Top Business Expense Management Solutions Companies

The integration of technology and changing company priorities are influencing the business expense management process in the US. Automation and artificial intelligence (AI) are critical in streamlining these transformations and automating receipt processing and data entry tasks. It speeds up process

2 views • 6 slides

Expenditure Transfers in Research

Understand the key concepts and procedures for managing cost transfers in research programs. Explore topics such as salary transfers, inter-program transfers, reimbursements, and toxic exposure fund requirements. Gain insights on executing financial tasks effectively and access resources for financi

2 views • 36 slides

Dynamic Transfer Types and Reporting: Enhancing Financial Operations

Explore the various types of dynamic transfers such as ODP, Sweep, ZBA, and more, enabling seamless movement of funds across accounts. Learn about excess balance transfers, maintain minimum transfers, and the intricacies of dynamic transfer reporting. Discover key strategies for efficient financial

1 views • 12 slides

Energy Stores and Transfers

Explore the concept of energy stores and transfers through various types such as gravitational potential, chemical, kinetic, and more. Learn about different energy transfer processes and how energy can be stored in various forms. Engage in tasks to enhance understanding and self-assessment of differ

7 views • 12 slides

Travel Expense & Concur Classroom Training Overview

Explore the essentials of travel expense management and Concur classroom training at FSU, covering topics such as travel procedures, reimbursement guidelines, recent updates, legal authority, and approver roles. Understand Florida travel basics, pre-travel requirements, and more. Enhance your knowle

3 views • 55 slides

Delete Expense Transactions in QuickBooks Online?

Delete Expense Transactions in QuickBooks Online?\nKeeping clean books in QBO requires managing expenses effectively. This includes deleting unnecessary transactions. Confused about how? Don't worry! This guide simplifies the process. Learn when to delete, what to consider beforehand, and follow the

1 views • 3 slides

Cost Transfers in Research Operations Training

This training session covers various aspects of cost transfers in research operations, including different types, executing salary transfers, inter-program transfers, reimbursements, toxic exposure fund requirements, and financial updates for FY 23. Participants will gain insights into when and how

1 views • 36 slides

Guidelines for Student Transfers and IEPs in Oklahoma Schools

This document outlines procedures for student transfers in Oklahoma schools, specifically focusing on transfers for students with disabilities. It covers aspects such as transferring students with expired IEPs, revocation of disability recognition, and the process for move-in students within the sta

0 views • 7 slides

Chrome River Overview - Travel and Expense Management System

Chrome River offers a comprehensive travel and expense management system with features such as pre-approvals, expense reports, P-Card management, mobile access, receipt capture, and single sign-on capability. Benefits include ease of use, mobile access, reduced paper usage, and automatic routing. Th

1 views • 12 slides

Getting Started with Concur: Financial & Business Services Presentation

Learn how to access Concur, update your Concur profile, assign travel and expense delegates, set up your profile, designate a travel arranger, and assign an expense delegate in this informative presentation from Financial & Business Services at the University of Utah. Access domestic and internation

0 views • 10 slides

Clayton State University Travel and Expense Guidelines

CSU employees must adhere to travel and expense reimbursement guidelines set by the university, including obtaining travel authorization, submitting expense reports promptly, and following specific document submission requirements. Cash advances are available under certain conditions and must be rep

0 views • 39 slides

Energy Stores and Transfers in Science Lessons

Dive into the fascinating world of energy stores and transfers through engaging science lessons. Recall different energy stores, common energy transfers, and create flow diagrams to illustrate energy transfers in various scenarios. Explore gravitational, elastic, magnetic, electrostatic potential en

5 views • 9 slides

Cost Transfers in Sponsored Projects

Cost transfers, also known as expenditure transfers, are the process of moving expenses from one project to another. It is crucial to follow guidelines to ensure proper documentation and approval to avoid audit issues. Learn when cost transfers are acceptable or unacceptable, how to complete the nec

0 views • 6 slides

Evaluation of Expense Allocation Proposal in ABC LIFE Insurance Company

ABC LIFE insurance company, facing reduced SH return from NPAR products due to expense allocation changes, contemplates increasing expense loading in PAR products. The presentation evaluates this proposal within the regulatory framework, exploring justifications, challenges, and alternative solution

1 views • 13 slides

Managing Inter-Departmental Transfers in Financial Accounting

Inter-departmental transfers involve recording and charging costs from one department to another, with different pricing bases like cost-based and market-based transfers. Unrealized profits in transfers are adjusted using stock reserves. Entries are made at the selling price to include costs and pro

1 views • 7 slides

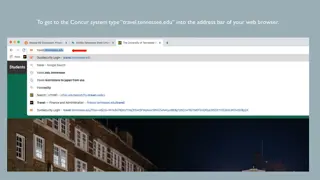

Navigating the Concur System for Travel Expense Management

Explore the step-by-step guide on how to access and utilize the Concur system for travel expenses at tennessee.edu. Learn how to log in via IRIS web and manage travel delegates efficiently. Discover features like Expense Delegates, Travel Assistant, Request References, and more to streamline your tr

2 views • 16 slides

Common Mistakes in Expense Reports that Delay Refunds

In submitting expense reports, several common mistakes can lead to delays in receiving refunds. Issues such as missing receipts, incorrect documentation, inadequate information, and incorrect claim submissions can all hinder the reimbursement process. This guide outlines key errors to avoid when pre

0 views • 11 slides

Expense Report Management Best Practices for Travel in 2023

Learn how to efficiently manage expense reports for travel in 2023 using Concur. Discover tips on submitting, reviewing, and processing expense reports, handling open requests with no expense reports, and more. Find out about the new Meal Per Diem policy starting in January 2024. Stay organized and

0 views • 28 slides

Efficient Expense Reporting with Allocations

Streamline your expense reporting process by following a step-by-step guide to create an expense report with allocations. Learn how to clear alerts, add allocations, and submit your report efficiently within your organization's system. Make the most of the allocated budgets for different expenses.

0 views • 10 slides

Updates and Changes for Travel Expenses and Purchasing Cards

Meeting on February 28, 2019 highlighted updates on UAT testing completion, purchasing card changes, expense reporting modifications, and blanket travel pre-approvals. Issues with per diem calculations, mileage, and expense routing were discussed. It was emphasized that all expenses must be in compl

0 views • 14 slides

Overview of Cost Transfers in Sponsored Research Accounting

Cost transfers involve the reassignment of expenses from one account to another in sponsored research accounting. Timely, supported, and properly documented transfers are essential to ensure compliance with federal requirements and internal controls. This overview highlights the definition, purpose,

0 views • 14 slides

Partial Land Transfers in Alberta

The module explains the process of submitting a Partial Land Transfer through the ETS system in Alberta. It covers initiating and submitting transfers, concurring to transfers, and retrieving final documents. It also includes steps for logging in to ETS, searching agreements, and more. Prior knowled

0 views • 26 slides

ASU EHS & FSE Chemical Approval Process Guidelines

Detailed guidelines and forms for the chemical approval process at ASU, including links to important resources, forms for new chemical purchases and transfers, responsibilities for lab managers, and procedures for chemical transfers. The process involves completing forms such as the Prior Approval A

0 views • 5 slides

Clayton State University Travel and Expense Reimbursement Guidelines

Guidelines for travel and expense reimbursement at Clayton State University including rules to follow, travel authorization process, submission of expense reports, required documents, and procedures for cash advances. Compliance with federal laws, state regulations, and university policies is emphas

0 views • 39 slides

Strategic Transfers for Enhancing Climate Policy Ambition in EU ETS

This study explores the use of strategic transfers, allowance allocation, and revenue spending in the EU ETS to enhance climate policy ambition. Motivated by the EU's goal of reducing emissions by 80% by 2050, the research delves into transfer decisions, cap-setting roles, challenges for decarboniza

0 views • 21 slides

Asymmetric Socialization and Resource Transfers in Welfare States

Exploring intergenerational resource transfers in the context of welfare states, this study examines three main channels: families, the government, and markets. It delves into different institutional arrangements governing asset-based reallocations, public transfers, and familial transfers. The leve

0 views • 12 slides

Challenges and Considerations in the Junior Tag Transfer Program

Challenges faced by NDOW staff include issues with tag transfers, administrative burden, disadvantaged minors, black market risks, and family dynamics. Suggestions for potential program considerations include limiting transfers, capping yearly transfers, and involving long-standing customers.

0 views • 7 slides

Enhancing Network Function State Transfers

Explore methods to improve the safety, scalability, and efficiency of network function state transfers. Addressing issues related to NF deployments, state management frameworks, and transfer mechanisms. Discuss challenges like safety, efficiency, and scalability with solutions such as re-routing flo

0 views • 16 slides

Efficient Expense Allocation and Reporting Process

Learn how to allocate expenses within your organization, create detailed expense reports, attach receipts, and change allocations for different departments. Follow the outlined steps for seamless expense management.

0 views • 15 slides

Wealth Accounts: Challenges and Models in NTA

Wealth accounts in National Transfer Accounts (NTA) are vital for classifying wealth by sector and age group. Challenges in constructing wealth accounts include data availability and modeling transfers. Public and private asset transfers, revaluations, and capital transfers are crucial components to

0 views • 14 slides

Managing Student Moves and Transfers in DLM 2022-2023

This content provides detailed guidance on managing student moves and transfers within the Dynamic Learning Maps (DLM) system for the 2022-2023 academic year. It covers the use of exit codes, special circumstance codes, key dates for assessments, required training materials, New Jersey specific guid

0 views • 22 slides

Optimization of Intergovernmental Transfers Presentation

This presentation focuses on the optimization of intergovernmental transfers (IGTs), specifically the relationship between County Fund Accounts (CFAs) and IGTs. It covers topics such as determining optimal funding sources, reconciliation considerations, dispute resolution processes, and educating co

0 views • 18 slides

Enhancing Food Security through Cash-Based Transfers in Mozambique

Explore the use of cash-based transfers in humanitarian assistance, focusing on addressing food security challenges in Mozambique. The presentation covers the objectives, definitions, programming types, and the transition from food aid to food assistance through cash interventions. Discover key cons

0 views • 28 slides

Guide to Creating Moving/House Hunting Expense Report Using Concur

Learn how to create a moving/house hunting expense report using Concur without the need for a request. Follow the steps outlined in the slides to include essential information like department account number and appointment letter. Sign in to Concur, create a new report, enter required details on the

0 views • 9 slides

Managing and Navigating WinRMS Session 4: Setting Up Accounts, Expense Transfers, and Split Account Transactions

This session covers essential aspects of managing WinRMS, including setting up accounts, expense transfers, and handling split account transactions. It includes valuable insights from experienced presenters and emphasizes the importance of effective account management for program success.

0 views • 37 slides

Efficient Expense Management and Reporting Guidelines

Explore the latest updates and guidelines for expense management and reporting, covering terminology updates, eligibility criteria for Chrome River, expense inclusions, program selection tips, report completion frequency, and delegation best practices. Stay informed on creating, entering, and approv

0 views • 14 slides

Understanding the Expense Prediction Bias: Study on Underestimation of Future Expenses

Expense Prediction Bias (EPB) refers to the persistent underestimation of future expenses. Research shows that individuals tend to under-predict their future expenses due to various factors. This study explores the magnitude of EPB in an adult sample, highlighting a mean EPB of $63.58, with predicte

0 views • 28 slides

Streamlining Expense Management with CentreSuite: Accessibility and Efficiency

CentreSuite is a web-based expense management tool being adopted due to changes like the end of a contract with US Bank, BPS compliance, and tax calculation enhancements. It prioritizes AODA guidelines, ensuring accessibility features for all users. By incorporating accessible features and embracing

0 views • 18 slides

Chrome River Expense Management Overview

Explore the features and benefits of Chrome River Expense Management, including Approval Queues, Department Naming Conventions, Employee Reimbursements, Invoice Module, Reports, and the transition from current processes to Chrome River. Understand the methodology of going simple with electronic appr

0 views • 23 slides

Enhancing Safety in Inter-Hospital Transfers for Intracranial Hemorrhage Patients

Background: Inter-hospital transfers pose safety risks due to care transitions and handoffs. This study discusses interventions to improve care quality and communication in such transfers, highlighting significant process improvements but non-significant clinical outcomes. Conclusion: Implementing

0 views • 8 slides