Virginia ACA Filing Season 2022 Carrier Teleconference: Important Updates

Explore key topics discussed during the Virginia ACA filing season teleconference, including important dates, rate filing template changes, health care savings programs, mental health parity compliance, and more. Stay informed about crucial deadlines and regulatory requirements for carriers in Virginia.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

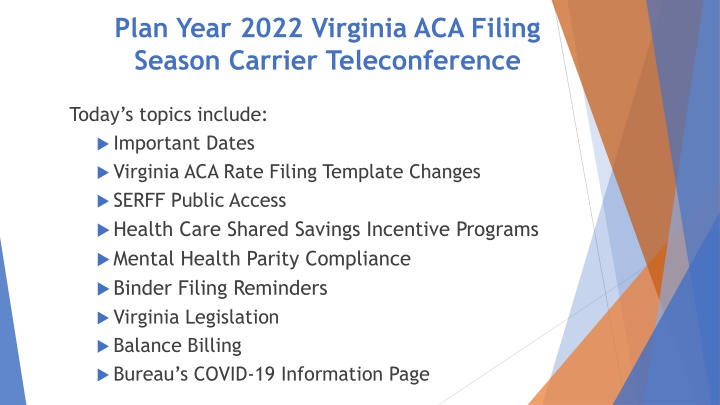

Plan Year 2022 Virginia ACA Filing Season Carrier Teleconference Today s topics include: Important Dates Virginia ACA Rate Filing Template Changes SERFF Public Access Health Care Shared Savings Incentive Programs Mental Health Parity Compliance Binder Filing Reminders Virginia Legislation Balance Billing Bureau s COVID-19 Information Page

Important Dates (2021) April 16: Form filing deadline for ALL ACA health carriers (excludes SADPs) April 30: Form and rate filing deadline for carriers submitting SADPs to be exchange-certified May 14: Binder filing deadline for carriers offering SADPs to be exchange- certified May 21: Rate filing deadline for ALL ACA health carriers May 21: Binder filing deadline for carriers offering individual and small group health insurance coverage inside or outside the exchange

Important Dates (2021) April 1: SERFF public access suspended for health form, rate, and binder filings and revisions made on or after this date up to the BOI rate presentations July 15: Deadline for voluntary service area revisions and rate filing revisions; revisions after this date can be made based only at request of BOI August: Rate presentations to the Commission (tentative date) August 18: Deadline for data transfer to CMS

Virginia ACA Rate Filing Template(VRFT) Changes Risk Adjustment Data (Tab TBD) o Carriers will provide the following data elements relating to their 2022 projected risk adjustment (both statewide and carrier specific): Actuarial Value (AV), Allowable Rating Factors (ARF), Plan Liability Risk Score (PLRS), Geographic Cost Factor (GCF), Induced Demand Factor (IDF) and EDGE data member months (carrier only). In addition, each carrier will provide their estimate of the statewide average premium PMPM. o Carriers need to submit the Plan Year 2021 VRFT based on approved rates but are not required to provide the above risk adjustment data for 2021 Test for compliance with 14VAC5-130-50 F1 & F3 (Tabs TBD) o o F1 requires that for any proposed area factor greater than 15% of the weighted average area factors, additional data is required in the actuarial memorandum and a public hearing will be held prior to rate approval (F2) o F3 requires that the BOI will not approve rates if the variance of the rating area factor is 15% or greater between the individual and small group markets for the same network, when the RAF development methodologies vary Consumer Factors and Rate Presentation Exhibits (Tab VIII) o o Reformatted slightly to make cosmetic changes for Rate Presentation exhibits o

SERFF Public Access Public access to SERFF will be turned off for all ACA rate, form and binder filings beginning April 1 Public access will be turned back on just prior to the Rate Presentations sometime in August

Health Care Shared Savings Incentive Program Carriers are not required to demonstrate cost effectiveness (or lack thereof) every year, but must submit updates for review prior to offering any Program that varies from the previously filed and reviewed Program. Requests for exemption must be filed by March 15 in the year prior to the requested exemption year. Beginning April 1, 2022, carriers that are not exempt are required to file the Health Care Shared Savings Annual Report found at: Virginia SCC - Life & Health Report is due April 1 in each subsequent year Refer to Administrative Letter 2020-01 for more information

Mental Health Parity (MHPAEA) Compliance Virginia s available on the BOI website MHPAEA Self-Compliance Tool continues to be Carriers can assess their MHPAEA compliance The BOI currently uses this tool during market conduct exams Submission of this tool is not required initially with 2022 form filings, but benefit design and administration should be compliant with the requirements it outlines

Mental Health Parity (MHPAEA) Compliance (cont) It has come to the BOI s attention that some carriers are not correctly defining Mental Health/Substance Use Disorder benefits MHPAEA is driven by diagnosis/condition, and carriers must define Mental Health/Substance Use Disorder benefits and Medical/Surgical benefits based on the condition being treated on a given claim For Example - PCP office visit flu shot vs. PCP office visit anxiety medication management Defining a service as Medical/Surgical or Mental Health/Substance Use Disorder based on which one it is most commonly used to treat (i.e. more than 50% of the time) does not comply with MHPAEA for fully- insured plans

Mental Health Parity (MHPAEA) Compliance (cont) ACTION ITEMS FOR PLAN YEAR 2022 FILINGS: Recognize that there are services that are most commonly performed to treat a Medical/Surgical condition but that may be used to treat a MH/SUD condition. used to treat a MH/SUD condition, these services become MH/SUD benefits subject to the protections of MHPAEA When When determining the expected claims dollar amounts for the Medical/Surgical services during the QTL/Financial Requirement analysis, identify the claims where that service is used to treat a MH/SUD condition and reduce the expected claim dollar amounts for that service by the dollar amounts associated with the treatment of MH/SUD conditions Ensure that cost-sharing compliant with the substantially all/predominant requirements is applied to MH/SUD benefits and that all covered services are correctly classified Establish processing guidelines to ensure that, even if a service most commonly used to treat Medical/Surgical conditions is submitted with a MH/SUD diagnosis code on a given claim, MHPAEA-compliant Financial Requirements and QTLs are applied

Mental Health Parity (MHPAEA) Compliance (cont) Copay Guidance Provide actuarial justification upon request OR Provide explanation to confirm MHPAEA analysis (substantially all/predominant) was considered upon plan design Carriers can reach out if there are questions/concerns

Binder Filing Reminders (2021 dates) May 14th- binder filing deadline for SADPs May 14th -binder filing deadline for any carrier who wants to take advantage of the early bird transfer May 21st binder filing deadline for Individual and Small Group coverage inside and outside the exchange. We strongly encourage carriers to run the appropriate review tools provided by CMS prior to submission of a binder, and prior to each submission of any revised templates. These tools are used to guard against incorrect information being provided on Healthcare.gov. The review tools and instructions may be found at: Review Tools (cms.gov)

Binder Filing Reminders (cont.) Following the date of the initial transfer, June 16, 2021, a carrier subject to this date can only make voluntary changes to the information in any form, rate or binder filing if the BOI allows the change. The carrier must make the request and submit the proposed revision as a Note to Reviewer in SERFF and wait for the BOI s response prior to submitting the voluntary change in the filing. This does not apply to BOI requested changes. The Virginia Plan Schedule Comparison is included as a tab on the Virginia ACA Rate Filing Template for all individual and small group plans inside and outside the exchange, therefore, carriers are not required to complete a separate Virginia Plan Schedule Comparison document for the binders. However, SADP carriers must still complete the Virginia Plan Schedule Comparison and attach it under the Supporting Documentation tab in each binder.

Binder Filing Reminders (cont.) The Associate Schedule Items (ASI) tab in the binder must include all forms and rates filed for each plan. Each form must include a valid link to the actual form submission. Each plan must include a link to a valid rate submission. For carriers who use a different filing instance for rates and are not able to complete this tab, a separate document presenting the same information as in the ASI tab must be submitted under the Supporting Documentation tab in the binder, and must be kept updated. The ASI tab must be kept updated with current form and rate filings. Carriers must update all related forms, rates and binder filings if changes are made to one of these filings.

Binder Filing Reminders (cont.) The VA Rate Filing Template should be attached under the Supporting Documentation tab in each binder. The rate sheet that is attached to the Rate/Rule Schedule in the rate filing should be attached under Associate Schedule Items and linked to the corresponding rate filing for each plan. HB 1896/SB 1276 Removes the prohibition on elective abortions for QHPs on the Exchange. Carriers who include coverage for elective abortion should report such coverage as an Addition to EHB. The BOI will review plans using federal guidance that all plans within a product must share the same drug formulary (also referred to as covered drug list ). Under 45 CFR 144.103, a set of plans that share a discrete package of benefits and network type within a service area are considered a single product. An issuer s drug formulary is a feature of the product s discrete package of benefits offered to the consumer. Any limits on the scope of covered benefits, including the drug formulary and tier structure, are considered product-level differences and all plans offered within each product must use the same drug formulary.

Virginia Legislation Review legislation for forms and rates development Forms checklists will provide some direction SB 423 (2020 General Assembly session) Hearing Aids for Minors. It is anticipated that coverage will not take effect July 1, 2021 as proposed due to fiscal impact to the Commonwealth. HB 1896/SB 1276 Essential Health Benefits; Abortion coverage: Removes the prohibition on elective abortions for QHPs on the Exchange. Carriers should report such coverage as an Addition to EHB. HB 2332 Commonwealth Health Reinsurance Program; The SCC must apply for a reinsurance program for the 2023 benefit year under a 1332 state innovation waiver to decrease premiums in the individual market up to 20%. Parameters will be provided by May 1, 2022.

Balance Billing Virginia s provider balance billing law effective January 1, 2021 Dates of service beginning January 1, 2021 Prohibits provider balance billing that exceeds in-network cost-sharing in certain situations Requires carriers to pay a commercially reasonable amount to providers directly clearly indicate the patient s payment responsibility on the EOB Requires a good faith negotiation period expend entire period prior to arbitration send carrier arbitration contact to BBVA@scc.virginia.gov to facilitate negotiation Provides a provider/carrier arbitration process Developing a balance billing complaint form Federal No Surprises Act effective January 1, 2022 Carrier 2022 filings and processes should not conflict with federal law

COVID-19 Updates Bureau Webpage for COVID-19 Updates: Virginia SCC Companies. The response to COVID-19 information is under New to Review.

Bureau of Insurance Presenters David Shea, Health Actuary David.Shea@scc.virginia.gov Sharon Holston, Principal Insurance Market Examiner (Plan Management) Sharon.Holston@scc.virginia.gov Brant Lyons, Principal Insurance Market Examiner (Market Conduct) Brant.Lyons@scc.virginia.gov Julie Blauvelt, Deputy Commissioner (Life & Health) Julie.Blauvelt@scc.virginia.gov

ACA Form/Rate Filing Questions ACAFilingInfo@scc.virginia.gov