Professional Standards Management Information Dashboard - May 2022 Update

The May 2022 update of the Professional Standards Management Information Dashboard highlights an increase in new cases opened compared to previous years. Key Performance Indicators (KPIs) for 2022 are on track, with some improvements noted in the last quarter. The Registration and Accreditation Management Information Dashboard for Q1 2022 shows consistent performance in processing UK applications, with slight delays due to missing information. Efforts to streamline processes and enhance applicant guidance have led to improved customer service. Overall, the updates demonstrate a proactive approach to monitoring and enhancing operational efficiency.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

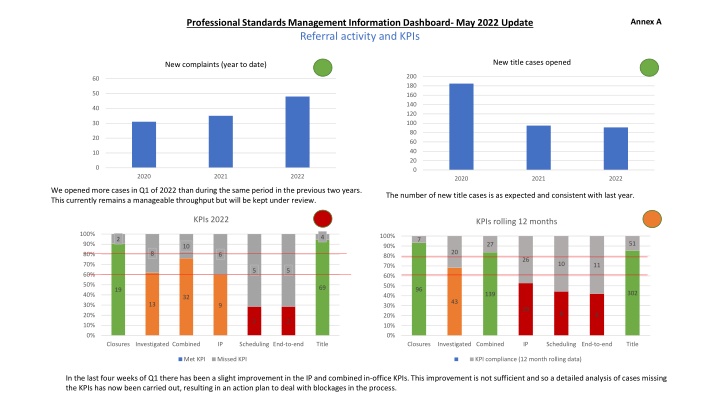

Annex A Professional Standards Management Information Dashboard- May 2022 Update Referral activity and KPIs New title cases opened New complaints (year to date) 200 60 180 50 160 140 40 120 100 30 80 20 60 40 10 20 0 0 2020 2021 2022 2020 2021 2022 We opened more cases in Q1 of 2022 than during the same period in the previous two years. This currently remains a manageable throughput but will be kept under review. The number of new title cases is as expected and consistent with last year. KPIs 2022 KPIs rolling 12 months 100% 100% 4 2 7 51 90% 27 90% 10 20 8 80% 6 80% 26 10 70% 11 70% 5 5 60% 60% 50% 50% 69 96 19 302 139 40% 40% 32 43 13 30% 9 30% 29 8 8 20% 20% 2 2 10% 10% 0% 0% Closures Investigated Combined IP Scheduling End-to-end Title Closures Investigated Combined IP Scheduling End-to-end Title Met KPI Missed KPI KPI compliance (12 month rolling data) In the last four weeks of Q1 there has been a slight improvement in the IP and combined in-office KPIs. This improvement is not sufficient and so a detailed analysis of cases missing the KPIs has now been carried out, resulting in an action plan to deal with blockages in the process.

Professional Standards Management Information Dashboard- May 2022 Update Notes on data Caseload and referral RAG ratings KPI RAG ratings No apparent risk or concern over caseload or referral numbers Achieving 80% or above Growing concern over caseload or referral numbers. To be monitored closely. Achieving between 60% and 80% Caseload or referral rate reaching critical level, posing risk to operational delivery. Compliance below 60% KPI timeframes Initial screening closures*: 14 weeks Cases investigated*: 14 weeks IP decisions: 12 weeks PCC scheduling: 29 weeks End-to-end: 56 weeks Title: 14 weeks NB: Some of the data sets in these dashboards are areas not reported upon historically. Therefore some 2019/20 data is estimated based on averages of the data available. *reported as a combined KPI to the Board

Registration and Accreditation Management Information Dashboard: Q1+ 2022 (January to April) UK route to registration Date UK apps received 2022 UK added to register Processed under 15 days Processed over 15 days KPI % in 2022 Mean time to process 2022 (days) Mean time to process (2021) UK apps received 2021 Added to Register 2021 KPI % in 2021 Jan-22 112 132 129 Feb-22 Mar-22 Apr-22 111 111 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Total 2022 48 51 45 6 91 83 79 4 362 377 352 15 93% 4.1 3.2 1183 1182 90% 99 2 3 98% 2.4 3.2 99 141 76% 88% 5.2 1.1 32 42 83% 95% 4.8 3.5 108 69 93% 89% 5.1 5.0 150 144 87% 2.5 77 105 92% 2.0 59 77 92% 1.4 44 44 95% 1.6 49 45 98% 2.1 62 61 85% 4.6 143 82 94% 9.2 277 275 93% 2.7 83 97 93% Performance update: New applications are broadly tracking the first quarter of 2021, with a minor decrease in April. There is evidence that this may be due to institutions issuing awards later than in previous years, as May 2022 applications are up on the previous year. Overall the volume assumptions in the budget are holding, with an increase in the prescribed fee for those re-joining the register. The KPI for UK applications is 15 working days from receipt. YTD the performance is 93%, up from 90% in 2021. We have refined our initial logging and triage process, meaning we can request missing information earlier, and improve customer service with more responsive communications. The cumulative rate of new UK applications is matching 2021 exactly, and our resource planning is based on this. There has been an increase in time to process applications, due to missing information. We have enhanced our guidance to applicants. We are still well within the KPI tolerances.

EU route to Registration Date EU apps received 2022 EU added to register Processed under 15 days Processed over 15 days KPI % 2022 Mean time to process 2022 (days) Mean time to process (2021) EU apps received 2021 Added to Register in 2021 KPI % 2021 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Total 2022 22 25 24 1 27 10 9 1 28 26 19 7 31 18 18 0 108 79 70 9 96% 5.4 28.1 31 47 6% 90% 7.7 26 22 62 24% 73% 11.7 23 22 33 64% 100% 7.5 29.6 89% 8.2 19.2 306 324 59% 20.9 21 20 75% 19.4 23 28 79% 8.9 15 23 83% 9.7 16 10 90% 4.9 35 20 5.4 34 22 95% 4.5 31 22 6 30 28 26 9 57% 100% 100% 100% Performance update: There have been three consecutive months where EU applications are higher in 2022 than in 2021. We are also having more enquires from EU applicants about returning to UK Register. We will monitor this through 2022. The KPI performance has stabilised after a period of complexity associated with the EU Transition period in Q1 2021. Seven of the last eight months have exceeded the KPI target. Low numbers of applications, and small numbers of breaches affect %. There are only 9 EU applications that were not processed within KPI. Those that did not were missing documentation from the home competent authority, who can be slow to respond. YTD there is a marked performance improvement (89% within KPI, versus 59% in 2021), due to our enhanced processes for checking applications earlier. The cumulative number of EU applications is similar to the pattern for 2021, though there is evidence that EU applications may be starting to increase. Our budget and resourcing assumptions match these levels of activity. Changes in processing times have been significant, from 25+ working days in Q1 2021, dropping through the remainder of the year, to 8.2 days for 2022 applications. This has been a direct result of earlier changes and chasing missing information, resulting in better customer service outcomes.

Re-joining the Register Date Within 5 working days (2021) Outside KPI Total KPI % Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21 Sep-21 Oct-21 Nov-21 Dec-21 Jan-22 Feb-22 Mar-22 Apr-22 134 18 152 88% 72 26 98 33 2 35 27 3 30 10 1 11 20 2 22 21 1 22 15 2 17 8 2 12 9 21 13 2 15 8 0 8 344 106 56 0 56 28 0 28 4 0 10 348 99% 106 73% 94% 90% 91% 91% 95% 88% 80% 57% 87% 100% 100% 100% 100% Performance update: There have been significantly more (almost double) architects re-joining the Register in 2022 than in comparison with 2021. The majority of these were removed for non-payment, despite the campaign of awareness and extended deadline for payment. These attracted the new prescribed fee of 80. We have had four complaints about the level of the fee from almost 500 re joins. 10% of the re-joins were returning to architecture after some time away. Performance for reinstating these architects has stabilised with five consecutive months of almost 100% compliance, despite the increased volumes. Having a permanent (not temporary) team, and reviewing our processes has yielded this result. We are confident this level of performance can be maintained.

Prescribed examinations Nationality of applicant British Indian Thai Australian South African Polish German Sudanese Russian Chinese Hong Kong Italian Canadian Japanese Venezuelan Lebanese Romanian Philippines Malay Part 1 Part 2 Total 5 1 0 1 0 2 0 1 1 2 2 2 3 1 0 1 1 1 1 5 1 2 1 1 1 1 0 0 5 1 0 0 0 1 0 0 0 0 10 2 2 2 1 3 1 1 1 7 3 2 3 1 1 1 1 1 1 44 25 19 Performance update: There were 30 Prescribed Examinations in January to end of March, and a further 14 in April. There are a further 25 examinations booked into July, which matches our budget and resource assumptions, and is similar to volumes in 2021. There are almost equal male to female applicants so far in 2022, whereas females have been higher numbers in previous years. The pass rate at Part 1 has increased and the pass rate decreased at Part 2. This relates to the re-take numbers in Part 1. We will review more closely the trend in Part 2, by country of applicant, and by stage of failure and report back. Hong Kong and Chinese applicants account for 25% of 2022 applicants. Another 25% of applicants are UK nationals with a non-prescribed qualification.

Qualifications Prescription Committee activity Preparing for transition to IET Jan-22 Mar-22 Apr-22 Total New qualifications Renewals Annual monitoring and changes Original prescription period Number by duration Prescription expiry year Number of qualifications 1 3 3 0 0 3 4 6 1 year 4 years 5 years (ext) 6 years (ext) 2 years 3 years 4 years 5 years (ext) 5 years (ext) 6 years (ext) 3 years 4 years 5 years (ext) 3 years 4 years 5 years (ext) 4 years 5 years 5 years 3 6 16 14 3 5 10 11 19 13 8 5 21 2 8 18 2 23 3 2022 39 4 8 9 12 9 12 22 32 2023 61 Performance update: The proportion of Part 1 qualifications remains the same, at 45%. Four new qualifications have been added since the last Board update The Prescription Committee has met three times so far in 2022, and there is a further meeting in May. This phasing of activity has allowed all Annual Monitoring considerations to be made, six months earlier than the previous cycle. This smoothing of the activity allows a greater, current, view of the institution for the Executive, and assists the institution to focus on their action plans or developments for the next cycle. In anticipation of IET and any transition of accreditation systems, we have started to analyse the existing qualifications to determine whether any qualifications (or institutions) may be required to extend or shorten their prescription periods. This will help plan activity to bridge the change in governance, and be based on risk assessment of the current performance. 2024 34 2025 28 2026 25 2027 3

Policy and Communications Management Information Dashboard- Q1 2022 Measures of success: Number and profile of respondents (i.e. whether the respondents are from our target audiences) Whether we have derived insights that support Board decision-making (i.e. whether we know the extent of support for our proposals, or have identified operational or policy risks we can mitigate) Consultations and surveys Events and targeted meetings Number and profile of attendees (i.e. whether the attendees are from our target audiences) Value of insights gathered in the meetings (i.e. whether we hear useful anecdotes that help us understand the sector or policy topics) Whether participant feedback is positive (i.e. satisfaction surveys or positive comments about the event or ARB) Key insights CONSULTATIONS AND SURVEYS START DATE CLOSE DATE RESPONSES Modernising initial education and training Respondents 69% (488): Registered architects 9%: students (including Parts 1 and 2, and Part 3 candidates) 15%: other built environment professionals including architectural designers or consultants Key insights Each of the five aspects of ARB s vision for success received high levels of support (between 92% and 79%) 65% of all respondents agreed the current structure of Parts 1,2 and 3 should change. The extent of the agreement differed: 94% of architecture students, 90% of other built environment professionals and 55% of Registered architects agreed 80% of respondents either strongly agree or agree that the best way to describe the competencies architects need would be to describe what an architect must know, be able to do and how they must behave (i.e. support our outcomes-based approach) 43% of respondents used their written response to suggest how structural change should happen. The most common suggestion was that the practical experience requirements need to change (raised proactively by 19% of respondents) 21% of respondents used their written response to highlight the importance of the competency area of business and practice skills; other topics raised were ethics and professionalism (7%), safety and sustainability. Modernising initial education and training 2 Oct 21 10 Jan 22 711 International routes 27 Oct 21 14 Jan 22 3 Mixed qualifications 1 Feb 22 28 Feb 22 2 ORGANISATION / EVENT SUBJECT DETAIL DATE RIAI Intro / catchup 24 Jan 22 RIBA - Jack Pringle Alan 1:1 10 Feb 22 CIAT Intro / catchup 15 Feb 22 CIAT - Kevin Crawford Alan 1:1 21 Feb 22 Annual lecture joint with RIBA Simon Allford Introduced themes from CPD survey to a small group of stakeholders: RIBA, RIAS, RSAW, RSUA, SCOSA, APSA International routes Technical consultation so low responses. Of the three responses, two were on behalf of an organisation and one was from an individual. We also gathered detailed feedback which informed the development of our proposals by meeting with interested parties and holding a roundtable discussion. Outcome published on 29 March and emailed to interested stakeholders. Bartlett Part 3 Lecture 1 Mar 22 ARB-hosted CPD briefing event on 11 March 11 Mar 22

Measures of success: Number and profile of respondents (i.e. whether the respondents are from our target audiences) Whether we have sent out briefings on the issues (i.e. Bill debates) that matter to us, and whether they have been read and/or resulted in positive comments about ARB or architects Number of primary target individuals or organisations that agree to meet with us Parliamentary and stakeholder activities Direct communications Number of people who open, read and interact with (i.e. click on links in) our relaunched eBulletin. Number and profile of people who act upon our targeted communications (i.e. complete surveys, visit landing pages or download reports). STAKEHOLDER COMMUNICATIONS NUMBER SENT POSITIVE RESPONSES REGISTRANT COMMUNICATIONS NUMBER SENT UNIQUE OPENS UNIQUE CLICKS DATE DATE House of Lords - Building Safety Bill 23 6 3 Feb 22 ARB Insight 44,448 24,590 4,378 8 Mar 22 eBulletin average in 2021 44,007 13,852 1,994 2021 Update on MRA- Australia and New Zealand 4 + website 2 5 Mar 22 Key insights Introductory meeting offers to MPs and peers 56% of recipients opened the relaunched ARB Insight. On average across all issues in 2021, only 31% of recipients opened the eBulletin. The number of recipients who clicked on links in ARB Insight was more than double the average number for the eBulletin last year. 40 TBC Mar 22 Update on MRA - USA Website 17 Mar 22 The most popular link in ARB Insight was the Chair s Message, with 1,806 unique users clicking on this link. International routes - consultation outcome 20 + website 29 Mar 22 When we emailed peers in advance of the Bill's second reading debate, we received several thank yous and a positive mention of ARB and CPD work (Baroness Eaton). No concerns were raised about Act changes.

Measures of success Number and (where possible) profile of users who have watched a video, completed a form or survey, read a page, downloaded a report, or requested a meeting. Number of times our online social media posts have been seen and/or shared and/or commented on or have resulted in further engagement i.e. meetings. Online (website and social media) VISITS (SESSIONS) WEBSITE USERS PAGES VIEWED MOST POPULAR PAGE (homepage excluded) JAN FEB 22,617 19,620 33,021 27,129 73,643 62,962 Public Information - Before hiring an architect Public Information - Before hiring an architect Architect information - Applying for registration for the first time - I hold overseas non-recognised UK qualifications 22,396 30,075 87,020 MAR Key insights VISITS (SESSIONS) REGISTER USERS TOP SOURCES There were no new publications launched or events held during this period. JAN FEB MAR 11,010 9,462 14,259 14,572 12,346 17,815 Direct* Direct Direct When we sent out ARB Insight, we included links to recent updates on our website. Our update about Register after the retention fee period was the main story (other than the Chair s Message). There were 1,778 unique users who clicked on this link (compared to 1,806 for the Chair s Message, the most popular link). *Direct means that the website visit came from typing the URL into the browser or from a bookmark. When Google Analytics is unable to identify the source of traffic, it defaults to direct . A session refers to every time that a user has engaged with the website. The users are unique individuals, but they might engage with a page more than once.

Measures of success Number and (where possible) profile of users who have watched a video, completed a form or survey, read a page, downloaded a report, or requested a meeting. Number of times our online social media posts have been seen and/or shared and/or commented on or have resulted in further engagement i.e. meetings. Online (website and social media) TWITTER TOTAL FOLLOWERS 3,105 IMPRESSIONS*ENGAGEMENTS AND CLICKS 15,200 ENGAGEMENTS AND CLICKS 65 20 48 133 FACEBOOK FOLLOWERS REACH *impressions: the number of times it has appeared in someone s feed 1,441 1,443 1,449 - 375 408 468 1,251 JAN FEB MAR Facebook Total 238 JAN 3,123 3,154 - 5,400 3,809 24,409 139 87 464 FEB MAR Twitter Total WATCH TIME (HOURS) 30 18 11 59 TOTAL FOLLOWERS 34,722 34,942 35,189 IMPRESSIONSENGAGEMENTS AND CLICKS 26,649 5,350 12,252 44,251 YOUTUBE VIEWS IMPRESSIONS LINKEDIN JAN FEB MAR LinkedIn Total 262 156 104 522 566 476 425 1467 JAN FEB MAR YouTube Total 811 207 372 1,390 - Key insights Our most popular tweets (based on impressions) were about EDI, recruiting a Chair, and our MRA work with Australia and New Zealand. Our most popular LinkedIn posts were videos of Elena Marco and Neal Shasore speaking at our education events, and an update on our MRA work with Australia and New Zealand. We received a high number of impressions in January owing to the popularity of the short videos we produced using footage from the 2021 IET events. One video in particular on LinkedIn caused a lot of discussion in the comment section which caused that post to get a big boost.

Policy and Communications Management Information Look Ahead to Q2 2022 April Online event to share CPD survey results with respondents Publication of CPD survey report Building Safety Bill and Professional Qualifications Bill receive Royal Assent May Launch consultation on changes to our Professional Indemnity Insurance guidance First focus groups on CPD June Second issue of ARB Insight following May Board meeting Online event to share IET survey results with respondents Publication of IET survey report with information about our policy development process (including events and future engagement opportunities) New powers on CPD, listing disciplinary outcomes on the Register and the new Appeals Committee come into force Publication of Annual Report and Financial Statements (subject to dates set by Parliamentary schedule) Potential publication on DLUHC s review of architects regulation