Understanding Overhead Costs in Accounting

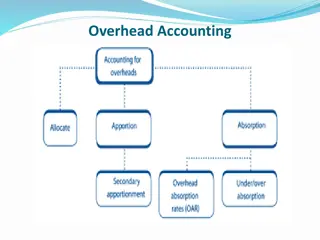

Overhead costs are supplementary expenses that cannot be easily allocated to specific cost objects. This includes indirect materials, labor, and expenses. Accounting and control of overheads involve steps like classification, codification, collection, allocation, apportionment, absorption, under/overabsorption. Classification can be element-wise (indirect materials, labor, expenses) or function-wise (factory/production, office/administration, selling, distribution overheads). Each category encompasses different expenses related to production, operations, sales, and distribution.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

What are Overheads Indirect + Indirect + Indirect = Overhead Material Labor Expenses Cost Overhead costs or supplementary cost or charges are the costs that cannot be easily identified and allocated to a cost object/ cost unit.

Accountings & Control of Overheads Steps includes Classification of Overhead cost Codification & Collection of Overheads Allocation & Apportionment of Overheads Absorption of Overheads Under & Overabsorbtion of Overheads

Element Wise Classification Includes: Indirect material : Indirect materials include the following: Consumable Stores, Loose Tools, Fuel, Lubricating oil, cotton waste, loss arising from deterioration of stores, small tools for general use etc. Indirect Labour: includes the following: Salary to supervisory staff and works manager, payment for idle time, leave and holidays, salary of foremen, employer s contributions to P.F., wages for maintenance workers, wages of store-keeper etc. Indirect expenses: Rent, Rates and Taxes, Insurance, Travelling expenses, Repairs and maintenance of Plant and Machinery, Depreciation on Plant and Machinery used for production purposes, Canteen expenses, Expenses relating to keep and handle stores, etc

Function Wise Classification Factory or Manufacturing or Production Overhead: include all indirect expenses which are incurred for the purpose of production activities that starts from the procurement of materials and ends with the primary completion of the product, e.g., Depreciation on Plant and Machinery, Lighting and Heating, Insurance of Plant and Machinery, consumable stores, Cost of spare parts, Repairs of Plant and Machinery etc. Office and Administration Overhead: include all expenses relating to Office and Administration e.g. Directors Remunerations, Office Rent and Taxes, Office Lighting, Printing and Stationery, Audit and Legal fees, Bank Charges, Salaries to staff etc.

Function Wise Classification Selling Overheads : Includes costs incurred for creating demand for the product/service. E.g. Advertisement expenses, Salesmen s salaries, Promotion expenses, Showrooms expenses, Travelling expenses of salesmen, cost of price list and catalogues, expenses, incurred for maintaining After Sale Service , etc. Distribution Overheads: includes costs incurred in connection with the delivery of products to the customers. E.g. Carriage Overhead, Godown Rent, Secondary Packing charges, Maintenance and running expenses of delivery vehicles, Reconditioning the empty containers returned by customers for re-use, etc.

Behavior Wise Classification Variable overheads : which tend to vary directly with the change of the volume of output. It is stated that there is a linear relationship between the volume of output and the variable overheads. As variable overheads tend to vary with the volume of output, unit variable cost is likely to remain constant at all levels although the total variable overhead . e.g. indirect material, indirect labour, salesmen s commission, fuel, etc. Fixed overheads: which do not vary with the volume of output within a certain range of activity and within a certain period of time. It is interesting to note that as the fixed overheads remain unaffected by the volume of output, per unit cost of a product will be decreased if the volume of output increases, and vice-versa in the opposite case. E. g. Rent, Rates and Taxes, Salaries, Depreciation of Machinery and Building, Interest on Capital, Audit Fees, etc

Behavior Wise Classification semi-variable overheads: are those which partly vary with the volume of output and partly remain fixed at a certain level of activity. These overheads include: Depreciations on Plant and Machinery, Repairs and Maintenance of Plant and Machinery, etc.

Segregation of Semi variable Cost Semi variable cost are partly fixed & partly variable . They cac be segregated by the following methods: Comparison by period method Comparison by level of activity method High & Low Point Simultaneous Equation method

Comparison by period method Under this method, the quantum of output at two different levels of activity is compared with corresponding amount of semi-variable costs. As fixed cost remains constant, variable cost is determined by applying the following ratio: Variable Cost per unit = Change in the amount of semi-variable cost Change in output For E.g. Taking the level of activity of any two months (in the given illustration) say, April and May, the variable and fixed element of cost may be calculated as follows: = 500/100 = Rs. 5 per unit Therefore, Variable Element of Cost (for April) = 300 x 5 = Rs. 1,500 and, Fixed Element of Cost (for April) = Rs. 2,500 1,500 = Rs. 1,000 Similarly, Variable Cost (for May) = 400 5 = Rs. 2,000

Comparison by level of activity method Under this method of segregation of fixed and variable elements of cost, first the average of the data relating to selected two levels of activity is calculated and then the equation method or range method is applied.

High & Low Point Method This method is similar to the comparison method except that the data relating to the highest and lowest level of activity are considered. This method is otherwise called as Range Method. Under this method, two levels of expenses are taken into account. One level of expenses is high and another level of expenses is low. Besides, output of these level periods is considered. The difference in output and expenses are found out. The difference in expenses is due to variable element. Moreover, it is assumed that the fixed element of semi-variable overhead is expected to remain fixed for two periods ie two levels of expenses. In this way, both fixed and variable overheads are find out.

Simultaneous Equation method This method is also called as Simple Linear Regression Analysis Method. Regression is the relationship between two or more variables in terms of the original units of the data. Under this method, the degree of prevailing relationship between two variables is identified. measure of the average Volume of production and expenses are two variables. Electricity charges, maintenance expenses and the like are the examples of expenses. These expenses may vary with the volume of production though not in the same proportion.