Utah's Budget FY 2023-2024 Overview

Utah's budget for FY 2023-2024 highlights key aspects including revenue sources, budget priorities, long-term fiscal health, and changes in the budget process. The budget breakdown shows allocations for various sectors such as public education, social services, and transportation. Additionally, deta

8 views • 35 slides

Budgeting Overview at Montclair State University

This presentation provides an overview of budget management concepts, departments, systems, and processes at Montclair State University. It covers the definition of a budget, the roles of the Office of Budget and Planning, the Division of Finance and Treasury, and the MSU Foundation in budgeting and

2 views • 21 slides

Budget Projection

Explore detailed insights into your company's budget projections, actual cost versus budget, month-wise budget forecasting, overhead cost analysis, and quarterly budget analysis. Identify key variances, cost breakdowns, revenue trends, and budget allocation for informed decision-making and financial

4 views • 20 slides

FY25 Budget Development Kickoff Overview

The FY25 budget development kickoff outlines the timeline, activities, and key processes involved in developing the budget for January 2024. It includes details on workbook creation, budget materials, planning, resource requests, and budget presentations. Changes in the budget process, planning allo

2 views • 14 slides

Compliance with Article 66 of the Public Sector Budget Law for Fiscal Year 2023

The document discusses the fulfillment of Article 66 of the Public Sector Budget Law for the fiscal year 2023, detailing approved budget modifications, budget execution progress, and interventions to address and prevent the El Niño phenomenon. It highlights budget reallocations, execution achieveme

2 views • 23 slides

Overview of Utah's Budget for FY 2024-2025

Utah's budget for the fiscal year 2024-2025 is outlined with details on revenue sources, budget priorities, special funding, long-term fiscal health, and budget process changes. The budget allocations cover various sectors including education, transportation, law enforcement, social services, and mo

1 views • 32 slides

Murray City School District FY25 Budget Overview

Murray City School District is preparing for the FY25 budget hearing in June 2024. The budget officer, usually the superintendent, must submit a tentative budget before June 1 each year. Legal requirements include holding a public hearing and publishing budget information for public inspection. The

1 views • 25 slides

County Budgeting Process in Mississippi

The process of county budgeting in Mississippi involves identifying needs, forecasting requirements, preparing departmental budget requests, reviewing requests, adopting and implementing the budget, amending the budget, and adopting the final amended budget. Various revenue sources, such as local ad

1 views • 12 slides

Charlton Fire District 2021 Budget Overview

The Charlton Fire District's 2021 budget process involves preparing, adopting, and finalizing the annual budget with public input. The budget includes personal services, fire equipment, capital outlay, and fire protection expenses. Various steps are taken to ensure the budget meets the district's ne

0 views • 15 slides

Montclair Board of School Estimates 2020-2021 Budget Overview

The Montclair Board of School Estimates presented the 2020-2021 budget with a focus on maintaining high-quality education services within a 2% tax levy cap. Major drivers of the budget include contracted salary increases and increases in health benefits. The budget goals are to modify academic progr

0 views • 20 slides

Adjusted Budget in Hyperion

In Hyperion, a scenario represents a storage folder for data, with three main scenarios compared for budget adjustments: Actuals, Original Budget, and Adjusted Budget. The Hyperion Adjusted Budget module allows users to copy and update data from these scenarios to maintain a balanced budget. Pre-pop

8 views • 22 slides

Budget Presentation: FY2018-19 Tentative Budget Overview

The FY2018-19 Tentative Budget was presented by Mark Mathers, CFO, and Mike Schroeder, Budget Director. The presentation covered updates on the General Fund, structural deficits, budget recommendations, and required actions to address the deficit. Base budget reductions have reduced the deficit to $

5 views • 50 slides

Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

2 views • 19 slides

Changes in Budget Control Procedures and Roles at Corbin de Nagy's Office

In a recent training session conducted by the Budget Office at Corbin de Nagy, significant changes in budget control procedures were highlighted. Starting in 2015-16, spending control will be at the Budgetary Account level for both non-E&G and E&G departments. Budget deficits and cash deficits are n

5 views • 27 slides

1st Quarter Budget Performance Report for Year 2018 by Ministry of Budget and Planning

The Ministry of Budget and Planning's 1st Quarter Budget Performance Report for 2018 highlights a total approved budget of N151,677,854,494, with N37,919,463,624 allocated for the first quarter. Recurrent revenue performance shows a realization of N16,728,826,925, representing 73.34% of estimates. T

0 views • 13 slides

Overview of Occupational Requirements Survey (ORS) and 2020 Estimates

The Occupational Requirements Survey (ORS) by the Bureau of Labor Statistics provides detailed insights into the occupational demands of various job roles, including physical, cognitive, and environmental requirements. The survey encompasses data on speaking requirements, weight lifting capabilities

0 views • 22 slides

Budget Orientation for Managing Financial Resources

Budget Orientation session for ALL EMPLOYEES THAT MANAGE A BUDGET, including new hires, current employees, and supervisors. Covers budget terminology, types of funds, budget cycle, uses of funds, reconciliation, transfers, time management, and tips from auditors. Explains the budget process, differe

1 views • 32 slides

Budget Orientation Overview for Effective Financial Management

This Budget Orientation provides essential information on budget basics, state and campus budget allocation processes, revenue sources, terminology related to budget scenarios, and key considerations for managing financial resources effectively. It is designed for all employees involved in budget ma

1 views • 25 slides

FY2017 Preliminary Budget Presentation Highlights

The FY2017 Preliminary Budget Presentation for the General Fund outlines key financial details and initiatives for various departments within the organization. The budget includes revenue estimates, expenditure comparisons, staffing details, and specific goals for financial planning and risk managem

2 views • 13 slides

Maryland Revenue Estimates & Economic Outlook March 2022

The revenue estimates and economic outlook for Maryland in March 2022 show growth in income taxes, sales and use taxes, and other revenues. Detailed figures for fiscal years 2021-2023 indicate estimates and actual data for various tax types like individual and corporate income taxes. The changes in

0 views • 17 slides

Analyzing Deepwater Disaster: Inaccurate Oil Spill Estimates

Explore the Deepwater Horizon disaster, where oil spill estimates were inaccurate due to various factors such as convoluted discharges, technological limitations, and reluctance to share data. Consequences of underestimation and reasons behind flawed estimates are discussed, shedding light on the ch

0 views • 13 slides

Provisional Gross Domestic Product (GDP) Estimates Presentation April 11, 2018

The release provides provisional GDP estimates for the fourth quarter of 2017, along with revised estimates for the first three quarters of 2017 and annual estimates for 2016. The GDP measures the value of goods and services produced in the country. The estimation of GDP is done in stages, with prov

0 views • 33 slides

Fiscal Year 2016 Budget and Statement of Work Discussion

Preliminary discussions and recommendations regarding the Fiscal Year 2016 budget and statement of work. Includes budget issues, 2014 and 2015 budget comparisons, steering committee recommendations, and executive committee budget discussions. Focus on budget guidance, funding allocations, and propos

1 views • 17 slides

GAO Cost and Schedule Assessment Guides: Enhancing Government Accountability

The Government Accountability Office (GAO) plays a crucial role in supporting Congress to fulfill its responsibilities by improving federal government performance and ensuring accountability. The GAO Cost Estimating and Assessment Guide outlines criteria for assessing cost estimates, and the Reliabl

0 views • 19 slides

Multiyear Estimates from the American Community Survey

This comprehensive guide delves into the concept of multiyear estimates from the American Community Survey (ACS). It explains what multiyear estimates are, when to use them, considerations to keep in mind, making comparisons with them, examples of their application, definitions of period and multiye

0 views • 35 slides

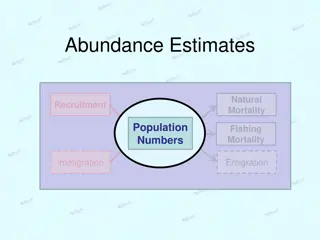

Abundance Estimates in Fisheries Management

Explore the concept of abundance estimates in fisheries management, including natural mortality, recruitment, population numbers, fishing mortality, immigration, and emigration. Learn about common abundance estimation methods like CPE/CPUE, depletion/removal estimates, and mark-recapture techniques.

0 views • 10 slides

Open Budget Meeting Town Hall Overview

The Open Budget Meeting at Clayton State University delves into the process of developing the new budget, emphasizing alignment with strategic priorities. The President has final decision-making authority in budget approvals. The meeting discusses funding requests, strategic plan support, and priori

1 views • 27 slides

Integrating Spending Reviews into the Budget Cycle: Best Practices and Recommendations

To integrate spending reviews effectively into the budget cycle, align the process with the budget calendar, ensure consistency with medium-term frameworks, and incorporate outcomes into budget decisions. Countries like Australia, the UK, Ukraine, Italy, and Slovakia have institutionalized spending

1 views • 11 slides

Budget Process for Intergovernmental Transfers to Local Government - Ministry of Finance, Planning, and Economic Development

The budget process involves key changes to comply with the PFM Act, including specific deadlines for discussions, submissions, approvals, and performance contracts. Activities are structured from September to December, focusing on preparing the LG BFP and budget estimates, leading to finalization by

0 views • 7 slides

UCOP Budget Development System Overview

Detailed overview of the UCOP Budget Development System for the FY1314 budget, including system logon instructions, workflow navigation, tool bar overview, data entry flow, payroll budget entry, budget allocation, review process, and deadlines for submission. The system provides access to view/edit/

0 views • 15 slides

US Federal Budget Process

Explore the intricate details of the US federal budget process, including budget formulation, presentation, and execution. Learn about discretionary spending, agency budget development, and the multi-year budget trend. Discover the authority for the US budget as outlined in the US Constitution. Unve

0 views • 31 slides

Update on FY20/21 Budget Implementation & FY21/22 Budget Preparation DEG Presentation to LDPG

This presentation provides an update on the approved FY20/21 budget, its performance, reprioritization, supplementary budget requests, and an overview of the FY21/22 budget. It also highlights the shift to Program Based Budgeting and DP engagement, as well as key issues for the LDPG. The approved bu

1 views • 23 slides

Overview of 2022/23 Budget Engagement and Proposals

The 2022/23 Budget Engagement outlines the financial context, funding requirements, and measures to balance the budget in the face of Covid impacts, inflation, and new demands. Core Spending Power allocation, council tax, and government grant incomes are detailed, along with budget performance forec

0 views • 17 slides

Budget Adjustments vs. Budget Amendments in AEL WIOA Summer Institute

Explore the differences between budget adjustments and budget amendments in the context of AEL WIOA Summer Institute's financial processes. Budget adjustments allow for moving a sum less than 20% without an amendment, while budget amendments involve larger changes and require specific approvals. Lea

1 views • 24 slides

School Budget Development Process Overview

The School Budget Development Process Overview provides a detailed look at the steps involved in creating a budget aligned with the school's strategic plan. It highlights the roles of the principal and the GO Team, emphasizing the importance of strategic priorities, budget parameters, and feedback s

0 views • 17 slides

Analysis of RPSTC Budget Estimates for FY23 and FY24

In this analysis, we delve into the budget estimates of RPSTC for FY23 and FY24. The breakdown includes salaries, wages, employee benefits, services, supplies, and capital outlay for each fiscal year. Additionally, funded capital projects and planned expenses are highlighted, providing insights into

0 views • 16 slides

Budget Breakdown and Financial Overview of Utah State FY 2018-2019

The budget of the State of Utah for FY 2018-2019 is detailed in various images illustrating where the funds go, where they come from, how they are distributed among different sectors like law enforcement, education, social services, transportation, and more. The breakdown includes information on gen

0 views • 14 slides

FY 2023 Kentucky Transportation Cabinet Budget Review

Review of the FY 2023 budget for the Kentucky Transportation Cabinet, including enacted road fund estimates versus actual revenue, revenue growth by quarter, and actual revenues compared to FY 2022. The analysis shows insights into revenue sources such as motor fuels, motor vehicle usage, and other

0 views • 5 slides

Cal Poly Budget Update and Planning Overview

This document provides an overview of Cal Poly's budget planning calendar for the 2019-20 fiscal year, including key milestones such as the release of the Governor's budget, negotiation processes, allocation planning, and final budget approvals. It also compares the California State University (CSU)

1 views • 15 slides

Model-Based Early Estimates for Health Statistics Enhancement

The National Center for Health Statistics (NCHS) is working on improving the timeliness and granularity of data through model-based early estimates. Their goal is to enable data-driven actions, predict deaths, and report data accurately. The NCHS is focusing on enhancing their data systems and produ

0 views • 6 slides