IEP Amendment & Change in Placement

The process of amending an Individualized Education Program (IEP) and understand the significant change in placement considerations. Learn when it is appropriate to amend an IEP, examples of non-significant changes, and the reevaluation required for significant changes. Discover how to identify a significant change in placement and examples of such changes. Delve into IEP procedures and definitions to ensure effective IEP modifications."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Macroeconomic Risks: FAD s Fiscal Stress Tests Covid-19 OCTOBER 27, 2020 Camilo Gomez Osorio Macro-fiscal Advisor AFRITAC South

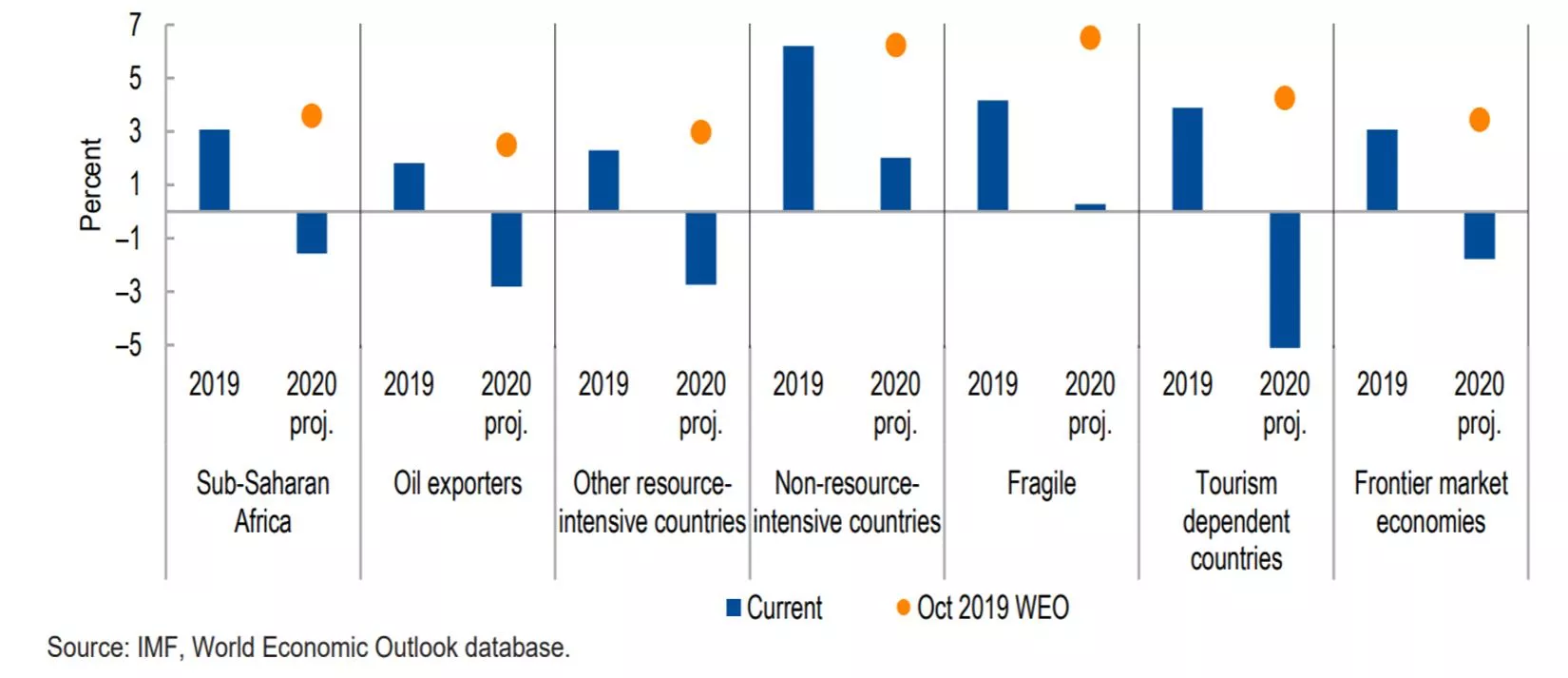

A differentiated economic impact across SS Africa Sub-Saharan Africa: Real GDP growth, 2019 - 2020

Fiscal risks: COVID-19 pandemic The COVID-19 pandemic is impacting the public finances through increased spending and reduced revenue collection, and through contingent liabilities turning into actual liabilities. Change in Government Debt and Overall Fiscal Balance (% of GDP) Projected real per capita GDP 5.4 percent loss in 2020 Source: IMF WEO 2020 Source: IMF WEO 2020

General macro-economic risks Analysis and quantification Historical evidence of economic shocks can be analyzed by comparing expectations with outcomes. Governments can assess their fiscal exposure to macroeconomic risks by means of: Sensitivity analysis shows the impact of small changes in key macroeconomic variables, taken one at a time, on government revenues, expenditures or debt. For example, lower GDP growth or higher oil prices. Scenario analysis is the design of alternative combinations of macroeconomic variables to illustrate the fiscal impact of adverse developments in key macroeconomic parameters. For example, a low growth scenario including contingent liability realization. Stochastic analysis derives a probability distribution of future debt stocks based on stochastic simulations of key variables, explicitly capturing the volatility and co- movements of key macroeconomic. Stochastic analysis could be expanded to include endogenous fiscal responses by governments.

MacroeconomicShocks: What is a Fiscal Stress Test? The stress test applies a large, correlated macroeconomic and asset price shock, combined with a contingent liability realization, to assess what fiscal impact there might be during an extreme macroeconomic event. Three Elements to a stress test Large macro-fiscal shock Contingent Liability Shock Impact of the shocks to the government s balance sheet Three summary outputs Fiscal Solvency Government liquidity needs Financing burden

How does the COVID-19 pandemic affect the economy? Containment measures Supply Demand Factory and mine closures Copper demand and prices Quarantines Travel bans and restrictions Cutbacks in services Confidence Closure of public places Supply chain disruption Business and tourism travel

How to model this? Two supporting approaches 1. Estimatingsectoral impactunder differentcombinationsof stringency and duration 2. Estimatingthe production function for longer-run effects. GDP at Constant Prices 11,960.0 9,960.0 7,960.0 5,960.0 3,960.0 1,960.0 -40.0 2018 2019 2020 2021 2022 2023 Sector Approach Trend PF Approach Once we have the GDP framework, we can link the fiscal framework with the GDP components, using proxy bases,buoyancies,and effectivetax rates. 7 IMF | Fiscal Affairs

The Structure of FADs Fiscal Stress Test Tool GDP scenarios Stringency vs Length lockdown Revenue implications (Effective Tax Rates) Expenditure implications (Links with Health) Net Lending or Borrowing Balance & Debt This approach allows quick demonstrations of different scenarios and requires only modest customization. However, the tool is unlikely to be integrated into macro-fiscal forecasting processes.

Steps in the FST Framework Stringency and Length GDP Revenue Expenditure Debt

Calibrating FADs COVID-19 F Tool FAD model sector calibration UK April GDP outturn Marginally affected (>90% operating capacity) Moderate decline (70-90% operating capacity) Large decline (50- 70% operating capacity) Severe decline (<50% operating capacity) 0% Fishing and fish processing on board Com, social and personal service activities Hotels and restaurants -5% Health -6% -10% Private -15% Real estate and business services Financial intermediation household with employed persons Education -20% Model FAD -19% -20% -20% -25% Public Wholesale and retail trade, repairs -24% Transport, and communication Mining and quarrying administration and defence -30% -35% Agriculture and forestry Electricity and water Construction Manufacturing -40% -40% -45% Public sector Agriculture Services Industry

Fiscal Risk Capacity Development IMF has a wide array of tools to meet existing and emerging needs Fiscal Stress Test for Covid-19 for understanding impact on macro-fiscal Fiscal risk assessment for broader diagnostic Other tools available for more granular needs IMF is providing flexible and remote CD on demand To discuss or request CD: Contact Camilo (CGomezOsorio@imf.org), Robert (rclifton@imf.org) or Sybi (Shida@imf.org) Email FAD s CD on demand address: CDsupport-macrofisc@imf.org

![RE: ELECTORAL MATTERS AMENDMENT BILL [ B42-2023]](/thumb/18837/re-electoral-matters-amendment-bill-b42-2023.jpg)