Taxation of Services in Louisiana and Texas

Louisiana and Texas impose taxes on various services such as hotel accommodations, telecommunications, amusement, personal care, and more. The taxation structure in these states covers a wide range of services provided to consumers and businesses, affecting both residents and non-residents alike.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Taxing Services James Alm, Grant Driessen, and Trey Dronyk-Trosper

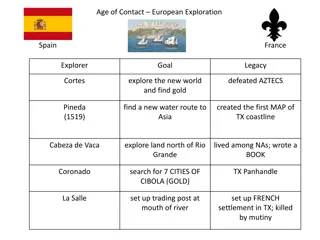

Louisianas Taxation of Services Louisiana Revised Statute 47:3014 the furnishing of sleeping rooms by hotels the furnishing of printing and over printing the furnishing of cold storage space and the preparation of property for such storage the furnishing of telecommunications services the furnishing of storage or parking privileges by auto hotels and parking lots the sale of admissions to places of amusement and to athletic and recreational events, and the furnishing of privileges of access to amusement, entertainment, athletic, or recreational facilities the furnishing of laundry, cleaning, pressing, and dyeing services the furnishing of repairs to tangible personal property

Categories of Services Taxed in Texas Taxable Services in Texas Non-residential Real Property Repair, Restoration, or Remodeling Services Personal Property Maintenance, Remodeling, or Repair Services Amusement Services Cable and Satellite Television Services Credit Reporting Services Personal Services Data Processing Services Reporting and Collecting Services Debt Collections Services Security Services Information Services Telecommunications Services Insurance Services Telephone Answering Services Utility Transmission and Distribution Services Taxable Labor--Photographers, Draftsmen, Artists, Tailors, etc. See Book on Taxable Services in Texas Texas Comptroller of Public Accounts Internet Access Services Motor Vehicle Parking and Storage Services

Scenario #1 Taxing Services with estimates from 2013 2013 Estimate: Tax Base 2013 Tax Estimate (at 4%) Adjustment for CY2015 Included Items Scenic and sightseeing transportation services and support activities for transportation $1,080,872,150 $43,234,886 $47,329,167 Veterinary services $207,122,851 $8,284,914 $9,069,484 Cable and other subscription services $221,854,739 $8,874,190 $9,714,563 Performing arts Promotional services for performing arts and sports and public figures Independent artists, writers, and performers Museum, heritage, zoo, and recreational services $44,550,187 $1,782,007 $1,950,761 $229,732,279 $9,189,291 $10,059,504 $57,663,899 $2,306,556 $2,524,983 $169,553,541 $6,782,141 $7,424,400 Personal care services $631,267,683 $25,250,707 $27,641,913 Other personal services $663,683,918 $26,547,356 $29,061,353 Total $3,306,301,247 $132,252,050 $144,776,127

Scenario #2 Taxing Services: Expanded Base 2013 Tax Estimate (at 4%) Adjustment for CY2015 Included Items Tax Base Estimate From Scenario #1 Other Personal Services: Transit and ground passenger transportation services $3,306,301,247 $132,252,050 $144,776,127 $367,811,060 $14,712,442 $16,105,689 Couriers and messenger services Accounting, tax preparation, bookkeeping, and payroll services Architectural, engineering, and related services $707,881,040 $28,315,242 $30,996,654 $1,577,445,934 $63,097,837 $69,073,111 $3,455,246,566 $138,209,863 $151,298,136 Photographic services $70,201,160 $2,808,046 $3,073,964 All other miscellaneous professional, scientific, and technical services Data processing-hosting-ISP-web search portals $827,151,371 $33,086,055 $36,219,257 $555,398,097 $22,215,924 $24,319,740 Other information services $81,956,833 $3,278,273 $3,588,721 Insurance-related support services $338,513,160 $13,540,527 $14,822,795 Total $11,287,906,468 $451,516,259 $494,274,194

Scenario #3 Taxing Services Not Taxed in LA But Taxed in TX and TN Comparable Item in Jindal 2013 Plan Jindal Tax Base Estimate 2013 Tax Estimate (at 4%) Adjustment for CY2015 Included Items Pet grooming Landscaping/lawn care Swimming pool cleaning Personal care services and other personal services $1,294,951,601 $51,798,064 $56,703,266 Cable TV Health clubs Auto road services Parimutuel racing $6,616,081 Exterminating Labor charges and remodeling Facilities support services Architectural, engineering, and related services Museum, heritage, zoo, and recreational services $151,093,676 $6,043,747 $3,455,246,566 $138,209,863 $151,298,136 $7,424,400 $222,041,884 Marina services Total $169,553,541 $5,070,845,384 $6,782,142 $202,833,815

Overall, then Taxing services in the sales tax will likely increase the progressivity of the tax system. There is significant revenue potential from taxing services. But: taxing services will likely add to administrative complexity.