Partnership Final Account

Partnership final account in the case of admission of a partner in a firm involves dividing the accounting year into two periods, determining expenses and incomes, and sharing profits accordingly. Different methods like Fixed capital method and Fluctuation capital method are used for this purpose. T

1 views • 12 slides

Recharge Operations in Financial Services at the University of Chicago

The Recharge Operations Training presented by the Cost Studies group in the Financial Services Department at the University of Chicago aims to educate participants on basic recharge concepts, policy compliance, rate development, and annual review processes. The responsibility of ensuring recharge co

0 views • 23 slides

CSUEB Hospitality Policy Overview

This overview provides information on the Hospitality Policy at CSUEB, applicable to all hospitality expenses regardless of funding source. It outlines the criteria for hospitality expenses, examples of approved activities, meeting examples covered under the policy, and expenditure limits per person

1 views • 37 slides

GPSA Travel Grant: Enhancing Professional Development Opportunities

The GPSA Travel Grant Committee provides reimbursement for graduate and professional students to achieve their professional goals by covering registration and travel costs to conferences, workshops, internships, and more. Applications are accepted during specific periods with decisions communicated

0 views • 13 slides

COVID-19 Uninsured Program: Provider Relief Fund Overview

The COVID-19 Uninsured Program, part of the Provider Relief Fund, aims to reimburse healthcare providers for testing and treating uninsured individuals with COVID-19. This initiative ensures access to healthcare services for those without insurance by covering allowable expenses such as specimen col

1 views • 6 slides

ELC Confinement Facilities Funding Overview

The ELC Confinement Facilities Funding initiative, updated as of August 31, 2021, provides essential financial support for the detection and mitigation of COVID-19 in various confinement facilities. The total award of $18,200,000 is allocated towards personnel, supplies, allowable costs like compute

0 views • 8 slides

Year End Journal Entries

Explore the significance of year-end journal entries, their various categories like expense accruals, revenue deferrals, prepaid expenses, and revenue receivable. Understand the process for submission, key dates, and the difference between accrual and deferral entries. Discover how to handle entries

0 views • 14 slides

GPSA Travel Grant: Reimbursement for Professional Development

The GPSA Travel Grant Committee provides reimbursement for graduate and professional students to support their professional and developmental goals by covering registration and travel expenses to conferences, workshops, and more. Applications open during specific periods, and eligible expenses inclu

1 views • 13 slides

Witness Expenses and Compensation in Civil Procedure

Witnesses play a crucial role in the administration of justice, and fair compensation for their expenses, including travel costs, is a fundamental right in a civilized justice system. This article discusses the provisions in the Code of Civil Procedure for the payment of witness expenses and the sca

0 views • 25 slides

Proposed Dues Change for OPEIU Local 39: An Overview

OPEIU Local 39 is proposing changes to its dues structure from a flat rate to a percentage based on compensation, aiming for equity among members. The shift is driven by the 2019 OPEIU International Convention decision and the merger with Local 95. The new dues structure will align more fairly with

0 views • 11 slides

Cooperative Agreement for Emergency Response: Public Health Workforce Expansion for COVID-19

This agreement outlines the funding, allowable workforce costs, milestones, and available funds allocation for expanding and sustaining the public health workforce to support COVID-19 prevention, preparedness, response, and recovery efforts. Key components include workforce metrics reporting, allowa

6 views • 11 slides

Child and Dependent Care Expenses Credit

The Child and Dependent Care Expenses Credit allows taxpayers to reduce their tax liability by a portion of expenses incurred for caring for qualifying persons. Qualifying persons include children under 13, incapacitated spouses or dependents, and certain criteria must be met to claim the credit. Th

8 views • 10 slides

Financial Aid for Educational Expenses

Financial aid is assistance available to help cover educational expenses such as tuition, fees, books, supplies, and living costs while in school. It can come in the form of grants, scholarships, loans, departmental payments, veteran's benefits, and more. This assistance can cover a range of items s

0 views • 13 slides

UAMS Travel Management Guidelines FY22

UAMS Travel Management provides guidelines for submitting, processing, and approving travel expenses efficiently. The guidelines emphasize proper coding, T-card details, trip resubmission through Workflow, and the requirement of a Justification to Open Closed Trip form. Prior approvals for expenses,

0 views • 52 slides

Guidelines for Allowable and Not Allowable Expenses in Program Funding

Ensure that program funds are used appropriately by adhering to guidelines that outline allowable expenses, factors affecting cost allowability, and common budget considerations. Eligible expenses include materials, professional services, transportation, and more, while not allowable costs involve i

1 views • 7 slides

Overhead Costs in Accounting

Overhead costs are supplementary expenses that cannot be easily allocated to specific cost objects. This includes indirect materials, labor, and expenses. Accounting and control of overheads involve steps like classification, codification, collection, allocation, apportionment, absorption, under/ove

1 views • 17 slides

Maximizing Title IV Part A Funds for Well-Rounded Education

The Title IV Part A program focuses on providing well-rounded education opportunities to students. Districts receiving over $30,000 must conduct a needs assessment and allocate at least 20% of funds for well-rounded activities. Funds can be maximized by collaborating with outside organizations such

1 views • 18 slides

Essential Business Travel Services and Expenses Guide

Learn about important business travel services and expenses for November 2012, covering airfare, lodging, vehicle use, conference fees, and miscellaneous expenses. Find out about per-diem rates, rental agreement options, and how to book airfare through Jackson Travel for SOU employees. Get insights

0 views • 15 slides

Title III Funding Guidelines

Explore the guidelines for using Title III funds to supplement programs for LEP students and immigrant children. Learn about the tests for supplanting, allowable expenses, and essential questions to ask. Ensure compliance with federal, state, and local laws to maximize the impact of Title III grants

0 views • 16 slides

The UO One Card Program

The UO One Card is a corporate credit card designed for individual business travel expenses. It allows UO employees to separate personal and business expenses, streamlines expense reporting, and offers benefits like no interest fees and insurance coverage. Eligible travelers can apply through a simp

0 views • 11 slides

Arkansas Tech University Procurement Card Policies & Guidelines

Arkansas Tech University's procurement card program helps manage lower-dollar supply purchases, allowing full-time employees to make official business purchases. The program emphasizes accountability, prohibiting personal purchases and emphasizing liability at the department level. Only certain char

0 views • 24 slides

Kentucky Crime Victims Compensation Program Overview

Kentucky Claims Commission Crime Victims Compensation Program provides financial assistance to eligible individuals who have suffered from criminally injurious conduct. Established in the mid-1970s, this program helps victims with various expenses incurred as a result of the crime, such as medical c

0 views • 13 slides

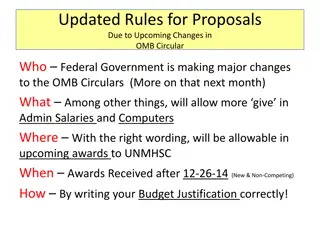

Updated Regulations for Federal Grant Proposals

Major changes in OMB Circulars by the Federal Government will impact allowable expenses for administrative salaries and computers in upcoming awards to UNMHSC. Proper budget justification is key for successful proposals post-December 26, 2014. Direct charging for clerical staff and computing devices

0 views • 5 slides

AmpliFund Expense Reporting Guidelines

Guidelines for entering and managing expenses in AmpliFund for grant management, including specific steps for adding expenses, marking expenses for review, and ensuring accuracy in financial reporting.

0 views • 15 slides

Guidelines on Allowable Costs and Related Parties in Long-term Debt Training

Explore guidelines on allowable costs and transactions with related parties in long-term debt training programs. Learn about costs paid to other agencies, examples of allowed costs, and costs not allowed. Gain insights into the XI-Q Bond Agency Guide and upcoming training sessions. Have questions? F

0 views • 6 slides

Managing Personal Finances: Understanding Income and Expenses

Develop confidence in managing personal finances by recognizing financial concepts related to income, expenses, and financial control. Learn to distinguish between sources of fixed, variable, and occasional income, as well as fixed, variable, and occasional expenses. Understand the advantages of kee

0 views • 4 slides

Financial Update and Budget Meeting Highlights

The financial update and budget meeting on February 6, 2014, emphasized the importance of staying focused on the mission and executing the strategy to achieve growth and financial strength. The meeting discussed operating expenses by campus, operating reserves from FY2008 to FY2014, operating fund r

0 views • 21 slides

Travel and Training Expenses Final Report Guidelines

Submit your Travel and Training Expenses Final Report correctly and on time to ensure timely reimbursement. Plan ahead, follow the approval process, and keep track of all receipts for a smooth expense reporting procedure. Remember important details such as required documentation, submission deadline

0 views • 7 slides

Travel Authorization Guidelines & Policies

This document outlines the procedures and guidelines for obtaining travel authorization, making reservations, collecting receipts, and following policies related to travel expenses. It also includes information on international travel registration requirements and restrictions on non-allowable purch

0 views • 13 slides

Breakdown of Income & Expenses for USA Wrestling Events in South Dakota (2016-17)

The provided data details the income and expenses breakdown for sanctioned USA wrestling events in South Dakota during the operating year of 2016-17. It includes specific event information, revenue, expenses, net profits, and comparisons over the last five years. Various USA wrestling events in diff

0 views • 11 slides

Barristers Council Financial Policies and Guidelines

Detailed overview of the financial policies and guidelines for members of the Barristers Council, including approved expenses, travel reimbursement rules, and non-approved expenses. It covers essential expenses, travel arrangements, hotel accommodations, transportation costs, and pre-approval requir

0 views • 13 slides

Managing Personal Expenses - Tips and Guidelines

Understand the difference between personal expenses and payment types like PCard, learn how to handle personal expenses effectively, adhere to guidelines, and avoid misusing funds. Explore tips for managing personal expenses on PCard and ensure compliance with regulations.

0 views • 33 slides

Title I Parental Involvement Funds Management Guide

This resource provides detailed information on managing Title I Parental Involvement funds, including allowable and unallowable expenditures, voucher certification, contracts, and more. It outlines specific expenses that can be covered by the funds, as well as those that are not allowed. Additionall

0 views • 9 slides

SGA Budget Report 2019-2020 Overview

The SGA Budget Report for 2019-2020 provides a detailed breakdown of expenses, including employee salaries, club allocations, sports club funding, and total line item expenses. The report also highlights specific club allocations for organizations like The Westfield Voice, Circle K Club, EMS Club, a

0 views • 18 slides

LIHEAP Budget and Award Management Training Overview

The LIHEAP Budget and Award Management Training provides an in-depth overview of budget categories, such as Administrative Expenses and Outreach and Eligibility Determination, outlining how LSPs can effectively allocate funds for program operations. It emphasizes the importance of careful budget pla

0 views • 44 slides

Accruals and Prepayments in Accounting

Accruals and prepayments are essential concepts in accounting that ensure accurate financial reporting. Accrual basis of accounting requires recognizing income and expenses when earned or incurred, regardless of cash flow timing. Accrued expenditure represents unpaid expenses at year-end, impacting

0 views • 13 slides

Recruitment vs. Relocation Expenses

The guidance distinguishes between recruitment and relocation expenses based on the date of the signed Letter of Offer at the University of New Mexico. Recruitment expenses incurred before the offer date may be reimbursed, including house hunting costs. However, expenses incurred after signify reloc

0 views • 7 slides

Deductible Expenses in Pensions for Veterans

This detailed content explains the deductible expenses involved in pensions for veterans, outlining how specific expenses can reduce a veteran's "countable income" to determine eligibility for improved pension benefits. It covers various income considerations, recurring and nonrecurring income defin

0 views • 17 slides

Understanding the Expense Prediction Bias: Study on Underestimation of Future Expenses

Expense Prediction Bias (EPB) refers to the persistent underestimation of future expenses. Research shows that individuals tend to under-predict their future expenses due to various factors. This study explores the magnitude of EPB in an adult sample, highlighting a mean EPB of $63.58, with predicte

0 views • 28 slides

Account Codes for Business Management Specialists

This content covers the basics of account codes, including types of expenses, selecting account codes for documents, allowable expenses, and more. It delves into operating ledger categories, computer account codes, and the selection process for different expenses, providing valuable insights for fin

0 views • 18 slides