Relevance of Countercyclical Fiscal Policy and Fiscal Acyclicality

This literature review examines the effectiveness of countercyclical fiscal policies in stabilizing output and enhancing welfare, with a focus on the correlation between public spending cycles and GDP cycles. The study analyzes examples from Sweden and Argentina to showcase the impact of fiscal poli

4 views • 29 slides

Overview of Utah's Budget for FY 2024-2025

Utah's budget for the fiscal year 2024-2025 is outlined with details on revenue sources, budget priorities, special funding, long-term fiscal health, and budget process changes. The budget allocations cover various sectors including education, transportation, law enforcement, social services, and mo

1 views • 32 slides

Enhancing Fiscal Policy Planning through Public Participation and Transparency

Explore the importance of public participation and meaningful transparency in fiscal policy planning and public expenditure management. Learn about the GIFT Network, its champions and stewards, and how fiscal transparency and public participation can lead to improved fiscal and development outcomes

0 views • 22 slides

Fiscal Policy Guidance for State Long-Term Care Ombudsmen

Overview of the fiscal management responsibilities for State Long-Term Care Ombudsmen under the Older Americans Act requirements. Covers topics such as fiscal management, funding allocations, state plan requirements, and fiscal responsibilities. Details the OAA and LTCOP rule provisions related to f

7 views • 22 slides

Principles of Fiscal Deficits and Debt Management According to Kalecki

Economist Kalecki advocated for a permanent regime of fiscal deficits to manage public debt, emphasizing the importance of debt management for liquidity in the financial system. His principles involve splitting the government budget into functional and financial parts, each influencing aggregate dem

0 views • 6 slides

Overview of Occupational Requirements Survey (ORS) and 2020 Estimates

The Occupational Requirements Survey (ORS) by the Bureau of Labor Statistics provides detailed insights into the occupational demands of various job roles, including physical, cognitive, and environmental requirements. The survey encompasses data on speaking requirements, weight lifting capabilities

0 views • 22 slides

Examination of Interim Fiscal Policy Paper for Financial Year 2019-2020

An independent auditor's report on the interim fiscal policy paper laid before the Houses of Parliament, confirming compliance with the requirements of the FAA Act. The report assesses the components, conventions, and assumptions underlying the paper for fiscal responsibility, macroeconomic framewor

2 views • 15 slides

Maryland Revenue Estimates & Economic Outlook March 2022

The revenue estimates and economic outlook for Maryland in March 2022 show growth in income taxes, sales and use taxes, and other revenues. Detailed figures for fiscal years 2021-2023 indicate estimates and actual data for various tax types like individual and corporate income taxes. The changes in

0 views • 17 slides

Analyzing Deepwater Disaster: Inaccurate Oil Spill Estimates

Explore the Deepwater Horizon disaster, where oil spill estimates were inaccurate due to various factors such as convoluted discharges, technological limitations, and reluctance to share data. Consequences of underestimation and reasons behind flawed estimates are discussed, shedding light on the ch

0 views • 13 slides

Butte County Office of Education Fiscal Oversight Role Overview

The Assembly Bill (AB) 1200 provides insights into the fiscal oversight role of Butte County Office of Education (BCOE). It outlines the responsibilities of local boards of education, BCOE as an intermediary agent, and the creation of the Financial Crises and Management Assistance Team (FCMAT) in 19

0 views • 12 slides

Provisional Gross Domestic Product (GDP) Estimates Presentation April 11, 2018

The release provides provisional GDP estimates for the fourth quarter of 2017, along with revised estimates for the first three quarters of 2017 and annual estimates for 2016. The GDP measures the value of goods and services produced in the country. The estimation of GDP is done in stages, with prov

0 views • 33 slides

California's Fiscal Outlook Presentation to California School Boards Association

California's fiscal outlook was presented to the California School Boards Association by the Legislative Analyst's Office in December 2016. The report highlights a decrease in revenues and expenditures for the 2016-17 fiscal year, leading to a revised reserve down by $1 billion. However, the state i

0 views • 22 slides

AmeriCorps California Volunteers Fiscal Training Conference 2017 Details

In July 2017, the AmeriCorps Grantee Training Conference took place, focusing on fiscal procedures, compliance, desk reviews, and monitoring. The conference covered topics such as improper payments elimination, common audit findings, and the fiscal desk review process implemented by California Volun

2 views • 22 slides

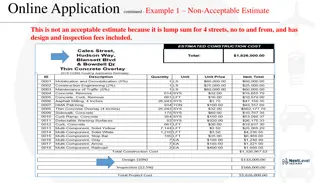

Guidelines for Acceptable Estimates in Online Applications

Examples of acceptable and non-acceptable estimates in online applications for infrastructure projects. Criteria include clear itemization, exclusion of unnecessary fees, proper documentation of road names, and accurate unit measurements to avoid common errors. These guidelines help ensure accuracy

0 views • 7 slides

GAO Cost and Schedule Assessment Guides: Enhancing Government Accountability

The Government Accountability Office (GAO) plays a crucial role in supporting Congress to fulfill its responsibilities by improving federal government performance and ensuring accountability. The GAO Cost Estimating and Assessment Guide outlines criteria for assessing cost estimates, and the Reliabl

0 views • 19 slides

Best Practices for Contractors: Examples of Acceptable and Non-Acceptable Estimates and Bids

Explore examples of acceptable and non-acceptable estimates and bids for contractors in online applications. Learn why lump sum estimates, lack of detailed information, and incorrect unit bidding can impact the bidding process negatively. Discover how clarity, itemization, and adherence to bidding s

0 views • 13 slides

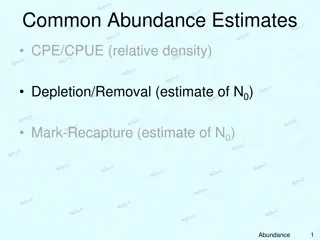

Fisheries Abundance Estimates and Depletion Methods

Explore common abundance estimation techniques like CPUE, mark-recapture, and depletion methods. Understand how to calculate relative density, depletion estimates, and cumulative catch. Discover the concepts of N0, Nt, Ct, and q in depletion estimates using regression models. Learn about the assumpt

0 views • 10 slides

Multiyear Estimates from the American Community Survey

This comprehensive guide delves into the concept of multiyear estimates from the American Community Survey (ACS). It explains what multiyear estimates are, when to use them, considerations to keep in mind, making comparisons with them, examples of their application, definitions of period and multiye

0 views • 35 slides

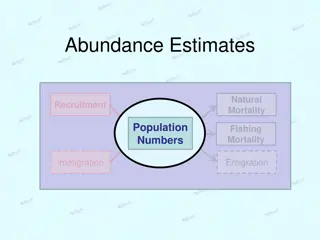

Abundance Estimates in Fisheries Management

Explore the concept of abundance estimates in fisheries management, including natural mortality, recruitment, population numbers, fishing mortality, immigration, and emigration. Learn about common abundance estimation methods like CPE/CPUE, depletion/removal estimates, and mark-recapture techniques.

0 views • 10 slides

Fiscal Year 2023 Budget Overview

The content presents detailed information on the fiscal year 2023 budget, including budget cycles, comparisons between fiscal years, source of funds, expenditure plans, and top projects for the Consolidated Municipal Agency (CMA). It covers budget development processes, funding sources, expenditure

0 views • 11 slides

Postharvest Loss Estimates for Cereals and Crops: A Practical Guide

Explore APHLIS website to access science-based estimates of postharvest losses for cereals and crops using an interactive calculator tool in Excel. Discover how to input location-specific data, select crop and climate zones, and obtain quality estimates for different harvest seasons. The APHLIS Calc

0 views • 38 slides

Emerging Markets Investors Alliance and GIFT: Promoting Fiscal Transparency

The Emerging Markets Investors Alliance, in partnership with GIFT (Global Initiative for Fiscal Transparency), aims to educate institutional investors about fiscal transparency and facilitate investor advocacy with governments. Through roundtable discussions and engagements with finance ministers, t

1 views • 5 slides

Fiscal Reports and Budgeting Process

Dive into the world of fiscal reports and budgeting with a presentation led by Stephanie Dirks. Explore the Budget Code Story, different types of reports, and examples of Fiscal 04 & Fiscal 06 reports. Learn about Fund allocations, Object Codes, and responsible oversight of funds. Get insights into

0 views • 17 slides

Economic Impact of Pandemic Relief Programs in Maryland May 2021

Evolution of estimates for ongoing general fund revenues in Maryland, detailing the impact of pandemic relief programs and federal fiscal policies on the state's economic outlook. The data shows changes in revenue estimates for fiscal years 2020, 2021, and 2022, reflecting the response to the COVID-

0 views • 15 slides

Lake Washington PCB/PBDE Study Estimates and Loading Pathways

This study presents estimates of loading of PCB/PBDE pollutants in Lake Washington from major pathways, including rivers, local drainages, and monitored tributaries. The data shows current PCB loading estimates to Lake Washington and its exits to Puget Sound, providing insights into sources and conc

0 views • 12 slides

Building Financial Systems Around Fiscal Data in Early Childhood Programs

Understand the importance of fiscal data in program management, identify key fiscal data elements, address policy questions, and learn from a state's cost study design. Explore the significance of fiscal data for decision-making, policy development, and program management, with a focus on revenue so

0 views • 31 slides

Global Practices in Fiscal Rule Performance

The study explores the implementation and impact of fiscal rules on macro-fiscal management, focusing on international experiences. It discusses the presence and compliance with fiscal rules, highlighting differences in pro-cyclicality among small and large countries. The rise in adoption of nationa

0 views • 23 slides

Fiscal Notes in Government Legislation

Fiscal notes are essential documents accompanying bills affecting finances of state entities. They detail revenue, expenditure, and fiscal impact, requiring a 6-day processing timeline. The need for a fiscal note may be determined by legislative services, committees, sponsors, or agencies. The proce

2 views • 30 slides

Fiscal Note Preparation Process and Guidelines

Fiscal notes are essential for bills affecting state finances. This includes the total processing time, exceptions, and what to do if there is disagreement on the fiscal note. The process involves multiple steps, including drafting, review, and resolution of disagreements. The President of the Senat

0 views • 29 slides

Support Structure Fabrication Project Overview

An overview of a support structure fabrication project by Hanzel, focusing on procurement strategy, budgetary estimates, vendor quotes, and lead times for various components like yokes, loadpads, collars, master and false coils, aluminum shells, nitronic end plates, axial rods, and tension rods. The

0 views • 13 slides

A Comparison of Injury Estimates from Population-Based and Provider-Based Surveys

This study compares injury estimates obtained from a population-based health survey with estimates from two provider-based surveys. Data from the National Health Interview Survey (NHIS), National Hospital Ambulatory Medical Care Survey (NHAMCS-ED), and National Hospital Discharge Survey (NHDS) are a

0 views • 18 slides

Government Tools for Economic Stability

The government uses fiscal and monetary policies to stabilize the economy. Fiscal policy involves Congress's actions through government spending or taxation changes, while monetary policy is driven by the Federal Reserve Bank. Discretionary fiscal policy involves new bills designed to adjust aggrega

0 views • 36 slides

Insights from India Maize Summit 2013: Market Trends and Production Estimates

Discover key highlights from the India Maize Summit 2013 in New Delhi, showcasing global maize market trends, production estimates, export destinations, challenges, and India's role in international trade. Explore data on maize production, trade, consumption, and stocks globally and in India, along

0 views • 13 slides

Enhanced Flow Estimates in NHDPlus Version 02 Presentation

Presentation by Tim Bondelid at the ESRI International User Conference discussing the Enhanced Runoff Method (EROM) in NHDPlus Version 02 for improved stream flow estimates. Highlights the importance of accurate flow estimates for various water-related goals and the methodology used to enhance flow

0 views • 18 slides

Confidence Intervals and Point Estimates in Statistics

Explore how confidence intervals are constructed around point estimates such as sample mean in statistics. Learn the significance of confidence levels and how to develop confidence intervals using practical examples. Follow step-by-step instructions to analyze data and interpret results for populati

0 views • 20 slides

Model-Based Early Estimates for Health Statistics Enhancement

The National Center for Health Statistics (NCHS) is working on improving the timeliness and granularity of data through model-based early estimates. Their goal is to enable data-driven actions, predict deaths, and report data accurately. The NCHS is focusing on enhancing their data systems and produ

0 views • 6 slides

Augmented Survey Data for More Accurate Poverty Estimates

how augmented survey data addresses shortcomings in American poverty research, providing precise and internationally comparable estimates. Learn about measurement errors, policy conceptualization, and cross-state variations. Discover solutions like applying augmented CPS microdata for improved relia

0 views • 31 slides

Contingency Factors in Construction Cost Estimates

This research project focuses on identifying and analyzing risk factors in early construction cost estimates for transportation projects. The goal is to develop a standardized approach for incorporating project-related risks into estimates, including defining contingency factor ranges for high-prior

0 views • 30 slides

Fiscal Responsibility Act and Budget Process in Nigeria

This paper delves into the Fiscal Responsibility Act of 2007 in Nigeria, focusing on its objectives, implementation challenges, and the role of the Fiscal Responsibility Commission in enhancing fiscal management and transparency. It explores the importance of prudent resource management, economic st

0 views • 23 slides

Independent Auditor’s Report

This paper presents the independent auditor's report and the Auditor General's examination of the Fiscal Policy Paper for FY2019/20. It discusses the adherence to principles of prudent fiscal management, macroeconomic assumptions, fiscal responsibility, and identification of fiscal risks.

0 views • 12 slides