Challenges and Recommendations for FY 2018 Budget Allocation

The FY 2018 budget faced significant cuts, particularly affecting the Bureau of Indian Affairs and Indian Health Service. Issues around tax reform and budget deficits add complexity. The Senate's budget resolution further highlights the potential impact on tribal funding. Recommendations include restoring proposed reductions and supporting tribal set-asides for key programs.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

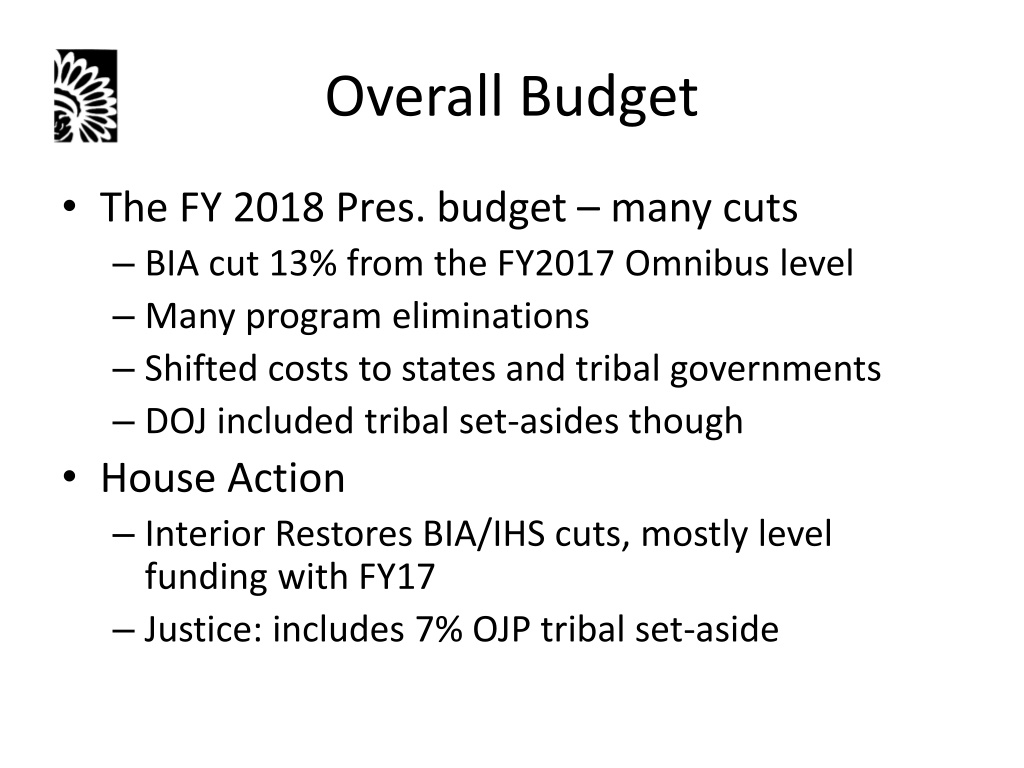

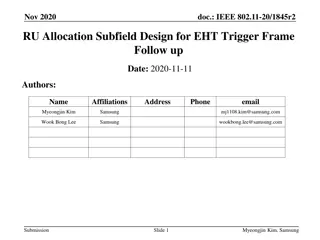

Overall Budget The FY 2018 Pres. budget many cuts BIA cut 13% from the FY2017 Omnibus level Many program eliminations Shifted costs to states and tribal governments DOJ included tribal set-asides though House Action Interior Restores BIA/IHS cuts, mostly level funding with FY17 Justice: includes 7% OJP tribal set-aside

Busy Fall Key Date - December 8th: Congressional leaders and the White House have agreed: to fund the government via CR and pass Harvey aid extend the debt limit until December Gives the minority party leverage on issues like spending, health care and dreamers . Gives Congress and the White House three months to reach consensus on the FY2018 spending levels, a long- term fix for the debt limit, and an omnibus spending bill. Punts debate over border wall for 3 months.

BIA/BIE Funding, FY 2018 3,500,000 3,000,000 2,870,753 2,500,000 2,488,059 2,066,406 2,000,000 1,790,938 1,500,000 1,000,000 500,000 0

Tax Reform and Budget Issues Congressional Republican Plan first pass a FY 2018 Budget Resolution to fast track tax legislation that is filibuster proof. Two Step tax and budget issues 1. Tax cuts that lead to deficits Tax framework would add at least $1.5 trillion to deficits over 10 years Tribal leaders should consider distributional impacts of tax cuts versus spending cuts 2. Future budget cuts due to high deficits

Senate Budget Resolution House Republicans plan to Pass Senate Budget Resolution to avoid conference. Non-Defense Discretionary (NDD) Impact By 2027, under the Senate plan, overall NDD funding would be 18 percent below its 2017 level and 29 percent below its 2010 level, after adjusting for inflation. This would impact BIA, IHS, NAHASDA, DOJ tribal funding.

Key Asks Restore the proposed reductions included in the FY 2018 Budget Request that would affect the Bureau of Indian Affairs, Indian Health Service, Health and Human Services, Housing and Urban Development, and other agencies meeting federal trust obligations. Support the 7% tribal set-aside of Office of Justice Program funding for Indian Country public safety, law enforcement, and the administration of justice and the 5% tribal allocation from the Crime Victim s Fund in the FY 18 Commerce-Justice-Science Appropriations Bill. Fund the Indian Health Service at $7.1 billion in FY 2018, consistent with the request of the Indian Health Service Tribal Budget Formulation Workgroup.

Key Ask: Budget Resolutions Policymakers should consider the distributional impacts to households as well as American Indians/Alaska Natives if the federal budget is cut in the future to reduce deficits caused by tax cuts; the cuts to federal treaty and trust obligations coupled with cuts to mandatory programs such as Medicaid and SNAP could leave AI/AN households worse off, even with some tax reductions.