Managing Interest Rate and Currency Risks: Strategies and Considerations

Interest rate and currency swaps are powerful tools for managing interest rate and foreign exchange risks. Firms face interest rate risk due to debt service obligations and holding interest-sensitive securities. Treasury management is key in balancing risk and return, with strategies based on expect

3 views • 21 slides

Improving Heat Rate Efficiency at Illinois Coal-Fired Power Plants

Heat rate improvements at coal-fired power plants in Illinois are crucial for enhancing energy conversion efficiency, reducing carbon intensity, and minimizing pollution. By increasing the heat rate/efficiency by 6%, these plants can generate more electricity while burning the same amount of coal. T

2 views • 11 slides

Understanding Student Loans: Options, Interest Calculation, Daily Interest Formula

Explore the various options available for student loans, learn how to calculate interest in different loan scenarios, and apply the simplified daily interest formula. Discover key terms like FAFSA, EFC, federal loans, private loans, and more. Dive into examples of interest accrual during school and

0 views • 19 slides

Understanding the Importance of Time Value of Money

Explore the significance of time value of money in financial decisions through topics like interest rates, types of interest, compound interest, future values, and comparing simple versus compound interest. Learn how time allows for earning interest, postponing consumption, and increasing the value

0 views • 41 slides

Understanding Futures and Swaps in FX Markets

Exploring the world of FX derivatives such as futures, options, and swaps, with insights into how futures contracts differ from forward contracts, the concept of long squeezes in the oil market, and the risks associated with specific investment products like Crude Oil Treasure. Discover the intricac

0 views • 47 slides

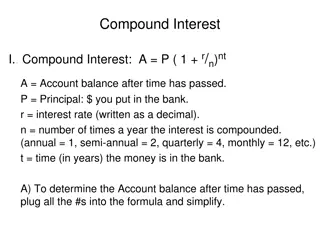

Understanding Compound Interest and Simple Interest Formulas

Interest rates play a crucial role in financial transactions. Compound interest is earned on both the principal and accumulated interest, while simple interest is earned solely on the principal amount. Different compounding frequencies affect the overall interest earned. Learn how to calculate simpl

1 views • 14 slides

Understanding Compound Interest and Future Value Calculations

Explore the concept of compound interest, its comparison with simple interest, and key formulas to calculate future values. Learn how to calculate interest rates, compounding periods, future values of investments, and present values of money. Understand the significance of periodic rates of interest

1 views • 39 slides

Understanding Data Rate Limits in Data Communications

Data rate limits in data communications are crucial for determining how fast data can be transmitted over a channel. Factors such as available bandwidth, signal levels, and channel quality influence data rate. Nyquist and Shannon's theoretical formulas help calculate data rate for noiseless and nois

0 views • 4 slides

Understanding Simple Interest: Calculations and Examples

Explore the concept of simple interest, including its definition, types, terminology, and calculations. Learn how to calculate interest based on principal, rate, and time with practical examples. Discover how to determine interest earned, balance, and interest rates in various scenarios involving de

0 views • 9 slides

Understanding Compound Interest in Class VIII Mathematics

In this chapter, students will learn about simple interest and compound interest, memorize their formulas, derive compound interest formula from simple interest concept, calculate compound interest with different compounding frequencies, understand growth and depreciation concepts, and derive formul

1 views • 29 slides

Understanding Interest Rate Calculation in Financial Mathematics

This course covers the formula for finding unknown factors of interest rates, such as compound amount, compound interest, and simple interest. Students learn to calculate interest rates based on given values and examples are provided for better understanding.

0 views • 22 slides

Empirical Analysis of Kuwaiti Dinar Exchange Rate Behavior and Misalignment

This research focuses on studying the behavior of the real equilibrium exchange rate (REER) of Kuwaiti Dinars, estimating the equilibrium exchange rate using the BEER model, and calculating real exchange misalignments (RERM). It delves into the impact of exchange rate fluctuations on macroeconomic v

0 views • 15 slides

Accounting Entries in Hire Purchase System for Credit Purchase with Interest Method

In the Credit Purchase with Interest Method of Hire Purchase System, assets acquired on hire purchase basis are treated as acquired on outright credit basis with interest. This method involves initial entries for recording the asset acquisition, down payments, interest on outstanding balance, instal

0 views • 10 slides

Practical Guide to Interest Rate Swap Valuation by Alan White

Understand the concept of interest rate swaps, their practical applications, valuation methods, and real-world examples. Learn about swaplets, fixed and floating legs, and how swaps can be used to manage interest rate exposure.

3 views • 11 slides

Understanding Interest Rates and Time Value of Money

This chapter delves into interest rate measurement, defining the force of interest, simple interest, and variable force of interest, along with the concept of time value of money. It explains amount functions, compound interest, effective rate of interest, and includes examples to illustrate calcula

0 views • 20 slides

Understanding Exchange Rate Behavior with Negative Interest Rates: Early Observations by Andrew K. Rose

In this study, Andrew K. Rose examines the exchange rate behavior in economies with negative nominal interest rates, focusing on the impact and implications of such rates on exchange rates. The findings suggest limited observable consequences on exchange rate behavior, with similarities in shocks dr

0 views • 42 slides

Overcoming the Zero Bound on Interest Rate Policy by Marvin Goodfriend

Exploring the zero bound problem in interest rates, the paper discusses the challenges of negative nominal interest rates, their impact on the economy's stability, and proposed solutions such as carry taxes on money, open market operations, and monetary transfers. Factors affecting real interest rat

0 views • 33 slides

Understanding Interest Rates: Key Concepts and Impacts Explained

Interest rates play a crucial role in financial decisions, affecting borrowing costs, savings, and overall financial success. Learn about compound interest, the impact of rates on payments, and how interest can work for or against you. Gain insights into the complexities of interest and how it influ

0 views • 13 slides

Understanding Forwards, Futures, and Swaps in Investment Finance

Dive into the world of investments with a detailed analysis of forwards, futures, and swaps. Discover how these derivatives work, their key characteristics, and practical examples of how they are utilized for hedging and risk management in the financial markets.

1 views • 36 slides

Understanding Derivatives for Managing Interest Rate Risks in Indian Insurance Industry

Exploring the use of derivatives in hedging interest rate risks and their significance in the Indian insurance sector. The seminar delves into interest rate risk management, derivatives market dynamics, challenges, and the impact on insurers. Insights are provided on the investment strategies of ins

0 views • 45 slides

Understanding Compound Interest Formulas and Examples

Compound interest is a powerful concept in finance that calculates the growth of an investment over time. This summary explains the formula for compound interest, how to calculate account balances and interest earned, and examples for various scenarios. You'll also learn how to solve for the princip

0 views • 7 slides

Understanding Compound Interest: A Practical Guide

Compound interest is a powerful financial concept that can significantly impact your savings and investments. This guide explains how compound interest works using geometric series and provides a step-by-step solution to a compound interest problem. Learn about the types of interest, the difference

0 views • 26 slides

Understanding Compound Interest in Advanced Financial Algebra

Compound interest refers to earning interest on both the principal amount and the accumulated interest. This concept is explored through examples of annual, quarterly, and daily compounding, showing how money grows over time based on different compounding frequencies. The formulas and calculations d

0 views • 13 slides

Understanding Compound Interest in Mathematics

This detailed content explains the concept of compound interest in mathematics, covering key terms like moneylender, borrower, principal, rate, and amount. It also delves into simple interest, types of interest, and provides formulas for calculating compound interest based on different scenarios. Pr

0 views • 12 slides

When is a Fixed Rate Loan Not a Fixed Rate Loan? Dissecting the Swift Report Bank Confidential 1st March 2022

Loans with embedded swaps, such as Fixed Rate Loans (FRL), can present challenges and risks that may make them toxic financial products. Tailored Business Loans (TBLs) were sold by various banks, including high street names like Yorkshire Bank/Clydesdale Bank, RBS/NatWest, Nationwide, Lloyds Bank, H

0 views • 11 slides

Introduction to Bubble Sort Algorithm

Bubble sort is a simple comparison-based sorting algorithm that repeatedly compares adjacent elements and swaps them if they are in the wrong order. It is easy to implement but inefficient for large datasets. The algorithm iterates through the list multiple times until no more swaps are needed, ensu

0 views • 16 slides

Debt-for-Nature Swaps: A Solution for Small States' Debt Challenges

Debt-for-Nature Swaps offer an innovative approach to addressing debt challenges in small states by converting debt into funding for conservation activities. While these swaps have potential benefits, their contribution to debt reduction has been limited. Despite generating significant funds for nat

0 views • 12 slides

Understanding Derivatives and Swaps: A Comprehensive Overview

Explore the concepts of derivatives and swaps, including their types, features, and the swap market. Delve into the details of how derivatives are used as contracts based on underlying financial assets, while swaps involve the exchange of financial instruments between parties. Learn about different

0 views • 20 slides

Understanding Interest Rate Swap Agreements

An interest rate swap agreement is a contract between two parties to exchange cash flows at specified intervals, allowing for risk management and altering the characteristics of assets and liabilities. By making fixed and floating rate payments, parties can hedge against interest rate fluctuations a

0 views • 21 slides

Understanding the Use of Interest Rate Swaps in Insurance Industry

This presentation delves into the world of interest rate swaps (IRS), their types, regulations, and market overview in the insurance sector. It explores why the IRS market is not growing despite its potential benefits. The content covers IRS basics, variations in types, regulatory guidelines, and ke

0 views • 21 slides

Use of Credit Default Swaps (CDS) by Investment Funds

Presentation at the ESMA workshop discussed the potential benefits and costs of using Credit Default Swaps (CDS) by investment funds. It highlighted the various uses of CDS, including risk management, alternative liquidity, and investment strategies. Evidence shows that a small percentage of UCITS f

0 views • 6 slides

Understanding Financial Derivatives: An Overview of Forward Contracts, Futures, Options, Swaps, and Credit Derivatives

Financial derivatives play a crucial role in managing risk and speculation in financial markets. This overview covers the definitions and characteristics of forward contracts, futures contracts, options (calls and puts), swaps, and credit derivatives. Swaps involve exchanging payments over time, whi

1 views • 23 slides

Understanding Funding Grid and Commitment Accounting in ConnectCarolina

Learn about lump sum payments, funding swaps, and essential processes in ConnectCarolina. Explore how to use the funding grid, enter payments, swaps, and chartfield rules. Discover the role of Commitment Accounting in managing employee funding effectively. Enhance your ConnectCarolina knowledge and

0 views • 64 slides

Retroactive Funding Swaps: Addressing Financial Issues in ConnectCarolina

ConnectCarolina faced challenges with inaccurate distribution of labor expenses, leading to complications in encumbrances and suspense accounts. A new tool for retroactive funding swaps is introduced to rectify these issues with a focus on improving compliance and accurate financial tracking, especi

0 views • 41 slides

Understanding Credit Derivatives and Managing Credit Risk

This chapter delves into credit derivatives, exploring their purpose, types such as credit default swaps and total return swaps, and the development of the market over the years. It discusses credit risk, problems associated with it, methods for estimating credit risk, and the role of credit derivat

0 views • 35 slides

Understanding Interest Rate and Currency Swaps

Introduction to interest rate swaps (IR) and currency swaps, covering definitions, examples, reasons for use, valuation, payoffs, credit risk, and other swap types. Details include the concept of swaps, calculation of cash flows, and a focus on interest rate swaps with examples and cash flow illustr

0 views • 63 slides

Impact of Negative Nominal Interest Rates on Bank Performance: Cross-Country Insights

Examining the effects of negative nominal interest rates on bank performance reveals challenges in maintaining profitability, with concerns around reduced interest rate margins and disruptions to monetary transmission mechanisms. Empirical evidence suggests a reluctance among banks to impose negativ

0 views • 43 slides

Understanding Heart Rate and Pulse: Key Differences and Measurement

Heart rate, also known as pulse, is the number of times your heart beats per minute. It varies based on factors like age, fitness level, and emotions. Pulse is a direct measure of heart rate. Learn about the differences between heart rate and blood pressure, how to measure heart rate, and what const

0 views • 8 slides

Understanding Simple Interest in Banking and Finance

Explore the concept of simple interest and its application in banking and finance. Learn how to calculate simple interest using the formula and solve examples to understand its practical implications. From earning interest on savings to owing interest on loans, grasp the fundamental principles of in

0 views • 23 slides

Understanding Interest and Calculating Simple Interest

In the realm of financial education, interest plays a crucial role both in savings and debt. Interest on savings helps you earn money, while interest on debt results in paying back more than borrowed. This article explains the concept of interest, how to calculate simple interest, and the difference

0 views • 8 slides