Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using various methods. The significance of overhead costs has increased with industrialization and automation, leading to a need for careful accounting and analysis. It is essential for cost accountants to make prudent decisions when allocating overhead costs to ensure accurate cost ascertainment and control.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Overheads Presented by Dr. B. N. Shinde Assistant Professor Department of Commerce Deogiri College, Aurangabad

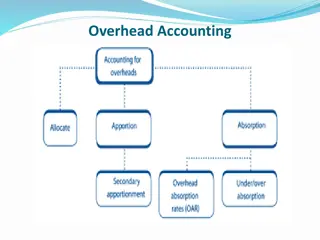

Overheads Cost pertaining to a cost centre or cost unit may be divided into two portions direct and indirect. The indirect portion of the total cost constitutes the overhead cost which is the aggregate of indirect material cost, indirect wages and indirect expenses. Indirect costs are those costs which are incurred for the benefit of a number of cost centers or costs units. Indirect cost, therefore, cannot be conveniently identified with a particular cost centre or cost unit but it can be apportioned to or absorbed by cost centres or cost units.

Continue CIMA defines indirect cost as expenditure on labour, materials or services which cannot be conveniently identified with a specific saleable cost per unit. Broadly speaking, any expenditure over and above prime cost is known as overhead. In general terms, overheads comprise all expenditure incurred for or in connection with the general organization of the whole or part of the undertaking i.e. the cost of operating supplies and services used by the undertaking including the maintenance of capital assets. The terms burden , supplementarycosts , oncosts , indirect expenses are used interchangeably for overhead.

Importance of Overhead Costs: In various five-year plans, industrialization was given due importance. The result is that a large number of establishments have grown up both in the public and private sectors for mass production for which use of improved and costlier and special type of machines has become absolutely necessary. With the increasing trend towards plant automation, heavy expenditure is being incurred which cannot be charged directly to any particular unit and can be called as cost common to all units of production.

Continue Overhead expenses being a significant proportion of the total cost have assumed an added importance and require analysis for purposes of cost ascertainment and control by function and for guidance in certain managerial decisions by the extent of the variability with production.

Continue Overhead costs cannot be allocated but have to be suitably apportioned and then absorbed by suitable methods. The cost accountant is required to pay so much attention to the accounting of overhead cost as prudence choice of various apportionment and absorbing the overheads in the cost of products has to be made by him. bases used for

Classification of Overhead Costs: Cost classification is the process of grouping costs according to their common characteristics and establishing a series of special groups according to which costs are classified. The various classifications are: (i) Functional classification, (ii) Classification with regard to behavior of the expenditure, (iii) Element-wise classification, (iv) Classification according to nature of expenditure.

Continue I. Functional Classification of Overhead: When overhead expenses are classified with reference to major activity divisions of a concern, it is called functional classification of overhead. This classification is necessary for the segregation of the cost of each of the principal functional division of the concern and for having separate methods of accounting and control for the diverse nature of expenses in each division.

The main groups forming the basis of the classification are: (a) Manufacturing Overhead, (b) Administration Overhead, (c) Selling Overhead, (d) Distribution Overhead, and (e) Research and Development Expenses

Continue II. Classification with Regard to Behavior of Expenditure: Under this overheads are classified with reference to their tendency to vary with production/sales volume or activity level. Some expenses vary directly with the rise and fall in output, some remain constant in spite of change in the level of activity of the concern whereas there are some other items which are constant only up to a certain level and then change their character to become variable or which vary with volume of output but less than proportionately. Based on this behaviour, the expenses may be classified into: (a) Fixed overhead, (b) Variable overhead, (c) Semi-variable or Semi-fixed overhead.

Continue (a) Fixed Overhead: Fixed overhead cost (also called period cost and policy cost) is the cost which accrues in relation to the passage of time and which, within certain limits tends to be unaffected by fluctuations in the level of activity. These expenses remain fixed in total amount with increases or decreases in the volume of output or productive activity for a given period of time. Fixed overhead cost per unit decreases as production increases and increases as production declines.

Continue Examples of fixed expenses are rent of building, storage space etc., depreciation of plant and machinery, depreciation of buildings, pay and allowances of space etc., depreciation of plant and machinery, depreciation of buildings, pay and allowances of directors, managers, secretaries, accountants etc., office expenses, like stationery and postage etc., bank charges, legal expenses, salaries of the works manager, interest on capital, if included in costs.

Continue (b) Variable Overhead: It is a cost which tends to follow (in the short-term) the level of activity. Variable overheads costs vary in total in direct proportion to the volume of output. These costs per unit remain relatively constant with changes in production. Thus variable costs fluctuate in total amount in direct proportion to the volume of output but tend to remain constant per unit as production activity changes. Examples are indirect material, indirect labour, spoilage, tools, defective work loss, lubricants, idle time, lighting and heating expenses and commission to salesmen. The variable overhead costs seldom reveal the characteristic of perfect variability i.e. an expenditure which varies directly with variation in the volume of output. They simply tend to vary rather than vary directly in direct proportion to output.

Continue (c) Semi-variable Cost (also called mixed cost or semi fixed cost): It is a cost, containing both fixed and variable elements and which is thus partly affected by fluctuation in the level of activity. These costs are partly fixed and partly variable. For example, telephone expenses include a fixed portion of annual charge plus variable charge according to calls, thus the total telephone expenses are semi-variable.

Continue Similarly if the salesmen are entitled for a fixed salary plus a commission beyond a certain level of sales, salesmen compensation is a semi-variable overhead having a fixed element constant at all the levels and a variable element which comes into operation after a specified level of sales is achieved.

Continue III. Element-wise Classification: This classification of overhead is done according to the nature and source of expenditure and follows naturally from the definition of overhead. According to this classification, the total expenses are broken up into: (i) Indirect Materials; (ii) Indirect Labour; and (iii) Indirect Expenses