Top Business Expense Management Solutions Companies

The integration of technology and changing company priorities are influencing the business expense management process in the US. Automation and artificial intelligence (AI) are critical in streamlining these transformations and automating receipt processing and data entry tasks. It speeds up process

2 views • 6 slides

ECC Social Value Reporting and Evaluation Framework

Essex County Council (ECC) has implemented a robust Social Value Reporting and Evaluation framework based on the Local Government Association's National TOMs method. This framework categorizes and assesses social value contributions in two parts - Value Score and Supporting Statement Score - to deri

3 views • 16 slides

Effective Financial Management for CSOs: Key Strategies and Tools

CSOs must prioritize effective financial management to ensure sustainability and integrity. Key aspects include budget creation, expense tracking, debt management, and adhering to budgeting rules. Understanding income, expenses, and project funding are essential for financial health. This unit cover

1 views • 13 slides

Travel Expense & Concur Classroom Training Overview

Explore the essentials of travel expense management and Concur classroom training at FSU, covering topics such as travel procedures, reimbursement guidelines, recent updates, legal authority, and approver roles. Understand Florida travel basics, pre-travel requirements, and more. Enhance your knowle

3 views • 55 slides

Expense Card Training

This Expense Card Training Program provides detailed information on card activation, documentation, reconciliation, security measures, auditing, and more. It covers the program goals, types of cards available, and outlines the policy regarding spending limits, restricted items, tax exemptions, and s

5 views • 36 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

1 views • 3 slides

Distribution of Income and Expense Document Overview

This document provides detailed information on the Distribution of Income and Expense (DI) process within Kuali Capital Asset Management (CAM). It explains the purpose of DI documents, their use in capitalizing Work-In-Progress (WIP) assets, and the various scenarios in which DI documents are utiliz

3 views • 29 slides

Final Expense Insurance: Product Features and Riders

Final Expense Insurance offers simplified issue whole life coverage with guaranteed premiums and death benefit options for ages 0-85. The policy includes various riders such as accelerated benefits, grandchild protection, and accidental death benefits. Additional features like terminal illness and c

0 views • 12 slides

Chrome River Overview - Travel and Expense Management System

Chrome River offers a comprehensive travel and expense management system with features such as pre-approvals, expense reports, P-Card management, mobile access, receipt capture, and single sign-on capability. Benefits include ease of use, mobile access, reduced paper usage, and automatic routing. Th

1 views • 12 slides

Getting Started with Concur: Financial & Business Services Presentation

Learn how to access Concur, update your Concur profile, assign travel and expense delegates, set up your profile, designate a travel arranger, and assign an expense delegate in this informative presentation from Financial & Business Services at the University of Utah. Access domestic and internation

0 views • 10 slides

Clayton State University Travel and Expense Guidelines

CSU employees must adhere to travel and expense reimbursement guidelines set by the university, including obtaining travel authorization, submitting expense reports promptly, and following specific document submission requirements. Cash advances are available under certain conditions and must be rep

0 views • 39 slides

Proposed Business Expense and Travel Reimbursement Policy Updates - April 2019

Business Expense and Travel Reimbursement Policy updates aimed at ensuring compliance with IRS rules, benchmarking with peers, addressing preferred purchasing methods, and enhancing communications and training. Key stakeholders and core team members involved in the project are listed.

1 views • 23 slides

Streamlining Electronic Reporting of COVID Lab Results to OSDH

This documentation outlines the process of electronically reporting COVID lab results to the Oklahoma State Department of Health (OSDH). It covers the purpose, available options, specifications, formats, and the onboarding and testing process, aiming to accelerate the reporting of healthcare facilit

1 views • 9 slides

Evaluation of Expense Allocation Proposal in ABC LIFE Insurance Company

ABC LIFE insurance company, facing reduced SH return from NPAR products due to expense allocation changes, contemplates increasing expense loading in PAR products. The presentation evaluates this proposal within the regulatory framework, exploring justifications, challenges, and alternative solution

1 views • 13 slides

Overview of 1099 Reporting Systems

The 1099 Reporting Systems consist of MINC, EARN, and SPPS, which are used for IRS 1099 reporting purposes. These systems handle transactions and generate Form 1099 for recipients based on predefined criteria. Taxpayers are responsible for accurate reporting to the IRS, with reporting thresholds set

1 views • 15 slides

Accounting & Financial Reporting Services Overview

Accounting & Financial Reporting is responsible for reviewing and processing various financial documents, monitoring account reconciliations, and generating internal and external financial reports. The staff members specialize in areas such as capital projects, account reconciliation, and processing

0 views • 45 slides

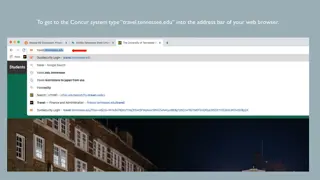

Navigating the Concur System for Travel Expense Management

Explore the step-by-step guide on how to access and utilize the Concur system for travel expenses at tennessee.edu. Learn how to log in via IRIS web and manage travel delegates efficiently. Discover features like Expense Delegates, Travel Assistant, Request References, and more to streamline your tr

2 views • 16 slides

UNEP Support for Improving UNCCD Reporting Procedures

UNEP has been providing support since 2010 to enhance the reporting processes of the UNCCD, focusing on streamlined funding approaches, technical assistance, and capacity building. Key outcomes include the development of reporting tools, online reporting systems, and building credible data from coun

0 views • 14 slides

Climate Change Monitoring, Reporting, and Verification (MRV) Training Session Overview

This document outlines the purpose and reporting requirements for the development of a Climate Change Monitoring, Reporting, and Verification (MRV) system, focusing on projections and scenarios. It highlights the importance of collecting information for climate mitigation, assisting Serbia in meetin

0 views • 19 slides

Transitioning to Incident-Based Crime Reporting: Enhancing Transparency and Accountability

Anytown Police Department (APD) is leading the transition from Summary Reporting to Incident-Based Reporting through the National Incident-Based Reporting System (NIBRS). This change promotes transparency, provides detailed crime data to the public, and improves statewide and national crime statisti

3 views • 17 slides

Insights into Structured Reporting Practices in Colorectal Cancer Imaging

A survey conducted by Dr. Eric Loveday at North Bristol NHS Trust revealed the current landscape of structured reporting in MRI and CT scans for rectal and colon cancer. Results indicate a positive outlook towards implementing national standards for structured radiology reporting, with an emphasis o

0 views • 7 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Expense Report Management Best Practices for Travel in 2023

Learn how to efficiently manage expense reports for travel in 2023 using Concur. Discover tips on submitting, reviewing, and processing expense reports, handling open requests with no expense reports, and more. Find out about the new Meal Per Diem policy starting in January 2024. Stay organized and

0 views • 28 slides

Efficient Expense Reporting with Allocations

Streamline your expense reporting process by following a step-by-step guide to create an expense report with allocations. Learn how to clear alerts, add allocations, and submit your report efficiently within your organization's system. Make the most of the allocated budgets for different expenses.

0 views • 10 slides

Updates and Changes for Travel Expenses and Purchasing Cards

Meeting on February 28, 2019 highlighted updates on UAT testing completion, purchasing card changes, expense reporting modifications, and blanket travel pre-approvals. Issues with per diem calculations, mileage, and expense routing were discussed. It was emphasized that all expenses must be in compl

0 views • 14 slides

Simpler Systems Reporting Pilot for Financial Data Enhancement

The Simpler Systems Reporting Pilot is underway to enhance financial data reporting at the university campus. Led by Vice President Ryan Nesbit's team, this initiative aims to improve University-wide financial reporting mechanisms and accessibility to data through the Simpler tool. The pilot include

1 views • 5 slides

Overview of WISEdata Snapshot Preparation and Reporting Requirements

The WISEdata Snapshot Preparation provides crucial details on data entry, validation, and reporting processes for educational institutions. It outlines the importance of accurate data collection for federal reporting, public reporting, and funding determinations. Additionally, the Snapshot Reporting

0 views • 41 slides

Ensuring Chemical Reporting and Preparedness at the DEQ

The Chemical Reporting and Preparedness section at the DEQ focuses on regulations under EPCRA, prompted by incidents like the Bhopal tragedy. EPCRA covers Tier II reporting, spill reporting, LEPCs, State Emergency Response Commission, and Oklahoma Hazardous Materials Emergency Response Commission. T

0 views • 17 slides

ARPA Reporting Overview and SLFRF Guidelines in Alaska

This document outlines the reporting overview for the ARPA (American Rescue Plan Act) and specific guidelines for the Coronavirus State and Local Fiscal Recovery Fund (SLFRF) in Alaska. It covers acceptance, use, and reporting of funds, as well as designating staff roles for managing reports. The co

5 views • 22 slides

Clayton State University Travel and Expense Reimbursement Guidelines

Guidelines for travel and expense reimbursement at Clayton State University including rules to follow, travel authorization process, submission of expense reports, required documents, and procedures for cash advances. Compliance with federal laws, state regulations, and university policies is emphas

0 views • 39 slides

Efficient Guide to Using Concur for New Employee Travel Training

Discover how Concur simplifies new employee travel training through integrated features like expense reporting, travel bookings, and encumbrances. Learn how to log in, access training materials, manage profiles, submit requests, and utilize the system effectively. Concur is the go-to system for all

0 views • 16 slides

Efficient Expense Allocation and Reporting Process

Learn how to allocate expenses within your organization, create detailed expense reports, attach receipts, and change allocations for different departments. Follow the outlined steps for seamless expense management.

0 views • 15 slides

Feedback Analysis on Medication Incident Reporting in Hospitals

Feedback received from IMSN members on NIMS and incident reporting revealed various issues affecting the rates at which staff report medication incidents/near misses within hospitals. Major themes included staffing numbers and turnover, pharmacist involvement in incident reporting, clinical pharmacy

0 views • 12 slides

Importance of Wildland Fire Reporting to the Fire Community

Wildland fire reporting plays a critical role in providing accurate data for effective fire management. Defined state fires and challenges in reporting impact funding, risk management, and agency support. Comprehensive reporting like the Wildland Fire Occurrence Reporting for Massachusetts is essent

0 views • 6 slides

Guide to Creating Moving/House Hunting Expense Report Using Concur

Learn how to create a moving/house hunting expense report using Concur without the need for a request. Follow the steps outlined in the slides to include essential information like department account number and appointment letter. Sign in to Concur, create a new report, enter required details on the

0 views • 9 slides

Efficient Expense Management and Reporting Guidelines

Explore the latest updates and guidelines for expense management and reporting, covering terminology updates, eligibility criteria for Chrome River, expense inclusions, program selection tips, report completion frequency, and delegation best practices. Stay informed on creating, entering, and approv

0 views • 14 slides

Understanding the Expense Prediction Bias: Study on Underestimation of Future Expenses

Expense Prediction Bias (EPB) refers to the persistent underestimation of future expenses. Research shows that individuals tend to under-predict their future expenses due to various factors. This study explores the magnitude of EPB in an adult sample, highlighting a mean EPB of $63.58, with predicte

0 views • 28 slides

Streamlining Expense Management with CentreSuite: Accessibility and Efficiency

CentreSuite is a web-based expense management tool being adopted due to changes like the end of a contract with US Bank, BPS compliance, and tax calculation enhancements. It prioritizes AODA guidelines, ensuring accessibility features for all users. By incorporating accessible features and embracing

0 views • 18 slides

Streamlining Research Progress Reporting for NIH Awards

Research Performance Progress Report (RPPR) is a standardized mechanism to facilitate interim progress reporting for NIH-funded projects, aiming to enhance consistency and minimize administrative burdens. It replaces the eSNAP process for certain types of awards and fellowship grants. RPPR includes

0 views • 12 slides

Chrome River Expense Management Overview

Explore the features and benefits of Chrome River Expense Management, including Approval Queues, Department Naming Conventions, Employee Reimbursements, Invoice Module, Reports, and the transition from current processes to Chrome River. Understand the methodology of going simple with electronic appr

0 views • 23 slides