Understanding FSA Enrollment and Benefits During Protected Leave

Employee benefits like Dependent Care FSA (DCFSA) and Health Care FSA (HCFSA) can be maintained or revoked during protected leaves such as FMLA/OFLA or Active Military Duty. Options like prepayment or catch-up payments are available for employees on unprotected, unpaid leave. Discover how to handle FSA discrepancies and termination scenarios for terminated employees.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

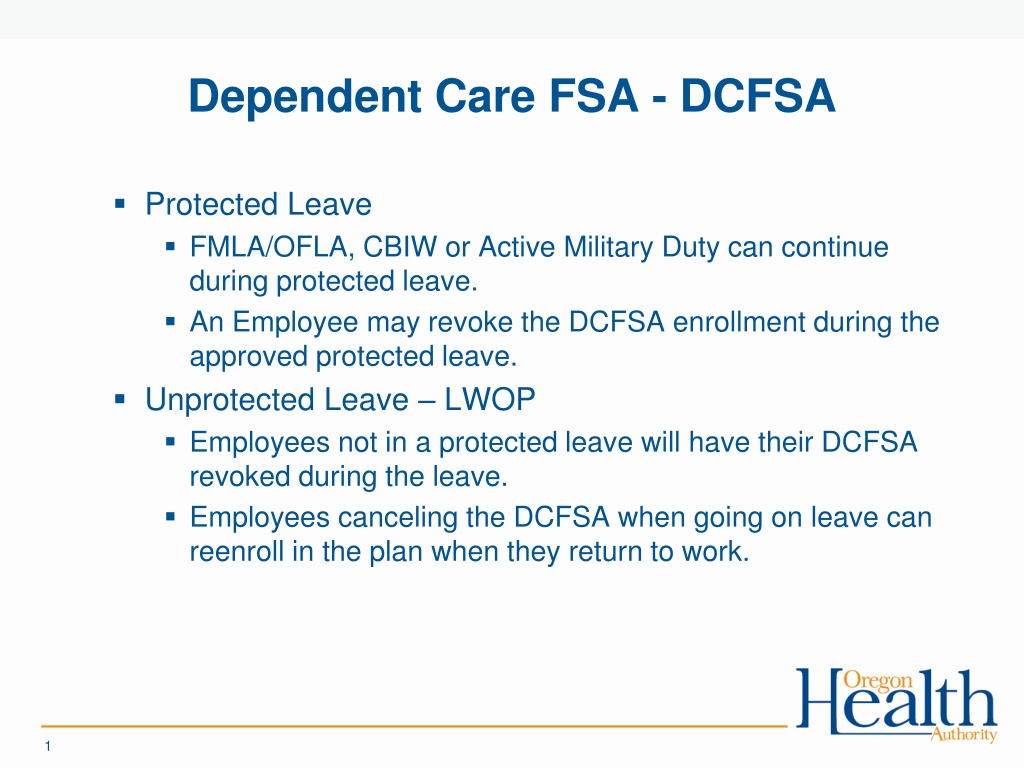

Dependent Care FSA - DCFSA Protected Leave FMLA/OFLA, CBIW or Active Military Duty can continue during protected leave. An Employee may revoke the DCFSA enrollment during the approved protected leave. Unprotected Leave LWOP Employees not in a protected leave will have their DCFSA revoked during the leave. Employees canceling the DCFSA when going on leave can reenroll in the plan when they return to work. 1

Health Care FSA - HCFSA Protected Leave Employees taking an approved protected leave FMLA/OFLA, CBIW, or Active Military Duty Leave are entitled to continuation of their HCFSA while on leave. If the leave is a substituted paid leave, then the employee s contribution for continuation must be paid by payroll deduction. Protected Leave Unpaid Leave An agency may offer one or more of the following options to an employee who continues the HCFSA account while on protected unpaid leave. Before the member commencing leave or shortly thereafter, the employee and the agency must agree to one of the following options for employee contribution. 2

Unpaid leave option 1. Prepay. The employee is given the opportunity to prepay their premium share due during the leave period before the leave begins. 2. Pay as you go. The employee pays the cost of coverage in installments during leave. Contributions are paid with after- tax dollars or with pre-tax dollars to the extent that the employee received compensation (e.g., unused sick or vacation days) during leave. 3. Catch-up options. The employer and employee agree in advance that the employer will advance payment of the employee share of the contribution during the leave and that the employee will repay the advance amounts when the employee returns to work. 3

Revoke coverage An employee may revoke the HCFSA account enrollment during the leave so long as the HCFSA account is in a positive status. 4

FSA Discrepancies FSA Discrepancies How to help lower your FSA discrepancies 1. All changes to a FSA Account must be first done in PEBB 2. Do not make the change in payroll only, the changes made in PEBB will feed over to payroll 3. FSA discrepancies must me corrected on the next payroll run 1. All accounts will be on hold with ASI until the account is current 2. By not making the changes correctly the member could over draft the account and put the account in the negative status. 4. When making a correction in payroll to correct the previous month discrepancies you also must include the admin fee. 5

Terminated Employees When processing a termination in the PEBB system Entering the Termination QSC Actual Event Date This is the actual date the event occurred No functionality in the system with this date QSC Event Date - The FSAs will end at the end of the month based on this date Coverage End Date The coverage end date is the date in which all coverage will end, however if the QSC event date is in a different month, the FSAs will not have the same end date 6