurance Real estate property taxes maintenance

Rent vs. Buyslide 1 Who pays more, renters or buyers? Short-term? Long-term? Use online tools to determine affordability. Realitor.com has great online tools link to realtor.com website

Rent vs. Buy-slide 2 Class activity worksheet Work in teams!

Rent vs. Buyslide3 Who is ideal for renting a home? Traditional College Student Someone with an uncertain future (desired new location, unstable/unsecured employment) Someone who wants minimal responsibilities Who is ideal for home buying? A person with stable income and a long employment history Someone who is planning to stay in the same community for at least 5-8 years Someone looking to invest their income

Can I afford to buy? Use online tools to determine what homes you can afford, for easy and accurate calculations Realtor.com link to mortgage calculator on realtor.com

3 realities of home buying 1. Historically low Interest rates link to federal reserve website regarding interest rate history 2. A buyer s market? Link to real estate charts and graphs 3. Tougher lending standards

Steps to buying a homeslide 1 Step 1: Get your finances in order (6 months before) Step 2: Prequalify for a mortgage (3 to 5 months before) Step 3: Search for a home (2 to 4 months before) Step 4: Agree to terms with a seller (2 months before) Step 5: Obtain a mortgage loan (1 to 2 months before) Step 6: Prepare for and attend the closing (last 4 weeks)

Steps to buying a home slide 2 Step 1: Get your finances in order (6 months before) Clean up credit report (if needed) Link to get your free credit report Adjust your budget to meet your estimated monthly housing costs

Steps to buying a home slide 3 Step 2: Prequalify for a mortgage (3 to 5 months before) Three determinants of a mortgage: Amount borrowed Length of loan (e.g. 30 years, 10 years) Interest rate - Link to graph of 30 year interest rates from St. Louis Federal Reserve Credit score- Link to website for FICO score Mortgage Tips Tip 1: If a dual-income household, use one income or part-time work for second person to determine mortgage or home affordability Tip 2: Get mortgage quotes from three different lenders

Steps to buying a home slide 4 Step 3: Search for a home (2 to 4 months before) Online (most helpful) Real estate agent - link to YouTube video: Freakonomics Asks: Does your real estate agent have your best interest in mind? Tips: Tip 1: Ask the seller/realtor lots of questions Tip 2: Spend time in the neighborhood Tip 3: Bring a small rubber ball

Steps to buying a home slide 5 Step 4: Agree to terms with a seller (2 months before) Negotiate a price with the seller Give earnest money to seller when making an offer Have a lawyer go over the contract with you Hire a home inspector before you sign

Steps to buying a home slide 6 Step 5: Obtain a mortgage loan (1 to 2 months before) Decide on a lender Consider a mortgage lock-in Obtain the formal loan commitment/approval from lender

Steps to buying a home final slide Step 6: Prepare for and attend the closing (last 4 weeks) Make moving arrangements Activate all utilities Initiate the change of address Correct an errors in the contract or uniform settlement agreement Sign the papers on closing day!

Questions Robert Caldwell 402-738-4771 rcaldwell11@mccneb.edu

Additional Information-2 Nondiscrimination and Equal Opportunity Statement Metropolitan Community College does not discriminate on the basis of race, color, national origin, religion, sex, marital status, age, disability or sexual orientation in admission or access to its programs and activities or in its treatment or hiring of employees. This work is licensed under the Creative Commons Attribution 4.0 International License. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/ This product was funded by a grant awarded by the U.S. Department of Labor s Employment and Training Administration. The product was created by the grantee and does not necessarily reflect the official position of the U.S. Department of Labor. The Department of Labor makes no guarantees, warranties, or assurances of any kind, express or implied, with respect to such information, including any information on linked sites and including, but not limited to, accuracy of the information or its completeness, timeliness, usefulness, adequacy, continued availability, or ownership. The Nebraska Consortium of community colleges is comprised of equal opportunity/affirmative action institutions.