Update on TDTMS and MarkeTrak Enhancements - October 2022

In the latest TDTMS update, key changes include defining Inadvertent Gain processes, introducing a No Current Occupant process, and planning upgrades for MarkeTrak. The analysis of MarketTrak Subtype Volumes for mid-year 2022 reveals variances in different issue subtypes over the past months and years.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

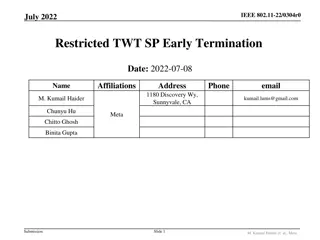

Presentation Transcript

TDTMS Update RMS OCTOBER 11TH, 2022

TDTMS TDTMS RMGRR170 - Inadvertent Gain Process Updates Possible VOTE Clearly define an Inadvertent Gain Clarify the appropriate use of the Inadvertent Gain Process Limit the use of the Bulk Insert template for IAGs Requiring a CR who experienced a system processing issue resulting in inadvertently gaining greater than 100 ESIs, who uses the IAG process to resolve, to inform impacted Market Participants and detail the cause of the issue Adding a Valid Reject/Unexecutable Reason for the losing CR referencing the new subsection on the Invalid Use of the IAG Process Introduce the commonly referred to No Current Occupant process supported by PUCT Subst. Rule 25.488 - Procedures for a Premise with No Service Agreement for scenarios where the losing CR no longer has a valid service agreement with the Customer and must regain an ESI ID

TDTMS TDTMS Update ERCOT Updates MarkeTrak Upgrade and Stabilization: 1 issue still being researched new users and search functionality SCR815 still planned for a December 5threlease. RMTE and WSDL availability toward end of October. TRAINING DATES: o November 16th during TDTMS @ 9:30 AM o November 30th afternoon Collaboration with Market Coordination Team to review business requirements for SCR 817 and TXSET 5.0 IAG changes reviewed a few outstanding development questions on SCR817: PENS DOWN 11/1 o IAG workflows happy path and unhappy path o 867 vs Sum of LSE Intervals final decision on time stamp no hh:mm:ss will default o Switch Hold workflows warning messages for ROR submissions and no SHs (out of sync)

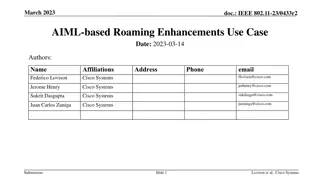

TDTMS TDTMS MarkeTrak Subtype Volume Analysis Mid Year 2022 Issue Sub Type 1 2 3 4 5 6 7 8 9 10 11 12 13 Difference last six months -109 724 -2953 4710 1077 6142 -20 -4948 40 116 -661 885 154 Difference same time last year -4696 2644 1342 813 383 2735 -14328 -3612 -146 25 111 924 48 1/1/19 - 6/30/19 7/1/19 - 12/31/19 1/1/20 - 6/30/20 7/1/20 - 12/31/20 1/1/21 - 6/30/21 7/1/21 - 12/31/21 1/1/22 - 6/30/22 Issue Sub Type Inadvertent Losing Inadvertent Gaining Switch Hold Removal Usage/Billing - Dispute Customer Rescission Usage/Billing - Missing AMS LSE Interval Dispute Other Cancel With Approval Missing Enrollment TXNS 997 Issues Siebel Chg/Info Bulk Insert LSE Relationship record present in MP System, not in ERCOT: de-engz Projects AMS LSE Interval Missing Ercot Initiated Safety Net Order Move Out With Meter Removal Redirect Fees Market Rule TOTALS 24408 16636 5463 5119 5198 2836 2104 2118 1328 936 735 702 441 22969 15447 10062 4550 3596 3262 4991 2504 1180 1079 346 685 254 18013 13096 6345 3779 3100 9857 261 4227 1204 1607 312 586 464 20933 13063 12258 5439 2787 10853 94 3094 955 1181 174 1281 258 24670 11732 5852 9641 2638 6796 14333 8552 949 678 26 463 283 20083 13652 10147 5744 1944 3389 25 9888 763 587 798 502 177 19974 14376 7194 10454 3021 9531 5 4940 803 703 137 1387 331 477 498 247 419 282 411 314 -97 32 14 15 16 17 18 19 20 21 296 164 186 246 187 217 163 69960 461 114 297 327 32 157 76 72887 1012 127 248 159 141 22 27412 92219 263 91 302 211 6 34 7317 81013 181 71 417 128 63 23 61 87839 193 61 228 260 200 76 60 69188 150 49 263 142 102 96 53 74697 -43 -12 35 -118 -98 20 -7 -31 -22 -154 14 39 73 -8

TDTMS TDTMS MarkeTrak Subtype Volume Analysis Mid Year 2022 - Observations Observations: While IALs are down, IAGs are up (likely due to the Bulk Insert submissions in June) Rescissions are up, may be due to higher prices in the market Switch Holds are down, however, could be seasonal with first half of the year being lighter than latter half also, DPP action is not impacted by ERP, Uri and weather moratoriums Usage & Billing Dispute and Usage & Billing Missing spike likely due to TNMP 3G remediation AMS LSE way down contributing factor is the improvement of AMS data quality saw spike with Uri impacts, now volumes have dropped and hopefully levelled off Other down as Oncor concluded their transition from BUSIDRRQ to BUSLO and now BUSLRG is an active choice for these size (>700 kW) customers Cancel w/ Approval slightly higher, but does not appear not appear out of line Siebel Changes bit of a spike and like due to CNP FME incident earlier in the year where Siebel changes were needed to re-sync the market Bulk Inserts submissions up contributing factor TNMP 3G remediation and IAG submissions in June ERCOT Initiated dropped - good story possibly meaning fewer invalid character issues and POLR Drops DEV issues have fallen off over the years as rules and behavior have shifted activity where leap frog scenarios have been minimized

TDTMS TDTMS Next Meeting Thursday, October 20th, 2022, 9:30 AM , WebEx only On the Agenda: ERCOT Updates System Instances & MT Performance Listserv MarkeTrak Upgrade Stabilization SCR815 Updates SCR817 Business Requirements discussion, if needed MarkeTrak Volume Subtype Analysis Discussion Time Spent on Issues of Various Subtypes Ranking Volumes over time