Important Updates on Elder Law, Medicare, and Estate Planning

Explore recent developments in elder law, Medicare premium amounts, Part A and B copayments, and the Jimmo Settlement Agreement clarifying Medicare coverage for skilled nursing care and therapy services. Stay informed on crucial aspects of estate planning and elder care.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Estate Planning Council of Estate Planning Council of Eastern New York, Inc. Eastern New York, Inc. By David Goldfarb By David Goldfarb Goldfarb Abrandt Salzman & Kutzin LLP Goldfarb Abrandt Salzman & Kutzin LLP Elder Law & Power of Attorney Update

New Developments in Elder Law New Developments in Elder Law Medicare and Medigap Insurance

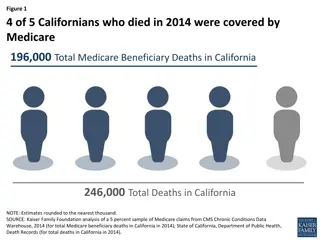

Part B Copayment and premium amounts Part B Copayment and premium amounts for 2019 & 2020: for 2019 & 2020: Part B premium: $135.50 per month on average (2020 will be $144.60). If your income is above $85,000 (single) or $170,000 (married couple), then your Medicare Part B premium may be higher. Part B deductible & coinsurance You pay $185 per year in 2019 ($198 in 2020) for your Part B Deductible. After your deductible is met, you typically pay 20% of the Medicare- approved amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy Durable medical equipment (DME)

Part A Hospital & Nursing Facility Co-payments: Inpatient hospital deductible: $1,340 ($1,408 in 2020). Inpatient hospital copay for days 61 90: $341 per day ($352 in 2020) . Hospital co-payment for days 91-150 (lifetime reserve days): $682 ($704 in 2020). All costs for each day beyond 150 days Skilled nursing facility co-payment for days 21 100: $170.50 ($176 in 2020)

If you don't qualify for premium-free Part A, you can buy Part A. If you buy Part A, you'll pay up to $437 ($458 in 2020) each month. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $437 ($458 in 2020). If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $240 ($252 in 2020).

Jimmo Jimmo v. Sebelius v. Sebelius Settlement Agreement Settlement Agreement The Jimmo v. Sebelius Settlement Agreement (January 2013), clarified that the Medicare program covers skilled nursing care and skilled therapy services under Medicare s skilled nursing facility, home health, and outpatient therapy benefits when a beneficiary needs skilled care in order to maintain function or to prevent or slow decline or deterioration (provided all other coverage criteria are met). Specifically, the Jimmo Settlement Agreement required manual revisions to restate a maintenance coverage standard for both skilled nursing and therapy services. See CMS s message Important Message about Jimmo Settlement at https://www.cms.gov/Center/Special-Topic/Jimmo-Center.html.

Observation Status Observation Status Medicare will only cover care you get in a nursing home if you first have a qualifying hospital stay. A qualifying hospital stay means you ve been a hospital inpatient for at least three days in a row (counting the day you were admitted as an inpatient, but not counting the day of your discharge). 42 CFR 409.30(a).

Observation Status: Required Notice New York law requires a hospital, when a patient is placed on observation status, to give the patient oral and written notice within 24 hours of such placement that the patient is not admitted to the hospital and is under observation status. It must be signed and acknowledged by the patient or the patient s representative and include a statement that observation status may affect the patient s coverage for the current hospital services, as well as coverage for any subsequent discharge to a skilled nursing facility or home and community based care. Pub. Health Law 2805-w. Regulations regarding Observation Services are at 10 NYCRR 405.32.

Termination of Certain Termination of Certain Supplemental Medicare Policies Supplemental Medicare Policies Medigap or Supplemental Medicare Insurance Policies are now offered under set federal guidelines. All Medigap policies in New York State have level premiums, not based on age or sex. Policies now fit into standard categories (A through N). E, H, I and J were no longer be sold after 6/1/2010, but individuals who had these plans can keep them. Plans C and F will no longer be sold after 1/1/2020, but individuals who have these plans can keep them.

Medicare recipients can protect their Medigap coverage. First, everyone currently enrolled in a Medigap Plan F or Plan C may keep this coverage for the remainder of their lives. Anyone who enrolls in such a program before January 1, 2020, may also retain this Medigap coverage. Another option is Part G coverage. This functions similarly to Plan F coverage, except recipients, must pay small annual Part B deductibles.

Emergency Medical Services Emergency Medical Services and Surprise Bills and Surprise Bills Emergency Medical Services and Surprise Bills law enacted in 2014 and effective March 31, 2015

Emergency Medical Services and Surprise Bills Law The law and regulations provide for submitting disputes regarding emergency services and surprise bills to an independent dispute resolution entity (IDRE). A Surprise bill means a bill for health care services, other than emergency services, received by an insured for services rendered by a non- participating physician at a participating hospital or ambulatory surgical center, or a non-participating physician renders services without the insured s knowledge, or unforeseen medical services arise at the time the health care services are rendered; or for services rendered by a non-participating provider, where the services were referred by a participating physician to a nonparticipating provider without explicit written consent of the insured

For emergency services The plan must pay physicians a reasonable fee for such services as well as ensure that the insured will incur no greater out-of-pocket costs for the services than he or she would have incurred if the physician were participating.

For Surprise Bills A consumer signs an assignment of benefits form permitting the provider to seek payment directly from the consumer s health plan, and sends the form to the plan with a copy of the bill believed to constitute a surprise bill. Under the hold harmless provisions of the law when an insured consumer assigns benefits for a surprise bill , the non-participating physician shall not bill the insured except for any applicable copayment, coinsurance or deductible that would be owed if the insured utilized a participating physician.

The Medicaid Program The Medicaid Program

Categories of Medicaid Categories of Medicaid Benchmark Coverage Expanded Medicaid coverage under the federal Affordable Care Act. It is based on Modified Adjusted Gross Income (MAGI). There are four groups under Benchmark Coverage Standard Coverage Replaces the prior Medicaid categories

Benchmark Coverage or MAGI The adult group consists of individuals between ages 19 and 65, not pregnant, not entitled to enroll in Medicare Part A or B, and not otherwise eligible for and enrolled in mandatory coverage under the State s Medicaid State Plan. Income eligibility for the adult group is 138% of the Federal Poverty Level (FPL) (this includes a 5% income disregard). The FPL for 2018 2019 for a single individual is $12,14012,490 per year or $1,0121,041 per month. There is NO asset test.

MAGI: personal injury award/settlement or a structured settlement Consider Benchmark (MAGI-based) Medicaid in case where there is a personal injury award/settlement or a structured settlement. MAGI-based income is based on IRC 36B(d)(2)(B). Under Revenue rulings the entire amount received by an individual in a settlement of a suit for personal injuries sustained in an accident, including the portion allocable to lost wages, is excludable from the individual s gross income. Rev. Ruling 61-1, 1961-1 C.B. 14

Medicaid: Community Based Care Medicaid Managed Long Term Care

Typical Timeline for Applying for Medicaid MLTC Personal Care Services Request Conflict Free Assessment (CFA) February 16 Medicaid Approved (45 Days*) February 15 File Medicaid Application with DSS January 1 Contact MLTC Plan And request Nurse Assessment of Needs February 26 Conflict Free Assessment (CFA) Conducted in 7days** February 23 CFA has two days to send written approval February 25 MLTC Plan assigns Licensed Home Care Vendor Enrollment Agreement signed with MLTC Plan March 20 (March 19 deadline for April 1 Service Commencement missed) MLTC Conducts Assessment of Needs March 19 *Can take longer if there are deferrals for additional documentation. **Maximus (New York Medicaid Choice) has state contract for Conflict Free Eligibility & Enrollment Center. CFEEC has 7 days to schedule home assessment. Services Commence May 1

The Consumer Directed The Consumer Directed Personal Assistance Program (CDPAP) Personal Assistance Program (CDPAP) CDPAP provides for the applicant-recipient, or a family member, to manage all aspects of the employment of the home care worker, including hiring, training, and supervising the worker. A Fiscal Intermediary authorized by the local Department of Social Services oversees the administrative aspects of the program such as timesheets and paychecks. The 2019 New York State Budget limited Fiscal Intermediaries to an entity that provides fiscal intermediary services and has a contract for providing such services with the department of health and is selected through the procurement process.

Labor Law Issues in Home Care Services Labor Law Issues in Home Care Services The New York Court of Appeals reversed two Appellate Division cases to find that pursuant to the New York State Department of Labor's (DOL) Miscellaneous Industries and Occupations Minimum Wage Order an employer does not need to pay its home health care aide employees for each hour of a 24-hour shift. DOL has interpreted its Wage Order to require payment for at least 13 hours of a 24-hour shift if the employee is allowed a sleep break of at least 8 hours - and actually receives five hours of uninterrupted sleep - and three hours of meal break time. Andryeyeva v New York Health Care, Inc.

Joint Employer The federal district court ruled that a Fiscal Intermediary in the Consumer Directed Program is a joint employer of personal assistants for purposes of the labor laws. Hardgers-Powell v. Angels in Your Home LLC, 330 F.R.D. 89, 2019 U.S. Dist. LEXIS 16315, 2019 WL 409276 (WDNY 2019),

Trusts in Medicaid Planning Supplemental Needs Trusts and Medicaid Trusts

A Homestead A Homestead in a Supplemental Needs Trust in a Supplemental Needs Trust A homestead purchased by a self-settled trust may be required by a court to be owned by the trust and not the beneficiary. Matter of Fontan, 2008 N.Y. Misc. LEXIS 3948 (Sur. Ct. New York County 2008). However, in Matter of Tinsmon (Lasher), 169 A.D.3d 1305, 95 N.Y.S.3d 411 (3d Dept. 2019), the Appellate Division affirmed a Surrogate Court decision allowing the trustee of an SNT to purchase an interest in the beneficiary's home and pay off an encumbering mortgage on it, leaving the title to the home in the beneficiary s guardians. Matter of Tinsmon (Lasher), relied on the former SSI POMS.

Irrevocable Medicaid Trusts Irrevocable Medicaid Trusts The principal of a trust is an available resource for purposes of a Medicaid eligibility determination where son, as a trustee, depleted a majority of the trust's value by using a home equity line of credit secured by a trust asset to pay for petitioner's living and caregiver expenses. Because the trust instrument gave the trustees broad discretion in the distribution of the trust principal, including for petitioner's benefit, the agency did not err in concluding that despite the fact that petitioner's son no longer wishes to exercise his discretion to make such distributions. Matter of Pugliese v Zucker, 2019 N.Y. App. Div. LEXIS 7203, 2019 NY Slip Op 07159 (4th Dept. October 4, 2019).

Third Party Liability Third Party Liability for Nursing Home Care for Nursing Home Care While a nursing facility may not require a third-party guarantee of payment to the facility as a condition to admission or a continued stay in the facility, it may require an individual who has legal access to a resident's income or resources to provide payment from such income or resources, without incurring personal liability. Jopal at St. James, LLC v Manning, 2019 N.Y. Misc. LEXIS 4983, 2019 NY Slip Op 32720(U) (Sup. Ct. Suffolk County September 5, 2019).

Medicaid: Supplying of Documentation Supplying of Documentation An applicant will not have eligibility denied or discontinued solely because he does not possess and cannot obtain information about the income or resources of a nonapplying legally responsible relative who is not living with him. 18 NYCRR 360-2.3(a)(2); Matter of Waterfront Ctr. for Rehabilitation & Healthcare v. New York State Dept. of Health, 162 A.D.3d 1717, 80 N.Y.S.3d 771 (4th Dept. 2018)

Medicaid:Supplying Medicaid:Supplying of Documentation of Documentation Attorney Guardian Where an attorney for the agent of the applicant failed to provide the requested documentation by the extended deadline the application was properly denied. Matter of Schaffer v Zucker, 165 A.D.3d 1266, 85 N.Y.S.3d 556 (2d Dept. 2018). Where a guardian admitted at the FH that the requested documents had not been provided, and failed to establish that the applicant was unable to obtain the documentation the application was properly denied. Matter of Mangels v Zucker, 168 A.D.3d 1060, 92 N.Y.S.3d 377 (2d Dept. 2019).

Power of Attorney Update on the NYS Power of Attorney; Statutory Gifts Rider; Review of litigation; Potential Legislation

Effective Dates of Current Law Chapter 340 of the Laws of 2010 The law amended various sections of Article 5, Title 15 of the N.Y. General Obligations Law. It became law on August 13, 2010. Effective on the 30th day after it became a law Deemed to have been in full force and effect on and after September 1, 2009 (the date the previous law became effective).

Previous Revision to POA Law Chapter 644 of the Laws of 2008 Amended the New York General Obligations Law Effective September 1, 2009 BIG MISTAKE: Using the 2008-2009 form after Sept. 2010 Such a POA would not only not be a Statutory Form, but also not be valid.

Overview To 2008 & 2009 Laws Major changes relating to the content Major changes relating to the execution including an acceptance by the agent. Major gifts now require a second form, called a Statutory Gift Rider (SGR) Additional execution requirements. The statute also creates specific fiduciary responsibilities for the agent.

Prior POAs Statutory Short Form Powers of Attorney properly executed in accordance with the law in effect at the time of their execution remain valid and must be honored. NY G.O.L. 5-1504. The 1986 Form (Between 9/21/86 and 9/30/94) The 1994 Form (Between 10/1/94 and 12/31/96) The 1997 Form (Between 1/1/97- 8/31/09) Look to the law in effect to see the interpretation of each section of the POA. These laws required exact wording for a POA to be a Statutory Short Form, but did not require exact wording of the Caution to the Principal in order to be a valid POA.

Need for Gifting Authority: Establishing & Funding Trusts NYS Department of Health requires that if a trust is established by an agent acting under a Power of Attorney, the powers granted under the POA must include permission to gift assets. Includes joining and funding a Pooled Trust. GIS 19MA/04 (02/04/2019). This may not be technically correct because the 2009 law clarified that SGR is not necessary for every trust situation.

Need for Gifting Authority Need for Gifting Authority Some brokerage and financial institutions (notably MML Investors) and some title companies are requiring any agent acting under a POA to have an SGR, claiming they cannot determine when a transaction is a gift. New York State Comptroller with regard to pensions and retirement accounts will not honor an agent under a POA to take certain actions without an SGR. It is required, for example, for changing a pension option to include a survivor benefit or for changing a beneficiary. This is correct because these actions do constitute a gift transaction.

Proper Execution of an SGR On the POA (h) must be initialed: (h) CERTAIN GIFT TRANSACTIONS: STATUTORY GIFTS RIDER (OPTIONAL) ( ) (SGR) I grant my agent authority to make gifts in accordance with the terms and conditions of the Statutory Gifts Rider that supplements this Statutory Power of Attorney. On the SGR: Do not Initial (a) GRANT OF LIMITED AUTHORITY TO MAKE GIFTS In (b) MODIFICATIONS: list the types of gifts that can be made including: I grant my agent authority to create, amend, revoke, or terminate an inter vivos trust. In (c) GRANT OF SPECIFIC AUTHORITY FOR AN AGENT TO MAKE GIFTS TO HIMSELF OR HERSELF: Initial: (______) I grant specific authority for the following agent(s) to make the following gifts to himself or herself: BE SURE TO LIST THE AGENTS NAMES Add: ( ) I grant my agents the same authority to make gifts to him or herself as I have listed in section (b) MODIFICATIONS, above.

Review of recent litigation Review of recent litigation

Exact Wording Exact Wording To be valid every statutory short form or non-statutory form power of attorney must conform to specific statutory requirements, including proper execution, the size of letters (at least 12-point type, or, if in writing, a reasonable equivalent), and specific language that is included on the statutory form in the Caution to the principal and Important information for the agent. GOL 5-1501B. Berrian v. Siena Coll., 129 A.D.3d 1004, 12 N.Y.S.3d 240 (2d Dep t 2015) (Statutory short form powers of attorney and nonstatutory powers of attorney must contain certain exact wording in order to be valid ).

Exact Wording Exact Wording The validity of a Power of Attorney depends on the then applicable section of the law at the time the Power of Attorney was executed. Powers of attorney must strictly comply with GOL 5-1501 to be considered statutory short form powers of attorney. But a power of attorney that fails to do so is not necessarily invalid; it is just not a statutory short form power of attorney. Robert L. Gordons LLC v. U.S. Bank N.A., 724 Fed. Appx. 18, 2018 U.S. App. LEXIS 2330, 2018 WL 627502 (2d Cir. 2018) (The Power of Attorney in question was executed in 2007; the law at that time did not require exact wording of the Caution to the Principal in order to be valid.)

Exempt Powers of Attorney Exempt Powers of Attorney A power of attorney given to create a trust or to engage in real estate transactions is not a power of attorney that is solely reserved for business or commercial purposes in and of itself And therefore does not come under the exceptions in General Obligations Law 5-1501C (1) or (9). Bronstein v Clements, 169 A.D.3d 1302, 1303-1304, 95 N.Y.S.3d 414, 416 (3d Dept. 2019).

Extrinsic Evidence Extrinsic Evidence Where a power of attorney is clear as written then no extrinsic evidence is necessary to explain it and a Court will not consider the testimony of the principal as to what she believed to be the effect or duration of the power of attorney. Sklavos v OKI-DO Ltd., 60 Misc. 3d 1203(A), 2018 N.Y. Misc. LEXIS 2351, 2018 NY Slip Op 50920(U), 2018 WL 3029365 (Sup. Ct. Suffolk County 2018).

Commencing a Proceeding to create an SNT Commencing a Proceeding to create an SNT An agent under a power of attorney has the authority to commence a proceeding in the Surrogate's Court for the creation of a supplemental needs trust. Matter of Delaney, 170 A.D.3d 1008, 1009, 94 N.Y.S.3d 591 (2d dept. 2019).

No Power to Swear or Sign an Affidavit No Power to Swear or Sign an Affidavit The statutory powers granted to an agent under 5- 1501 of the General Obligations Law, do not include the power to swear or sign an affidavit in the name of the principal. U.S. Bank N.A. v Allen, 63 Misc. 3d 1207(A), 2019 N.Y. Misc. LEXIS 1317, 2019 NY Slip Op 50435(U), 2019 WL 1431419 (Sup. Ct. Kings County 2019).

Gifting authority Gifting authority Gifts by an agent to herself without explicit authority, or that are not in the principal s best interest, may indicate impropriety and self-dealing and are scrutinized closely by the courts, particularly if they remove assets from the reach of creditors, beneficiaries named in a will or non-probate assets, or intestate distributees. Matter of Argondizza, 168 A.D.3d 426, 91 N.Y.S.3d 387 (1st Dept, 2019) (gifting upheld where petitioner knew about the power of attorney and understood that it would be used to transfer decedent's half-interest in the apartment to respondent for her to obtain Medicaid benefits and decedent's treating physician testified that she told him about the transfer and indicated her approval).

Removing an agent Removing an agent In a proceeding to remove an agent for violating fiduciary duties or because the agent is unfit it is not the role of the Court under G.O.L. section 5-1510 to examine the principal's motives for appointing an agent and determine whether they are worthy, except to the extent that improper means such as threats or fraud were used to secure or maintain the appointment. Kotlow v Hanft, 2018 N.Y. Misc. LEXIS 9654, *30-31, 2018 NY Slip Op 51994(U), 12 (Sup. Ct. Albany County 2018).

PENDING LEGISLATION PENDING LEGISLATION Legislation is currently pending to revise the General Obligations Law regarding the Power of Attorney. A5630 (Weinstein) passed the Assembly on June 20, 2019. S 3923 (Hoylman), which is the same asthe Assembly bill, did not get voted on, but hopefully will be voted on when the Senate is back in session in January.

PURPOSE OF THE BILL PURPOSE OF THE BILL: 1) simplify the current power of attorney form, which is too complex and prone to improper execution; 2) allow for substantially compliant language, because the exact wording requirement in current law is unduly burdensome and becomes a trap for the unwary; 3) provide safe-harbor provisions for those who, in good faith, accept an acknowledged power of attorney without actual knowledge that the signature is not genuine; 4) allow sanctions for those who unreasonably refuse to accept a valid power of attorney; and, 5) make a number of technical amendments.

Technical Amendments allow a person to sign at the direction of a principal who is unable; expand an agent's power to make gifts in the aggregate in a calendar year from the current $500 limit to $5,000 without requiring a modification to the form; clarify an agent's obligation to keep records or keep receipts; and clarify the agent's authority with regard to financial matters related to health care.

5-1504: Add Safe Harbor provisions: Subdivision 1 provides for reliance in good faith upon an acknowledged power of attorney and allows for requesting an agent's certification and an opinion of counsel. Subdivision 2 (a), add reasonable cause for refusing to honor a power of attorney to include new provisions (10) refusal to provide a certification or opinion of counsel. These provisions are based on provisions from the Uniform Power of Attorney Act, which has been adopted in other states.