Unobligated Balance Review April 2018

Review of unobligated balances from April 2018 discussing policies for carryover authority, automatic carryover vs. prior approval, and requirements for reporting and explanation of unobligated funds exceeding 25% of the approved budget. The case study illustrates calculations and determinations of unobligated balances, prompting the need for explanations in progress reports. Contact Research Finance Analyst for questions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Unobligated Balance Review April 2018

NIH Grants Policy Statement 8.1.1.1 Carryover of Unobligated Balances from One Budget Period to Any Subsequent Budget Period The NoA will include a term and condition to indicate the disposition of unobligated balances (automatic carryover authority vs. prior approval required). For awards under SNAP, funds are automatically carried over to the subsequent budget period. However, the grantee will be required to indicate, as part of the grant's progress report, whether any estimated unobligated balance (including prior-year carryover) is expected to be greater than 25% of the current year's total approved budget. If greater than 25%, the grantee must provide an explanation and indicate plans for expenditure of those funds within the current budget year. For both SNAP and non-SNAP, when a grantee reports a balance of unobligated funds in excess of 25%, the GMO will review the circumstances resulting in the balance to ensure that these funds are necessary to complete the project, and may request additional information from the grantee, including a revised budget, as part of the review. If the GMO determines that some or all of the unobligated funds are not necessary to complete the project, the GMO may restrict the grantee's authority to automatically carry over unobligated balances in the future, use the balance to reduce or offset NIH funding for a subsequent budget period, or use a combination of these actions. https://grants.nih.gov/policy/nihgps/index.htm 2

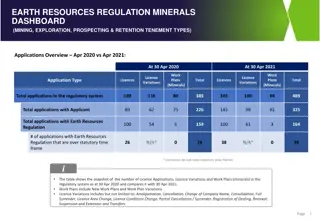

Unobligated Balance Example R01 subject to SNAP (automatic carryover, annual FFR not required) Current budget period: Year 3 (from 7/1/17 to 6/30/18) BSR shows total spent = 82% Is the unobligated balance greater than 25% of the current year's total budget? 3

Unobligated Balance Example - Continued Budget Period NOA Budget (TC) Posted Expenses (TC) Year 1: 07/2015 06/2016 450,925 375,000 Year 2: 07/2016 06/2017 432,425 375,000 Unobligated Balance Year 3: 07/2017 06/2018 432,425 333,531 Total for all years 1,315,775 1,083,531 $ 232,244 Incorrect Calculation Correct Calculation Base = All Years Base = Yr 3 NOA Unobligated Balance 232,244 232,244 Budget Base 1,315,775 432,425 % Unspent 18% 54% Unspent = 54% Unobligated balance > 25 % Summary: We determined that the unobligated balance is expected to be greater than 25% of the current year's total approved budget. PI/Admin should provide an explanation for unobligated balance in RPPR. Contact your Research Finance Analyst with any questions. 4