Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting for this new regime need to consider the impact on their taxation obligations and compliance requirements.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

1 Impact Analysis New Corporate Taxation Regime Taxation Laws(Amendment) Ordinance, 2019 BY- CA MANOJ GUPTA

2 High Tax Rates = Lower Compliance Low Tax Rates = Higher Compliance

3 Major Changes

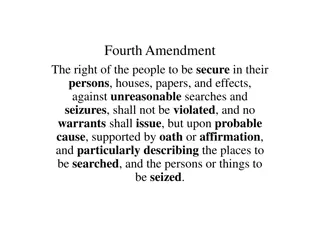

4 Section 115BAA (Effective from F.Y. 2019-20) Option to all domestic Companies to tax @ 22% plus surcharge and cess-effective rate 25.17%. No exemption or incentive may be claimed. No condition on account of turnover or nature of business Applicable to all existing and new companies Existing Tax Rates -25% & 30% plus surcharge & cess (29.12% & 34.94%)-First Schedule of Finance Act 2019

5 Option to pay Tax u/s 115BAA When & How? Should be exercised before due date of furnishing of IT Return U/s 139(1) Option may be exercised in first year or subsequent years Once exercised cannot be withdrawn

6 Exemptions or Deductions not available to companies opting for section 115BAA Section 10AA- Deduction for units established in Special Economic Zones (SEZ ) Section 32(1)(iia)- Additional Depreciation in respect of new plant and machinery Section 32 AD- Deduction for investment in new plant and machinery in notified backward areas Section 33 AB- Deduction in respect of tea, coffee or rubber business Section 33ABA- Deduction in respect of business consisting of prospecting or extraction or production of petroleum or natural gas in India Section 35(1)(ii)- Deduction for donation made to approved scientific research association, university college or other institutes for doing scientific research which may or may not be related to business.

7 Exemptions or Deductions not available to companies opting for section 115BAA Section 35(1)(iia)- Deduction for payment made to an Indian Company for doing scientific research which may or may not be related to business Section 35(1)(iii)- Deduction for donation made to university, college or other institution for doing research in social science or statistical research Section 35(2AA)- Deduction for donation made to National Laboratory or IIT s. etc for doing scientific research which may or may not be related to business Section 35(2AB)- Deduction for capital expenditure(excluding cost of land and building) on scientific research relating to business of bio- technology or manufacturing any article or thing Section 80(IA) & 80(IB)- Deduction in respect of profit from undertakings or engaged in infrastructure development.

8 A Comparison between Corporate Tax Rates u/s 115BAA & Existing Tax Rates

9 Domestic Companies whose turnover in Previous Year 2017-18 does not exceed Rs. 400 crores Tax liability under normal provisions 115BAA Category of Taxpayers Tax liability under section Net saving in taxes (in %) Income upto Rs. 1 crore 26.00% 25.17% 0.83% Income more than Rs. 1 crore but upto Rs. 10 crores Income more than Rs. 10 crores 27.82% 25.17% 2.65% 29.12% 25.17% 3.95% 99.3% of total Companies fall in this category

10 Domestic Companies whose turnover in Previous Year 2017-18 exceeds Rs. 400 crores Category of Taxpayers Tax liability under normal provisions Tax liability under section 115BAA Net saving in taxes (in %) Income upto Rs. 1 crore 31.20% 25.17% 6.03% Income more than Rs. 1 crore but upto Rs. 10 crores Income more than Rs. 10 crores 33.38% 25.17% 8.21% 34.94% 25.17% 9.77% Biggest Gainer- Companies having Turnover of more than Rs. 400 crores and Income above Rs. 10 crore

11 Selection of Tax Regime for Existing Companies Section 115BAA v/s Regular Tax Regime Have to forego incentives/deductions Not eligible to set off any loss C/F, if attributable to any such deduction/incentives Work out tax liability under existing provision @25% where Turnover is upto Rs.400 crore and @30% where it exceeds Rs. 400 crore and after claiming various deductions/ incentives. Compare with new rate of 25.17% without claiming any deduction/incentives. If existing Tax Regime is beneficial, then the company may opt for 115BAA in subsequent year. Consideration of reduced MAT liability

12 Which Option to choose? Example:- If a company is having turnover of less than Rs. 400 crore in F.Y. 2017-18. It purchases a Plant & Machinery of Rs. 10 Lacs. Total Income of the company before allowing additional depreciation on Plant & Machinery is Rs. 20 Lacs for F.Y. 2019-20. Now company should use which option? If company opts for Sec.115BAA 20,00,000 If company does not opt for Sec.115BAA 20,00,000 Total Income before additional depreciation Less: Additional Depreciation available u/s 32(1)(iia) - 2,00,000 Total Income 20,00,000 18,00,000 Applicable Tax Rate 25.17% 26% Tax liability 5,03,000 4,68,000 Extra Tax Payable under 115 BAA 35,000 -

13 Section 115BAB For New Manufacturing Companies Domestic Companies- setup and registered on or after 1st October 2019 Should commence Manufacturing on or before 31/03/2023 No Split up or reconstruction or transfer of assets/business Old Plant & Machinery upto 20% of total value of Plant & Machinery Tax Rate 15% plus surcharge & cess effective rate 17.16% The new rate is Assessee based,not manufacturing unit based Should not claim any deduction or incentives

14 Challenges in opting Taxation u/s 115BAB - 17.16% No condition as to turnover Should not engage in any business other than manufacturing (trading, renting, providing services,etc) Income from Interest, Rent, Capital Gain Consequences of indulging in any other business activities Definition of Manufacturing/ Production Controversy (Refining Oil, generating power, job work, Builders,etc.)

15 Definition of Manufacturing Landmark Judgement of Supreme Court of Delhi Cloth & General Mills Co. Ltd. 1977(1) ELT (J199)(SC) Definition inserted in 2009 in Income Tax Act-Section 2(29BA) wef. 01.04.2009- Manufacture", with its grammatical variations, means a change in a non-living physical object or article or thing, (a) resulting in transformation of the object or article or thing into a new and distinct object or article or thing having a different name, character and use; or (b) bringing into existence of a new and distinct object or article or thing with a different chemical composition or integral structure.

16 Option to pay Tax u/s115 BAB When & How? Option to be exercised in very first year? Before filing of return U/s 139(1) Once exercised cannot be withdrawn If option is disputed by AO (due to non- manufacturing activity),then cannot opt for section 115BAA

17 MAT- Minimum Alternate Tax Reduction in MAT rates from 18.5% to 15% (plus surcharge)- Saving of 3.64% to 4.10% No MAT on taxation U/s 115BAAand 115BAB The difference between book profit and taxable profit will not be high, as incentives/deduction not allowed in computation U/s 115BAA. No set off of earlier MAT Credit U/s 115BAA.

18 Advantages of New Regime- Removal of MAT on LTCG of Capital Assets/ Properties The anomaly of fictitious profit on sale of assets is removed ( Sale Price- Cost of Acquisition= Book Profit), whereas in Income Tax indexed cost is reduced, hence capital gain is lower LTCG of Equity Shares/ Mutual Fund- Chargeable at lower rate of 10% under Income Tax Act, Whereas MAT charged @18.5% on book profits. STCG on STT Paid Equity Shares/ Mutual Fund-will be taxed at 15%, whereas MAT charged @18.5%.

19 MAT Credit- Use it or not Circular No. 29/2019 dtd. 2nd October 2019 If have credit-remain in earlier tax regime as per turnover limits & fully set off Faster Adjustment of MAT Credit- Turnover > 400 crore 34.94% Turnover < 400 crore 29.12% Tax Rate MAT Rate 17.47% 17.47% Difference 17.47% 11.65% Earlier difference 13.39% (34.94-21.55) 4.08% 7.57% (29.12-21.55) 4.08% Net Differential Advantage

20 MAT Credit- Loss due to Higher Tax Rates Tax Rate 34.94% 29.12% Tax Rate u/s Sec 115 BAA 25.17% 25.17% Higher Tax Liability 9.77% 3.95% Effective Advantage of MAT Credit ( Tax Rate as per 115BAA-MAT) (25.17-17.47) 7.70% 7.70% Note:- Huge Amount of MAT Credit is consumed in higher tax liability.

21 MAT Credit- Not a viable option Illustration of a company having > 400 crore turnover Amt. ( in Rupees) 8 crore 100 crore 34.94 crore 17.47 crore 8 crore 26.94 crore 25.17 crore 55% Available MAT Credit Taxable Income & Book Profit Tax liability as per regular provision MAT liability Set Off restricted upto MAT credit Net tax payable(34.94-8.00) Tax liability as per Sec. 115 BAA Reason- MAT Credit consumed due to higher tax rates in old tax regime Actual utilisation 45%

22 MAT Credit- Other Issues Government denied its promise for c/f of credit MAT Credit written off- if opted Sec. 115 BAA -Book Result & EPS Adverse Effect -(Request for write off in equal installments in 5 years) Deferred Tax Liability- Reduction-Creation of DTA New ITR Forms- F.Y. 2019-20(A.Y. 2020-21) Preparation of ITR S - Available ITR Software incapable - Manual decision making- selection of option

23 Hardships to Borrowers Removed U/s 115BAA Waiver of debt- Write back of loans to P&L A/C Earlier book profit increased and MAT paid Now no MAT- C/F business loss and depreciation is allowed in full, whereas in MAT, lower of business loss or unabsorbed depreciation as per books was allowed.

24 Advance Tax Recomputation for A.Y. 2020-21 CASE TO CASE STUDY Consider Turnover Category Consider C/f losses as per Income Tax Act Consider MAT credit Cost benefit Analysis Decide the option considering future planning Work out total tax liability Adjustment of last 2 installments paid Explanation regarding lower Advance Tax payment.

25 Old Regime v/s New Regime Old (Existing) New(115BAA & 115BAB) No Yes in 115BAB Low No Turnover Based Business Specified Tax Rates Deductions/Incentives allowed C/f of losses MAT Applicability MAT Credit Allowed Migration from one regime to another regime permissible Yes No High Yes Yes Yes Yes Yes Yes with restrictions No No No

26 TAX PLANNING THROUGH RESTRUCTURING OF BUSINESS/ENTITY

27 Structuring of Existing Corporate Entities Splitting existing business into Different Companies Manufacturing Units Entitled to Tax Benefits- To continue under old regime and pay MAT @ 17.47% Manufacturing Units not entitled to Tax Benefits- Opt for New Regime 115BAA and pay tax @ 25.17% Slump Sale of Manufacturing Units entitled to tax benefits to WOS at Book Value Other issues- NCLT Approval, Stamp Duty, MAT Credit Transfer) Commercial Justification of Split- Risk of GARR Applicability of Domestic Transfer Pricing provisions- Sec 92BA

28 Methods of Reorganisation of Other Entities Sale of Business(Slump Sale or Itemised Sale) Conversion of Firm into Company ( Section 47 (xiii)) Succession of Sole Proprietor by Company (See.47 (xiv)) Merger/ Demerger of firm/LLP into Company Conversion of LLP into Company(No provision- Reverse situation (47 (xiiib))

29 Taxation Disparity for Individual, HUF, Firm, LLP etc. Tax rate is 30%+surcharge+cess- Average 33.4% Individuals and HUF Tax Rates- Income Range 10-50 Lakhs 50-100 Lakhs 100-200 Lakhs 200-500 Lakhs Above 500 Lakhs Tax Rates 31.20% 34.32% 35.88% 37.10% 42.30% Corrective measures are required Partnership Firm/LLP having Income above 1 crore- Tax Rate- 34.94%

30 Mathematics of Government of India Finance Minister announced loss of Rs. 145000 crore due to tax relief F.Y. 2017-18, Government collection of Corporate Tax Rs. Rs. 523857 crore. Difference between existing rate of 34.94% and new tax rate of 25.17% is considered the gross revenue loss comes to Rs. 147129 crore. During F.Y. 2017-18, the Government has foregone revenue of Rs. 117337 due to various tax incentives and deductions allowed to domestic companies, which will be saved in new regime U/s 115 BAA & 115 BAB. Hence net revenue loss to Government would be approximately Rs. 29792 or say Rs.30000 crore only.

31 ThankYou! For any query- Contact Manoj.g.ca@gmail.com

![Enhancing Corporate Transparency: Analysing The Companies Amendment Bill [B27B-2023]](/thumb/60028/enhancing-corporate-transparency-analysing-the-companies-amendment-bill-b27b-2023.jpg)

![RE: ELECTORAL MATTERS AMENDMENT BILL [ B42-2023]](/thumb/18837/re-electoral-matters-amendment-bill-b42-2023.jpg)