Macroeconomic Policy Tools: Monetary and Fiscal Policy in Short Run

This chapter delves into the IS-LM model to illustrate the functioning of monetary and fiscal policies in influencing economic growth. It explains how these policies impact output, interest rates, and inflation rates in a closed economy in the short run. Monetary policy mainly operates through open market operations conducted by the Central Bank, while fiscal policy affects the goods market. The equilibrium between IS and LM curves dictates the economic conditions based on the government's policy choices.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

(GENERIC ELECTIVE) B.Com(Hon),B.A.(Hon) English, B.A.(Hon) History, BSc(Hon) Mathematics,2nd Semester INTRODUCTION TO MACROECONOMICS CHAPTER 4: THE CLOSED ECONOMY IN THE SHORT RUN. Topic: MONETARY AND FISCAL POLICY

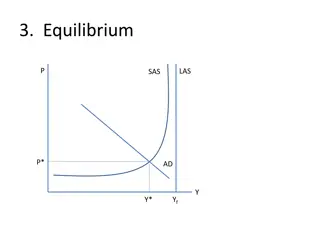

INTRODUCTION 2 In this chapter we use the IS-LM model, to show how monetary policy and fiscal policy work. The government of any country can use these macroeconomic policy tools to keep an economy growing growing at a reasonable rate of growth and at a low rate of inflation. However, fiscal policy has its initial impact in the goods market, and monetary policy has its initial impact mainly in the assets markets. But because the goods and assets markets are closely interconnected, both monetary and fiscal policies have effects on both the level of output and interest rates. The IS curve represents equilibrium in the goods market. The LM curve represents equilibrium in the money market. The intersection of the two curves determines output and interest rates in the short run, that is, for a given price level shows the future given below

3 Expansionary monetary policy moves the LM curve to the right, raising income and lowering interest rates. Contractionary monetary policy moves the LM curve to the left, lowering income and raising interest rates. Expansionary fiscal policy moves the IS curve to the right, raising both income and interest rates. Contractionary fiscal policy moves the IS curve to the left, lowering both income and interest rates.

Monetary Policy 4 The Central Bank conducts monetary policy mainly through open market operations, In an open market operation, the Central Bank Buys bonds( or sometimes other assets) in exchange for money, thus increasing the stock of money, or its seller bonds in exchange for money paid by the purchasers of the bonds, thus reducing the money stock. We take here the case of an open market purchase of bonds. The Fed pays for the bonds it buys with money that it can create. In this process, it increases the supply of money. Alternatively, the central bank sells bonds in exchange for money, thus reducing the stock of money.

5 The working of an open market operation is shown in figure FIGURE: MONETARY POLICY

6 The above figure shows graphically how an open market purchase works. The initial equilibrium at point E is on the initial LM schedule that corresponds to a real money supply, M? P. Now consider an open market purchase by the Fed. This increases the nominal quantity of money and, given the price level, the real quantity of money. As a consequence, the LM schedule will shift to LM? . The new equilibrium will be at point E? , with a lower interest rate and a higher level of income. The equilibrium level of income rises because the open market purchase reduces the interest rate and thereby increases investment spending. The Figure you will be able to show that the steeper the LM schedule, the larger the change in income. If money demand is very sensitive to the interest rate (corresponding to a relatively flat LM curve), a given change in the money stock

7 By contrast, if the demand for money is not very sensitive to the interest rate (corresponding to a relatively steep LM curve), a given change in the money supply will cause a large change in the interest rate and have a big effect on investment demand. Similarly, if the demand for money is very sensitive to income, a given increase in the money stock can be absorbed with a relatively small change in income and the monetary multiplier will be smaller. THE TRANSMISSION MECHANISM Two steps in the transmission mechanism the process by which changes in monetary policy affect aggregate demand are essential. The first is that an increase in real balances generates a portfolio disequilibrium; that is, at the prevailing interest rate and level of income, people are holding more money than they want. The second stage of the transmission process occurs when the change in interest rates affects aggregate demand. (1) Change in real money syppply. Adjustment lead to a change in asset priced interest rate (2) - Portfolio (3) Spending adjusts to changes in interest rate (4) Output adjusts to the change in aggregate demand.

8 The above Table - provides a summary of the stages in the transmission mechanism. There are two critical links between the change in real balances (i.e., the real money stock) and the ultimate effect on income. First, the change in real balances, by bringing about port- folio disequilibrium, must lead to a change in interest rates. Second, that change in interest rates must change aggregate demand. Through these two linkages, changes in the real money stock affect the level of output in the economy. THE LIQUIDITY TRAP As we have to discuss earlier, the effects of monetary policy on the economy, two extreme cases have received much attention. The first is the liquidity trap, a situation in which the public is prepared, at a given interest rate, to hold whatever amount of money is supplied. This implies that the LM curve is horizontal and that changes in the quantity of money do not shift it. In the liquidity trap, monetary policy is powerless to affect the interest rate. The liquidity trap has been a useful expositional device mostly for understanding the consequences of a relatively flat LM curve, with little immediate relevance to policymakers. The following diagram shows the liquidity trap. FIGURE LIQUIDITY TRAP

THE CLASSICAL CASE 9 The polar opposite of the horizontal LM curve which implies that monetary policy cannot affect the level of income is the vertical LM curve. The LM curve is vertical when the demand for money is entirely unresponsive to the interest rate. Recall that the LM curve is described by _M ? =kY- ? hi P If h is zero, then corresponding to a given real money supply, M? LM curve is vertical at that level of income. P, there is a unique level of income, which implies that the The vertical LM curve is called the classical case. Rewriting equation (1), with h set equal to zero and with P moved to the right- hand side, we obtain M ? =k(P ? Y ) We see that the classical case implies that nominal GDP, P ? quantity theory of money, which argues that the level of nominal income is determined solely by the quantity of money. Y, depends only on the quantity of money. This is the classical When the LM curve is vertical, a given change in the quantity of money has a maximal effect on the level of income. Check this by moving a vertical LM curve to the right and comparing the resultant change in income with the change produced by a similar horizontal shift of a non vertical LM curve. By drawing a vertical LM curve, you can also see that shifts in the IS curve do not affect the level of income when the LM curve is vertical. Thus, when the LM curve is vertical, monetary policy has a minimal effect on the level of income, and fiscal policy has no effect on Income.

FISCAL POLICY AND CROWDING OUT 10 This section shows how changes in fiscal policy shift the IS curve, the curve that describes equilibrium in the goods market. Recall that the IS curve slopes downward because a decrease in the interest rate increases investment spending, thereby increasing aggregate demand and the level of output at which the goods market is in equilibrium. Specifically, a fiscal expan- sion shifts the IS curve to the right. The equation of the IS curve, derived in Chapter 10, is repeated here for convenience: =. G (A ? Y? ? bi) ? ? G = 1 ? / 1-c (1 -? t) Note that G, the level of government spending, is a component of autonomous spending, A, in equation (3). The income tax rate, t, is part of the multiplier.

AN INCREASE IN GOVERNMENT SPENDING 11 In this slide shows fiscal expansion raises equilibrium income and the interest rate. At unchanged interest rates, higher levels of government spending increase the level of aggregate demand. To meet the increased demand for goods, output must rise. The following diagram express how increase in government spending to rise the equilibrium income and interest rate. ** Output per unit of employed labour

12 we show the effect of a shift in the IS schedule. At each level of the interest rate, equilibrium income must rise by ? if government spending rises by 100 and the multiplier is 2, equilibrium income must increase by 200 at each level of the interest rate. Thus the IS schedule shifts to the right by 200. G times the increase in government spending. For example, If the economy is initially in equilibrium at point E and government spending rises by 100, we would move to point E ? if the interest rate stayed constant. At E ? is in equilibrium in that planned spending equals output. But the money market is no longer in equilibrium. Income has increased, and therefore the quantity of money demanded is higher. Because there is an excess demand for real balances, the interest rate rises. Firms planned investment spending declines at higher interest rates, and thus aggregate demand falls off. the goods market What is the complete adjustment, taking into account the expansionary effect of higher government spending and the dampening effects of the higher interest rate on private spending? Figure 11-6 shows that only at point E? clear. Only at point E? is planned spending equal to income and, at the same time, the quantity of real balances demanded equal to the given real money stock. Point E? therefore the new equilibrium point. do both the goods and money markets is

CROWDING OUT 13 Crowding out occurs when expansionary fiscal policy causes interest rates to rise, thereby reducing private spending, particularly Investment. In the context of crowding out , we have to seen that diagram shows comparing E? to the initial equilibrium at E, we see that increased government spending raises both income and the interest rate. But another important comparison is between points E? and E? , the equilibrium in the goods market at unchanged interest rates. Point E? corresponds to the equilibrium we studied in previous class when we neglected the impact of interest rates on the economy. In comparing E? and E? , it becomes clear that the adjustment of interest rates and their impact on aggregate demand dampen the expansionary effect of increased government spending Income, instead of

14 What factors determine how much crowding out takes place? In other words, what determines the extent to which interest rate adjustments dampen the output expansion induced by increased government spending? By drawing for yourself different IS and LM schedules, you will be able to show the following: Income increases more, and interest rates increase less, the flatter the LM schedule. Income increases less, and interest rates increase less, the flatter the IS schedule. Income and interest rates increase more the larger the multiplier, ? and larger the horizontal shift of the IS schedule. G, thus the

15 THE CLASSICAL CASE AND CROWDING OUT If the LM curve is vertical, an increase in government spending has no effect on the equilibrium level of income and increases only the interest rate. This case, already noted when we discussed monetary policy, is shown in Figure FIGURE: CROWDING OUT

16 The third point is that with unemployment, and thus a possibility for output to expand, interest rates need not rise at all when government spending rises, and there need not be any crowding out. Monetary policy is accommodating when, in the course of a fiscal expansion, the money supply is increased in order to prevent interest rates from increasing. Monetary accommodation is also referred to as monetising budget deficits, meaning that the Central Bank prints money to buy the bonds with which the government pays for its deficit.

THE COMPOSITION OF OUTPUT AND THE POLICY MIX 17 The effects of expansionary monetary and fiscal policy on output and the interest rate, provided the economy is not in a liquidity trap or in the classical case. Outside of these special cases, it is apparent that policymakers can, in practice, use either monetary or fiscal policy to affect the level of income. What difference does it make whether monetary or fiscal policy is used to control output? The choice between monetary and fiscal policies as tools of stabilization policy is an important and controversial topic. One basis for decision is the flexibility and speed with which these policies can be implemented and take effect. THE POLICY MIX The policy problem of reaching full-employment output, Y*, for an economy that is initially at point E, with unemployment. Should we choose a fiscal expansion, moving to point E1 with higher income and higher interest rates? Or should we choose a monetary expansion, leading to full employment with lower interest rates at point E2? Or should we pick a policy mix of fiscal expansion and accommodating monetary policy, leading to an intermediate position?

18 Reference: * Dornbusch ,R.,Fischer, S.,Starts,R. (2018). Macroeconomics, 13th edition, McGraw Hill Publication, Chapters 11.1 to 11.3(pp.249-271). Course Teacher Dr.D.Appala Naidu. *THANK YOU*