Payroll Tax & Medical Centre Businesses

The intricacies of payroll tax in the context of medical businesses, including obligations, taxable wages, payments to contractors, and exemptions. Gain insights on how to register, provide voluntary disclosure, and navigate the Payroll Tax Act of 2011 effectively.

10 views • 23 slides

Wage Bill and Inflation Analysis in South Sudan's Public Sector

Concerns over inflation and stagnant wages in South Sudan have prompted a study on adjusting public sector salaries based on the increasing cost of living. The research outlines the need for revisions to address economic hardships faced by various government employees, emphasizing the potential soci

1 views • 48 slides

Sustainability in Fashion

Quince is a San Francisco-based fashion brand challenging the notion that quality items must come at a high price. Focused on quality, sustainability, and affordability, Quince's mission emphasizes responsible manufacturing practices and transparency. Their products are made in a global network of p

0 views • 8 slides

Addressing Mental Health Workforce Shortage in New Hampshire

New Hampshire is facing a critical shortage of mental health workers, impacting businesses and services. The demand for mental health services has surged post-pandemic, with a significant gap in wages for community mental health clinicians. Efforts to meet the rising demand include opening new beds

3 views • 12 slides

Lewis Two-Sector Model: Sustaining Economic Growth Through Labor Transfer

Lewis Two-Sector Model, based on the assumption of surplus labor in agriculture, explains how transferring labor to the industrial sector boosts economic growth. The model highlights the shift from traditional to modern sectors, increased output, wages, and profits, and self-sustaining growth capabi

0 views • 10 slides

Distribution of Employment Opportunities in India: Promoting Equal Access to Fair Work

The Indian constitution emphasizes equal opportunities in public and private employment to ensure fair wages and working conditions. Sustainable Development Goal 8 highlights the importance of decent work for all, addressing the informal employment sector prevalent in India. Inequality of opportunit

2 views • 23 slides

Maine's Paid Family and Medical Leave Law Overview

Maine's Paid Family and Medical Leave (PFML) law, effective October 25, 2023, provides up to 12 weeks of paid leave per benefit year for various reasons. Employers and employees contribute to the PFML fund, with key dates and rulemaking processes outlined for implementation. Contributions are calcul

1 views • 14 slides

2024 NJC Pay Campaign for Council and School Workers in England, Wales, and Northern Ireland

The 2024 NJC pay campaign focuses on increasing pay by £3,000 or 10%, introducing a £15 per hour minimum wage by 2026, addressing equalities pay gaps, reducing the working week by two hours, and providing an additional day of annual leave. The background highlights the impact of the cost of living

1 views • 14 slides

Michigan Employment and Training Services for Businesses - Overview

Michigan's Department of Labor & Economic Opportunity provides Employment & Training services to support individuals in achieving employment, upskilling, and workforce development. Programs like Michigan Rehabilitation Services and Workforce Development help individuals with disabilities and the str

0 views • 21 slides

Transforming Employment Opportunities for Illinoisans with Disabilities

Explore the journey from subminimum wage to competitive integrated employment for individuals with disabilities in Illinois. Gain insights into the impact of subminimum wage, current employment statistics, earnings disparities, poverty rates, and the significance of transitioning to fair wages. Lear

0 views • 37 slides

Streamlining Canadian Payroll and Attendance Management Software!

Payroll and attendance management software serves as a comprehensive solution for businesses to efficiently handle the intricacies of employee compensation and attendance tracking. These digital platforms streamline payroll processing by automating calculations for various components like wages, tax

3 views • 8 slides

Guard Your Investments- Corporate Defaults Alarm

Investor apprehensions intensify against a backdrop of mounting corporate defaults propelled by soaring interest rates. With defaults anticipated to crest by mid-2024, corporations grapple with challenges emanating from sluggish demand and surging wages.

4 views • 6 slides

Exploring Nonlinear Relationships in Econometrics

Discover the complexities of nonlinear relationships through polynomials, dummy variables, and interactions between continuous variables in econometrics. Delve into cost and product curves, average and marginal cost curves, and their implications in economic analysis. Understand the application of d

2 views • 34 slides

Understanding Aggregate Supply in the Short and Long Run

Aggregate Supply in the short and long run is crucial in understanding the relationship between the economy's price level and the total quantity of goods and services produced. In the short run, sticky wages and production costs play key roles in determining supply levels, while in the long run, cha

0 views • 16 slides

Public Works Labor Compliance Vendor Workshop by Housing Authority of the City of Los Angeles

The Housing Authority of the City of Los Angeles conducted a workshop to assist contractors in understanding their Public Works labor compliance responsibilities. The workshop covered topics such as contractor responsibilities, registration with the state under SB854, federal and state labor laws, a

1 views • 26 slides

Understanding Labor and Wages: Education, Discrimination, and Workers

Explore the impact of education on wages and discrimination on income in this lesson. Identify terms like Labor Force, Glass Ceiling, and more. Learn about different types of workers and their skills. Discover how education level affects wages and the distinction between blue-collar and white-collar

1 views • 16 slides

Recent Changes in Labour Laws and Code on Wages, 2019

The recent changes in labour laws involve the amalgamation of 44 laws into 4 codes, focusing on wages, occupational safety, industrial relations, and social security. The Code on Wages, 2019, aims to amend and consolidate laws related to wages and bonus, applicable to all employees in India. The Cod

1 views • 104 slides

Impact of the Black Death on the Late Middle Ages in Europe

The Black Death had a profound impact on European society and economy in the 14th century, causing social and economic upheaval, labor shortage, increased wages, and anti-Semitic sentiments. It also led to peasant revolts and the disintegration of medieval life, ultimately contributing to the breakd

5 views • 10 slides

Understanding Wage Principles in Economics

Compensation paid to employees for work is termed as wages and is typically based on an hourly basis. The relationship between real wages and money wages, as well as the concepts of nominal and real wages, are essential in understanding the dynamics of wages in economics.

1 views • 7 slides

The Impact of Software Industry on Global Development

The software industry has revolutionized how organizations operate, leading to increased innovation, technical progress, productivity, and workforce enhancement. Every sector, including government, healthcare, agriculture, finance, transportation, energy, entertainment, education, and manufacturing,

0 views • 16 slides

Overview of Minimum Wages Act 1948 for Unorganized Workers

The Minimum Wages Act 1948 aims to protect the welfare of unorganized workers by setting minimum wage rates that ensure their subsistence and efficiency. The Act empowers the government to fix minimum wages in industries prone to exploitation. It includes provisions for fixing rates, procedure for r

3 views • 21 slides

Directive on Adequate Minimum Wages in the EU Priorities

Priority 1 emphasizes protecting against unintended consequences and detrimental impact by amending definitions of collective bargaining, monitoring mechanisms, and promoting real improvements in national action plans. Priority 2 focuses on ensuring the Directive lives up to its aims by introducing

0 views • 4 slides

Challenges and Implications of Labor Shortages in the Restaurant Industry

Labor shortages in the restaurant industry, exacerbated by the COVID-19 pandemic, have led to operators facing challenges such as reduced hours of operation. To attract employees, operators are offering increased wages and benefits. The future implications include potential increases in menu prices

0 views • 8 slides

Challenges of Unpaid Wages in a Fissured Economy

Non-payment of wages, especially in cases of fissuring where subcontracting and dependence on intermediaries are prevalent, poses a significant issue in employment standards legislation. Better enforcement practices are essential, but the complex scenarios of fissuring make compliance challenging. T

0 views • 19 slides

Understanding Section 14(c) of the Fair Labor Standards Act

Section 14(c) of the Fair Labor Standards Act allows for the payment of subminimum wages to workers with disabilities when their productivity is impaired. The Wage and Hour Division of the U.S. Department of Labor oversees compliance with this provision, aiming for a vigorous and effective program.

0 views • 126 slides

Thomas Malthus and His Theory on Population Growth

Thomas Robert Malthus, an influential economist, proposed a theory on population growth in the 18th century. His theory suggested that population grows exponentially while food production increases at a slower rate, leading to inevitable food scarcity. Malthus also discussed the concept of preventiv

2 views • 19 slides

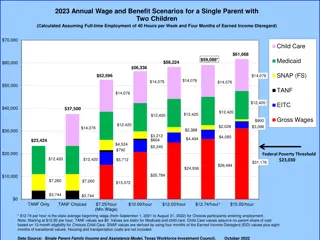

Comparison of Annual Wage and Benefit Scenarios for Single Parent with Two Children

Annual wage and benefit scenarios for a single parent with two children in 2019 and 2023, considering full-time employment with four months of earned income disregard. The analysis includes child care costs, Medicaid, SNAP (FS), TANF, EITC, gross wages, and federal poverty thresholds. Trends in wage

0 views • 6 slides

The Rise of Unions and Labor Conditions in the Late 19th Century

Labor conditions in the late 1800s were harsh, with long work weeks, low wages, and no benefits for workers. Deflation caused a rise in the value of money, leading to resentment among workers who organized into unions to demand better wages and working conditions. Craft workers and common laborers f

0 views • 17 slides

Understanding Spasticity and Increased Muscle Tone in Neurological Disorders

Spasticity and increased muscle tone are common features in neurological disorders, characterized by hyperactive stretch reflexes and muscle contractions. Spasticity is velocity-dependent and associated with upper motor neuron lesions, leading to increased resistance to passive movement. Rigidity, o

0 views • 28 slides

Stockholm Region Economy Report Q1 2022

The Stockholm Region Economy Report for Q1 2022 reveals a strong recovery post-Covid pandemic, with notable improvements in employment rates and total wages. Unemployment has decreased, while the number of people in employment has risen. Total wages in the private sector have increased, indicating a

0 views • 18 slides

Indiana INDemand Jobs and Labor Market Information

Indiana INDemand Jobs are determined based on future demand, percent change, wages, and real-time labor market data. The ranking methodology includes short-term and long-term projections, with a scoring system for each occupation. The Decile Ranking Method assigns scores from 1-10 in various categor

0 views • 14 slides

Understanding Collective Bargaining in School Districts

Collective bargaining in school districts involves negotiating over mandatory and permissive subjects such as wages, hours, and conditions of employment. School districts must differentiate between mandatory and permissive subjects, and disputes over mandatory subjects must be resolved through impas

0 views • 29 slides

Examining Socioeconomic Status of Childcare Workers in Illinois

Childcare workers in Illinois earn a median hourly wage of $10.5, ranking 35th in hourly wages among 730 occupations. The study aims to understand the flexibility and demographics of childcare workers compared to other occupations with similar wages. Assumptions suggest childcare work is predominant

0 views • 11 slides

Understanding Quarterly Census of Employment and Wages (QCEW) Program

The Quarterly Census of Employment and Wages (QCEW) is a collaborative program between federal and state entities that collects and disseminates employment and wage data at local levels. This program covers over 10 million establishments, offering valuable insights into employment trends and industr

0 views • 28 slides

Economic Disparities in the European Union: Insights from 2018 Meetings

The data presented showcases wage inequalities, compensation rates, minimum wages, monthly salaries, and low-paid workers' share in the EU, particularly focusing on Bulgaria. The figures indicate disparities among EU countries in terms of hourly wages, minimum wage levels, average monthly salaries,

0 views • 11 slides

Understanding W-2 Discrepancies and Pay Statement Variances

The W-2 form and pay statements may not always match due to differences in taxable wages, deductions, and withholdings. Understanding how to reconcile Box 1 wages, Box 2 federal income tax withheld, and Box 3 Social Security wages can help employees accurately report their income for tax purposes. T

0 views • 14 slides

Global Trends in Garment Worker Wages: A Closer Look

Explore the dichotomy of garment workers' wages in the global industry, analyzing the race to the bottom versus the potential route out of poverty. Worker Rights Consortium's research sheds light on real wage trends and challenges faced by garment workers in leading exporting countries.

0 views • 34 slides

Impact of Proposed Labour Codes on Employers and Compliance Structure

This content discusses the impact and evolving compliance structure under the Code on Wages, 2019, focusing on clauses related to minimum wages, payment of wages, and payment of bonus. It outlines key aspects like wage fixation, deductions from wages, eligibility for bonus, and computation of profit

0 views • 23 slides

Evolution of the Code on Wages: A Comprehensive Overview

The Code on Wages, 2019 aims to streamline and modernize labor laws in India by consolidating various regulations into four codes. The journey of this code, from its inception to becoming law, is detailed along with the significance of the proposed changes. The evolution of labor laws and the implic

0 views • 17 slides

Understanding Economic Growth: Key Concepts and Calculations

Economic growth is a fundamental goal for nations, leading to increased wages, improved living standards, and reduced unemployment. This article explores the basics of economic growth, including how to calculate growth rates, real GDP per capita, and the Rule of 70 for forecasting future growth tren

0 views • 23 slides