Special Education Cohort Program: Payment FAQs

Find answers to common payment questions in the Special Education Cohort Program at George Mason University. Learn about financial holds, payment methods, receipts, late fees, dropping classes, and more. Contact specepay@gmu.edu for assistance.

1 views • 16 slides

Cash Flow Forecasts

Learn about cash flow fundamentals, inflows/receipts, outflows/payments, planning, monitoring, and cash flow statements. Discover the importance and benefits of cash flow forecasts in business management.

0 views • 29 slides

Special Education Cohort Program

Get answers to common payment questions in the Special Education Cohort Program. Learn about handling financial holds, late fees, class payments, withdrawals, receipts, and more. Ensure smooth payment transactions in the program.

0 views • 16 slides

Receipts and Payment Account in Accounting

Receipts and Payment Account, similar to a cash book, tracks cash and bank transactions of a nonprofit organization. It records entries on a cash basis for receipts and payments, showing opening and closing balances of cash and bank. It serves as a summary of the Cash Book and follows the Real Accou

0 views • 4 slides

Overview of Kentucky High School Athletic Association (KHSAA)

The Kentucky High School Athletic Association (KHSAA) is a nonprofit organization managing high school sports in Kentucky since 1917. With 290 member schools, KHSAA provides championships, insurance, coaching education, and safety programs for student-athletes, coaches, and officials. It is designat

1 views • 20 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

1 views • 7 slides

ASI Student Research & Travel Reimbursement

This document provides detailed instructions for students applying for research and travel reimbursement, covering guidelines, receipt itemization, lodging/hotel expenses, transportation, airfare, conference registration, and reimbursement timeline. It emphasizes the importance of applying for funds

1 views • 11 slides

Direct Listing Of Share Of Indian Companies Overseas Through IFSC GIFT City

Indian companies can now directly list shares on overseas markets, bypassing depository receipts. This flexibility allows them to raise capital in both INR domestically and foreign currency internationally. The LEAP Rules and NDI Rules govern eligibility criteria and conditions for listing in IFSC.

2 views • 6 slides

Opportunities for Small Businesses through PWSBE Certification

Sharon Harvey and Lee Lim lead the Office of Minority and Women's Business Enterprises (OMWBE) in Washington State, providing essential resources for under-represented businesses to access procurement opportunities. The OMWBE aims to promote equity in public spending by eliminating barriers to parti

1 views • 12 slides

Effortless E-Bill Access with IntelliBooks

\nDiscover how IntelliBooks is transforming the restaurant industry while championing environmental sustainability! With our cutting-edge software solutions, over 1000* restaurants are streamlining operations and reducing paper waste with our unique E-billing feature. Say goodbye to printed receipts

0 views • 8 slides

IntelliBooks Pioneers Sustainable Restaurant Management

Transforming Dining: IntelliBooks Pioneers Sustainable Restaurant Management\n\nDiscover IntelliBooks, the innovative restaurant software that's revolutionizing operations and promoting sustainability. With over 1000 restaurants onboard, IntelliBooks offers comprehensive solutions from POS systems t

0 views • 1 slides

QuickBooks Printer Setup

Setting up a printer with QuickBooks involves installing printer drivers, configuring printer settings, integrating with QuickBooks, and performing test prints. By following these steps and troubleshooting common issues, you can ensure seamless printing of invoices, receipts, and reports, enhancing

2 views • 3 slides

The 40% Retention Rule for Charitable Organizations in Kentucky

The 40% Retention Rule in Kentucky mandates that a charitable organization must retain at least 40% of the adjusted gross receipts from charitable gaming for its charitable purposes. This rule ensures that funds generated from gaming activities are primarily used for the organization's intended char

0 views • 16 slides

Accounting & Accounting Controls Workshop with Tom Walters

Explore the Minnesota District Leadership Workshop focusing on accounting controls led by retired CPA Tom Walters. Learn about preventive, detective, and corrective controls in a congregational setting to ensure accurate financial management. Gain insights on safeguarding cash receipts, cash disburs

0 views • 12 slides

Transportation Documents in International Trade

International trade relies on various documents to facilitate transactions, including transportation documents, invoices, and insurance policies. These documents are crucial for commercial operations and compliance with exchange control regulations in different countries. Main transportation documen

6 views • 41 slides

Chrome River Overview - Travel and Expense Management System

Chrome River offers a comprehensive travel and expense management system with features such as pre-approvals, expense reports, P-Card management, mobile access, receipt capture, and single sign-on capability. Benefits include ease of use, mobile access, reduced paper usage, and automatic routing. Th

1 views • 12 slides

Streamlining Good and Services Reconciliation Procedures

Streamline your reconciliation procedures for goods and services efficiently with detailed steps on user profiles, logging in, activating receipts, email verification, e-receipt handling, and delegate submission. Enhance accuracy and compliance with organized workflows and tools.

0 views • 21 slides

Getting Started with Concur: Financial & Business Services Presentation

Learn how to access Concur, update your Concur profile, assign travel and expense delegates, set up your profile, designate a travel arranger, and assign an expense delegate in this informative presentation from Financial & Business Services at the University of Utah. Access domestic and internation

0 views • 10 slides

Accounting and Accounting Controls Workshop Overview

This workshop led by Tom Walters covers the importance of accounting controls, including preventive, detective, and corrective measures. It delves into the types of controls needed in a congregational setting to safeguard cash receipts and disbursements effectively. Attendees will gain insights on m

4 views • 12 slides

Comprehensive Report on Computer Aging and Replacement Plan

This detailed report provides insights into the aging of computers categorized by fiscal years, use type, and cost. It includes statistics on instructional and non-instructional desktops and laptops, accompanied by corresponding cost breakdowns. Additionally, the report outlines the funding mileston

1 views • 8 slides

Insights into Travel Patterns and Tourism Trends

Explore international and regional travel trends such as visitor arrivals, tourism receipts, and top destinations. Understand the significance of tourism growth, both domestic and international, and learn about the world's top tourism destinations and expenditures. Delve into topics like tourism sur

9 views • 30 slides

Global Travel Trends and Insights

Understanding international and regional travel patterns and trends is crucial for the future planning and marketing of touristic destinations. This includes analyzing visitor arrivals, tourism receipts, top destinations, and the balance between domestic and international tourism. The World Tourism

5 views • 30 slides

Mastering Desktop Receiving in PeopleSoft eProcurement

Explore the functionality of desktop receiving in the PeopleSoft eProcurement module to efficiently manage goods receipt processes in your department. Learn how to receive, review, sort, and reject ePro goods, along with creating desktop receipts for Office Depot Purchase Orders. Understand the step

0 views • 14 slides

Effective Receipt Documentation Guidelines

Guidelines for documenting aircraft fuel receipts, vehicle fuel receipts, and merchandise receipts to ensure accurate record-keeping for reimbursement. Includes details on checking fuel quantities, total purchase amounts, tail numbers, vehicle numbers, vendor information, and member details. Emphasi

1 views • 4 slides

Overview of Gross Receipts Taxes in Louisiana and Other States

Gross Receipts Taxes, a resurgence in state revenue-raising mechanisms, are examined in Louisiana and other states, highlighting similarities and differences in approaches. The presentation delves into the structure and implications of gross receipts taxes, providing insights on legislation and fisc

0 views • 27 slides

Best Practices for Cash Handling and Receipt Management

Enhance your cash handling and receipt management practices with essential guidelines such as separation of duties, internal controls, and proper handling of funds and transactions. Discover key insights on authorized departments, standards for receipts and funds handling, and ways to share responsi

1 views • 43 slides

Efficient eOffice File Management System Guide

Step-by-step procedures for using the eOffice File Management System, including logging in, diarization, sending letters, receipts filing, and document uploading. Learn how to efficiently manage files and documents using this system for seamless workflow and productivity.

0 views • 29 slides

Hepatitis B Vaccines: Genuine vs Counterfeit - Insights from Uganda National Drug Authority

Explore the difference between genuine and counterfeit Hepatitis B vaccines in Uganda, as detailed by the National Drug Authority. Learn about the authorized vaccine on the market, counterfeit batch numbers, fake addresses on invoices/receipts, and the availability of vaccines in private sectors. St

0 views • 8 slides

Analysis of Union Budget 2021-22: Economist's Perspective by Dr. Soumya Kanti Ghosh

The analysis provides insights into the fiscal arithmetic of FY21 and projections for FY22, including capital expenditure growth, revenue receipts, non-tax revenue, disinvestment targets, and measures for financial consolidation. It highlights the shift towards greater transparency in finances and t

5 views • 11 slides

Receipt Generation for BIBD Online Payment

Receipt Generation for BIBD Online Payment is a process required to generate receipts for Government school students' payments made via BIBD online for public examinations (IGCSE/GCE O Level/GCE AS Level/GCE A Level). School Exam Secretaries can use this system to handle student lists, course querie

0 views • 48 slides

County Government Banking Arrangements Presentation

This presentation outlines the County Government's banking arrangements, cash management, and the roles of accounting officers in ensuring effective financial management. It emphasizes the importance of maintaining internal controls, preparing accurate financial reports, and transferring funds only

1 views • 19 slides

CSU Travel Policy: Per Diem Implementation Guidelines

In this detailed guide, learn about the implementation of per diem in CSU Travel Policy, reasons for moving from actuals to per diem, coverage areas, GSA rates, and the benefits of per diem over receipts. Get insights into complying with federal guidelines, avoiding tax implications, and the per die

0 views • 23 slides

Guidelines and Procedures for Reimbursements and Vendors at BCC

This document outlines the step-by-step process for becoming a vendor, requesting reimbursements, and purchasing items at Berkeley City College. It includes instructions on filling out forms, getting price estimates, submitting receipts, and adhering to budget proposals to ensure compliance with pol

0 views • 10 slides

Efficient Student Club Funds Management System

Student Activities Purchase Orders streamline the payment process for student clubs, ensuring uniformity and accountability in fund usage. Purchase orders require three signatures and necessary information such as date, club details, vendor, description of purchase, and spending amount. Different ty

0 views • 14 slides

The Design of the Tax System: An Overview

This chapter explores the design of the tax system in the US, discussing how the government raises revenue, its efficiency, and fairness. It delves into historical perspectives, Benjamin Franklin's views on taxes, government revenue trends, federal income tax rates, and government spending. The cont

3 views • 43 slides

Comprehensive Setup and Configuration Guide for Office Management Software

Detailed setup and configuration instructions for your office management software, including customizing company information, tax rates, localization settings, barcode types, stock management, receipts, and invoices. Ensure a seamless setup process by following the step-by-step guidance provided in

0 views • 31 slides

P-Cards: Guidelines and Procedures for Efficient Use

This comprehensive guide covers essential topics such as P-card timelines, completing forms, itemized receipts, supporting documentation requirements, and online orders. Learn about the importance of submitting P-cards promptly, understanding itemized receipts, and how to handle different types of s

0 views • 16 slides

Gross Receipts Taxation for Health Care Practitioners in New Mexico

New Mexico imposes gross receipts tax on individuals and businesses conducting business in the state. This presentation discusses the basic principles of the tax, exemptions for non-profits, and deductions available for health care practitioners. It outlines the specific deductions under Sections 7-

0 views • 10 slides

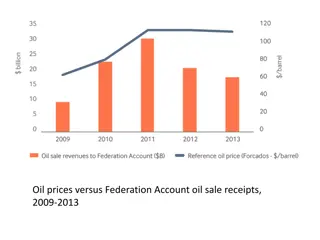

Analysis of Oil Sales and Revenues in Nigeria, 2009-2015

Comparison of oil prices vs. Federation Account oil sale receipts, reported earnings vs. treasury receipts, oil-for-product swap deals, NNPC trading subsidiaries, and more in Nigeria from 2009 to 2015, including significant losses and contract holders.

0 views • 9 slides

The Difference Between Receipts and Payments Account and Income and Expenditure Account

Receipts and payments account is akin to a cash book, while income and expenditure account resembles a profit and loss statement. The former tracks cash receipts and payments, while the latter shows financial results over a specific period. They differ in format, nature, treatment of capital and rev

0 views • 10 slides