Utah's Budget FY 2023-2024 Overview

Utah's budget for FY 2023-2024 highlights key aspects including revenue sources, budget priorities, long-term fiscal health, and changes in the budget process. The budget breakdown shows allocations for various sectors such as public education, social services, and transportation. Additionally, deta

7 views • 35 slides

Budgeting Overview at Montclair State University

This presentation provides an overview of budget management concepts, departments, systems, and processes at Montclair State University. It covers the definition of a budget, the roles of the Office of Budget and Planning, the Division of Finance and Treasury, and the MSU Foundation in budgeting and

2 views • 21 slides

Briefing to the Standing Committee on Appropriations on Adjustments Appropriation Bill

The presentation by Ms. Funani Matlatsi, DDG: CFO District Development Model, covers the adjustments in the national expenditure outcome, rationale for unallocated funds, impact on LGES, financial performance of the Municipal Infrastructure Grant, measures to mitigate fund stopping, steps to settle

3 views • 37 slides

Budget Projection

Explore detailed insights into your company's budget projections, actual cost versus budget, month-wise budget forecasting, overhead cost analysis, and quarterly budget analysis. Identify key variances, cost breakdowns, revenue trends, and budget allocation for informed decision-making and financial

2 views • 20 slides

FY25 Budget Development Kickoff Overview

The FY25 budget development kickoff outlines the timeline, activities, and key processes involved in developing the budget for January 2024. It includes details on workbook creation, budget materials, planning, resource requests, and budget presentations. Changes in the budget process, planning allo

2 views • 14 slides

Compliance with Article 66 of the Public Sector Budget Law for Fiscal Year 2023

The document discusses the fulfillment of Article 66 of the Public Sector Budget Law for the fiscal year 2023, detailing approved budget modifications, budget execution progress, and interventions to address and prevent the El Niño phenomenon. It highlights budget reallocations, execution achieveme

2 views • 23 slides

Delete Inventory Adjustments in QuickBooks Online and Desktop

Delete Inventory Adjustments in QuickBooks Online and Desktop\nDeleting inventory adjustments in QuickBooks is easy. To delete an inventory adjustment in QuickBooks Online, go to \"Inventory\" > \"Inventory Adjustments\", find the adjustment, click it, and choose \"Delete\". For QuickBooks Desktop,

1 views • 4 slides

Workplace Adjustments and Employee Lifecycle Overview

This content discusses the key stages in the employee lifecycle where workplace adjustments may be necessary to support employees effectively. It emphasizes the importance of providing reasonable adjustments as required under the Equality Act 2010, especially during recruitment, induction, performan

3 views • 4 slides

District Budget Development 2024-25 Overview

The district's budget development for 2024-25 focuses on staying within tax cap limitations, preserving student programs, recognizing the fiscal climate, and strategically managing resources. Major budget items include health insurance increases, salary adjustments, and maintenance costs. Revenue pr

0 views • 12 slides

Murray City School District FY25 Budget Overview

Murray City School District is preparing for the FY25 budget hearing in June 2024. The budget officer, usually the superintendent, must submit a tentative budget before June 1 each year. Legal requirements include holding a public hearing and publishing budget information for public inspection. The

0 views • 25 slides

County Budgeting Process in Mississippi

The process of county budgeting in Mississippi involves identifying needs, forecasting requirements, preparing departmental budget requests, reviewing requests, adopting and implementing the budget, amending the budget, and adopting the final amended budget. Various revenue sources, such as local ad

1 views • 12 slides

Resource Adequacy Load Forecast Adjustments 2023

The document outlines the process of adjusting load forecasts for resource adequacy in 2023, focusing on factors such as IOU service areas, coincidence factors, peak demand estimates, LSE-specific adjustments, demand-side programs, and pro-rata adjustments. It includes detailed data and forecasts fo

1 views • 15 slides

Charlton Fire District 2021 Budget Overview

The Charlton Fire District's 2021 budget process involves preparing, adopting, and finalizing the annual budget with public input. The budget includes personal services, fire equipment, capital outlay, and fire protection expenses. Various steps are taken to ensure the budget meets the district's ne

0 views • 15 slides

Overview of Retirement of a Partner and its Effects

Understanding the process of retirement of a partner in a business entity is essential as it involves various adjustments and implications on the firm's financial structure. When a partner retires, it can lead to changes in profit-sharing ratios, adjustments in assets and liabilities, and the treatm

0 views • 15 slides

Understanding Adjusted Budget in Hyperion

In Hyperion, a scenario represents a storage folder for data, with three main scenarios compared for budget adjustments: Actuals, Original Budget, and Adjusted Budget. The Hyperion Adjusted Budget module allows users to copy and update data from these scenarios to maintain a balanced budget. Pre-pop

7 views • 22 slides

Budget Presentation: FY2018-19 Tentative Budget Overview

The FY2018-19 Tentative Budget was presented by Mark Mathers, CFO, and Mike Schroeder, Budget Director. The presentation covered updates on the General Fund, structural deficits, budget recommendations, and required actions to address the deficit. Base budget reductions have reduced the deficit to $

3 views • 50 slides

Managing Budget Operations in Education Institutions

In the process of developing a budget for educational institutions, conducting a needs assessment, defining priorities, and reviewing data are crucial steps. The budget for 2017-2018 includes revenue projections and details of expenditures on instructional personnel, operations, and adjustments made

0 views • 15 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

Changes in Budget Control Procedures and Roles at Corbin de Nagy's Office

In a recent training session conducted by the Budget Office at Corbin de Nagy, significant changes in budget control procedures were highlighted. Starting in 2015-16, spending control will be at the Budgetary Account level for both non-E&G and E&G departments. Budget deficits and cash deficits are n

3 views • 27 slides

Understanding Grant Award Adjustments and Budget Modifications

Grant award adjustments involve modifications to federal awards, such as reallocating funds or changing project scope. Recipients must initiate a Grant Adjustment Notice (GAN) for budget modifications and follow specific guidelines to ensure timely processing and approval. Different criteria apply f

8 views • 6 slides

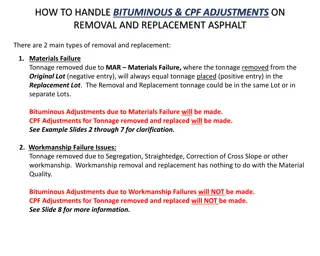

Handling Bituminous & CPF Adjustments on Removal and Replacement of Asphalt

Learn how to manage bituminous and CPF adjustments when removing and replacing asphalt due to materials failure or workmanship issues. Understand the process for adjustments within the same lot or different lots, including entering tonnage, dates, and certifications. Follow step-by-step instructions

0 views • 8 slides

Budget Orientation for Managing Financial Resources

Budget Orientation session for ALL EMPLOYEES THAT MANAGE A BUDGET, including new hires, current employees, and supervisors. Covers budget terminology, types of funds, budget cycle, uses of funds, reconciliation, transfers, time management, and tips from auditors. Explains the budget process, differe

1 views • 32 slides

Budget Orientation Overview for Effective Financial Management

This Budget Orientation provides essential information on budget basics, state and campus budget allocation processes, revenue sources, terminology related to budget scenarios, and key considerations for managing financial resources effectively. It is designed for all employees involved in budget ma

1 views • 25 slides

FY2017 Preliminary Budget Presentation Highlights

The FY2017 Preliminary Budget Presentation for the General Fund outlines key financial details and initiatives for various departments within the organization. The budget includes revenue estimates, expenditure comparisons, staffing details, and specific goals for financial planning and risk managem

2 views • 13 slides

Fiscal Year 2016 Budget and Statement of Work Discussion

Preliminary discussions and recommendations regarding the Fiscal Year 2016 budget and statement of work. Includes budget issues, 2014 and 2015 budget comparisons, steering committee recommendations, and executive committee budget discussions. Focus on budget guidance, funding allocations, and propos

1 views • 17 slides

UCOP FY1314 Budget Proposal Process Using BDS II

Explore the UCOP FY1314 budget proposal process utilizing BDS II, including budget entry phases, payroll distribution matrix, FAQs, and payroll data refresh details. Learn about budget allocation by project code, payroll entry tabs, supplies and expenses management, adjustments to proposed budgets,

0 views • 8 slides

Empowering Tomorrow's Leaders: Denali Borough School District FY20 Budget Overview

Denali Borough School District's FY20 budget focuses on nurturing, empowering, and inspiring students to shape a brighter future. The budget breakdown includes revenue sources, enrollment funding, state aid calculations, local contributions, and more, highlighting the district's commitment to provid

0 views • 25 slides

Lowell Joint School District 2024-25 Proposed Annual Budget Report

The Lowell Joint School District presents its 2024-25 Proposed Annual Budget Report to the Board of Trustees. The report includes budget assumptions, revenue details, major changes in fund sources, and expenditure outlines such as salaries and healthcare benefits. It highlights a decline in seat att

0 views • 30 slides

Open Budget Meeting Town Hall Overview

The Open Budget Meeting at Clayton State University delves into the process of developing the new budget, emphasizing alignment with strategic priorities. The President has final decision-making authority in budget approvals. The meeting discusses funding requests, strategic plan support, and priori

0 views • 27 slides

PVSC-49 Draft Budget Summary for Planning Meeting

The PVSC-49 draft budget and preliminary budget were discussed for the 1st planning meeting. The income and expenses based on previous PVSC events were detailed, along with registration rates and other financial considerations for the upcoming event. Various income sources, expenses, and potential a

0 views • 6 slides

Integrating Spending Reviews into the Budget Cycle: Best Practices and Recommendations

To integrate spending reviews effectively into the budget cycle, align the process with the budget calendar, ensure consistency with medium-term frameworks, and incorporate outcomes into budget decisions. Countries like Australia, the UK, Ukraine, Italy, and Slovakia have institutionalized spending

0 views • 11 slides

UCOP Budget Development System Overview

Detailed overview of the UCOP Budget Development System for the FY1314 budget, including system logon instructions, workflow navigation, tool bar overview, data entry flow, payroll budget entry, budget allocation, review process, and deadlines for submission. The system provides access to view/edit/

0 views • 15 slides

Understanding the US Federal Budget Process

Explore the intricate details of the US federal budget process, including budget formulation, presentation, and execution. Learn about discretionary spending, agency budget development, and the multi-year budget trend. Discover the authority for the US budget as outlined in the US Constitution. Unve

0 views • 31 slides

Update on FY20/21 Budget Implementation & FY21/22 Budget Preparation DEG Presentation to LDPG

This presentation provides an update on the approved FY20/21 budget, its performance, reprioritization, supplementary budget requests, and an overview of the FY21/22 budget. It also highlights the shift to Program Based Budgeting and DP engagement, as well as key issues for the LDPG. The approved bu

0 views • 23 slides

Overview of 2022/23 Budget Engagement and Proposals

The 2022/23 Budget Engagement outlines the financial context, funding requirements, and measures to balance the budget in the face of Covid impacts, inflation, and new demands. Core Spending Power allocation, council tax, and government grant incomes are detailed, along with budget performance forec

0 views • 17 slides

Understanding Budget Adjustments vs. Budget Amendments in AEL WIOA Summer Institute

Explore the differences between budget adjustments and budget amendments in the context of AEL WIOA Summer Institute's financial processes. Budget adjustments allow for moving a sum less than 20% without an amendment, while budget amendments involve larger changes and require specific approvals. Lea

0 views • 24 slides

School Budget Development Process Overview

The School Budget Development Process Overview provides a detailed look at the steps involved in creating a budget aligned with the school's strategic plan. It highlights the roles of the principal and the GO Team, emphasizing the importance of strategic priorities, budget parameters, and feedback s

0 views • 17 slides

Transportation Budget and Funding Update

Original transportation budgets were affected by the COVID-19 pandemic leading to adjustments in funding allocations across various districts. State funding, program revenues, and expenditures were analyzed to reflect changes due to ridership and operational costs. The update includes insights on th

0 views • 7 slides

Understanding District Characteristic Adjustments in Education Funding

Various types of formula adjustments are used to address the diverse costs of education among schools and districts, including district size adjustments, necessarily small schools adjustments, density adjustments, regional cost adjustments, and transportation funding approaches. These adjustments ai

0 views • 11 slides

Cal Poly Budget Update and Planning Overview

This document provides an overview of Cal Poly's budget planning calendar for the 2019-20 fiscal year, including key milestones such as the release of the Governor's budget, negotiation processes, allocation planning, and final budget approvals. It also compares the California State University (CSU)

0 views • 15 slides