Guard Your Investments- Corporate Defaults Alarm

Investor apprehensions intensify against a backdrop of mounting corporate defaults propelled by soaring interest rates. With defaults anticipated to crest by mid-2024, corporations grapple with challenges emanating from sluggish demand and surging wages.

Uploaded on | 4 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

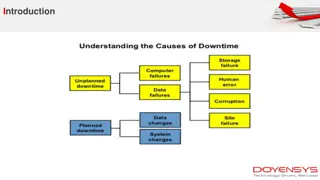

F i n a n c i a l S e r v i c e s Corporate Defaults Alarm AI-driven Corporate Risk Assessment ML-powered sentiment modelling tools Real-time Debt Market Monitoring

Global Corporate Default Highest since 2010 Global Corporate Defaults (year-to-date count till Feb 2024) Record High Cases: Global Corporate Defaults Soar to 29 in 2024, Highest Since 2010 Decades of Low Rates: Fuel Extensive Borrowing by US Companies Europe's Defaults Double: 8 Cases in 2024, Twice 2023's Count for Same Period US Leads Defaults: Hornblower Corp, GoTo Group, Cano Health Among Top defaults

2024 US Corporate Default Risks: Investor Concerns Amplify for High-Debt Sectors Sector wise: Projected corporate US default rate for 2024 Highest Risk Projections: Telecom, Consumer Services, Leveraged Loans Modest Risks Expected: Consumer Goods, Industrials, Materials, Financials institutions

IACPM Credit Outlook Survey: Global Consensus Points to Rising Corporate Defaults Ahead Survey Outlook 2024: Global Corporate Defaults to Rise ahead 91% of respondents anticipate corporate default increase in Europe 86% Foresee Defaults Rising in North America; 68% Predict Increase in Asia High interest rates driving corporates into default cycle Regulators urge banks to review portfolio hedges amid rising defaults urgency

Jasper Colin's Solutions: Navigating Corporate Defaults Real-time Debt Market Monitoring Receive alerts on market shifts and competitor activities. Sentiment Modeling Tools Utilize predictive sentiment algorithms for accurate forecasting. AI powered Portfolio Optimization Automate repetitive tasks for faster decision-making. AI-driven Corporate Risk Assessment Employ AI algorithms for thorough risk evaluation. Tech-enabled Competitive Intelligence Leverage technology for comprehensive competitor analysis. Advanced Data Analytics Harness AI for in-depth market analysis.