Insights into 2022 Holiday Retail Trends

Mastercard forecasts a 7.1% YoY increase in holiday retail sales, while Deloitte predicts a 4-6% rise. Consumer behavior is varied, with considerations for inflation, supply chain disruptions, and lessons from the 2021 holiday season influencing shopping trends. Profiling holiday shoppers reveals evolving preferences for in-store shopping over online services. Key insights suggest a complex landscape for retailers to navigate this holiday season.

- Holiday retail trends

- Consumer behavior

- Inflation impact

- Supply chain disruptions

- Shopping preferences

Uploaded on Sep 24, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

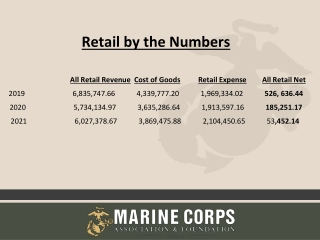

Latest Forecasts Mastercard SpendingPulse s latest forecast is a 7.1% YOY increase for total holiday retail sales, excluding automotive, from November 1 to December 24, 2022, and slightly more (+7.3% YOY) for the extended holiday season from October 11 to December 24th. Mastercard s aggressive predictions are based on the 11.7% YOY and 20.4% (from 2019) increases in total US retail sales during August 2022. August e-commerce sales increased 8.9% YOY and 100.2% compared to 2019. Deloitte s forecast is more conservative at a 4% to 6% increase (a total of $1.45 to $1.47 trillion), compared to a 15.1% increase for 2021, however, its forecast period is November through January.

Mark the Calendar In a time of economic uncertainty, conflicting consumer data about when they will start their holiday shopping is understandable. While Macy s executives expect more people to shop early (and earlier), Best Buy executives think they will wait until later. Similarly, a July 2022 survey from 4over revealed 12% of respondents said they had already started their shopping, but 44% would wait until November/December. An August 2022 Jungle Scout survey found 58% of consumers would start before the end of October. A late August 2022 survey from Samba TV and HarrisX reported 20% had started their holiday shopping before Labor Day, 25% of parents before September and more than half of all shoppers before Thanksgiving.

Inflation, Supply-Chain and Inventory Updates Inflation and concerns about product availability are causing disparities about when consumers will start shopping for the holidays. Some want to spend early before inflation increases prices while others want to wait for better deals or late-season discounts. Although inflation may ease by the holidays, a late August 2022 survey from Tinuiti found 50% of respondents said they will shop more stores because of the impact of inflation, 36% plan to buy different types of gifts and 32% plan to buy fewer gifts. Two positive signs are core capital goods orders unexpectedly increased by 1.3% during August, which means businesses are investing in equipment, and the Conference Board reported its Consumer Confidence Index increased to 108.0 from 103.6 during August.

More Lessons from 2021 for 2022 As has been the case since 2015, Black Friday sales continued to decrease during the 2021 holiday shopping season, and by 31 points. More US consumers are shopping throughout November, in which sales increased 10% from 2020 to 2021. Although more US consumers are spreading their holiday spending throughout November, data from Criteo shows the share of new shoppers reaches an apex on Black Friday while existing customers are more likely to shop during December. As the pandemic has waned, in-store shopping has increased in popularity and often drives online purchases. Criteo found consumers who visit a retailer s Website are almost twice as likely to buy at the store.

Profiling Holiday Shoppers According to Emodo s report, The 2022 Holiday Shopper Survey for Marketers, 65% of surveyed consumers who will spend more said they will shop more in stores, an 85% increase from the 2021 holiday shopping season. Consumers, therefore, said they are less likely to use order online/pick up in-store services at 28%, order online and use curbside services at 25% and order online for home delivery at 39%, which collectively is 14% less than 2021. Of the consumers responding to the Emodo survey, 80% will be looking for more affordable products, 77% are concerned about product availability and 75% are looking for more discounts than during previous holiday shopping seasons.

Targeting Multiple Audience Groups Although many Gen Zers don t have large incomes, a late- August 2022 survey from Samba TV and HarrisX revealed the average Gen Zers will spend $377 more than the average adult during the 2022 holiday shopping season or an average of $1,418. Millennials by contrast said they would spend $1,139 on average, 31% would do all or most of their shopping at a store compared to 22% doing all or most of it online. Latinx Americans will spend even more than Millennials, on average, at $1,392, or $351 more than the average all US adults. The vast majority (83%) said they will spend the same or more than last year and 46% said they will shop in stores on Black Friday.

New Holiday Shoppers Spending Plans According to the Emodo report cited on slide #6, more men are expected to spend more than women, or 53% and 47%, respectively, during the 2022 holiday shopping season while more women than men said they will spend the same at 59% and 41%, respectively. The July 2022 survey from 4over found 53% of respondents said they would be paying for their holiday shopping with a credit card, followed by points/rewards programs at 35%, with savings at 29%, existing gift cards at 24% and buy-now, pay-later services at 15%. Of those same respondents, 43% were planning to reduce spending for other products and services to have the means to play for their holiday shopping, with restaurant dining first at 36% and various activities (movies, concerts, etc.) second at 27%.

Gift-Giving Trends In its 2022 Peak Consumer Survey, Radial reports 61% of respondents were planning to change their gift-giving. While 20% said they won t be changing how they will spend 15% said they would buy fewer gifts and 8% wouldn t buy any gifts. The 4over survey revealed a similar pattern with 22% planning to buy gifts for fewer people; however, the top five gift recipients would be parents at 67%, partner/spouse at 56%, siblings at 48%, children at 45% and friends at 37%. The results of the Samba TV/HarrisX survey were different than the 4over results, as the average spending for children was first at $356, followed by significant other at $193, me at $183, extended family at $117, parents at $108 and friends at $49.

Engaging with Santa via E-Commerce Holiday shopping e-commerce forecasts from Mastercard and Deloitte are the opposite of what they predict for total retail sales as cited on slide #2. Mastercard s forecast is more conservative at a 4.2% YOY increase while Deloitte s forecast is a 14.3% YOY increase. The Samba TV/HarrisX survey shows relatively small percentages of target audiences will be doing most or all of their shopping online: Gen Z at 17%, Millennials at 22%, parents at 23% and Latinx Americans at 15%. The Tinuiti Holiday Shopper Study found 70% of survey respondents said they will shop for gifts online via a smartphone, with desktop/laptop second at 55%, tablet third at 31% and a voice-enabled device at 8%.

More E-Commerce Holiday Shopping Insights Research from Future Publishing revealed almost all (94%) of survey respondents said they would be searching for online content from brand and retail experts to find the lowest prices, with 56% looking for the best deals and 40% relying on expert product reviews. Because consumers are very aware of supply-chain and inventory issues, 42% told Coveo for its 2022 Holiday Shopping Report that they will abandon any site with limited shipping options or that doesn t offer BOPIS services (buy online, pick up in-store). In its 2022 Holiday E-Commerce Sales Calendar, NetElixir recommends November 16th through the 19th, November 30th through December 3rd and December 16th and 17th as the prime e-commerce days with low competitive intensity.

Minimizing Shopping Cart Abandonment Research from a June/July 2022 YouGov survey for Bolt found 70% of online shopping carts are abandoned which equates to $1 trillion in lost sales. Retailers can minimize this effect during the holiday shopping season with details from the survey. The largest percentage (43%) said free shipping and free shipping for returns was the most important factor in a positive online shopping experience, with knowing the transaction is secure a close second at 35%. Receiving an email reminder with a discount code at 54% is the primary method for brands and retailers to persuade consumers to purchase the items in their abandoned shopping carts.

Advertising Strategies Local holiday retailers will have to be nimble this season: prepared to engage with and attract the increasing number of early shoppers and have ad campaigns and deals and special offers in place for the large percentage who wait until December. Share the contents of the table at the bottom of page 1 of the Profiler to help local advertisers to plan their holiday campaigns and special offers according to the projected busiest shopping days of the season. Consider a special weekend promotion targeting Baby Boomers to bring their Gen Z grandchildren with them for a multi-generational, in-store shopping experience. Display and/or offer deals on gifts for other family members.

New Media Strategies Use the table at the bottom of page 4 of the Profiler to create separate social media posts, preferably short videos, to highlight the store s gift offerings in each of the categories. Include limited-time special offers in each post, either a digital coupon or QR code. Retailers with an e-commerce site should emphasize their holiday shipping process and whether they offer BOPIS services, as a large percentage of shoppers will abandon orders if BOPIS services are unavailable. Using social media to target holiday shoppers requires a multi-platform strategy. Facebook has the best average as the source for holiday shopping inspiration among all adults, but a presence on TikTok, YouTube and or Instagram is necessary to reach Gen Zers.