Controversial issues under the Income Tax & Fake Invoice

Controversial issues surrounding income tax and fake invoices discussed at the National Conference in Indore. Topics include fake billing, burden of proof, and maintaining quantity details to avoid scrutiny. Learn about cases where genuine transactions were questioned and how to prevent disallowance

2 views • 129 slides

Department of Home Affairs 2023/24 Annual Performance Plan Presentation

Presentation of the 2023/24 2nd quarterly performance report and budget versus expenditure report to the Portfolio Committee on Home Affairs. The content includes the vision, mission, and value statement of the Department of Home Affairs, its mandate, outcomes, overall performance for the quarter, p

3 views • 58 slides

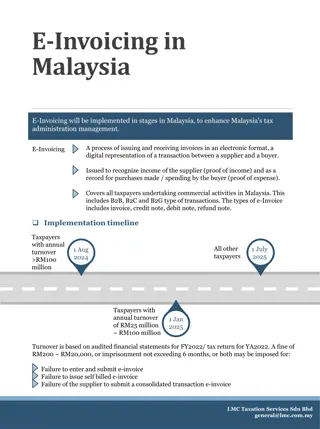

Implementation Plan for E-Invoicing in Malaysia

E-Invoicing is being phased in across Malaysia to improve tax administration. It involves electronic issuance and receipt of invoices, crucial for income recognition and expense records. The implementation timeline is set by annual turnover, with fines for non-compliance. The process includes steps

0 views • 9 slides

Credit Finance Sub-Group and NPRR Updates

Updates from the Credit Finance Sub-Group include discussions on operational NPRRs, new invoice reports, EAL changes, and DC Energy's exposure calculations. The group considered improvements in credit implications, concentration limits, and more. NPRR 1186 was reviewed for enhancements to ESR monito

0 views • 12 slides

Dental Practice Management Software Market Projected to Surpass $3.11 Billion

Dental Practice Management Software Market by Deployment Mode (On-premise, Web-based, Cloud-based), Application (Patient Communication {E-Prescription, Monitoring, Appointment booking, Other Patient Communication Applications}, Invoice\/Billing, Insurance Management, Other Applications, End User (De

2 views • 2 slides

Efficient Payment Processing Workflow with Transcepta Integration

Streamline accounts payable processes with Transcepta by automating invoice submission, payment creation, and voucher review. Connected suppliers can submit invoices easily via various methods, and Accounts Payable can efficiently review and process incoming invoices for payment. Helpful queries and

3 views • 17 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

1 views • 5 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

0 views • 5 slides

Credit Finance Sub Group update to the. Technical Advisory Committee

Updates from the recent ERCOT Credit Finance Sub-Group meeting include discussions on voting matters, operational NPRRs without credit impacts, new invoice report implementation, and evaluation of changes to the Letter of Credit Concentration limits. Additionally, NPRRs related to State of Charge wi

0 views • 11 slides

How to Delete a Invoice in QuickBooks?

How to Delete a Invoice in QuickBooks?\nTo delete an invoice in QuickBooks, follow these steps meticulously. First, access the \"Invoices\" section after logging into your QuickBooks account. Then, locate the specific invoice you wish to remove from the list displayed. Open the invoice to view its d

0 views • 4 slides

Mastering Invoice Creation in QuickBooks_ A Step-by-Step Guide

Learn how to create an invoice in QuickBooks with our detailed guide. Whether you're using QuickBooks Online or Desktop, we'll walk you through each step, from setting up customers to customizing invoice templates and sending out professional invoices. Our guide ensures you can efficiently manage yo

1 views • 4 slides

How to Restore deleted Invoice in Quickbooks Online?

How to Restore deleted Invoices in Quickbooks Online?\nRestoring a deleted invoice in QuickBooks Online involves using the Audit Log to track and recreate it. First, access the Audit Log via the Gear icon under \"Tools\" and identify the deleted invoice details. Then, manually recreate the invoice b

1 views • 7 slides

Create an Invoice in QuickBooks

Creating an invoice in Quickbooks is a fundamental aspect of business operations, essential for billing customers and tracking revenue. QuickBooks, developed by Intuit, offers powerful tools to streamline the invoicing process, whether you're using QuickBooks Online or QuickBooks Desktop.

1 views • 6 slides

Boost Your Cash Flow with Invoice Factoring

Seacoastbusinessfunding.com provides quick and dependable invoice factoring services to help you get the money you need right away, so don't let cash flow problems keep your company from growing!

3 views • 1 slides

Procedures for Processing Purchases on Account in Accounting

The process of purchasing items for a business involves several steps including requesting needed items, ordering from a supplier, verifying items received, and processing the supplier's invoice. A purchase requisition is prepared to request specific items, a purchase order is written to order from

2 views • 35 slides

Common Invoice Exceptions in Guided Buying

In guided buying, invoice exceptions play a critical role. Learn about common invoice exceptions such as price variances, quantity discrepancies, and auto-reject scenarios. Discover how to handle these exceptions effectively to ensure smooth procurement processes.

1 views • 8 slides

Integrated Acquisition System (IAS) and Treasury's Invoice Processing Platform (IPP)

This presentation provides an overview of how the Integrated Acquisition System (IAS), Invoice Processing Platform (IPP), and Federal Financial Management Modernization Initiative (FMMI) interact to process acquisitions. It covers the role of the Procurement Systems Division (PSD), the purpose of th

0 views • 27 slides

Update on Invoice Processing Platform (IPP) Implementation

The Invoice Processing Platform (IPP) is a web-based system provided by the U.S. Treasury for tracking invoices from award to payment notification. This update outlines the scope, schedule, and implementation overview, including phases and actions needed for successful invoicing. Vendors are require

0 views • 8 slides

Easily Determine if an Invoice has been Paid - Procure to Pay Project Tips

Wondering how to tell if an invoice has been paid? Follow simple steps like checking the payment status and viewing payment details to quickly confirm the payment status. Utilize supplier invoice numbers and payment tabs for efficient tracking.

1 views • 6 slides

Best Practices for Utility Invoice Submission in Construction Projects

Ensure your utility invoice submission meets requirements by including project information, relevant documentation, and detailed billing. Avoid submitting invoices for the exact estimate amount and provide supporting documentation for total cost calculation.

0 views • 25 slides

Efficient Navigation and Export Process for AP Invoice Inquiry in TAMS System

Streamline your AP invoice inquiry process in TAMS system by learning how to access screens, narrow down searches, and export data to Excel effectively. Utilize filters for org number, account, and fiscal year to enhance efficiency.

0 views • 9 slides

Accounts Payable and FY18 Invoice Deadlines and Procedures Overview

Accounts Payable department details, staff members, invoice procedures, fiscal year 2018 invoice and travel deadlines, along with a reminder for submitting invoices and travel documents. Also includes information on financial manager signature authority form submission for the new fiscal year.

0 views • 8 slides

Invoice Entry Process and Common Mistakes in Banner FIS System

Detailed insights and reminders for navigating the complex invoice entry process in Banner FIS system, highlighting common mistakes and solutions. Emphasizes the importance of attention to detail and offers practical guidance for invoice management to ensure accuracy and efficiency.

0 views • 13 slides

Introduction of Invoice Management System (IMS) on GSTN portal

The new Invoice Management System (IMS) on the GSTN portal, launching in October 2024, aims to streamline the GSTR-2B invoice matching process. This update simplifies claiming Input Tax Credit (ITC) by allowing businesses to easily match, accept, or

0 views • 2 slides

Invoice Match Exception Overview - P2P Staff Meeting October 30, 2018

Detailed information on invoice match exceptions discussed at the P2P Staff Meeting on October 30, 2018, including rules, types of exceptions, review steps, and resources for assistance in Workday procurement processes.

0 views • 10 slides

Overview of Procure-to-Pay Project Invoice Match Exception Rules

This provides a detailed overview of the invoice match exception rules for a Procure-to-Pay project discussed during the P2P staff meeting on October 30, 2018. It covers specific rules related to purchasing, different types of exceptions, system tolerances, review steps, and updates made to freight

0 views • 12 slides

Check Invoice Status on NJDOT Intranet

Access the Accounts Payable (Invoice) Online Web Center on the NJDOT Intranet to find information on the status of your invoice. Follow step-by-step instructions to navigate through the system, enter search criteria, and view the status of your invoice. Utilize the Vendor Reference to track invoices

0 views • 17 slides

Invoice Processing at National Institutes of Health Office of Financial Management

The Commercial Accounts Branch at NIH's Office of Financial Management handles invoice processing efficiently to ensure timely payments to vendors. They manage various types of invoices, address improper submissions, and facilitate the payment approval process. Vendors' reasons for delayed payments

0 views • 10 slides

Accounts Payable Procedures and Guidelines

Ensure smooth processing of accounts payable by following these guidelines: verify vendor information in the Banner FIS system, match addresses accurately, handle new vendors diligently, practice efficient invoice entry techniques, and adhere to specific timing requirements for document delivery and

0 views • 10 slides

Mental Health Medi-Cal Administrative Activities Invoice Training Overview

This training covers the essential components of Mental Health Medi-Cal Administrative Activities Invoice, including learning objectives, schedule details, purpose, source data requirements, documentation, and review processes. Participants will gain a thorough understanding of reporting time, staff

0 views • 31 slides

Effective Training and Improvements for Transportation Invoice Procedures

Comprehensive training and improvements for the Department of Transportation invoice processes in October/November 2015. The content covers agenda, site logistics, invoice spreadsheet definitions, payment methods, contractual relationships, budget types, modifications, and overall enhancements for b

0 views • 36 slides

Streamlining Deliverable and Invoice Management Process

Streamline your deliverable and invoice management process with the new data and invoice tabs. Now enter weekly deliverable details separately from monthly invoicing data, improving accuracy and efficiency. Notifications and alerts are set up for invoice data only, ensuring timely billing processes.

0 views • 19 slides

Efficient Supplier Invoice Request Process Tips and Tricks

Learn valuable tips and tricks for handling Supplier Invoice Requests (SIRs) effectively, including best practices for invoice verification, internal memo usage, acceptable employee payments, and handling codes selection. Ensure a smooth procure-to-pay process by following these guidelines to preven

0 views • 10 slides

Streamlining Invoice Processing with Concur - Benefits and Workflow Overview

Concur Invoice is an electronic, cloud-based direct pay system designed to replace traditional paper claim voucher processes. By enabling direct payments for various expenses, it enhances visibility, reduces financial risks, and fosters a culture of accountability. This innovative solution also help

0 views • 9 slides

Semantic Data Model of Electronic Invoicing Core Elements

Presentation by Fred van Blommestein on the EN16931-1 semantic data model of core elements in electronic invoicing, covering invoice processes, core invoice design, semantic model details, business rules, and invoicing principles. The model includes 160 elements in 33 groups, with mandatory elements

0 views • 13 slides

Benefits of Invoice Currency in International Trade: Analysis and Implications

Explore the benefits of using invoice currency in international trade, focusing on the implications for importers. The study presents a model of endogenous choice of import frequency and invoice currency, revealing how Home Currency Invoicing (HCI) can help mitigate exchange-rate risks and reduce im

1 views • 35 slides

Invoice Approval and Notification Process Quick Reference Guide

This reference guide outlines the invoice approval and notification process, detailing email alerts for approval and exceptions, with instructions on how to validate and approve invoices in Guided Buying. It also covers notifications for invoices requiring accounting information and provides guidanc

0 views • 13 slides

Financial Management for DoD/DoD Related Agencies Workshop

Join Senior Accountant Kim Lewis for an informative workshop on Financial Management for DoD/DoD Related Agencies. The agenda covers Invoicing/Financial Reporting, Invoice/Financial Report Submission, Audit Standards/Requirements, and key forms such as SF-270, SF-1034, SF-425. Learn about Standard I

0 views • 10 slides

ERCOT Market Credit Manager Proposal Analysis

This document outlines EAL change proposals scenarios for ERCOT Market Credit Manager, including definitions of invoice exposures, current EAL formulas, and various scenarios affecting the calculation. It covers invoice exposure definitions, current EAL formula versus scenarios #1, #1a, and #1b, as

0 views • 11 slides

How Invoice Discounting Works A Step-by-Step Guide

Sanjeevani Wealth offers a seamless invoice discounting process, empowering SMEs with quick access to funds while maintaining full control over their invoices. From raising an invoice to receiving early payments, we guide you through every step, ensu

1 views • 9 slides