Top Business Expense Management Solutions Companies

The integration of technology and changing company priorities are influencing the business expense management process in the US. Automation and artificial intelligence (AI) are critical in streamlining these transformations and automating receipt processing and data entry tasks. It speeds up process

2 views • 6 slides

Travel Expense & Concur Classroom Training Overview

Explore the essentials of travel expense management and Concur classroom training at FSU, covering topics such as travel procedures, reimbursement guidelines, recent updates, legal authority, and approver roles. Understand Florida travel basics, pre-travel requirements, and more. Enhance your knowle

3 views • 55 slides

Lusaka Securities Exchange Q1 2024 Market Performance Overview

The Lusaka Securities Exchange (LuSE) in Q1 2024 witnessed notable market performance with Equity Market Capitalization at K97.76 billion, a 10.20% YTD increase. Quarterly media engagements support market transparency and investor confidence. Sector-wise, Retail Trading leads with 36% market capital

1 views • 18 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

1 views • 3 slides

Chrome River Overview - Travel and Expense Management System

Chrome River offers a comprehensive travel and expense management system with features such as pre-approvals, expense reports, P-Card management, mobile access, receipt capture, and single sign-on capability. Benefits include ease of use, mobile access, reduced paper usage, and automatic routing. Th

1 views • 12 slides

Getting Started with Concur: Financial & Business Services Presentation

Learn how to access Concur, update your Concur profile, assign travel and expense delegates, set up your profile, designate a travel arranger, and assign an expense delegate in this informative presentation from Financial & Business Services at the University of Utah. Access domestic and internation

0 views • 10 slides

Clayton State University Travel and Expense Guidelines

CSU employees must adhere to travel and expense reimbursement guidelines set by the university, including obtaining travel authorization, submitting expense reports promptly, and following specific document submission requirements. Cash advances are available under certain conditions and must be rep

0 views • 39 slides

Mastering Punctuation and Capitalization in Writing

Understand the significance of punctuation marks in writing to enhance clarity and comprehension. Learn about commas, full stops, question marks, and capitalization rules to perfect your writing skills.

0 views • 50 slides

Learn Sentence Writing with Proper Capitalization, Punctuation, and Spelling

Enhance your writing skills with this interactive lesson on sentence construction, capitalization, punctuation, and spelling. Through engaging examples like "The cat is on the mat" and "The dog runs," you'll understand the importance of correct grammar in creating clear and effective sentences. Expl

1 views • 5 slides

Rules of Proper Capitalization and Italics in Writing

Learn the rules of proper capitalization and italics based on the guidelines provided in "Real Good Grammar, Too" by Mamie Webb Hixon. Understand when to capitalize major words in a title, the first word in direct quotations, brand and trade names, personal names, titles with proper nouns, titles de

0 views • 22 slides

Evaluation of Expense Allocation Proposal in ABC LIFE Insurance Company

ABC LIFE insurance company, facing reduced SH return from NPAR products due to expense allocation changes, contemplates increasing expense loading in PAR products. The presentation evaluates this proposal within the regulatory framework, exploring justifications, challenges, and alternative solution

1 views • 13 slides

Navigating the Concur System for Travel Expense Management

Explore the step-by-step guide on how to access and utilize the Concur system for travel expenses at tennessee.edu. Learn how to log in via IRIS web and manage travel delegates efficiently. Discover features like Expense Delegates, Travel Assistant, Request References, and more to streamline your tr

2 views • 16 slides

NSU Editorial Style Quick Tips and Guidelines

Learn valuable NSU editorial style quick tips on punctuation, capitalization, grammar, numbers, and more to enhance the clarity and professionalism of your writing. Get insights on when to use the serial/Oxford comma, em dashes, and proper capitalization rules. Understand the correct usage of facult

0 views • 7 slides

Capitalization Rules in APA Style for Titles of Works

Understanding the principles of capitalizing titles according to APA style is crucial for proper academic writing. In APA format, titles of books, articles, and sections within articles have specific capitalization rules. Major words such as verbs, nouns, adjectives, adverbs, and pronouns are capita

0 views • 19 slides

Rules of Capitalization, Possessives, and Plurals in English Writing

Learn the rules of capitalization, possessives, and plurals in English writing. Understand when to capitalize words like mom or dad, how to form possessives correctly, and how to pluralize nouns following specific patterns. Explore examples and guidelines for improving your English language skills.

0 views • 12 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Mastering Capitalization Rules: Proper Nouns, Titles, and More

Learn the ins and outs of capitalization rules, from when to capitalize proper nouns, titles, and headings to the first word in a sentence and the pronoun "I." Explore examples and quick practice exercises to enhance your understanding of capitalization conventions.

0 views • 15 slides

Expense Report Management Best Practices for Travel in 2023

Learn how to efficiently manage expense reports for travel in 2023 using Concur. Discover tips on submitting, reviewing, and processing expense reports, handling open requests with no expense reports, and more. Find out about the new Meal Per Diem policy starting in January 2024. Stay organized and

0 views • 28 slides

Efficient Expense Reporting with Allocations

Streamline your expense reporting process by following a step-by-step guide to create an expense report with allocations. Learn how to clear alerts, add allocations, and submit your report efficiently within your organization's system. Make the most of the allocated budgets for different expenses.

0 views • 10 slides

Grammar Rules by Mary Ann Hudson - A Guide to Proper Capitalization and Punctuation

Explore essential grammar rules for proper capitalization, including guidelines for proper and common nouns, titles before people's names, quotations, interrupted quotations, titles and subtitles, as well as commonly confused words. Enhance your writing skills by understanding when to capitalize, pu

0 views • 79 slides

Updates and Changes for Travel Expenses and Purchasing Cards

Meeting on February 28, 2019 highlighted updates on UAT testing completion, purchasing card changes, expense reporting modifications, and blanket travel pre-approvals. Issues with per diem calculations, mileage, and expense routing were discussed. It was emphasized that all expenses must be in compl

0 views • 14 slides

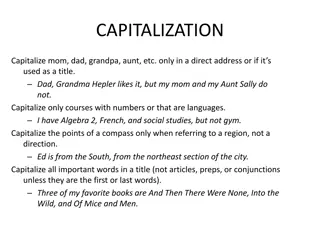

Grammar Rules Guide: Capitalization, Possessives, and Plurals

Learn the rules of capitalization, possessives, and forming plurals in English grammar. Understand when to capitalize titles, direct addresses, and regions. Discover how to form possessives for singular, plural, and irregular nouns. Get insights on creating plural forms, especially for compound word

0 views • 10 slides

Capitalization Changes in Government Financial Management

The evolution of capitalization policies in governmental financial management, as guided by GASB, is explored through examples and implementation considerations. Key points include applying capitalization thresholds to groups of assets, considering aggregate significance, and planning for effective

0 views • 8 slides

Valuation Using the Income Approach in Real Estate

The income approach to appraisal in real estate involves converting future income into a present value through income capitalization. This method utilizes direct capitalization and discounted cash flow techniques to estimate property value based on net operating income. Estimating net operating inco

0 views • 17 slides

Financial Reporting Updates - Capitalization Threshold Policy Changes

The financial reporting updates highlight changes to the capitalization threshold policy effective 07/01/2024. The new threshold for purchases for the UR will increase from $1,000 to $5,000 per unit cost. Active fabrications under the current threshold will be grandfathered, while new fabrications r

0 views • 6 slides

Capitalization Regulations in Taxation

This document delves into the intricate world of capitalization regulations in taxation, covering topics such as safe harbors, routine maintenance, small taxpayers, partial disposition elections, and more. It discusses the evolution of the 263 regulations, changes in methods of accounting, and the c

0 views • 64 slides

Property Tax Capitalization in Public Finance

Explore the concept of property tax capitalization, its implications for public policy, and how it impacts property value. Learn how property taxes influence housing prices and the valuation of assets, and delve into the relationship between property taxes and the value of housing services. Discover

1 views • 50 slides

Mastering Capitalization: Essential Rules and Examples

Dive into the world of capitalization with this comprehensive guide. Learn the definition of capitalization and its importance in writing. Explore various rules such as capitalizing the first letter of a sentence, proper nouns, dates, and more. Enhance your writing skills by grasping the nuances of

0 views • 17 slides

Clayton State University Travel and Expense Reimbursement Guidelines

Guidelines for travel and expense reimbursement at Clayton State University including rules to follow, travel authorization process, submission of expense reports, required documents, and procedures for cash advances. Compliance with federal laws, state regulations, and university policies is emphas

0 views • 39 slides

Efficient Expense Allocation and Reporting Process

Learn how to allocate expenses within your organization, create detailed expense reports, attach receipts, and change allocations for different departments. Follow the outlined steps for seamless expense management.

0 views • 15 slides

Punctuation and Capitalization in Writing

Punctuation and capitalization play essential roles in writing by helping to separate words into sentences, clauses, and phrases to clarify meaning. This class focuses on teaching students the importance of using standard marks and signs correctly in their writing. Topics covered include the definit

0 views • 18 slides

Mastering Punctuation and Capitalization in English Grammar Class

Enhance your punctuation and capitalization skills with examples and exercises in English grammar and composition. The lesson covers the use of capital letters, punctuation marks, and their correct placement. Practice identifying and correcting errors in written text to improve your writing proficie

0 views • 12 slides

Year-End Closing Procedures for Fiscal Year 2021

Conducting the fiscal year-end closing procedures for FY2021 involves tasks such as finishing all current year processing in the EIS system, ensuring items are properly added to EIS based on the receipt date, running reports to verify capitalization thresholds are met, and generating recommended rep

0 views • 17 slides

Mastering Capital Letters: Practice Worksheets for Proper Capitalization

Enhance your capitalization skills with engaging worksheets focusing on using capital letters correctly at the beginning of sentences, for names of people and places, days of the week, and months of the year. Practice different sentences and improve your writing proficiency in English.

0 views • 12 slides

Guide to Creating Moving/House Hunting Expense Report Using Concur

Learn how to create a moving/house hunting expense report using Concur without the need for a request. Follow the steps outlined in the slides to include essential information like department account number and appointment letter. Sign in to Concur, create a new report, enter required details on the

0 views • 9 slides

Efficient Expense Management and Reporting Guidelines

Explore the latest updates and guidelines for expense management and reporting, covering terminology updates, eligibility criteria for Chrome River, expense inclusions, program selection tips, report completion frequency, and delegation best practices. Stay informed on creating, entering, and approv

0 views • 14 slides

Understanding the Expense Prediction Bias: Study on Underestimation of Future Expenses

Expense Prediction Bias (EPB) refers to the persistent underestimation of future expenses. Research shows that individuals tend to under-predict their future expenses due to various factors. This study explores the magnitude of EPB in an adult sample, highlighting a mean EPB of $63.58, with predicte

0 views • 28 slides

Streamlining Expense Management with CentreSuite: Accessibility and Efficiency

CentreSuite is a web-based expense management tool being adopted due to changes like the end of a contract with US Bank, BPS compliance, and tax calculation enhancements. It prioritizes AODA guidelines, ensuring accessibility features for all users. By incorporating accessible features and embracing

0 views • 18 slides

Chrome River Expense Management Overview

Explore the features and benefits of Chrome River Expense Management, including Approval Queues, Department Naming Conventions, Employee Reimbursements, Invoice Module, Reports, and the transition from current processes to Chrome River. Understand the methodology of going simple with electronic appr

0 views • 23 slides

Capitalization Rules for Races, Nationalities, and Species

Learn how to properly capitalize races, nationalities, and species in your writing. Always capitalize races such as Chinese, Indian, and Hispanic. Capitalize nationalities and nation-related words like French, Swiss, and Spanish. When writing species names, capitalize the first part of the scientifi

0 views • 5 slides