Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

Secure State Migration in the Data Plane Overview

The data plane synchronization protocol for secure state migration addresses the challenges of untrusted networks, ensuring completeness, low overhead, and integrity guarantee. P4Sync offers a solution by running in the data plane with minimal local control plane involvement, ensuring completeness,

2 views • 21 slides

CIGRE Canada Study Committees Update Meeting 2021: Advancing Overhead Lines Technology

Study Committee B2 focuses on improving overhead lines technology, ensuring reliability, and environmental compatibility. The Canadian representative, Pierre Van Dyke, plays a key role in Technical Direction and various advisory groups. Working groups within SC B2 address diverse topics such as dyna

0 views • 12 slides

Standard Costing: Understanding Variances in Actual vs. Budgeted Costs

Explore the concept of standard costs, variance analysis, and the importance of investigating variances in actual vs. budgeted costs. Learn to calculate and interpret material and labor variances, overhead variances, and participate in a case study to apply learned concepts. Understand the developme

2 views • 52 slides

Computation of Machine Hour Rate: Understanding MHR and Overhead Rates

Computation of Machine Hour Rate (MHR) involves determining the overhead cost of running a machine for one hour. The process includes dividing overheads into fixed and variable categories, calculating fixed overhead hourly rates, computing variable overhead rates, and summing up both for the final M

4 views • 18 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

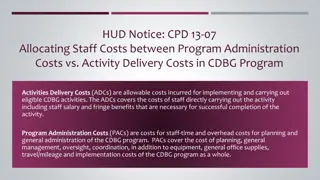

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

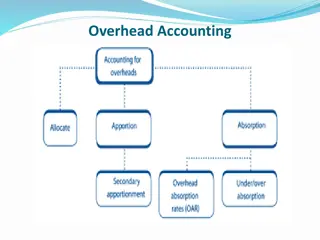

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding Absorption Costing and Overhead Absorption in Cost Accounting

Absorption costing is a method that includes direct costs and a fair share of production overhead costs in the cost of a product. Overhead absorption rate (OAR) is calculated using budgeted figures and can lead to over/under-absorption. Over-absorption occurs when absorbed overhead is more than actu

1 views • 23 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

Understanding Cost Allocation in CDBG Program: ADCs vs. PACs

Activities Delivery Costs (ADCs) in the CDBG program cover non-profit staff expenses related to implementing eligible activities, while Program Administrative Costs (PACs) encompass planning and general administration expenses. ADCs include salaries and benefits for staff directly involved in activi

0 views • 10 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Overhead Analysis of Coordinated Spatial Reuse in IEEE 802.11-23

Analysis of overhead components impacting the performance of Coordinated Spatial Reuse (Co-SR) in IEEE 802.11-23 standard for wireless communication. Evaluation of MAC overhead, negotiation and measurement phases, and frames in the negotiation phase. Discussion on the impact of overhead on Co-SR per

0 views • 14 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Understanding Overhead Costs in Accounting

Overhead costs are supplementary expenses that cannot be easily allocated to specific cost objects. This includes indirect materials, labor, and expenses. Accounting and control of overheads involve steps like classification, codification, collection, allocation, apportionment, absorption, under/ove

1 views • 17 slides

Understanding Overhead Allocation in Financial Accounting

Overhead in accounting refers to expenses incurred in production or providing services that cannot be directly traced to specific products or departments. This involves classifying overhead based on function, element, and behavior, as well as allocating, apportioning, and absorbing overhead costs in

0 views • 13 slides

Understanding Overhead Costs in Accounting

Overheads in accounting consist of indirect materials, labor, and expenses not directly attributable to a specific cost object. They play a vital role in budgeting and pricing strategies for businesses. Overheads can be classified based on elements and functions, such as factory overhead, office and

0 views • 23 slides

Overview of Administrative Services Overhead Charge (ASO)

The Administrative Services Overhead Charge (ASO) allows central administration to recover costs for support services by allocating them to separately funded areas of the campus. Various costs are charged through ASO, with a focus on administrative, environmental health, personnel, and other service

0 views • 11 slides

Developing Common Metrics and Models for RF Overhead Calculations

Issues surrounding power overhead in RF engineering, optimizing design power budget, understanding losses and disturbances, simulations, meaningful measurements, and future plans for the ILC. Topics covered include power requirements, cost optimization, accelerator section costs, static losses, and

5 views • 15 slides

Actively Secure Arithmetic Computation and VOLE Study

Exploring actively secure arithmetic computation and VOLE with constant computational overhead at Tel Aviv University. Understanding how functions are represented in secure computation using arithmetic circuits over boolean circuits. Efficiently evaluating arithmetic circuits over large finite field

0 views • 36 slides

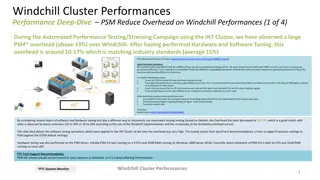

Windchill Cluster Performance Deep-Dive: PSM Overhead Reduction Strategies

During an automated performance testing campaign, a large PSM overhead was observed over Windchill, which was reduced to around 10-17% through hardware and software tuning efforts. Various recommendations and strategies were shared, including turning off UEM if not required, avoiding monitoring remo

0 views • 4 slides

Understanding Job Order Cost Flow in Manufacturing

Job costing in manufacturing involves assigning manufacturing costs to work in process through debits to work in process inventory and credits to raw materials inventory, factory labor, and manufacturing overhead. Job cost sheets are used to record costs chargeable to specific jobs, acting as a subs

2 views • 44 slides

Understanding Product Costs and Prices in Manufacturing

Product costs are expenses incurred to create a product for sale, including direct material, direct labor, and manufacturing overhead. Direct material refers to raw materials used for production, while direct labor includes wages for workers directly involved in manufacturing. Manufacturing overhead

2 views • 7 slides

Project Cost Estimation for Microgrid Equipment and Installation

This module delves into estimating project costs for microgrid equipment, including procurement, installation, design, and engineering. It covers categories such as installation costs, design and engineering costs, overhead costs, and contingency costs, to provide a comprehensive understanding of es

0 views • 18 slides

Understanding Overhead Labour Costs in Neo-Kaleckian Growth Models

Overhead labour costs play a crucial role in income distribution and determining whether economies operate in a profit-led or wage-led demand regime. This article explores the relationship between overhead labour, non-supervisory workers, and managers in the context of economic models proposed by re

0 views • 39 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding Facilities and Administrative (F&A) Rates in Research Funding

Facilities and Administrative (F&A) rates, also known as indirect costs, are crucial in research projects to cover overhead expenses. The Office of Cost Analysis calculates and negotiates F&A rates with the federal government, ensuring fair cost recovery. This article explains the distinction betwee

0 views • 9 slides

Understanding Cost Accounting Principles and Concepts

Explore the fundamentals of cost accounting through the 14th edition by Carter. Learn about cost concepts, production costing, job order costing, process costing, activity-based accounting, joint costing, and standard costing. Dive into assessments, activities, and classifications of costs related t

0 views • 28 slides

Characterization of 3G Control-Plane Signaling Overhead

This study focuses on characterizing the control-plane signaling overhead in 3G networks caused by the initiation and release of radio resources with raw IP data packets. It explores the impact of massive signaling messages triggered by data transfer on 3G networks, aiming to validate a data-plane a

0 views • 22 slides

Cost Calculation and Inventory Analysis for Manufacturing Companies

This content delves into the calculation of various costs and inventory data for manufacturing companies based on specific scenarios and information provided. It covers topics like direct materials inventory, manufacturing overhead costs, labor costs, finished goods inventory, and more, offering a d

0 views • 20 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Optimizing Line Coding for PM-PHY: A Detailed Analysis

Enabling line coding and channel equalization methods for PM-PHY, the IEEE 802.15.13 standard introduces overhead while enhancing channel adaptation. This contribution proposes 64b67b and Uniform Line Coding as alternative transmission modes, aiming to reduce line coding overhead while maintaining a

0 views • 26 slides

DeltaINT: General In-band Network Telemetry with Low Bandwidth Overhead

This paper discusses DeltaINT, a novel framework for in-band network telemetry aimed at reducing bandwidth overhead while ensuring high generality and convergence. It addresses the limitations of existing methods by providing theoretical analysis on bandwidth mitigation guarantees and offering softw

0 views • 20 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides

Paper Airplanes Production Process and Cost Analysis

Explore the production process and cost accounting for paper airplanes, detailing team roles, materials costs, employee costs, and overhead costs. Understand the sequential process of folding paper airplanes in teams and the critical quality assurance step. Get ready for controlled chaos in managing

0 views • 6 slides