Top Business Expense Management Solutions Companies

The integration of technology and changing company priorities are influencing the business expense management process in the US. Automation and artificial intelligence (AI) are critical in streamlining these transformations and automating receipt processing and data entry tasks. It speeds up process

2 views • 6 slides

Deductions in Personal Finance

In Lesson 2 of "Deductions: What You See Is Not What You Get," the content delves into concepts central to financial literacy. Covering topics like gross and net income, types of deductions, compound interest for retirement planning, and the workings of insurance (including health insurance), this l

1 views • 24 slides

Amendment in Section 43B for MSME Presented by CA Naman Maloo

The recent amendment in Section 43B of the Income Tax Act introduces a new clause (h) focusing on payments to Micro and Small Enterprises (MSMEs). Payments to MSMEs must adhere to the time limits prescribed in the MSMED Act of 2006 for deductions to be allowed. This change emphasizes timely payments

1 views • 29 slides

Travel Expense & Concur Classroom Training Overview

Explore the essentials of travel expense management and Concur classroom training at FSU, covering topics such as travel procedures, reimbursement guidelines, recent updates, legal authority, and approver roles. Understand Florida travel basics, pre-travel requirements, and more. Enhance your knowle

3 views • 55 slides

The Role of the Indian Government in Lowering Tax Deductions for NRIs

The Indian government assumes a crucial role in enabling reduced tax deductions for Non-Resident Indians (NRIs). By implementing diverse policies and initiatives, it strives to entice investments from NRIs while ensuring equitable taxation. These endeavors encompass tax treaties, specific provisions

0 views • 11 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

1 views • 3 slides

Solving Money Problems with Arithmetic

This chapter focuses on applied arithmetic concepts such as calculating mark-up, margin, compound interest, income tax, and net pay. It covers topics like percentages, income, deductions, and income tax rates in Ireland. Detailed examples on calculating tax payable, deductions, and net pay are provi

0 views • 12 slides

Chrome River Overview - Travel and Expense Management System

Chrome River offers a comprehensive travel and expense management system with features such as pre-approvals, expense reports, P-Card management, mobile access, receipt capture, and single sign-on capability. Benefits include ease of use, mobile access, reduced paper usage, and automatic routing. Th

1 views • 12 slides

Getting Started with Concur: Financial & Business Services Presentation

Learn how to access Concur, update your Concur profile, assign travel and expense delegates, set up your profile, designate a travel arranger, and assign an expense delegate in this informative presentation from Financial & Business Services at the University of Utah. Access domestic and internation

0 views • 10 slides

Clayton State University Travel and Expense Guidelines

CSU employees must adhere to travel and expense reimbursement guidelines set by the university, including obtaining travel authorization, submitting expense reports promptly, and following specific document submission requirements. Cash advances are available under certain conditions and must be rep

0 views • 39 slides

Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

2 views • 20 slides

Evaluation of Expense Allocation Proposal in ABC LIFE Insurance Company

ABC LIFE insurance company, facing reduced SH return from NPAR products due to expense allocation changes, contemplates increasing expense loading in PAR products. The presentation evaluates this proposal within the regulatory framework, exploring justifications, challenges, and alternative solution

1 views • 13 slides

Payslips and Overtime Calculations

Explore the world of payslips and overtime calculations with examples involving basic pay, overtime rates, gross pay, and net pay. Follow along as we calculate earnings for different scenarios like Joe the worker, Mark the joiner, Louise the admin assistant, and Zoe the nursery nurse. Understand how

0 views • 11 slides

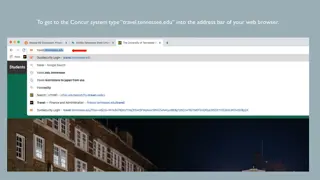

Navigating the Concur System for Travel Expense Management

Explore the step-by-step guide on how to access and utilize the Concur system for travel expenses at tennessee.edu. Learn how to log in via IRIS web and manage travel delegates efficiently. Discover features like Expense Delegates, Travel Assistant, Request References, and more to streamline your tr

2 views • 16 slides

Arizona Health Care Cost Updates Effective 04/01/2018

In these updates shared by Tara Lockner, the Deputy Assistant Director at the Programs Division of Member Services, changes regarding Share of Cost (SOC) deductions in medical expenses are highlighted. The proposed modifications will now allow SOC deductions for medical services that would have been

1 views • 6 slides

Income Tax Issues in the Ratemaking Process

This content explores various aspects related to income tax issues in the ratemaking process, including Accumulated Deferred Income Taxes (ADIT), Net Operating Losses (NOLs), Tax Normalization, Repair Deductions, and more. It provides insights on how ADIT is calculated, the significance of NOLs, dif

0 views • 24 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Expense Report Management Best Practices for Travel in 2023

Learn how to efficiently manage expense reports for travel in 2023 using Concur. Discover tips on submitting, reviewing, and processing expense reports, handling open requests with no expense reports, and more. Find out about the new Meal Per Diem policy starting in January 2024. Stay organized and

0 views • 28 slides

Guardianship Fees and Participation Under Medicaid

This session delves into how DSHS utilizes Medicaid State Plan and Home & Community-Based Waiver rules for deductions related to guardianship fees. Topics covered include personal needs allowance arrangements, cost of care rules, participation distinctions, and specific guidelines for deductions. A

1 views • 67 slides

Comparing Before-Tax and After-Tax Deductions in Paychecks

Exploring the differences between before-tax and after-tax deductions in January and February paychecks, highlighting deductions with double premium amounts. Visual comparisons and analysis help understand the financial impact on income.

0 views • 10 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Basic Educational Series on Income Tax: Salaries and Income from House Property

This educational series covers the essentials of income tax related to salaries and income from house property. It delves into topics like charging sections, definitions, deductions, and responsibilities in employer-employee relationships. The content explains the basis of charge, annual value, admi

0 views • 43 slides

Efficient Expense Reporting with Allocations

Streamline your expense reporting process by following a step-by-step guide to create an expense report with allocations. Learn how to clear alerts, add allocations, and submit your report efficiently within your organization's system. Make the most of the allocated budgets for different expenses.

0 views • 10 slides

Updates and Changes for Travel Expenses and Purchasing Cards

Meeting on February 28, 2019 highlighted updates on UAT testing completion, purchasing card changes, expense reporting modifications, and blanket travel pre-approvals. Issues with per diem calculations, mileage, and expense routing were discussed. It was emphasized that all expenses must be in compl

0 views • 14 slides

Per Diem Guidelines for Reimbursement Changes

Accommodating changes in per diem rates for lodging and meals, this guide outlines the maximum rates based on location, deductions for provided meals, and the proper use of corporate cards. Ensure compliance with federal per diem allowances to streamline expense reporting.

0 views • 10 slides

Gross Receipts Taxation for Health Care Practitioners in New Mexico

New Mexico imposes gross receipts tax on individuals and businesses conducting business in the state. This presentation discusses the basic principles of the tax, exemptions for non-profits, and deductions available for health care practitioners. It outlines the specific deductions under Sections 7-

0 views • 10 slides

Clayton State University Travel and Expense Reimbursement Guidelines

Guidelines for travel and expense reimbursement at Clayton State University including rules to follow, travel authorization process, submission of expense reports, required documents, and procedures for cash advances. Compliance with federal laws, state regulations, and university policies is emphas

0 views • 39 slides

Efficient Expense Allocation and Reporting Process

Learn how to allocate expenses within your organization, create detailed expense reports, attach receipts, and change allocations for different departments. Follow the outlined steps for seamless expense management.

0 views • 15 slides

Money Management in Applied Arithmetic

This chapter focuses on practical applications of arithmetic related to money, including solving problems involving mark-up, margin, compound interest, income tax, and net pay calculations. Topics covered include percentages, income and deductions, income tax rates, and example scenarios to calculat

0 views • 12 slides

Physical Education Grading Policy and Procedures at CDHS

Physical Education at CDHS follows a detailed grading policy where each class is worth 10 points. Points are earned based on participation, effort, behavior, and adherence to rules. Deductions can occur for violations such as tardiness, inappropriate behavior, lack of participation, and disrespect o

0 views • 22 slides

IRC 280E in the Cannabis Industry

Explore the implications of IRC 280E on cannabis businesses, highlighting tax practitioner considerations, deductions limitations, and the history behind the enactment of this tax code. Learn about the impact of federal and state laws on deductions for businesses involved in the sale of controlled s

0 views • 19 slides

Aerobic Gymnastics Competition Guidelines and Rules

The guidelines for aerobic gymnastics competitions include compulsory elements, categories, competition spaces, deductions, and specific rules for different age groups. The competitions have specific parameters for elements allowed, lifting, floor elements, music length, maximum difficulty elements,

1 views • 17 slides

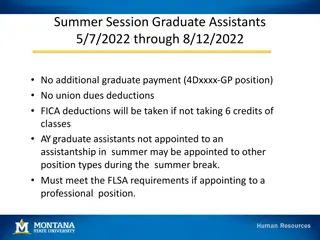

Guidelines for Summer Session Graduate Assistants 2022

Detailed guidelines for Summer Session Graduate Assistants from May 7, 2022, to August 12, 2022, regarding payment, deductions, appointment types, payroll dates, and EPAF instructions for teaching and research positions. The document also covers information on student workers during the summer sessi

0 views • 5 slides

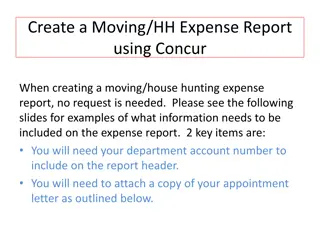

Guide to Creating Moving/House Hunting Expense Report Using Concur

Learn how to create a moving/house hunting expense report using Concur without the need for a request. Follow the steps outlined in the slides to include essential information like department account number and appointment letter. Sign in to Concur, create a new report, enter required details on the

0 views • 9 slides

Work-from-Home Expense Deductions for Employees in the 2022-23 Financial Year

Explore the revised fixed cost method and actual cost method for claiming work-from-home expenses as a typical employee in the 2022-23 financial year. Learn about eligibility criteria, claimable expenses, calculation methods, necessary records to keep, and more. Take advantage of deductions while fu

0 views • 14 slides

Efficient Expense Management and Reporting Guidelines

Explore the latest updates and guidelines for expense management and reporting, covering terminology updates, eligibility criteria for Chrome River, expense inclusions, program selection tips, report completion frequency, and delegation best practices. Stay informed on creating, entering, and approv

0 views • 14 slides

Understanding the Expense Prediction Bias: Study on Underestimation of Future Expenses

Expense Prediction Bias (EPB) refers to the persistent underestimation of future expenses. Research shows that individuals tend to under-predict their future expenses due to various factors. This study explores the magnitude of EPB in an adult sample, highlighting a mean EPB of $63.58, with predicte

0 views • 28 slides

Streamlining Expense Management with CentreSuite: Accessibility and Efficiency

CentreSuite is a web-based expense management tool being adopted due to changes like the end of a contract with US Bank, BPS compliance, and tax calculation enhancements. It prioritizes AODA guidelines, ensuring accessibility features for all users. By incorporating accessible features and embracing

0 views • 18 slides

Chrome River Expense Management Overview

Explore the features and benefits of Chrome River Expense Management, including Approval Queues, Department Naming Conventions, Employee Reimbursements, Invoice Module, Reports, and the transition from current processes to Chrome River. Understand the methodology of going simple with electronic appr

0 views • 23 slides

Contractor Tax Deductions | Kwaccountingservice.com

Use Kwaccountingservice.com to your advantage to reduce your tax liability and increase your savings. Claim the greatest tax deductions with the aid of our skilled staff. Make sure you don't pass this one up!

3 views • 1 slides