Effortless Campaign Management with Salesflow360

Manage voice campaigns, monitor calls, create call lists, and integrate with clients like Ricochet or Allstate. Easily send SMS, MMS, or promotional banners. Choose SMS, MMS, or email campaigns, create custom banners, and monitor deliverability using integrated tools. Watch results, import contacts,

1 views • 13 slides

Use Busy Accounting Software on Your PC or Laptop from Anywhere, Anytime.

https:\/\/bsoft.co.in\/busy-on-cloud\/\nCall For Free Demo : 91 9990-46-9001\nEmail: info@bsoft.in\n\nBusy Accounting Software allows you to manage your finances conveniently from anywhere, anytime. Whether you're using your PC or laptop, you can access the software easily. With its user-friendly i

2 views • 3 slides

Best CRM for lead management

Workday CRM is easy to use CRM software that is designed for B2B. It include everything you need to run your businesses. like manage customers, projects, invoices, estimates, time logs

1 views • 1 slides

Best Customer Relationship Management CRM services Lead Project Management

Workday CRM is easy to use CRM software that is designed for B2B. It include everything you need to run your businesses. like manage customers, projects, invoices, estimates, time logs

0 views • 1 slides

Contract Management & Tracking Tool

Learn to streamline invoices, analyze key indicators, and manage financial operations effectively. Tools enable data entry, reporting, and monitor payment cycles to ensure program success and accountability. Popular

1 views • 15 slides

Controversial issues under the Income Tax & Fake Invoice

Controversial issues surrounding income tax and fake invoices discussed at the National Conference in Indore. Topics include fake billing, burden of proof, and maintaining quantity details to avoid scrutiny. Learn about cases where genuine transactions were questioned and how to prevent disallowance

2 views • 129 slides

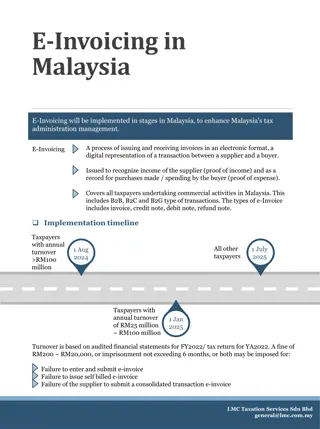

Implementation Plan for E-Invoicing in Malaysia

E-Invoicing is being phased in across Malaysia to improve tax administration. It involves electronic issuance and receipt of invoices, crucial for income recognition and expense records. The implementation timeline is set by annual turnover, with fines for non-compliance. The process includes steps

0 views • 9 slides

Streamlining Documentation Processes with Cargo Cloud Solutions

In today's fast-paced world, efficiency is key, especially in the logistics and transportation industry where every minute counts. One area that often presents challenges is the documentation process involved in cargo handling. From invoices to customs declarations, the paperwork can be overwhelming

14 views • 5 slides

Efficient Payment Processing Workflow with Transcepta Integration

Streamline accounts payable processes with Transcepta by automating invoice submission, payment creation, and voucher review. Connected suppliers can submit invoices easily via various methods, and Accounts Payable can efficiently review and process incoming invoices for payment. Helpful queries and

3 views • 17 slides

Caltrans District 12 Technical Advisory Committee Meeting Updates

Updates from a recent Technical Advisory Committee meeting for Caltrans District 12 include important deadlines for submitting allocations, information on inactive invoices, updates on the Active Transportation Program, announcements regarding the Clean California Local Grant Program, and reminders

1 views • 12 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

1 views • 5 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

0 views • 5 slides

Caltrans District 12 Local Assistance Update - March 27, 2024

The Caltrans District 12 Local Assistance Update for March 27, 2024, provides important information on various topics such as CTC Meetings deadlines, Inactive Invoices submission, Active Transportation Program (ATP) updates, and Highway Safety Improvement Program (HSIP) details. Stay informed about

0 views • 13 slides

Local Assistance Update - Technical Advisory Committee Meeting April 26, 2023

Update on various topics discussed during the Technical Advisory Committee meeting including CTC Meetings deadlines, Inactive Invoices submission, Active Transportation Program updates, and Clean California Local Grant Program application deadlines. Details about each item and their respective deadl

0 views • 12 slides

How to Delete a Invoice in QuickBooks?

How to Delete a Invoice in QuickBooks?\nTo delete an invoice in QuickBooks, follow these steps meticulously. First, access the \"Invoices\" section after logging into your QuickBooks account. Then, locate the specific invoice you wish to remove from the list displayed. Open the invoice to view its d

0 views • 4 slides

Integrating PayPal with QuickBooks

Integrating PayPal with QuickBooks streamlines financial management by seamlessly syncing transactions, invoices, and payments. This integration enhances accuracy, efficiency, and visibility into your business's finances. Automatic reconciliation saves time, while real-time data updates ensure up-to

2 views • 3 slides

Mastering Invoice Creation in QuickBooks_ A Step-by-Step Guide

Learn how to create an invoice in QuickBooks with our detailed guide. Whether you're using QuickBooks Online or Desktop, we'll walk you through each step, from setting up customers to customizing invoice templates and sending out professional invoices. Our guide ensures you can efficiently manage yo

1 views • 4 slides

How to Delete a Customer in QuickBooks

Deleting a customer in QuickBooks involves a few simple steps. First, navigate to the \"Customers\" menu and select \"Customer Center.\" Find the customer you want to delete, right-click on their name, and choose \"Delete Customer.\" QuickBooks will prompt you to confirm the deletion; ensure you're

4 views • 4 slides

QuickBooks Printer Setup

Setting up a printer with QuickBooks involves installing printer drivers, configuring printer settings, integrating with QuickBooks, and performing test prints. By following these steps and troubleshooting common issues, you can ensure seamless printing of invoices, receipts, and reports, enhancing

2 views • 3 slides

How to Restore deleted Invoice in Quickbooks Online?

How to Restore deleted Invoices in Quickbooks Online?\nRestoring a deleted invoice in QuickBooks Online involves using the Audit Log to track and recreate it. First, access the Audit Log via the Gear icon under \"Tools\" and identify the deleted invoice details. Then, manually recreate the invoice b

1 views • 7 slides

Resolving the QuickBooks Can not Fit on Printed Page Error

Resolving the QuickBooks Can not Fit on Printed Page Error, developed by Intuit, is one of the most widely used accounting software applications by businesses of all sizes. It offers robust features for managing finances, invoices, payroll, and more. However, like any software, QuickBooks can encoun

2 views • 4 slides

Exporting Invoices from QuickBooks to Excel

Exporting invoices from QuickBooks to Excel is a valuable feature that enables businesses to manipulate, analyze, and present financial information in a versatile spreadsheet format. Invoices, as critical financial documents, often require exportation for detailed analysis, reporting, or integration

1 views • 6 slides

What do you do when QuickBooks Desktop is not open

QuickBooks Desktop is a powerful accounting software used by businesses of all sizes to manage their finances, track expenses, create invoices, and more. However, like any software, QuickBooks Desktop may encounter issues that prevent it from opening

4 views • 7 slides

QuickBooks Unable To Sync License or QuickBooks License Sync Issues

QuickBooks, developed by Intuit, is a popular accounting software used by millions of businesses worldwide for managing finances, invoices, payroll, and more. One crucial aspect of using QuickBooks is licensing, which ensures that users have authoriz

1 views • 5 slides

Vendor Invoicing Process Overview

Detailed presentation slides outlining the vendor invoicing process for the Department of Rehabilitation. Topics covered include multi-factor authentication, authorization procedures, invoice processing steps, and submitting invoices through the VRC Portal for expedited processing.

1 views • 15 slides

Supplier Compliance Requirements and Evaluation Presentation

Responsibilities and functions of the Grants and Compliance Department in managing grants, compliance, governance, and risk issues. Supplier compliance requirements include timely quotations, tax-compliant invoices, full deliveries, and supplier evaluations. Feedback from suppliers is valued for pro

0 views • 6 slides

Managing Subawards at Montana State University: A Guide

Providing basic information and resources for managing subawards at Montana State University's Office of Sponsored Programs. Topics covered include the definition of subawards, why they are issued, how they get issued, responsibilities of the pass-through entity, processing subaward invoices, and su

0 views • 21 slides

Analysis of Invoices Payment Compliance in Government Departments

The analysis covers information on payment compliance within the government departments for the financial years 2019/2020 and 2020/2021. It highlights the challenges faced, such as delays in payments and non-compliance with the 30-day payment period. The main contributors to late payments are identi

1 views • 9 slides

Step-by-Step Guide for Invoice Approval Process

Detailed guide on how to view and approve invoices using the ISTC website and Banner Self-Service portal. Includes steps to access employee resources, navigate through finance tabs, and utilize the Banner Document Manager for document approvals.

0 views • 19 slides

Tax Invoices and Billing Procedures under GST

An in-depth overview of tax invoices, credit notes, and debit notes, focusing on their significance under the GST taxation system. Explains the difference between a tax invoice and a bill of supply, and provides guidance on issuing proper documentation under different scenarios. Covers the time limi

0 views • 24 slides

Efficient Supplier Portal for GE Transportation/Wabtec iSupplier Training

GE Transportation/Wabtec offers a user-friendly iSupplier Portal (iSP) for suppliers to manage invoices, payments, and orders efficiently. Learn how to register, receive system updates, and ensure compliance for seamless transactions. Access web invoicing, credit card processing, and ERS settlement

0 views • 16 slides

Update on Invoice Processing Platform (IPP) Implementation

The Invoice Processing Platform (IPP) is a web-based system provided by the U.S. Treasury for tracking invoices from award to payment notification. This update outlines the scope, schedule, and implementation overview, including phases and actions needed for successful invoicing. Vendors are require

0 views • 8 slides

Accounts Payable in C-Store Office Advanced Accounting

Accounts Payable is a crucial function within the accounting department of a company that handles processing vendor invoices and bills for goods and services received on credit. This article covers the definition of accounts payable, its importance, how to locate and pay invoices in C-Store Office,

0 views • 10 slides

X3 Workflows for Efficient Business Processes

X3 workflows are messages that signal actions, such as placing orders on hold, approving purchase requests, or notifying of state changes like overdue invoices. These workflows expedite business processes by requiring actions, providing information, or reacting to object state changes. Examples incl

0 views • 7 slides

Non-PO Invoice Submission Training Program - STAN

Streamline the submission of non-PO invoices through the STAN program, improving efficiency and reducing processing time. Understand the steps to email invoices, use proper subject lines, handle attachments, and manage multiple indexes/account codes effectively.

1 views • 10 slides

Invoice Processing at National Institutes of Health Office of Financial Management

The Commercial Accounts Branch at NIH's Office of Financial Management handles invoice processing efficiently to ensure timely payments to vendors. They manage various types of invoices, address improper submissions, and facilitate the payment approval process. Vendors' reasons for delayed payments

0 views • 10 slides

Streamlining Invoicing Process with PayPaw in BuyWays - May 2017

PayPaw is a new workflow introduced for invoicing through BuyWays to streamline the Procure to Pay process, improve accuracy, and ensure payments are directed to the correct supplier. By scanning invoices directly into BuyWays, manual data entry is eliminated, enhancing efficiency and reducing proce

0 views • 15 slides

Efficient Accounts Payable Processes and Procedures

Streamline your accounts payable functions with detailed guidelines on vendor invoices, payments, cabinet level approvals, handling of independent contractors, and managing invoices for direct payments. Learn about the essential steps, requirements, and best practices to ensure timely and accurate p

0 views • 9 slides

Invoice Approval and Notification Process Quick Reference Guide

This reference guide outlines the invoice approval and notification process, detailing email alerts for approval and exceptions, with instructions on how to validate and approve invoices in Guided Buying. It also covers notifications for invoices requiring accounting information and provides guidanc

0 views • 13 slides

Tax Invoices, Debit Notes, and Credit Notes in Goods and Services Tax

This content covers the basic concepts of supply, invoicing obligations, tax invoices under Section 28, removal of goods for supply, and scenarios where removal does not result in a supply. Learn about the different types of taxes and when tax invoices should be issued for taxable goods and services

0 views • 28 slides