Developing Enterprise Skills Through Budget Planning Activity

Explore an engaging budget planning activity focusing on entrepreneurship characteristics such as managing resources, planning, negotiation, and risk management. Learners develop skills in budgeting, decision-making, and teamwork by creating a business budget, applying for a loan, researching product prices, and reflecting on budget decisions. The activity enhances negotiation, planning, and financial literacy, preparing students for real-world business scenarios.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

ENTERPRISE Skills and Behaviours Learning resources to support the facilitation of enterprise and entrepreneurship education at Key Stage 4 and above

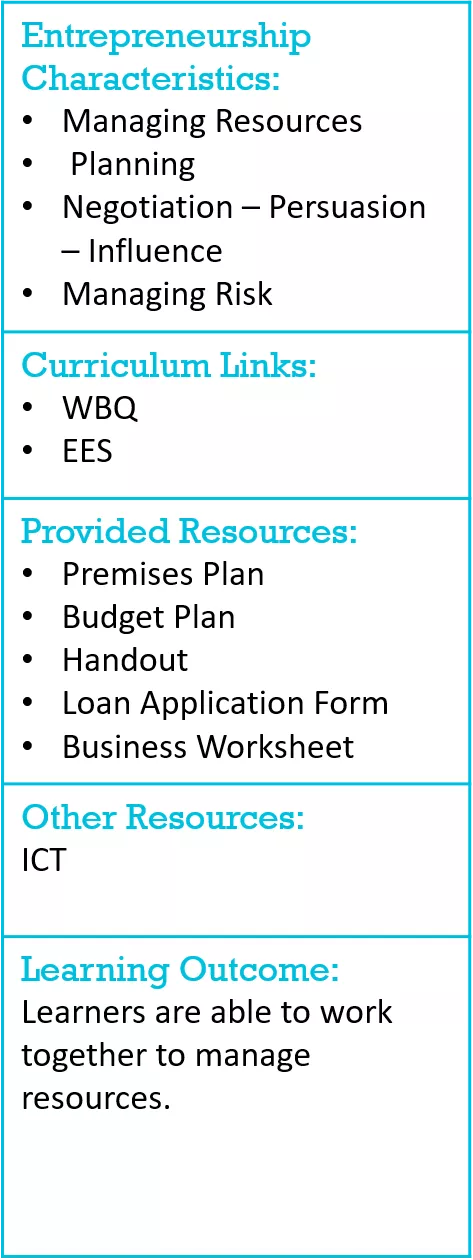

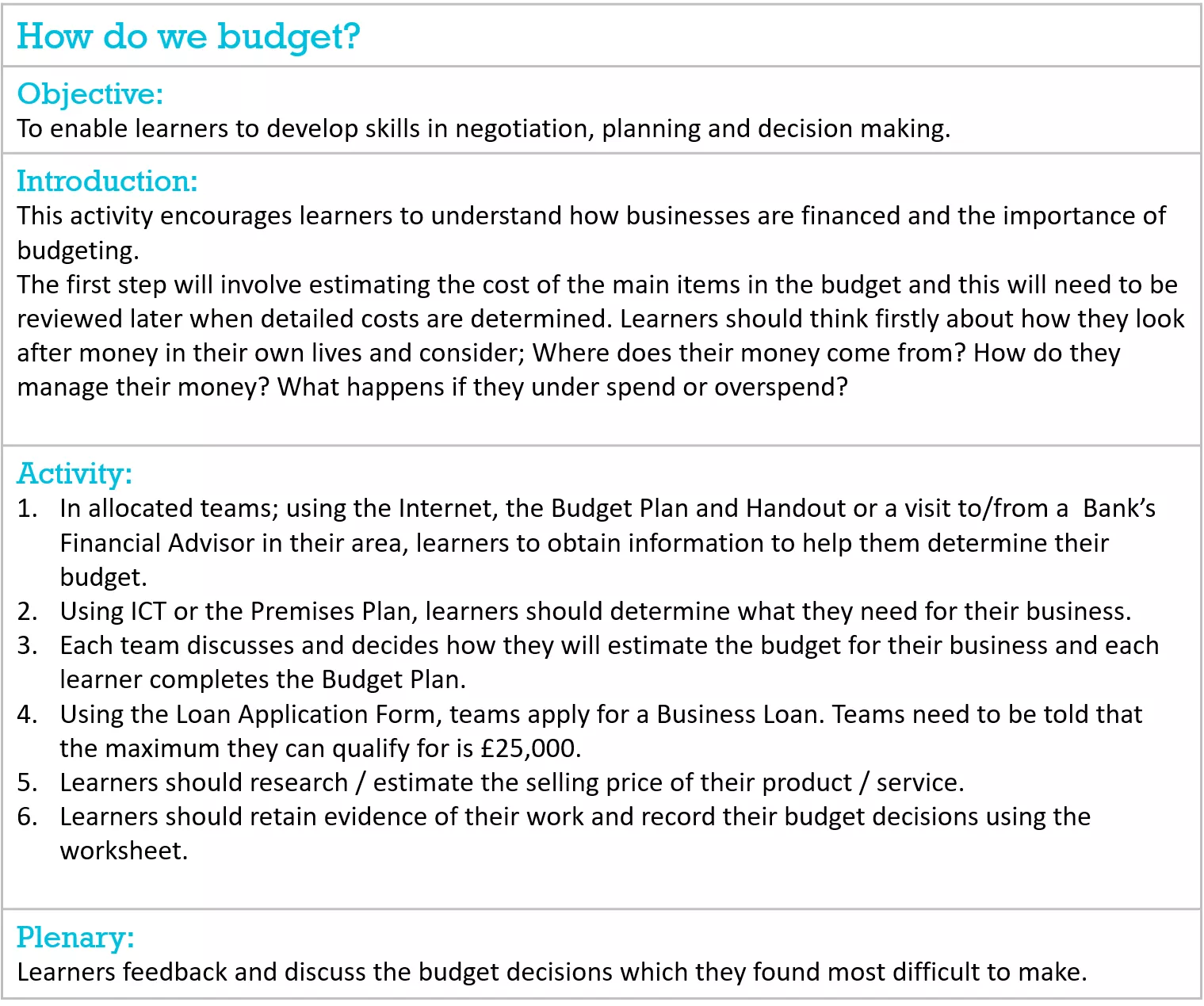

Entrepreneurship Characteristics: Managing Resources Planning Negotiation Persuasion Influence Managing Risk How do we budget? Objective: To enable learners to develop skills in negotiation, planning and decision making. Introduction: This activity encourages learners to understand how businesses are financed and the importance of budgeting. The first step will involve estimating the cost of the main items in the budget and this will need to be reviewed later when detailed costs are determined. Learners should think firstly about how they look after money in their own lives and consider; Where does their money come from? How do they manage their money? What happens if they under spend or overspend? Curriculum Links: WBQ EES Provided Resources: Premises Plan Budget Plan Handout Loan Application Form Business Worksheet Activity: 1. In allocated teams; using the Internet, the Budget Plan and Handout or a visit to/from a Bank s Financial Advisor in their area, learners to obtain information to help them determine their budget. 2. Using ICT or the Premises Plan, learners should determine what they need for their business. 3. Each team discusses and decides how they will estimate the budget for their business and each learner completes the Budget Plan. 4. Using the Loan Application Form, teams apply for a Business Loan. Teams need to be told that the maximum they can qualify for is 25,000. 5. Learners should research / estimate the selling price of their product / service. 6. Learners should retain evidence of their work and record their budget decisions using the worksheet. Other Resources: ICT Learning Outcome: Learners are able to work together to manage resources. Plenary: Learners feedback and discuss the budget decisions which they found most difficult to make. Lesson Plan

How do we budget? What do you need for your business? Businesses need to encourage customers to spend money and use a variety of methods to do this. Think about the following aspects before you decide on your budget Wages How many people will you employ? Do you intend to do all the work yourself (ordering stock / keeping records / serving customers / paperwork / cleaning). Stock Do you want to hold lots of stock, so you always have what the customer wants or do you intend to reorder regularly? Does your stock go out of date / go out of fashion? Advertising and Promotion How will customers know where you are? Will you use newspaper adverts, posters, flyers, websites etc? Rent The local council is keen to attract new business to the area and has offered to cover the cost for the first 12 months. Contingency Fund Do you need to put money aside for other costs not covered here? Help card

How do we budget? What do you need for your business? Businesses need to encourage customers to spend money and use a variety of methods to do this. Think about the following before you decide on your budget Flooring Is image important to your business? Does it need to be practical, stylish, load bearing? Will it be on show or do you intend to cover it with products? Lighting Do you need a strong light so that customers can see the products or more subtle lighting to create a mood? Do you need lights scattered around the premises dividing it into zones, do you intend to use coloured lights to create a mood? Fitments (shelves, counters, stands etc): Will you have lots of products on display? Where will you place the till? Do your shelves need to be attractive? Is colour important? Do they need to be at different eye levels? E.g. In Supermarkets sweets are always low down at a child s level, but expensive goods are set at 5 foot 4 inches (the height of the average female shopper). As a team estimate the cost of the main items for your business budget. You are provided with a low cost and a high cost as guidelines. Keep within these cost guidelines and decide how much you need or want to spend on each item and then complete the Estimated Cost column. You need to plan carefully you must have enough money left in your budget to cover the Low Costs for each item in Budget Categories A to E Help card

How do we budget? Premises Plan Worksheet

Example Budget Plan Budget Category A Flooring Items Cost Guide Estimated Cost Final Cost High 2,500 Low 900 High 550 Low 300 High 500 Low 200 High 1,000 Low 500 High 1500 Low 500 High (3 x staff) 2,400 Medium (2 x staff) 1600 Low (1 x staff) 800 High 12,000 Low 4,000 High 4,500 Low 1,000 Free for 12 months Walls Lighting Pay Desk Display B Wages Stock C Advertising and Promotions D Rent None 12 months No cost for 12 months E Contingency Fund: money set aside for: e.g. launch/Unexpected Expenditure High 6,000 Low 3,500 Total Budget: Total Final Budget: Maximum Loan Available: Total Estimated Budget: 25,000 Worksheet

How do we budget? How did you decide how much to spend on each item of the budget items? Estimated Cost Decided Budget Category Item Reason A Flooring: Walls: Lighting: Pay Desk: Display: Wages: Stock: Advertising and Promotions: Rent: Contingency Fund: B C D E Which decision was the hardest to make and why? Worksheet

How do we budget? Loan Application Please complete the following questions. All boxes must be completed and failure to do so will delay your loan application. State the name of your business State the full names of each business partner (please print) For what purpose do you require the loan? How much do you require? (Please tick) Provide a brief description of your business: 10,000 __ 15,000 __ 20,000 __ 25,000 __ Other ____________ Describe the product / service your business will offer: Identify any likely competition: Describe and explain your target market: Each owner needs to sign below and all signatures must be witnessed by a separate individual --------------------- --------------------- --------------------- ------------------------- (Witness Signature) This document was signed in my presence by the recipients of the loan Disclaimer: This loan is subject to the rules and regulations of The Bank and can be terminated at any time should the recipient fail to meet their agreed repayments. See Article IV; ss (a) (b) of The Bank s regulatory agreement. Worksheet