1st Quarter Budget Performance Report for Year 2018 by Ministry of Budget and Planning

The Ministry of Budget and Planning's 1st Quarter Budget Performance Report for 2018 highlights a total approved budget of N151,677,854,494, with N37,919,463,624 allocated for the first quarter. Recurrent revenue performance shows a realization of N16,728,826,925, representing 73.34% of estimates. The report provides a breakdown of actual revenue collected across various sources during the period under review.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

1ST QUARTER BUDGET PERFORMANCE REPORT FOR YEAR 2018 PREPARED BY MINISTRY OF BUDGET AND PLANNING

FIRST QUARTER BUDGET PERFORMANCE REPORT FOR YEAR FIRST QUARTER BUDGET PERFORMANCE REPORT FOR YEAR 2018 2018 Preamble Preamble The Ministry of Budget and Planning is, among other key functions, statutorily responsible for the preparation of quarterly Budget Performance Report. This function provides the state with a credible tool for assessing accountability, transparency and efficiency in governance. This document, therefore, Performance for the first quarter of 2018. The total Approved Budget package for the State in the period under review was N151,677,854,494. Out of this, the sum of N37,919,463,624 was for the first quarter estimates i.e. from January-March, 2018. Of this amount, N16,016,690,308 was earmarked for recurrent services while N21,902,503,316 was for capital projects/programmes conveys the Budget

RECURRENT REVENUE PERFORMANCE RECURRENT REVENUE PERFORMANCE The total recurrent revenue estimates for first quarter (Jan. March) 2018 was N22,808,696,915 (Internally Generated Revenue + Federation Accounts), However, the total sum of N16,728,826,926 was realized, representing 73.34% performance. Out of this amount realized, N2,528,461,174 came from internally generated Revenue Sources while N14,200,365,752 came from Federation Account. The breakdown of the actual revenue collected with the percentage performance during the period under review is presented in the table & graph below.

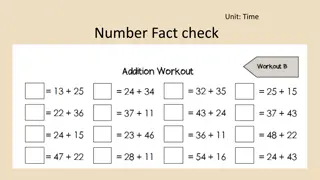

A : RECURRENT REVENUE PERFORMANCE S/NO S/NO DETAILS DETAILS APPROVED APPROVED ESTIMATES ESTIMATES 2018 2018 APPROVED APPROVED ESTIMATES Jan. ESTIMATES Jan. March. 2018 March. 2018 ACTUAL REVENUE ACTUAL REVENUE AS AT AS AT 31/03/18 31/03/18 % PERFORMANCE % PERFORMANCE (E/DX100) (E/DX100) A A B B C C D D E E 2,528,461,174 F F 8,415,385,636 30.05 1. Internal Revenue 33,661,542,542 8,364,914,277 11,212,638,603 134.04 2. State share from the federation Account 33,459,657,108 3,061,891,035 2,759,065,545 90.11 3 Value Added Tax(VAT) 12,247,564,141 Excess Crude 1,333,375,338 5,333,501,351 1.51 4 20,195,287 Exchange Differentials 1,038,583,528 4,154,334,112 20.07 5 208,466,316 Budget Augmentation 594,547,101 2,378,188,404 0.00 6 0 Total Total 16,728,826,925 91,234,787,658 22,808,696,915 73.34

Recurrent Revenue Analysis 12 ACTUAL REVENUE APPROVED ESTIMATES Jan. March. 2018 11.2 Bn (NGN bn) 10 134.04% 8.4 Bn 8.4 Bn 8 NGN 6 30.05% Billions 4 90.11% 3.0 Bn 2.8 Bn 2.5 Bn 2 1.3 Bn 20.07% 1.0 Bn 1.51% 0.60 Bn 0.0% 0.20 Bn 0.02 Bn 0 Bn 0 Internal Revenue State share from the federation Account Value Added Tax(VAT) Excess Crude Exchange Differentials Budget Augmentation Recurrent Revenue Items

From the above table, the figures in red represent budget lines of low performance. It can thus be seen that, the State Government needs to do more to improve on its revenue generation, and is still largely dependent on its share of allocation from the Federation Accounts for her development programmes. It is, therefore, imperative for the State to explore additional revenue sources, to boost its Internally Generated Revenue. The state is therefore putting in place new measures to increase IGR in line with estimates and will review this stance in the second quarter of 2018.

RECURRENT EXPENDITURE The Jan.-March. 2018) was N16,016,690,308 while the actual for the same period was N9,917,138,522 representing 61.92% performance. The 2018 Approved Budget for the first quarter recurrent expenditure and the breakdown of the actual expenditure with the percentage performance are shown in the table below: approved recurrent expenditure for the period under review ( C: DETAILS OF RECURRENT EXPENDITURE PERFORMANCE S/NO S/NO DETAILS DETAILS APPROVED APPROVED ESTIMATES 2018 ESTIMATES 2018 APPROVED APPROVED ESTIMATES Jan ESTIMATES Jan March. 2018 March. 2018 D D ACTUAL ACTUAL EXPENDITURE EXPENDITURE AS AT AS AT 31/03/2018 31/03/2018 E E 2,871,744,574 % PERFORMANCE % PERFORMANCE (E/DX100) (E/DX100) C C F F A A B B 1. Personnel Cost including Statutory Office holders / pension and gratuities 7,063,824,517 28,255,298,068 40.65% 2. Overhead Costs 8,952,865,791 35,811,463,165 7,046,393,948 78.71% 16,016,690,308 64,066,761,233 9,917,138,522 61.92% Total Total

Recurrent Expenditure Analysis ACTUAL EXPENDITURE AS AT 31/03/2018 APPROVED ESTIMATES Jan March. 2018 (NGN bn) Overhead Costs 78.71% 7.0 Bn Recurrent Expenditure Items 8.9 Bn Statutory Office holders / Personnel Cost including pension and gratuities 40.65% 2.9 Bn 7.0 Bn 0 2 4 6 8 10 (NGN Bn) Billions

From the above table, it can be seen that out of the sum of N16,016,690,308 approved for the first quarter recurrent expenditure, the sum of N9,664,272,404was actually spent within the period under review representing 60.34%.

CAPITAL CAPITAL RECEIPTS LOANS) LOANS) The total approved capital receipts for the year 2018 was N60,443,066,836 out of which the sum of N15,110,766,709 represents the first quarter figures (Jan-March., 2018). Out of this sum for the period under review, the sum of N3,000,000,000 was the actual collection, representing 19.85% performance. RECEIPTS (TRANSFER (TRANSFER SURPLUS, SURPLUS, GRANTS GRANTS AND AND

Capital Receipts Performance NGN (Billions) 16 15 Bn 14 12 10 8 6 4 3 Bn 2 19.85% 0 Q1 Approved capital receipts (Estimate) Q1 Approved capital receipts (Actual)

CAPITAL CAPITAL EXPENDITURE EXPENDITURE: : The total sum of N88,802,571,192 was approved for capital expenditure for the year 2018. Out of this, the sum of N21,902,503,316 represents the first quarter estimates (Jan.-March, 2018) out of which, the sum N5,143,889,096was the actual capital expenditure, representing 23.49% performance. (Graph below) Below is a summary of Capital Expenditure by Budget Line: Health Equipment Building Social Investment and Food Security Road Construction and Electrification Projects Debt Servicing N329,943,071.50 N155,923,237.50 N73,566,666.67 N21,131,000 N488,691,370.81 N4,074,633,749.47

Capital Expenditure Actual Performance Actual Capital Expenditure by Budget Line Debt Servicing 25 4,075 Mn 22 Bn Electrification Construction 20 Projects 489 Mn Road and Investment and Food Security Social 21 Mn 15 NGN Billions NGN Billions Building 74 Mn 10 Equipment 156 Mn 5 Bn 5 Health 330 Mn 23.49% 0 0 1,000 2,000 3,000 4,000 5,000 Q1 Approved Capital Expenditure (Estimate) Q1 Approved capital Expenditure (Actual) NGN Millions Note: The Actual Capital Expenditure is depicted in Millions of Naira