Utah's Budget FY 2023-2024 Overview

Utah's budget for FY 2023-2024 highlights key aspects including revenue sources, budget priorities, long-term fiscal health, and changes in the budget process. The budget breakdown shows allocations for various sectors such as public education, social services, and transportation. Additionally, deta

7 views • 35 slides

Budgeting Overview at Montclair State University

This presentation provides an overview of budget management concepts, departments, systems, and processes at Montclair State University. It covers the definition of a budget, the roles of the Office of Budget and Planning, the Division of Finance and Treasury, and the MSU Foundation in budgeting and

2 views • 21 slides

Comprehensive Overview of Energy Balances in Germany

This material covers various aspects of energy balances in Germany, including components of energy flowcharts, renewable energy sources in the German energy balance, and total final consumption of road transport energy. It provides a detailed analysis of energy imports, domestic extraction, losses,

2 views • 10 slides

Budget Projection

Explore detailed insights into your company's budget projections, actual cost versus budget, month-wise budget forecasting, overhead cost analysis, and quarterly budget analysis. Identify key variances, cost breakdowns, revenue trends, and budget allocation for informed decision-making and financial

2 views • 20 slides

FY25 Budget Development Kickoff Overview

The FY25 budget development kickoff outlines the timeline, activities, and key processes involved in developing the budget for January 2024. It includes details on workbook creation, budget materials, planning, resource requests, and budget presentations. Changes in the budget process, planning allo

2 views • 14 slides

Compliance with Article 66 of the Public Sector Budget Law for Fiscal Year 2023

The document discusses the fulfillment of Article 66 of the Public Sector Budget Law for the fiscal year 2023, detailing approved budget modifications, budget execution progress, and interventions to address and prevent the El Niño phenomenon. It highlights budget reallocations, execution achieveme

2 views • 23 slides

Murray City School District FY25 Budget Overview

Murray City School District is preparing for the FY25 budget hearing in June 2024. The budget officer, usually the superintendent, must submit a tentative budget before June 1 each year. Legal requirements include holding a public hearing and publishing budget information for public inspection. The

0 views • 25 slides

Fall Budget Forum: Financial Overview and Projections

Explore the financial landscape from the Fall Budget Forum, including current budget status, projections for 2022-23, and key areas like state aid, enrollment, PERS rates, federal funding, and financial results. Gain insights into funding variations, expenditure breakdowns, net balances, and more.

0 views • 21 slides

County Budgeting Process in Mississippi

The process of county budgeting in Mississippi involves identifying needs, forecasting requirements, preparing departmental budget requests, reviewing requests, adopting and implementing the budget, amending the budget, and adopting the final amended budget. Various revenue sources, such as local ad

1 views • 12 slides

Charlton Fire District 2021 Budget Overview

The Charlton Fire District's 2021 budget process involves preparing, adopting, and finalizing the annual budget with public input. The budget includes personal services, fire equipment, capital outlay, and fire protection expenses. Various steps are taken to ensure the budget meets the district's ne

0 views • 15 slides

Understanding Trial Balance and Trading Account Preparation

Trial balance is a statement that tests the accuracy of ledger account balances, with debit balances displayed in the debit column and credit balances in the credit column. The preparation involves using ledger and cash books, with specific rules for different accounts such as purchases, sales, open

0 views • 6 slides

Understanding Stores Budgeting Process in Organizations

Budgeting is a crucial process in organizations to plan activities and allocate resources effectively. The Stores Budget involves preparing estimates for the upcoming year and revising current year plans. This process includes analyzing opening balances, estimating debits and credits, and projecting

1 views • 34 slides

Understanding Adjusted Budget in Hyperion

In Hyperion, a scenario represents a storage folder for data, with three main scenarios compared for budget adjustments: Actuals, Original Budget, and Adjusted Budget. The Hyperion Adjusted Budget module allows users to copy and update data from these scenarios to maintain a balanced budget. Pre-pop

7 views • 22 slides

Budget Presentation: FY2018-19 Tentative Budget Overview

The FY2018-19 Tentative Budget was presented by Mark Mathers, CFO, and Mike Schroeder, Budget Director. The presentation covered updates on the General Fund, structural deficits, budget recommendations, and required actions to address the deficit. Base budget reductions have reduced the deficit to $

3 views • 50 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Changes in Budget Control Procedures and Roles at Corbin de Nagy's Office

In a recent training session conducted by the Budget Office at Corbin de Nagy, significant changes in budget control procedures were highlighted. Starting in 2015-16, spending control will be at the Budgetary Account level for both non-E&G and E&G departments. Budget deficits and cash deficits are n

3 views • 27 slides

Budget Orientation for Managing Financial Resources

Budget Orientation session for ALL EMPLOYEES THAT MANAGE A BUDGET, including new hires, current employees, and supervisors. Covers budget terminology, types of funds, budget cycle, uses of funds, reconciliation, transfers, time management, and tips from auditors. Explains the budget process, differe

1 views • 32 slides

Budget Orientation Overview for Effective Financial Management

This Budget Orientation provides essential information on budget basics, state and campus budget allocation processes, revenue sources, terminology related to budget scenarios, and key considerations for managing financial resources effectively. It is designed for all employees involved in budget ma

1 views • 25 slides

Semi-Annual Financial Report S2 - 2022 Summary

This report provides key financial data for the second half of 2022, including budgetary execution, fund quotas compliance, member states' balances due, liquidity risk assessment, and more. It outlines the overall program budget execution, quota compliance of member states, and fund liquidity status

0 views • 14 slides

Idaho Fiscal Officers Meeting - General Fund Review July 31, 2013

Fiscal officers in Idaho reviewed the General Fund for the fiscal year 2013, analyzing revenue growth, transfers, appropriations, and historical data. The meeting discussed actual revenue figures, beginning balances, cash reversions, budget stabilization funds, total appropriations, and estimated en

0 views • 5 slides

Understanding Budget Balances and Errors in ConnectCarolina

Explore the intricacies of budget balances in ConnectCarolina, uncovering why they fluctuate throughout the month, how errors are managed, and the role of associated revenue. Learn about the Commitment Control system and the four ledgers that track expenses, providing a comprehensive understanding o

0 views • 49 slides

Fiscal Year 2016 Budget and Statement of Work Discussion

Preliminary discussions and recommendations regarding the Fiscal Year 2016 budget and statement of work. Includes budget issues, 2014 and 2015 budget comparisons, steering committee recommendations, and executive committee budget discussions. Focus on budget guidance, funding allocations, and propos

1 views • 17 slides

Open Budget Meeting Town Hall Overview

The Open Budget Meeting at Clayton State University delves into the process of developing the new budget, emphasizing alignment with strategic priorities. The President has final decision-making authority in budget approvals. The meeting discusses funding requests, strategic plan support, and priori

0 views • 27 slides

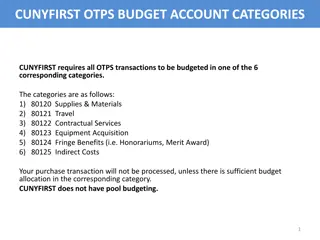

Managing Budget Allocations in CUNYFIRST OTPS System

CUNYFIRST OTPS system requires all transactions to be budgeted in specific categories. Before making a purchase, ensure budget balance sufficiency, follow steps to complete budget transfers if needed, and use the Budget Balances Query Viewer to check available balances for your department. Proper bu

0 views • 11 slides

Integrating Spending Reviews into the Budget Cycle: Best Practices and Recommendations

To integrate spending reviews effectively into the budget cycle, align the process with the budget calendar, ensure consistency with medium-term frameworks, and incorporate outcomes into budget decisions. Countries like Australia, the UK, Ukraine, Italy, and Slovakia have institutionalized spending

0 views • 11 slides

UCOP Budget Development System Overview

Detailed overview of the UCOP Budget Development System for the FY1314 budget, including system logon instructions, workflow navigation, tool bar overview, data entry flow, payroll budget entry, budget allocation, review process, and deadlines for submission. The system provides access to view/edit/

0 views • 15 slides

Understanding the US Federal Budget Process

Explore the intricate details of the US federal budget process, including budget formulation, presentation, and execution. Learn about discretionary spending, agency budget development, and the multi-year budget trend. Discover the authority for the US budget as outlined in the US Constitution. Unve

0 views • 31 slides

Update on FY20/21 Budget Implementation & FY21/22 Budget Preparation DEG Presentation to LDPG

This presentation provides an update on the approved FY20/21 budget, its performance, reprioritization, supplementary budget requests, and an overview of the FY21/22 budget. It also highlights the shift to Program Based Budgeting and DP engagement, as well as key issues for the LDPG. The approved bu

0 views • 23 slides

Overview of 2022/23 Budget Engagement and Proposals

The 2022/23 Budget Engagement outlines the financial context, funding requirements, and measures to balance the budget in the face of Covid impacts, inflation, and new demands. Core Spending Power allocation, council tax, and government grant incomes are detailed, along with budget performance forec

0 views • 17 slides

Understanding Nutrient Cycling in Soil for Sustainable Agriculture

Explore the intricate processes of nutrient cycling in soil, with a focus on nitrogen (N) and phosphorus (P) balances. Discover the various inputs and outputs considered within different scales, from field to country level. Gain insights into the importance of interpreting data correctly and the imp

0 views • 22 slides

Understanding Budget Adjustments vs. Budget Amendments in AEL WIOA Summer Institute

Explore the differences between budget adjustments and budget amendments in the context of AEL WIOA Summer Institute's financial processes. Budget adjustments allow for moving a sum less than 20% without an amendment, while budget amendments involve larger changes and require specific approvals. Lea

0 views • 24 slides

School Budget Development Process Overview

The School Budget Development Process Overview provides a detailed look at the steps involved in creating a budget aligned with the school's strategic plan. It highlights the roles of the principal and the GO Team, emphasizing the importance of strategic priorities, budget parameters, and feedback s

0 views • 17 slides

Torch Lake Township FY23-FY24 Budget Review

Torch Lake Township's budget review for FY23-FY24 shows a breakdown of tax allocations, revenue increases, cash flow changes, and fund balances across various township funds. The township receives $0.18 on every tax dollar collected, with 82% going outside the township. The budget includes increment

0 views • 16 slides

Budget Breakdown and Financial Overview of Utah State FY 2018-2019

The budget of the State of Utah for FY 2018-2019 is detailed in various images illustrating where the funds go, where they come from, how they are distributed among different sectors like law enforcement, education, social services, transportation, and more. The breakdown includes information on gen

0 views • 14 slides

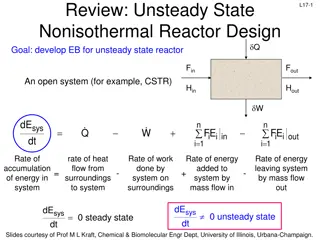

Chemical Reactor Design: Unsteady State and Nonisothermal Reactors

Developing energy balances for unsteady state and nonisothermal reactors is essential for designing efficient chemical reactors. The energy balances involve terms such as heat flow, work done, energy accumulation, and mass flow, which impact the reactor's performance. By considering factors like pha

0 views • 29 slides

Understanding Mass Measurement and Balances in Sugar Processing

The knowledge topic discusses the use of balances in sugar processing to measure mass accurately. It explains the difference between weight and mass, the units of mass, and the types of balances used in laboratories. From traditional mechanical balances to modern electronic balances, each plays a cr

0 views • 13 slides

School Food Service Update and Financial Overview

Within the School Food Service update, information is provided on negative account balances, personal parent notifications, and payment options available to parents. The data includes details on total negative balances, number of families contacted, and payment methods. Challenges with negative bala

0 views • 5 slides

Cal Poly Budget Update and Planning Overview

This document provides an overview of Cal Poly's budget planning calendar for the 2019-20 fiscal year, including key milestones such as the release of the Governor's budget, negotiation processes, allocation planning, and final budget approvals. It also compares the California State University (CSU)

0 views • 15 slides

Understanding Control Accounts and Reconciliation in Accounting

Control accounts in accounting are essential for summarizing a large number of transactions and verifying the accuracy of the ledger system. They include receivables and payables balances, with entries for credit sales and purchases. Reconciliation of these accounts ensures that financial records ar

0 views • 12 slides

Unobligated Balance Review April 2018

Review of unobligated balances from April 2018 discussing policies for carryover authority, automatic carryover vs. prior approval, and requirements for reporting and explanation of unobligated funds exceeding 25% of the approved budget. The case study illustrates calculations and determinations of

0 views • 4 slides