Evolution of the Code on Wages: A Comprehensive Overview

The Code on Wages, 2019 aims to streamline and modernize labor laws in India by consolidating various regulations into four codes. The journey of this code, from its inception to becoming law, is detailed along with the significance of the proposed changes. The evolution of labor laws and the implications for businesses and workers are discussed in this informative content.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Background India has approximately 40 central and 100 state specific labour laws. The Ministry of Labour & Employment has been targeting the codification of labour laws to: Transform old & obsolete labor laws Expand the ambit of the law (to cover a broader working population) Remove multiple definitions (often overlapping) & authorities Ensure ease of compliance & ability to do business in India seamlessly Rationalize penalties and accordingly increase implementation India s federal level labor laws are proposed to be combined under four codes. (i) wages; (ii) industrial relations; (iii) social security: and (iv) occupational safety, health and working conditions The Code on Wages, 2019 is the first in the series of four labor codes The Code on Wages has received Presidential assent on Aug 8th,2019 and now awaits its effective date. Different provisions of the Code may have different effective dates. The Draft Rule under he Code on Wages, 2019 have been released for public review.

Codes in the pipeline Code on Industrial Relations Code on Social Security & Welfare Code on Occupational Safety, Health & Working Conditions (introduced in the Parliament)

Evolution of the Code on Wages Bill lapsed with dissolution of Lok Sabha March 10, 2015: Draft of Labour Code was discussed in the first tripartite meeting December 18, 2017: Jul 30, 2019: New Bill (Code on Wages 2019) passed by the Lok Sabha Aug 21, 2017: Bill referred to a Parliamentary Standing Committee March 21, 2015: Draft Labour Code was placed for public consultation August 2, 2019: Code on Wages Bill, 2019 passed by Rajya Sabha August 8, 2019: Code on Wages Bill 2019 received Presidential assent. Aug 10, 2017: Bill on Code on Wages first introduced in the Lok Sabha April 13, 2015: Second tripartite discussion

Equal Payment of Bonus Act, 1965 (POBA) Payment of Wages Act, 1936 (POWA) Min. Wages Act, 1948 (MWA) Remuneration Act, 1976 (ERA) Any action taken under the above enactments including any notification, nomination, appointment, order or direction made or any amount of wages paid shall be deemed to have been done under the Code on Wages unless it is contrary to the provisions of the Code and until such time that they are repealed by the provisions of the Code or a notification to that effect issued by the Central Government.

Coverage and Applicability Applies to employee in both the organized and un-organized sectors. The provisions relating to payment of wages under the Code on Wages, 2019 will extend to all employees irrespective of their wage ceiling & type of employment, unlike. a) the Payment Of Wages Act, 1936 (POWA) which applied only to factories & certain specified establishments and those employees who drew monthly wages of up to INR 24,000 (approx. US$ 340) and b) the Minimum Wages Act, 1948 (MWA) which applied only to scheduled employments.

DEFINITIONS NEWLY INTRODUCED & EXISTING AMENDED-1 2(f): Contractor 2(g): Contract Labour 2(h): Cooperative Society 2(i): Corporation 2(k): Employee 2(l) (iii): Employer-Contractor 2(r ): Inspector-cum-Facilitator

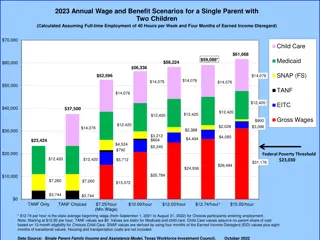

DEFINITIONS NEWLY INTRODUCED & EXISTING AMENDED-2 2(q) : Industrial Dispute 2(s) : Minimum Wages 2(y) : Wages (ctc) At least 50% of total remuneration to be wages If the exclusions under the definition of wages exceed one half or such other percent as may be notified by the Central Government of the entire remuneration, the amount which exceeds such one half or such other per cent shall be treated as wages . Case Study on next page

DEFINITIONS NEWLY INTRODUCED & EXISTING AMENDED-3 Case Study of CTC Basic Rs. 10,000/- pm DA/Cost of Living All. Rs. 3,500/- pm HRA Rs. 8,000/- pm Conv. All. Rs. 3,500/- pm Bonus (Statutory) Rs. 850/- pm Excluded Category Rs. 18,600/- pm PF (Employer Share) Rs. 2,000/- pm Commission Rs. 4,250/- pm ------------------------------------------------------------------ Total Rs. 32,100/- pm ------50% : Rs. 16,050/- pm Hence any thing in excess of 50% of excluded categories shall get added to Wages under this Code that is Rs. 2,550/- in the instant case. Hence for the purpose of computation of wages, it would be Rs. 10,000/- + 3,500/- + 2550/- totaling to Rs. 16050/- 2(z) : Worker (i) : Working Journalist (ii) : Sales Promotion Employees

Other Provisions Other Provisions- -1 1 3(1) : Equal Remuneration Provisions 7(1)(a) : Special Allowance is renamed as Cost of Living Allowance 9(1) : Fixation of Floor Wage 10 : If daily rated employee or worker is provided half day work by his/her employer, then he/she will have to pay full day wages 14 : OT wages shall not be paid less than twice the normal rate of wages

Other Provisions Other Provisions- -2 2 17(2)(ii) : in case of removal, retrenchment or resignation from the employee, the wages payable to him shall be paid within 2 working days from his removal, dismissal, retrenchment or resignation as the case may be. 18(2)(a) to (o) : Deductions from the wages 18(3) : Deductions from the wages can not be more than 50% of such wages

PAYMENT OF BONUS PAYMENT OF BONUS Under Bonus Chapter IV, the ceiling for eligibility of employee under the Act is not yet defined. 26(1) : It will be pronounced by the Appropriate Govt. from time to time and it can vary from State to State. 26(2) : Says for the purpose of calculation of Bonus, there shall be separate notification fixing the wages on which Bonus shall be computed or the min. wages whichever is higher. 31(2) : Says Audited accounts of the Companies shall not be questioned.

Sec. 50 : RESPONSIBILITY OF THE EMPLOYER pertaining to Records, Registers, Returns and Notices Various Registers to be maintained as prescribed in the Rules Display of Abstract and Notice containing category wise wage rates, wage period, date of payment of wages, name & address of the Facilitator, issuance of Wage Slip Sec. 50(4) : Above is to be done even for 5 or more Domestic Workers & Agri Workers. Sec. 56 : Provision for Compounding of certain Offences

Sec. 52 : Employees and Regd. Trade Unions are empowered to file an application or lodge the complaint against the employer before the appropriate Court of Law in this regard. Earlier the said powers were vested only with GLO/ALC. Sec. 54: Fine ranges from Rs. 10,000/- to Rs. 1,00,000/- per count.

Vide Sec. 69, Payment of Bonus Act, Payment of Wages Act, Equal Remuneration Act and Min. Wages Act are now repealed. However, if any cases are already pending before the Court under the above repealed Acts, the same shall be trialed under this Code.

Responsibility of Principal Employer Rules 46: Employer must transfer unclaimed Bonus amount to the Office of the Chief Labour Commissioner (C ) within 6 months from its due date. However, this clause does not says, if its applicable only for left employees or deceased employees. Rule 56: Where the contractor fails to pay minimum bonus to his/ her employee, the principal employer shall be responsible for such payment no option for recovery from the contractor provided.