Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purchases. Learn about the implications of electronic transfers of digital content and the ongoing discussions in the state regarding the taxation of such transactions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Digital Delivery of Tangible Personal Property Alabama Department of Revenue

Tangible Personal Property In the Leasing Tax Law Personal property which may be seen, weighed, measured, felt, or touched, or is in any other manner perceptible to the senses. In a Sales Tax Case -- Electricity is tangible personal property (See Curry v. Alabama Power Company, 243 Alabama 53, 8 So.2d 521, holding that electricity is tangible personal property within the meaning of that term as used in the sales and use tax statutes.) The Alabama Supreme Court applied an almost identical definition in holding that electricity, i.e., the flow of electrons, constituted tangible personal property for sales and use tax purposes

Other Cases The Court later confirmed that holding in State v. Television Corp., 127 So.2d 603 (Ala. 1961) , and Sizemore v. Franco Distributing Co., Inc., 594 So.2d 143 (Ala. Civ. App. 1991) . While TPP not defined in Sales Tax Law, as we see, Courts apply definition to Sales Tax cases

Robert Smith dba Flipflopfoto According to ALJ. My understanding, albeit limited, is that the internet and e- mail involve the transmission of electrical impulses, i.e., electricity, which, as indicated, constitutes tangible personal property. Consequently, the electronic transfer of digital photographic images from a seller to a purchaser for a price constitutes the sale of tangible personal property.1 ... [t]he means of delivery should be irrelevant in determining the taxability of canned software purchases. Such a distinction places form over substance and is, for lack of a better word, silly. Also, advances in technology make almost all software or programs available via electronic transfer. Taxpayer will easily be able to structure their purchases to avoid the sales tax. Providing avenues for tax avoidance strategies is bad for tax policy and it's unfair to require a few to bear the entire tax burden because of the idiosyncrasies of their particular software. Carr and Griffith, The Taxation of Canned Software: Should the Delivery Method Matter? , State Tax Notes, Dec. 26, 2005, p. 1088. ALJ Case 05-1240

Other parts of the country Ohio Is the download of a cookie sufficient to establish physical nexus? Some tax video streaming while others don t.

Alabama Digital Goods Working Group Response to failed attempt to exempt digital goods Current statute antiquated First Meeting to discuss future of taxation of digital goods October 12 Invited members to include stakeholders

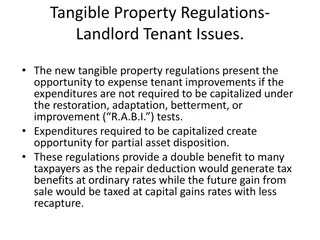

Current State of Affairs Any downloadable software program, e-book, music, photograph, or digital good transmitted electronically taxable Use of software information only? For example, Carfax (software not downloaded) Jury still out on rental of movies streamed to a customer in Alabama Should mode of delivery impact the taxation of a movie rental? Hard copy DVD s taxable Perceptible to the senses Many services allow for downloads

Questions Can a password or access code be considered license to use If the software is not downloaded to customer s website, is it taxable? Is clip art taxable? If printed, is this considered tangible personal property ? A flooring company pays a monthly fee for a subscription for software used to build insurance estimates. Xactware is the software provider that provides the subscription. The subscription is like having cable service. You pay for it even if you do not use it. Should there be use tax on this monthly fee? Is Black Book, Kelly Blue Book, magazine subscriptions taxable? Is web access taxable?

Questions Autobytel Dealership is able to scan car at auction and bring up Carfax. Limited License to Access Program Systems Data Software Services LLC/Elead1One Is a Customer Relationship tool to gather customer information and know what happens to customer as far as purchasing a vehicle. Automotive Dealership Software Dealersocket Dealership can upload inventory to Dealersocket and inside Dealersocket can add pictures, description and price. Dealership sends to dealership s website for advertising. Dealership Software

Taxable/Nontaxable No clear answer Digital goods not specifically addressed in sales and use tax law Argument for taxation License to use Perceptible to the senses