Examination of Components of Fiscal Policy Paper

This paper, presented before the Houses of Parliament on February 15, 2024, delves into the detailed examination of the various components of fiscal policy. It offers insightful observations and analysis regarding the fiscal measures outlined, aiming to provide a comprehensive understanding of their implications and effectiveness in the economic landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

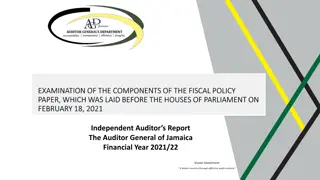

E EXAMINATION XAMINATION OF OF THE THE C COMPONENTS OMPONENTS OF F FISCAL ISCAL P POLICY OLICY P PAPER which was laid before the Houses of Parliament on February 15, 2024 OF THE THE APER

Auditor Generals Comments Auditor General s Comments The FPP met the requirements of the Third Schedule and included the minimum content under the Fiscal Responsibility Statement, Macroeconomic Framework and Fiscal Management Strategy. In addition, the FPP included the Fiscal Risk Statement (FRS) as required by the enhanced fiscal rules. I reviewed the Fiscal Policy Paper (FPP), which was laid before the Houses of Parliament on February 15, 2024, in accordance with the Financial Administration and Audit (FAA) Act. I adhered to the standards issued by the International Association of Supreme Audit Institutions and International Standard on Assurance Engagement (ISAE) 3000.

Auditor Generals Responsibilities Auditor General s Responsibilities Section 48B (6) of the FAA Act requires the Auditor General to examine the components of the Fiscal Policy Paper and provide a report to the Houses of Parliament indicating whether: - The Conventions & assumptions underlying preparation of the FPP comply with principles of prudent fiscal management. Reasons given for deviations from the Budget are reasonable, having regard to the circumstances. There are public bodies that do not form part of the specified public sector that were part thereof in the preceding fiscal year. A public private partnership involves only minimal contingent liabilities.

a) Regarding a) Regarding the conventions and assumptions underlying the preparation of the conventions and assumptions underlying the preparation of the Fiscal Policy Paper the Fiscal Policy Paper The principles of prudent fiscal management require the budget to be informed by reasonable revenue projections, underpinned by realistic macroeconomic assumptions, and that related risks and risk-mitigating measures are identified. Given the established relationship between Tax Revenue and nominal GDP as well as linkages to the economic performance of Jamaica s trading partners, I reviewed actual GDP growth relative to forecast and global economic growth. I found that the revenue projections for FY2024/25 and the medium-term, were aligned with GDP and the growth of the major trading partners. The Fiscal Risk Statement reaffirmed Government s commitment to monitor developments in the global economy to gauge possible spillover effects on the Jamaican economy. In particular, the FPP underscored the Government s Debt Management Strategy as a means of reducing interest rate and exchange rate risks.

Conventions & assumptions underlying preparation of the Conventions & assumptions underlying preparation of the FPP comply with principles of prudent fiscal management FPP comply with principles of prudent fiscal management Auditor General s Comment Given the macroeconomic assumptions and identification of risk, I found that the preparation of the FPP complied with the principles of prudent fiscal management.

b) b) Reasons given for deviations from the Budget are reasonable, having Reasons given for deviations from the Budget are reasonable, having regard to the circumstances. regard to the circumstances. The report highlighted a lower than programmed fiscal deficit and a larger than projected primary surplus, relative to budget. Tax Revenue, Non-Tax Revenue and Grants exceeded budget. There were no receipts for Capital Revenue. Within Tax Revenue, Income and Profits and International Trade exceeded budget. Production and Consumption was below target. Income and Profits was largely attributed to higher-than-expected tax inflows from Other Companies , based on increased profitability. International Trade largely reflected higher than projected imports values and tourist arrivals. Production & Consumption mainly reflecting lower SCT (local) due to lower-than-expected production of petroleum and related products.

Tax Revenue vs Budgeted Tax Revenue Tax Revenue vs Budgeted Tax Revenue 1,200.0 29 28.5 1,000.0 28 800.0 27.5 J$ Billion 27 600.0 26.5 400.0 26 25.5 200.0 25 - 24.5 FY2023/24 Est. 856.4 FY2024/25 Proj. 924.4 FY2025/26 Proj. 996.2 FY2026/27 Proj. 1,056.5 FY2027/28 Proj. 1,120.5 FY2020/21 FY2021/22 FY2022/23 Budgeted Tax Revenue Actual Tax Revenue % (GDP) 510.1 505.7 25.9 572.5 616.4 26.5 671.5 752.8 27.4 28.1 28.1 28.4 28.4 28.4

Explanations for deviation in revenue for April Explanations for deviation in revenue for April Dec 2023 vis Dec 2023 vis- -a a- -vis Original budget vis Original budget Auditor General s Comment Overall, I found the explanations for the deviations relative to Budget to be reasonable, having regard to the circumstances.

b b c) c) There are public bodies that do not form part of the specified public There are public bodies that do not form part of the specified public sector that were part thereof in the preceding fiscal year. sector that were part thereof in the preceding fiscal year. The FAA Act requires the Minister, no later than August 31, in every third year, to provide the Auditor General with a list of public bodies that the Minister wishes the Auditor General to consider for certification Auditor General s certification for JMB Limited and BOJ was submitted to the Minister of Finance on September 29, 2022, and the report was tabled in Parliament on October 11, 2022.The next request for certification is anticipated for August 2025

d) a public private partnership involves only minimal contingent liabilities d) a public private partnership involves only minimal contingent liabilities Based on the impact of the COVID-19 pandemic, four of five PPP concessionaires namely TransJamaica Highway (TJH) and Jamaica North-South Highway, Norman Manley International Airport, Sangster International Airport, submitted claims under the Force Majeure clause and other sections of their respective PPP agreements. The recommended strategy for the two airport concessions was approved; a 12-month extension of the concession for Sangster International Airport and a reduced concession fee for Norman Manley International Airport (NMIA). No analysis was provided in the FPP regarding the potential impact of NMIA concession claim on the GOJ For the TJH concessionaire, legal opinion provided to NROCC indicated that the claim submitted by TJH was not valid. For Jamaica North-South Highway, the claim is still under review.

Auditor Generals Auditor General s Recommendations Recommendations The FPP should consider including a quantification of projected losses from adjustments to the concession agreements for the NMIA airport for the short- to medium-term to facilitate an analysis of materialised contingency risk.

Thank You Thank You