Filing a Candidate’s Statement of Organization

The process of filing a Candidate's Statement of Organization (CFA-1) in Indiana. Understand the deadlines based on the salary for the elected office and the campaign finance committee requirements.

1 views • 10 slides

RBI Directions on Filings of Supervisory Returns

RBI issues new Master Directions on 'Filing of Supervisory Returns,' emphasizing NBFCs. Timelines, revised applicability, and online portals introduced for streamlined filing. Physical submission required for Form A Certificate.

1 views • 5 slides

Online Consumer Complaint Filing and Response Process in India

Learn how to file a consumer complaint online and write a response as an opposite party in Consumer Forums of India through the Edaakhil portal. Understand the steps for registration, login, and filing a response for approved complaints and responses. Discover how to search for cases and access case

4 views • 15 slides

Online Application Filing Guide for Consumer Complaints in India

Learn how to file complaints at Consumer Commissions of India online through the E-daakhil portal. Explore steps for filing applications, searching by reference number, conducting an advanced search, viewing case details, and submitting applications with necessary documents.

3 views • 13 slides

For Tax Filing - Analyze the Tax Regime

As the financial year closes, taxpayers would need to ensure that their books of accounts, pay slips, bank statements and other important documents are in place such that the details are available at the time of audit and filing the return of income. While filing the return of income, a taxpayer mu

0 views • 3 slides

Navigating Hart-Scott Act Filing Requirements (2024)

This guide provides an overview of the HSR filing process, including reportable transaction thresholds, exemptions, and filing requirements. It explains the key aspects like size-of-the-transaction test, size-of-the-persons test, types of transactions involved, and the valuation of voting securities

4 views • 60 slides

Process for Filing a Petition for Divorce in India

Filing a Petition for Divorce in India\n\nFiling a Petition: The divorce process in India begins with the crucial step of filing a petition. This is the formal action taken by one spouse, known as the petitioner, to initiate the legal proceedings for divorce. The petition is filed in the appropriate

0 views • 4 slides

Precise Watering, Prosperous Fields: The Booming of Precision Irrigation Market

The Global Precision Irrigation Market is on a steady rise. According to the BIS Research, estimates suggest a current size of around $2,238.7 Million in 2022, with a projected Compound Annual Growth Rate (CAGR) of 14.84% reaching $4,471.2 Million by 2027 during the forecast period 2022-2037.

0 views • 2 slides

Simplifying Income Tax Filing_ A Friendly Guide

Get expert income tax return filing service providers in Punjagutta, Begumpet, Banjara Hills, Hyderabad. We offer online tax filing, ITR filing and tax preparation services.

1 views • 2 slides

ITR filing services in Udaipur

ITR filing services in Udaipur, provided by the renowned company CA Vatsalya Soni, offer comprehensive and expert assistance to individuals and businesses in navigating the complexities of income tax returns.

0 views • 1 slides

Virginia ACA Carrier Teleconference 2025: Important Updates and Deadlines

The teleconference scheduled for today covers a range of important topics for the 2025 plan year in Virginia, including critical dates, rate filing information, new benchmark and Essential Health Benefits (EHBs), mental health parity, compliance binder filing reminders, the Commonwealth Health Reins

2 views • 26 slides

Unemployment Benefits and Resources for Workers

Provides information on unemployment insurance programs, benefits, and resources for workers who lost their jobs or had hours reduced. Discusses the unemployment insurance program, online certification, and filing a claim process. Connects to federal, state, and local resources for employment and tr

0 views • 26 slides

Benefits of filing the Return of Income

Filing your Return of Income (ROI) is crucial for compliance and offers benefits like improved credit scores, visa application support, loss carryforward, and tax refunds. The best time to file is by the due date, with necessary documents such as For

1 views • 3 slides

The Importance of Filing Income Tax Returns

Filing income tax returns is crucial as it involves declaring total income and tax payable. Deadlines are specified based on the type of assessee, with penalties for late filing. The process allows for claiming refunds, showing financial worth for visas, and ensuring eligibility for tenders. Failing

0 views • 26 slides

Annual Filing Requirements for Knights of Columbus Councils

Learn about the IRS annual filing requirements for Knights of Columbus Councils, including the need to file Form 990, obtain an EIN, and maintain tax-exempt status. Failure to comply can result in the revocation of tax-exempt status and reinstatement fees. Find detailed guidance on applying for an E

0 views • 23 slides

Guide to Filing for Conservatorship in Fresno, CA Probate Court

Comprehensive guide on filing for conservatorship in Fresno, CA Probate Court, covering basics, costs, required forms, service procedures, and due diligence efforts. Detailed information on the process including filing location, fees, required documents, and serving requirements. Includes tips on du

0 views • 22 slides

Tax Filing, Payment, and Penalties Overview for LRA Practitioners in Monrovia 2021

Comprehensive training module covering income tax, excise tax, goods and services tax filing requirements, due dates for tax returns, and more for taxpayers in Monrovia. Learn about the responsibilities of taxpayers, due dates for filing tax returns, and specific requirements for various types of ta

0 views • 43 slides

Critical Load Status of Water and Sewer Facilities - Filing Requirements and Impacts

Water and wastewater utilities in Texas are required to provide critical load status information to various entities by November 1, 2021. The Senate Bill 3 of the 87th Legislature outlines the filing requirements and impacts on electric utilities and Retail Electric Providers (REPs). The process inv

2 views • 4 slides

Comprehensive Guide to Filing in Business Organizations

Filing is essential for maintaining records in business organizations. It involves systematic arrangement of documents for easy access and reference. The objectives, functions, and importance of filing are discussed in this informative guide.

0 views • 16 slides

Federal Fiduciary Income Tax Returns Overview

Form 1041 is an income tax return for trusts or estates reporting income earned by the assets. Understand filing requirements, types of returns, and deadlines for Form 1041, Form 706, and Form 1040. Learn about calendar year vs. fiscal year options for estates and trusts.

0 views • 15 slides

GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Security and Authentication in Electronic Filing Systems: Arkansas Subcommittee Report

Explore the subcommittee report on security and authentication in electronic filing systems for campaign and finance reports in Arkansas. Learn about user authentication, risks, mitigation strategies, and approaches used in other states. Discover the filing processes in both paper and electronic for

2 views • 24 slides

Guide to Completing Income and Expense Declaration Form for Orange County Superior Court

Assist in filling out an Income and Expense Declaration form for the Superior Court of California, Orange County. Provides step-by-step instructions for completing the form, including details on income, education, and tax information. Recommends filing at Lamoreaux Justice Center after completion.

1 views • 80 slides

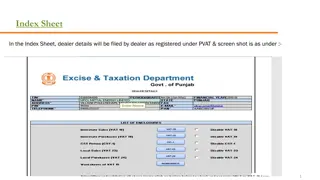

Overview of Dealer Details Filing Procedures Under Different Forms

This content outlines the process for dealers to file various details under different forms such as Index Sheet, VAT-18, VAT-19, CST Form, VAT-23, VAT-24, Worksheet-4, Worksheet-5, and Worksheet-6. With the arrival of GST, changes in the filing requirements have been highlighted, emphasizing the imp

0 views • 10 slides

Step-by-Step Guide for Creating an NCDPI WiFi C2 Contract in the EPC Portal

This detailed guide provides a comprehensive walkthrough of the steps involved in creating a 471 for 2019-20 NCDPI WiFi C2 contracts in the EPC portal. From setting up application nicknames to adding FRNs and selecting contract options, this guide covers every aspect for a successful submission.

0 views • 22 slides

Gift Tax Returns: A Comprehensive Overview

This presentation covers the basics of preparing and filing federal estate and gift tax returns. It explains who is required to file Form 709, what constitutes a gift, when to file, and exceptions to gift tax filing requirements, providing a fundamental understanding for individuals involved in esta

0 views • 27 slides

Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virgi

0 views • 19 slides

Election Filing Deadlines and Procedures for 2024

Detailed information on candidate filing deadlines and procedures for the 2024 election season, covering key dates for filing, deadlines for petitions, withdrawals, challenges, and ballot vacancies for Democratic, Republican, and Libertarian parties in Indiana.

0 views • 10 slides

Louisiana Department of Revenue Electronic Filing Guidelines

This content provides a comprehensive overview of the electronic filing process for individual income tax returns with the Louisiana Department of Revenue. It covers important details such as filing requirements, third-party filings, ERO application procedures, retention of paper documents, and more

1 views • 30 slides

Step-by-Step Guide for Filing Form 471 Using ITS for CenturyLink and Frontier Local

Detailed instructions for completing Form 471 with ITS as the Billed Entity for CenturyLink and Frontier Local services. Includes steps for filing Form 470, evaluating bids, creating a contract record, and managing contracts in EPC profile.

0 views • 41 slides

Guide to Using Electronic Forms System (EFS) for Form LM-1

This guide provides instructions on using the Electronic Forms System (EFS) for completing and filing Form LM-1, the Labor Organization Information Report. It covers system requirements, accessing the system, registering for a PIN, and accessing the form within EFS. For detailed instructions on repo

0 views • 36 slides

Simplify Data Entry with Forms in MIS - Chapter 3 Overview

Explore the world of forms in Management Information Systems (MIS) to streamline data entry processes. Learn about designing and utilizing forms effectively, including different form types, form views, controls, and the form wizard. Discover how form views, layout views, and design views contribute

0 views • 25 slides

Updates on 2022 H-2A Temporary Labor Certification Program

The United States Department of Labor conducted a stakeholder webinar on November 17, 2022, to discuss the final rule of the 2022 H-2A Temporary Labor Certification Program. The webinar covered topics such as filing preparations, effective dates, and important forms like ETA-790A and ETA-9142A. The

0 views • 47 slides

Tax Rates and Standard Deductions for Different Filing Statuses

This content provides information on tax rates and standard deductions for various filing statuses for tax years 2010 and 2011. It includes details on taxable income brackets and corresponding tax rates for single filers, all filers, and married filing jointly, along with standard deductions for dif

0 views • 10 slides

Guide to Filing 2015 Federal Tax Return with 1040NR-EZ Form

Learn about filing your 2015 Federal Tax Return using the 1040NR-EZ form, including guidance on completing the form, using tax preparation software, and determining eligibility. Understand the criteria for completing the 1040NR-EZ form and find resources to help you navigate through the tax filing p

0 views • 78 slides

Ensuring Compliance with Form 990 Filing Requirements

Explore common pitfalls in filling out Form 990 after a decade, presented by Elaine L. Sommerville, CPA. Learn about different Form 990 variations based on organization size and revenue, along with crucial sections like mission statement clarity, detailed program accomplishments, Schedule A for 501(

0 views • 20 slides

UCC Article 9 Filing System

The UCC Article 9 filing system plays a crucial role in perfecting security interests and providing public notice for creditors' rights adjustments. It emphasizes the importance of proper filing, searchers' due diligence, and the neutral role of the filing office in maintaining accurate records. Key

0 views • 40 slides

The E-Filing Process for Guardianship/Probate

Explore the e-filing procedure and process for guardianship/probate cases, covering document formats, form/template modifications, and designations of emails for pro se parties and unrepresented individuals. Learn about acceptable document formats, necessary modifications, and recommendations for em

0 views • 17 slides

Criminal E-Filing Procedure and Document Formats

Explore the detailed process of e-filing for criminal cases, including points of interest, document format requirements, form/template modifications, and guidelines for Pro Se litigants and unrepresented parties. Learn about email designations, submission errors, and recommended practices for effici

0 views • 16 slides

Form 700 Filing Requirements for Board & Commission Members

Board and Commission members must comply with filing Form 700, a Statement of Economic Interests, to disclose financial interests that could lead to conflicts of interest. The process involves taking an Oath of Office, accurately completing the form's sections, and disclosing various financial inter

0 views • 9 slides