Guidelines for Allowable and Not Allowable Expenses in Program Funding

Ensure that program funds are used appropriately by adhering to guidelines that outline allowable expenses, factors affecting cost allowability, and common budget considerations. Eligible expenses include materials, professional services, transportation, and more, while not allowable costs involve items like alcohol, entertainment, and lobbying. Remember to follow federal regulations, maintain proper documentation, and prioritize expenses that directly support program outcomes.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

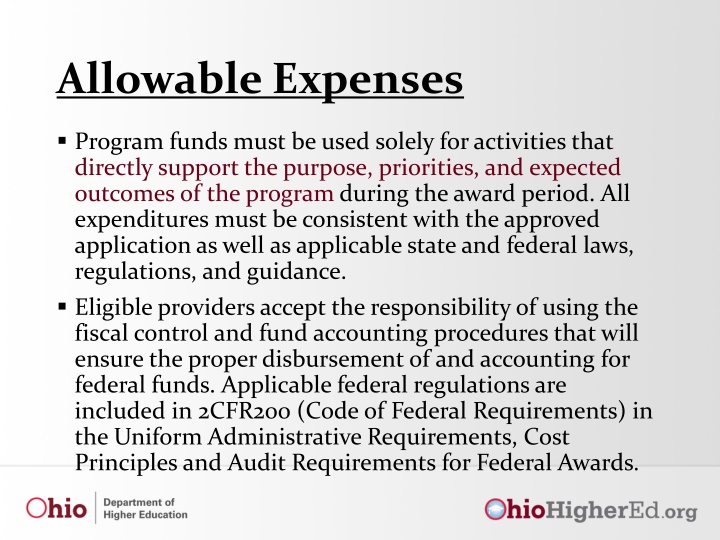

Allowable Expenses Program funds must be used solely for activities that directly support the purpose, priorities, and expected outcomes of the program during the award period. All expenditures must be consistent with the approved application as well as applicable state and federal laws, regulations, and guidance. Eligible providers accept the responsibility of using the fiscal control and fund accounting procedures that will ensure the proper disbursement of and accounting for federal funds. Applicable federal regulations are included in 2CFR200 (Code of Federal Requirements) in the Uniform Administrative Requirements, Cost Principles and Audit Requirements for Federal Awards.

Factors Affecting Cost Allowability All costs must be: Reasonable: incurred by a prudent person, and necessary for the performance of the project. Allocable: charged only in proportion to the value or benefits received by the program. Authorized: federal, state, and local laws and regulations. Adequately documented.

Allowable AEFLA Costs Materials/Supplies/Computers Membership/subscription Professional service cost Publication and printing Recruiting costs Rental cost of property/equipment Specialized service facilities Training and Education costs Transportation costs Travel costs Audit Services Costs to recover improper payments Compensation personal services and fringe benefits Depreciation Employee health/welfare Equipment Insurance/indemnification Intellectual property Maintenance/repair

NOT Allowable AEFLA Costs Advisory Councils Alcohol/Food Bad Debts Contributions Entertainment Fines/penalties Fundraising Goods or services of personal use Interest Lobbying Organization costs Selling and marketing costs Student activity costs

SOMETIMES/LIMITED Allowable AEFLA Costs Advertising Conferences Taxes This is not an exhaustive list. Refer to the Uniform Guidance 2 CFR 200 for details.

Common Budget Considerations NO Gifts or items that appear to be gifts are not allowable. Souvenirs, memorabilia, or agency promotional items, such as T-shirts, caps, tote bags, etc., are not allowable. YES Minimal cost certificates or instructionally-related items to be used in the classroom, such as pens/pencils or flash drives are acceptable awards for recognition or incentives for participation in program activities. NO "Door prizes," movie tickets, gift certificates, passes to amusement parks, etc., may not be purchased with grant funds but may be donated by others

More Budget Considerations YES Bus passes are allowable, very minimally. The purpose must be only for Aspire-related instruction. For example, a monthly bus pass would not be acceptable because the student could use it for multiple purposes. A one-day bus pass may be acceptable to provide transportation to class while the student s car is being repaired, for example. NO Food, snacks, beverages, caps and gowns, decorations, and entertainment for graduation and recognitions events are not allowable costs. NO Aspire funds may not be used to pay for an individual s HSE test (practice test is OK) nor can funds be used to pay for the proctoring of HSE tests.