Examination of Components of Fiscal Policy Paper Laid Before Parliament

An independent auditor's report on the Fiscal Policy Paper laid before Parliament on February 18, 2021, is reviewed. The Auditor General of Jamaica examined the components of the paper, ensuring compliance with the Financial Administration & Audit Act. The report covers conventions, assumptions, public-private partnerships, and more, highlighting the need for realistic revenue projections, risk mitigation strategies, and reasonable explanations for deviations from budget.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

EXAMINATION OF THE COMPONENTS OF THE FISCAL POLICY EXAMINATION OF THE COMPONENTS OF THE FISCAL POLICY PAPER, WHICH WAS LAID BEFORE THE HOUSES OF PARLIAMENT ON PAPER, WHICH WAS LAID BEFORE THE HOUSES OF PARLIAMENT ON FEBRUARY 18, 2021 FEBRUARY 18, 2021 Independent Auditor s Report The Auditor General of Jamaica Financial Year 2021/22 Vision Statement A better country through effective audit scrutiny

Auditor Generals Comments Auditor General s Comments I reviewed the Fiscal Policy Paper (FPP), presented in Parliament on 2021 February 18 The report complied with the Financial Administration & Audit (FAA) Act

Auditor Generals Responsibilities Auditor General s Responsibilities Section 48B (6) of the FAA Act requires the Auditor General to examine the components of the Fiscal Policy Paper and provide a report to the Houses of Parliament indicating whether: - The Conventions & assumptions underlying preparation of the FPP comply with principles of prudent fiscal management. Reasons given for deviations from the Budget are reasonable, having regard to the circumstances. There are public bodies that do not form part of the specified public sector that were part thereof in the preceding fiscal year. A public private partnership involves only minimal contingent liabilities.

a) Regarding the conventions and assumptions underlying the preparation of the Fiscal Policy Paper Principles of Prudent Fiscal Management What I found The Budget must be based on reasonable revenue projections, underpinned by realistic macroeconomic assumptions; Despite a notable deviation in FY2019/20, I was assured that the revenue projections underpinned macroeconomic assumptions. were realistic by Estimates of expenditure must be based on reasonable revenue projections; Public deficit to be maintained at a level consistent with other macroeconomic objectives; Risk mitigating strategies were not proffered in all cases. The FRS failed to identify risks related to invocation of force majeure clauses of the PPPs. Risks must be identified and evaluated, to enable cost-effective and appropriate risk mitigating measures

b) the reasons given, pursuant to subsection (5)(d)(ii) are reasonable having regard to the circumstances; The Fiscal Management Strategy (FMS) stated that Central Government performance for April December 2020 was assessed relative to the First Supplementary Estimates given that it incorporated the expected impact of the COVID-19 pandemic Greater clarity was required for the better than budgeted Income & Profits tax receipts. The Ministry confirmed the higher Tax collected related to payments by the private sector. The reasons given for lower than budgeted Production & Consumption and International Trade tax receipts were reasonable based on the lower GDP growth The FAA Act requires an assessment relative to Original Budget, but the non-conformity was reasonable given the circumstances of the pandemic.

c) pursuant to regulations made under Section 50 (1), there are public bodies that do not form part of the specified public sector that were part thereof in the preceding fiscal year. The Minister of Finance s Responsibility The Auditor General s Responsibility The FAA Act requires the Minister, no later than August 31, in every third year, to provide a list of public bodies the Auditor General (AG) should consider for certification. However, based on the Minister s notification on October 18, 2019, no public body met the condition for consideration.

d) a public private partnership involves only minimal contingent liabilities The Ministry formally advised that Force Majeure claims have been made by two of the Concessionaires. Ministry of Finance Response The report highlighted that 3 of 5 existing concessionaires had indicated their intention to invoke force majeure clauses that are provided for in the concession agreement respective concession agreements. FPP FY2020/21 Interim Report Given that the FPP FY2021/22 made no mention of any invocation of force majeure clauses, I sought an update from the Ministry of Finance. Fiscal Policy Paper 2021/22 The Cabinet has already approved some of the claims made by the concessionaires and negotiations are underway to facilitate further relief. Information received from the Ministry was that that a fourth concessionaire had indicated its intention to invoke force majeure clause. Further, that invoking the force majeure clauses could result in the Government granting relief to the concessionaires for obligations under the contracts and may also result in compensation events for the Government.

The Auditor Generals Recommendations Given suspension of the Fiscal Rules provision and possible realization of contingent liability risks associated with 4 PPPs, provision of medium-term projections to FY2027/28 would have provided more assurance of Government s commitment to meeting the fiscal targets. The GOJ has indicated its commitment to make the necessary adjustments over the medium-term to return to the trajectory that will achieve the legislative debt target by FY2027/28.

Performance against Fiscal Framework The GOJ tabled an amendment to the FAA Act in May 2020 to extend the legislated Debt to GDP target of 60 per cent or below from March 2026 to March 2028 and passed a resolution in Parliament for the suspension of fiscal rules, given the expected adverse economic impact of the COVID-19 pandemic. The fiscal targets were revised in the First Supplementary Estimates, on account of expected significant revenue shortfall and re- prioritisation of expenditure. The Second and Third Supplementary Estimates were tabled in October 2020 and January 2021, respectively due to the continued impact of the COVID-19 pandemic. I noted that based on the suspension of the Fiscal Rules in May 2020, no reference was made to a suspension of the legislated Wage to GDP target. Implications for Wage /GDP Fiscal Rule Suspension Supplementary Estimates Projections presented in the FPP, the Wage to GDP ratio is estimated at 10.7 per cent at end FY2020/21, declining to 9.9 per cent at end FY2022/23 and remaining flat to FY2024/25. No forecasts were provided beyond FY2024/25.

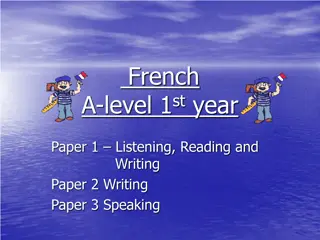

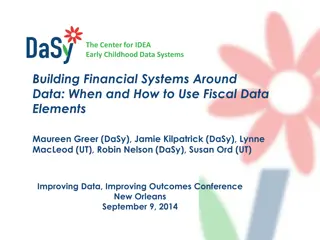

Primary and Fiscal Balance Forecast For FY2021/22, the Primary and Fiscal Balance targets as a per cent of GDP are estimated to be 6.1 and 0.3, respectively, reflecting increases of 3.1 and 0.7 percentage points relative to FY2020/21. However, if the adverse impact of COVID-19 persists into the new fiscal year, a subsequent downward revision might be necessary consistent with prudent fiscal management. Primary Balance (% of GDP) Fiscal Balance (% of GDP) 9 8.3 4 8 3.3 3 6.4 6.3 1.7 7 6.4 2 0.7 1.7 6 1 5 0.3 6.1 4.7 0 5.6 5.1 3.1 4 -0.4 -1 0.3 0.3 0.3 3 -2 2 -3 3.0 -3.5 -4 1 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 0 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2021 Feb FPP 2020 IFPP 2021 Feb FPP 2020 IFPP

Public Debt: GDP Ratio The Debt to GDP ratio is projected to decline to 100.7 per cent for FY2021/22 and thereafter, steadily to 76.8 per cent by FY2024/25. However, in a context where the achievement of the 60 per cent of GDP target was extended to FY2027/28, we would have expected an extension of the projections in line with the path towards the revised legislated target; given that improvement in the forecasted Debt to GDP over the medium-term also hinges on sustained global economic recovery, based on containment of the COVID 19 pandemic. Debt/GDP Trend 145.0 134.0 135.0 125.0 110.1 115.0 100.7 105.0 94.4 95.0 102.9 94.8 85.0 76.8 75.0 69.1 65.0 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2021 Feb FPP 2020 Interim FPP