County Budgeting Process in Mississippi

The process of county budgeting in Mississippi involves identifying needs, forecasting requirements, preparing departmental budget requests, reviewing requests, adopting and implementing the budget, amending the budget, and adopting the final amended budget. Various revenue sources, such as local ad valorem taxes, licenses, fines, fees, state homestead, reimbursements, state aid roads, and federal grants, contribute to the budget. The budget is a plan of action for the fiscal year that includes revenues, expenditures, capital projects, debt service, cash management, and taxation requirements. Amendments to the budget are allowed during the year but must be finalized by September 30th.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

COUNTY BUDGET PROCESS MISSISSIPPI ASSOCIATION OF SUPERVISORS 2021 ANNUAL EDUCATIONAL CONFERENCE BILOXI, MS JUNE 15, 2021

COUNTY GOVERNMENT IN MISSISSIPPI CENTER FOR GOVERNMENT & COMMUNITY DEVELOPMENT MSU COOPERATIVE EXTENSION SERVICE SIXTH EDITION PUBLISHED 2019 https://mssupervisors.org/county-government-mississippi EXCERPTS FROM CHAPTER 7 - FINANCIAL ADMINISTRATION

RHUEL P. DICKINSON, JR., CPA SIMPSON COUNTY ADMINISTRATOR rhuel@co.simpson.ms.us OFFICE 601-847-1418 CELL 601-382-3009

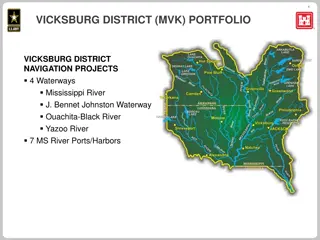

BUDGETING REVENUE SOURCES: LOCAL AD VALOREM TAXES, LICENSES, FINES, FEES, ENDING CASH BALANCE & ETC. STATE HOMESTEAD, REIMBURSEMENTS, STATE AID ROADS, EMS, GAS TAX, TRUCK & BUS PRIV., OIL, GAS, TIMBER, SALT SEVERANCE, LIQUOR PRIV., GRAND GULF, INSURANCE REBATE, GAMING AND ETC. FEDERAL EMPG, NATIONAL FOREST DISTRIB., PILT, GRANTS

BUDGETING BUDGET IS A PLAN OF ACTION FOR THE FISCAL YEAR FOR REVENUES, EXPENDITURES, CAPITAL PROJECTS, DEBT SERVICE, CASH MANAGEMENT AND TAXATION REQUIREMENTS BUDGET IS A LEGAL LIMITATION 19-11-17 BUDGET MAY BE AMENDED DURING THE YEAR 19-11-19 BUDGET MAY BE AMENDED THOUGH SEPTEMBER 30. 19-11-19 (NOT AFTER)

BUDGETARY PROCESS IDENTIFY NEEDS AND FORECAST REQUIREMENTS FOR NEEDS PREPARE DEPARTMENTAL BUDGET REQUESTS DEPT. HEADS REVIEW DEPARTMENTAL BUDGET REQUESTS ADMIN/COMP PREPARE RECOMMENDED ANNUAL BUDGET ADMIN/COMP ADOPTING AND IMPLEMENTING THE BUDGET BOS AMENDING THE BUDGET - BOS ADOPTING THE FINAL AMENDED BUDGET - BOS

BUDGETARY ORGANIZATION NEW BUDGET REQUESTS TO BE SUBMITTED AT JULY BOS MEETING NEW BUDGET PRESENTED TO BOS AT AUGUST MEETING ADVERTISE PUBLIC HEARING FOR NEW BUDGET & TAX LEVY AUG. ADOPT NEW BUDGET AND LEVY RESOLUTION BY SEPTEMBER 15 AMEND NEW BUDGET THROUGHOUT THE NEW YEAR FROM OCT. 1 TO THE FOLLOWING SEPT. 30. SPREAD FINAL AMENDED BUDGET ON MINUTES BY OCT. 31.

BUDGET CALENDAR MAY FORMULATE NEW BUDGET POLICY BOS MAY DEVELOP NEW FINANCIAL FORECAST ADMIN/COMP/OTHER JUNE DISTRIBUTE NEW DEPT. BUDGET FORMS ADMIN/COMP/OTHER JULY - FIRST BOS MEETING NEW BUDGET REQUEST DEADLINE 19-11-7, 19-25-13, 27-1-9 BOS/DEPT. HEADS JULY/AUG REVIEW NEW DEPT. BUDGET REQUESTS AND FORMULATE BUDGET ADMIN/COMP/OTHER 19-11-7 AUG PROPOSED NEW BUDGET TO BOS ADMIN/COMP/OTHER 19-11-7

BUDGET CALENDAR AUGUST ADVERTISE NEW BUDGET & CURRENT YEAR TAX LEVY HEARING 19-11-7 & 27-39-203 BOS/ADMIN/COMP/OTHER SEPT. 15 DEADLINE TO ADOPT AND ADVERTISE NEW BUDGET AND TAX LEVY 27-39-317 & 27-39-203, 27-39-317 - BOS WITHIN 10 DAYS AFTER TAX LEVY ADOPTION ADVERTISE OR POST 27-39-319 CHANCERY CLERK SEPTEMBER 30 DEADLINE TO AMEND OLD BUDGET 19-11-19 - BOS

BUDGET CALENDAR OCTOBER 31 DEADLINE FOR SPREADING FINAL AMENDED OLD YEAR BUDGET ON THE BOS MINUTES ADMIN/COMP/OTHER 19-11-19 MONTHLY FINANCIAL REPORT OF BUDGET SHOWING EXPENDITURES, LIABILITIES AND UNEXPENDED BALANCE AND UNEMCUMBERED BALANCE IN EACH FUND AND RECEIPTS FOR EACH FUND. CHANCERY CLERK/ADMIN/COMPTROLLER/OTHER 19-11-23

BUDGET FORMS FORMS - OFFICE OF STATE AUDITOR (OSA) 19-11-9 COUNTY FINANCIAL ACCOUNTING MANUAL - OSA FORMS MAY BE COMPUTERIZED ALL REQUIRED INFORMATION MUST BE PROVIDED

undefined

undefined