Overview of Dealer Details Filing Procedures Under Different Forms

This content outlines the process for dealers to file various details under different forms such as Index Sheet, VAT-18, VAT-19, CST Form, VAT-23, VAT-24, Worksheet-4, Worksheet-5, and Worksheet-6. With the arrival of GST, changes in the filing requirements have been highlighted, emphasizing the importance of filling only specific details in designated worksheets. Each form serves a unique purpose in recording different aspects of the dealer's transactions, both intra and interstate. Detailed image shots of each form and worksheet are provided for clarity and reference.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

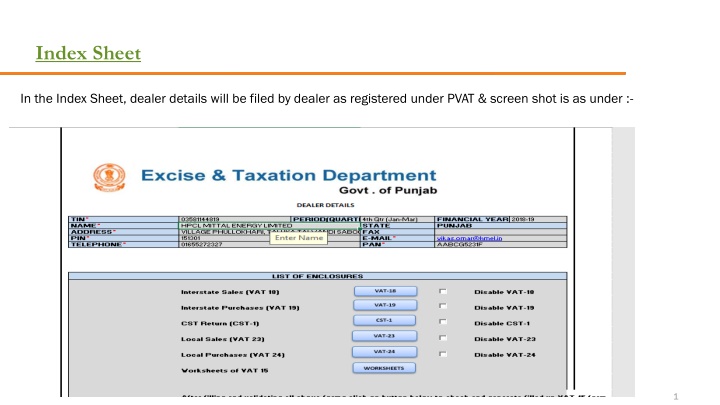

Index Sheet In the Index Sheet, dealer details will be filed by dealer as registered under PVAT & screen shot is as under :- 1

VAT-18 In the Form VAT-18 , Dealer will be filed sale of inter state & screen shot is as under:- 2

VAT-19 In the Form VAT-19 , Dealer will be filed purchase of inter state & screen shot is as under:-

CST Form In the CST Form, Dealer will be filed details of CST Liability & screen shot is as under:-

VAT-23 In the Form VAT-23 , Dealer will be filed sale of intra state & screen shot is as under:-

VAT-24 In the Form VAT-24 , Dealer will be filed purchase of intra state & screen shot is as under:-

Worksheet-4 After coming the GST , no information will be required to file in Worksheet No. 1, 2 & 3 & only details will be filed in worksheet no. 4, 5, & 6. Screen shot of worksheet no.4 is as under:-

Worksheet-5 After coming the GST , no information will be required to file in Worksheet No. 1, 2 & 3 & only details will be filed in worksheet no. 4, 5, & 6. Screen shot of worksheet no.5 is as under:-

Worksheet-6 After coming the GST , no information will be required to file in Worksheet No. 1, 2 & 3 & only details will be filed in worksheet no. 4, 5, & 6. Screen shot of worksheet no.6 is as under:-