Tax Expenditures and Their Impact on Government Revenue

Tax expenditures are provisions in the U.S. federal tax laws that result in revenue losses by allowing exclusions, exemptions, deductions, credits, preferential tax rates, and deferrals. This concept is crucial as it affects government revenue, and there are challenges in reporting these expenditure

3 views • 18 slides

Efficient Payment Processing Workflow with Transcepta Integration

Streamline accounts payable processes with Transcepta by automating invoice submission, payment creation, and voucher review. Connected suppliers can submit invoices easily via various methods, and Accounts Payable can efficiently review and process incoming invoices for payment. Helpful queries and

3 views • 17 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

1 views • 5 slides

Exporting Invoices from QuickBooks to Excel

Exporting Invoices from QuickBooks to Excel\nExporting invoices from QuickBooks to Excel is a simple process that makes managing financial data more efficient. QuickBooks' intuitive interface allows users to extract comprehensive invoice details into Excel sheets with just a few clicks. Once in Exce

0 views • 5 slides

How to Delete a Invoice in QuickBooks?

How to Delete a Invoice in QuickBooks?\nTo delete an invoice in QuickBooks, follow these steps meticulously. First, access the \"Invoices\" section after logging into your QuickBooks account. Then, locate the specific invoice you wish to remove from the list displayed. Open the invoice to view its d

0 views • 4 slides

Exporting Invoices from QuickBooks to Excel

Exporting invoices from QuickBooks to Excel is a valuable feature that enables businesses to manipulate, analyze, and present financial information in a versatile spreadsheet format. Invoices, as critical financial documents, often require exportation for detailed analysis, reporting, or integration

1 views • 6 slides

Quick Course on Setting up Fund Accounting in QuickBooks Pro for Municipalities

Discover how to set up fund accounting in QuickBooks Pro for municipalities using class tracking features. Learn to define funds, track balances for revenues and expenditures, and create new revenue accounts. Explore examples of recording revenue and managing expenditures effectively.

0 views • 19 slides

Overview of Food Price Trends and Consumer Expenditures in the US

The presentation highlights the consumer spending on food, food price trends over time, 2021 food prices, and forecasts for 2022 in a historical context. It emphasizes that U.S. consumers spent 12% of their expenditures on food in 2020, aligning with historical averages. Food price inflation remaine

0 views • 21 slides

Tax Invoices and Billing Procedures under GST

An in-depth overview of tax invoices, credit notes, and debit notes, focusing on their significance under the GST taxation system. Explains the difference between a tax invoice and a bill of supply, and provides guidance on issuing proper documentation under different scenarios. Covers the time limi

0 views • 24 slides

Efficient Supplier Portal for GE Transportation/Wabtec iSupplier Training

GE Transportation/Wabtec offers a user-friendly iSupplier Portal (iSP) for suppliers to manage invoices, payments, and orders efficiently. Learn how to register, receive system updates, and ensure compliance for seamless transactions. Access web invoicing, credit card processing, and ERS settlement

0 views • 16 slides

Update on Invoice Processing Platform (IPP) Implementation

The Invoice Processing Platform (IPP) is a web-based system provided by the U.S. Treasury for tracking invoices from award to payment notification. This update outlines the scope, schedule, and implementation overview, including phases and actions needed for successful invoicing. Vendors are require

0 views • 8 slides

Overview of Ontario's Expenditures and Revenues

Ontario's projected expenditures for 2018-2019 are around $158 billion, with 30 ministries grouped into six major sectors. The top spending sectors include Health, Education, Other Programs, and Interest on Debt. Revenue sources for the same fiscal year are projected to be approximately $152 billion

7 views • 16 slides

Accounts Payable in C-Store Office Advanced Accounting

Accounts Payable is a crucial function within the accounting department of a company that handles processing vendor invoices and bills for goods and services received on credit. This article covers the definition of accounts payable, its importance, how to locate and pay invoices in C-Store Office,

0 views • 10 slides

X3 Workflows for Efficient Business Processes

X3 workflows are messages that signal actions, such as placing orders on hold, approving purchase requests, or notifying of state changes like overdue invoices. These workflows expedite business processes by requiring actions, providing information, or reacting to object state changes. Examples incl

0 views • 7 slides

Provincial Treasury Process for Dealing with Irregular Expenditures

The Provincial Treasury outlines the process for handling irregular expenditures, including the definition of irregular expenditure, regulations introduced, legal opinions, and duties of Accounting Officers (AOs) and Authorized Officials (AAs) to prevent and address irregularities. Various steps and

0 views • 12 slides

Colorado Expenditures on the Medically Indigent Presentation

The presentation focuses on Colorado's expenditures for the medically indigent, conducted by Yondorf & Associates. It outlines the background of the expenditures project, preliminary findings, and possible policy implications. The project aims to estimate current spending on Coloradans who cannot af

0 views • 12 slides

Evaluation Process for AAU Membership and Indicators

AAU evaluates universities for membership based on research and education profiles. Non-member universities exceeding standards may be invited to join, while current members falling below may face review. The process involves membership and phase 1 indicators, federal R&D expenditures, and expenditu

0 views • 12 slides

Missouri HealthNet Pharmacy Program and Budget Update Summary

The Missouri HealthNet Pharmacy Program and Budget Update for July 2023 provides detailed insights into the enrollees, expenditures, and services covered. It highlights the distribution of enrollees among different categories such as children, custodial parents, pregnant women, elderly, and disabled

0 views • 9 slides

Musculoskeletal Disorders in Norway: Statistics and Analysis

This information provides an in-depth look at musculoskeletal disorders in Norway, including disease categories, public expenditures, burden of disease, DALYs by ICD10 chapters, health expenditures, productivity loss, deaths, and YLDs in 2013. The data sheds light on the prevalence, impact, and dist

0 views • 9 slides

Non-PO Invoice Submission Training Program - STAN

Streamline the submission of non-PO invoices through the STAN program, improving efficiency and reducing processing time. Understand the steps to email invoices, use proper subject lines, handle attachments, and manage multiple indexes/account codes effectively.

1 views • 10 slides

UC Merced Entertainment Policy Overview for Catering Recharges

University of California, Merced's entertainment policy (BUS-79) outlines expenditures for business meetings, entertainment, and other occasions, including guidelines for catering recharges. The policy covers purposes, maximum rates, general limitations, approval of expenditures, exceptions, busines

0 views • 17 slides

Litchfield Elementary School District Bond Update June 30, 2021

Litchfield Elementary School District provides an update on the 2014 Bond Authorization as of June 30, 2021. The District has issued bonds totaling $35 million with expenditures and available cash detailed. Expenditures include school remodeling, new construction projects, operational expenses, and

0 views • 11 slides

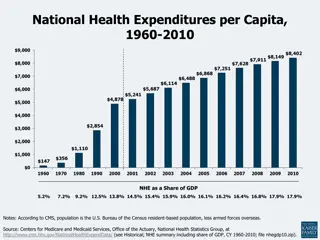

Trends in National Health Expenditures and Care Costs, 1960-2010

National health expenditures per capita and as a share of GDP from 1960 to 2010, along with average annual growth rates, show the evolving landscape of healthcare spending in the U.S. The data reveals changing patterns in healthcare expenditure and outlines the concentration of health care spending

0 views • 20 slides

Audit Report on Adult Corrections Expenditures

Adult corrections expenditures report from the Legislative Audit Bureau highlights trends in inmate population, operating expenditures, employee wages, turnover rates, vacancy rates, and inmate health care management issues. The report identifies areas of growth in corrections spending and offers re

0 views • 14 slides

Invoice Processing at National Institutes of Health Office of Financial Management

The Commercial Accounts Branch at NIH's Office of Financial Management handles invoice processing efficiently to ensure timely payments to vendors. They manage various types of invoices, address improper submissions, and facilitate the payment approval process. Vendors' reasons for delayed payments

0 views • 10 slides

Streamlining Invoicing Process with PayPaw in BuyWays - May 2017

PayPaw is a new workflow introduced for invoicing through BuyWays to streamline the Procure to Pay process, improve accuracy, and ensure payments are directed to the correct supplier. By scanning invoices directly into BuyWays, manual data entry is eliminated, enhancing efficiency and reducing proce

0 views • 15 slides

Efficient Accounts Payable Processes and Procedures

Streamline your accounts payable functions with detailed guidelines on vendor invoices, payments, cabinet level approvals, handling of independent contractors, and managing invoices for direct payments. Learn about the essential steps, requirements, and best practices to ensure timely and accurate p

0 views • 9 slides

Invoice Approval and Notification Process Quick Reference Guide

This reference guide outlines the invoice approval and notification process, detailing email alerts for approval and exceptions, with instructions on how to validate and approve invoices in Guided Buying. It also covers notifications for invoices requiring accounting information and provides guidanc

0 views • 13 slides

Tax Invoices, Debit Notes, and Credit Notes in Goods and Services Tax

This content covers the basic concepts of supply, invoicing obligations, tax invoices under Section 28, removal of goods for supply, and scenarios where removal does not result in a supply. Learn about the different types of taxes and when tax invoices should be issued for taxable goods and services

0 views • 28 slides

Essential Guidelines for Documenting University Expenditures during Emergency

Guidelines for documenting essential expenditures at the university during emergencies, emphasizing the categories of essential activities to be maintained such as protecting life, preserving university property, supporting critical services, ensuring continuity of operations, education, student ser

0 views • 17 slides

Medicaid Program Expenditure Analysis August 2022

Analysis of Medicaid program expenditures in August 2022 reveals interesting insights. Total enrollees in August 2022 were 1,358,275 with total expenditures amounting to $304,664,691.2. The report delves into expenditure distribution across various services, top drug classes per fiscal year, and Med

0 views • 12 slides

Chowan County Manager's Recommended Budget 2021-2022 Overview

The Chowan County Manager, Kevin Howard, has recommended a budget for FY 2021-2022 with details on property tax information, general fund revenues, revenue sources, and fund expenditures. The proposed budget includes information on assessed tax values, tax rates, revenue sources, and expenditures by

2 views • 7 slides

Public Housing Capital Fund Management Guidelines

Public Housing Capital Fund Management Guidelines provide detailed instructions for Public Housing Authorities (PHAs) regarding the proper utilization of capital funds, including obligations, expenditures, and modernization projects. PHAs are required to follow HUD regulations, maintain fiscal respo

0 views • 21 slides

Impact of MGNREGA on Private Coaching in West Bengal, India

This study explores the impact of the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) on private coaching expenditures in West Bengal, focusing on how participation and earnings under MGNREGA influence decisions related to private tutoring. More than half of households involved in M

0 views • 21 slides

Insights on Intergovernmental Funding of Surface Transportation

The interconnected nature of surface transportation funding system is highlighted, showing a decline in overall spending across federal, state, and local governments. Challenges in funding call for dialogue among all levels of government. The data reflects expenditures, funding sources, and the vary

2 views • 11 slides

Title I Parental Involvement Funds Management Guide

This resource provides detailed information on managing Title I Parental Involvement funds, including allowable and unallowable expenditures, voucher certification, contracts, and more. It outlines specific expenses that can be covered by the funds, as well as those that are not allowed. Additionall

0 views • 9 slides

Obligations and Expenditures in Grant Management

Explore the definition and characteristics of obligations in grant management, including the importance of tracking and managing funds responsibly to avoid overages. Learn how purchase orders create obligations and how to report expenditures effectively within the period of availability of funds.

0 views • 28 slides

Financial Policy Recommendations for Accumulated Surplus Management

The council policy recommends retaining an accumulated surplus up to 4% of operating expenditures, with any excess transferred to the Capital Works Reserve. The rationale behind this policy includes ensuring cash flow, setting aside funds for future expenditures, maintaining a rainy day fund, and pr

0 views • 14 slides

Event Highlights: Around the World of ESSA

Enjoy a recap of the ESSA event featuring morning coffee by Presentation Solutions, Consultation 2.0 for eGAP questions and challenges, an informative session on Invoices, Expenditures, and Bid Laws, TAG TEAM meetings on the second floor, and a concluding Q&A with Angela Martin and her team. Dive in

0 views • 6 slides

2020 Impact Fee Summary Report

The 2020 Impact Fee Annual Report, Traffic Impact Fee Summary, and Park Impact Fee Summary outline the eligible project expenditures, impact fee balances, spending requirements, and more for the year. Key highlights include significant project expenditures, balance allocations, and future spending p

0 views • 6 slides