Circular Flow Of Income Two Sector Model

The Two Sector Model of an economy divided into Household and Production sectors, their interactions, income flows, and the role of savings and capital market in economic activities. Understand factors of production, factor payments, savings, and investments in the circular flow of income.

2 views • 11 slides

Urban Mining and CDW Circular Economy Cost-Benefit Analysis

This case study focuses on comparing the cost and greenhouse gas emissions savings of local processing and reuse of Construction and Demolition Waste (CDW) materials versus sending them to landfills. By developing a prototype cost and GHG savings calculator, the aim is to showcase the potential of e

0 views • 14 slides

Tradeoffs Between Water Savings and GHG Emissions in Irrigated Agriculture

This study examines the tradeoffs between water savings, economic impact, and greenhouse gas emissions resulting from technological changes in the irrigation industry. Key objectives include estimating water savings for different crops, quantifying GHG emissions from new irrigation technologies, and

0 views • 24 slides

Maximize Tax Savings and Profitable Returns with Section 12BA Renewable Asset Portfolio

Discover how to preserve your earnings through smart tax savings and harvest profitable returns from solar investments with the innovative Futureneers Energy Team. Learn about the main differences between 12J and 12B tax deductions, investment structures, and the unique approach taken by securing So

0 views • 15 slides

Ohio's New Tax System Overview May 2023

Ohio is launching a new tax system in May 2023 aiming to improve taxpayer service, modernize technical systems, enhance user experience, and ensure secure taxpayer information. The project scope includes Individual Income Tax and School District Tax, with key dates set for testing in August 2023 and

5 views • 11 slides

Enhancing Tax Compliance: Factors, Audit, and Investigation" (56 characters)

Exploring factors influencing taxpayer behavior towards tax compliance, this study delves into the impact of tax audit and investigation procedures on adherence to tax laws at both corporate and individual levels. Previous research gaps are identified and addressed to provide a comprehensive underst

1 views • 20 slides

Budget-Friendly Brilliance_ The Value of Kitchen Cabinet Refacing

For a kitchen makeover, you don\u2019t always need to break the bank! There is an effective and budget-friendly option called kitchen cabinet refacing! This budget-friendly option offers a brilliant solution to refresh your kitchen without draining your savings. Read the following points to understa

5 views • 6 slides

Al Masraf Retail Savings Account: Grow Your Savings Securely

Are you looking for a safe and secure place to save your money and watch it grow over time? Look no further than Al Masraf's Retail Savings Account! This account is a perfect solution for individuals in the UAE who prioritize saving and want to earn competitive interest rates. \u200b

1 views • 6 slides

Taxpayer Information for Direct Fee Payments - Guidelines and Forms

Guidelines and procedures for providing taxpayer information to the IRS for direct fee payments made to representatives of claimants for Social Security and Supplemental Security Income benefits. Learn how to register, complete required forms, and request direct payment online. Find information on e

0 views • 30 slides

Understanding Vesting in the Thrift Savings Plan (TSP) and Retirement Saving Importance

Explore the concept of vesting in the Thrift Savings Plan, learn why saving for retirement is crucial, and discover the benefits of early investing. Delve into the Blended Retirement System components and reasons to prioritize retirement savings for financial security.

0 views • 23 slides

Challenges of Kenyan Taxation System and Solutions

The Kenyan taxation system faces complexities in terms of the ITax system, low taxpayer acceptance, capacity issues at the Kenya Revenue Authority (KRA), and lack of political will. Simplifying the filing process, increasing taxpayer education on the importance of taxes, enhancing KRA capacity, and

1 views • 13 slides

Legal Professional Privilege in the Protection of Taxpayer Rights: South African Perspective

Legal professional privilege plays a crucial role in safeguarding taxpayer rights in South Africa. This privilege ensures that communications between a legal advisor and client remain confidential, promoting fairness in litigation and enabling a proper functioning adversarial system of justice. The

0 views • 16 slides

Understanding Keynesian Consumption and Savings Functions in Macroeconomics

Keynesian consumption function details the relationship between total consumption and gross national income. It emphasizes the stability of aggregate consumption and the marginal propensity to consume. Similarly, Keynesian savings function illustrates the link between savings and national income, hi

0 views • 6 slides

Enhancing Taxpayer Education for Voluntary Compliance

Liberian taxes operate on a self-assessment system, where taxpayers must assess, submit returns, and pay taxes. Taxpayer education is crucial in promoting voluntary compliance. The Liberia Revenue Authority's Taxpayer Service Division conducts extensive educational programs covering tax types, respo

0 views • 21 slides

Understanding Saving and Investing Money

This chapter delves into the importance of saving money for various purposes such as future expenditures, emergencies, and retirement. It also covers factors to consider when saving, including risk, reward, liquidity, and taxation implications. Furthermore, it discusses the safety of savings, the co

0 views • 25 slides

Family Assets for Independence in Minnesota (FAIM) Program Overview

The Family Assets for Independence in Minnesota (FAIM) program helps individuals achieve financial independence through a structured process involving eligibility criteria, opening a savings account, financial coaching, obtaining assets, and closing the account. Eligibility requirements include inco

0 views • 25 slides

Evolution of Low Income Taxpayer Clinics (LITC) Program

The Low Income Taxpayer Clinics (LITC) Program has evolved over the years to ensure fairness and integrity in the tax system for low-income taxpayers and those who speak English as a second language. Initially housed in Wage and Investment, the program now reports to the National Taxpayer Advocate.

0 views • 10 slides

Understanding Keynesian Consumption and Savings Functions in Macroeconomics

Keynesian Consumption Function relates total consumption to national income, with stable characteristics like MPC and APC. Savings Function shows the relationship between savings and income, highlighting the Marginal Propensity to Save and Average Propensity to Save. Both functions are essential con

0 views • 6 slides

Michigan OIG: Cost Avoidance and Investigation Types Overview

Michigan's Office of Inspector General (OIG) within the Department of Health & Human Services conducts investigations to ensure data integrity, targeting areas like cost avoidance, fraud, and program violations in public assistance programs. The OIG's efforts have resulted in significant savings and

0 views • 12 slides

Understanding the Enforceability of Taxpayer Bill of Rights (TBOR)

Explore the enforceability of the Taxpayer Bill of Rights (TBOR) as outlined in IRC 7803(a)(3), delving into its history, statutory interpretation, the question of remedy, and enforcement issues. Discover the evolution of TBOR, statutory text, and challenges surrounding its enforcement.

0 views • 21 slides

Financial Management Strategies for Budget Revisions and Vacancy Savings

Explore effective financial management practices such as budget revisions, vacancy savings, one-time spending, and tracking sweep activities. Understand the process of sweeping salaries, managing departing employees vs. new hires, and increasing allocations mid-year. Learn how to handle budget chang

0 views • 12 slides

Energy Efficiency Achievements and Labeling Program by Bureau of Energy Efficiency, India

The Standards & Labeling (S&L) program, initiated by the Bureau of Energy Efficiency in India, aims to reduce energy consumption of appliances without compromising on service levels. It focuses on creating consumer awareness, promoting informed decision-making, and monitoring energy savings. Key ach

0 views • 11 slides

Florida Expressway Authority Cost Savings Study Overview

This presentation outlines the Florida Expressway Authority Cost Savings Study conducted by Cambridge Systematics and the University of South Florida. The study aims to analyze opportunities for cost savings and efficiency improvements among Florida Expressway Authorities by sharing resources. Key f

1 views • 40 slides

Performance Indicators for Centralized Public Procurement

The presentation by Gian Luigi Albano, Ph.D., outlines performance indicators for centralized public procurement, including economic effects of demand aggregation, value for money, inclusion of SMEs, market dynamics, and transaction costs. It also discusses relevant performance indicators such as sa

0 views • 26 slides

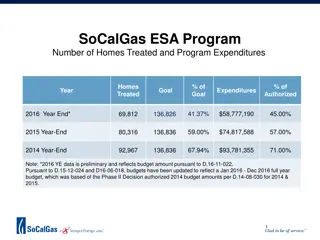

SoCalGas Energy Savings Assistance Program Overview

SoCalGas Energy Savings Assistance program aims to treat homes in Southern California, with significant progress made in recent years. The program focuses on achieving energy savings goals, with intensified efforts in designated areas. Positive developments include paperless invoicing and mobile pil

0 views • 16 slides

National Fuels Supplier Engagement Overview

National Fuels Supplier Engagement provides commercial services to the public sector, saving money for the taxpayer by managing procurement activities for common goods and services. Crown Commercial Service (CCS) works with a vast network of customer organizations and suppliers, aiming to achieve va

0 views • 13 slides

Understanding Global Imbalances and Chinese Savings

This content discusses the importance of understanding global imbalances and Chinese savings, analyzing data on current account balances, national income accounting, international exchanges, and balance of payments. It covers the concept of global imbalances, the ways in which national income is spe

0 views • 45 slides

The Integral Role of Sustainability in Airport Capacity-Enhancing Projects

Sustainability plays a crucial role in airport capacity enhancement by providing numerous benefits such as cost savings, good relations with neighbors, efficient operations, employee satisfaction, and balancing competing interests. By integrating sustainability into projects like new runways, termin

0 views • 10 slides

Reliance Nippon Life Fixed Savings Plan - Key Benefits and Coverage Details

The Reliance Nippon Life Fixed Savings Plan is a non-linked, non-participating individual savings life insurance plan offering survival benefits, maturity benefits, and death benefits. Policyholders can benefit from fixed regular additions, guaranteed sum assured on maturity, and protection for thei

0 views • 14 slides

Understanding TABOR: Taxpayer's Bill of Rights Overview

The Taxpayer's Bill of Rights (TABOR) is a crucial constitutional amendment in Colorado that limits government spending and empowers citizens to vote on expenditure increases. TABOR aims to secure individual freedoms and prevent excessive government control through financial accountability. This bri

0 views • 10 slides

Housing Health Cost Calculator (HHCC) by Linda Hibbs: Transforming Housing for Health Benefits

Utilizing the Housing Health Cost Calculator (HHCC) purchased from BRE, Linda Hibbs, a Private Sector Housing Manager in Tonbridge & Malling B.C., measures cost savings to the NHS and wider society. The calculator focuses on hazards such as excess cold, falling on stairs, damp and mold growth, fire,

0 views • 6 slides

Cost Savings in Postoperative Pain Management with NOL-Guided Anesthesia

Acute postoperative pain is a significant issue globally, with high prevalence rates and potential long-term consequences. This economic assessment explores cost savings associated with using NOL-guided anesthesia to optimize postoperative pain treatment. By categorizing postoperative pain scores an

0 views • 4 slides

Understanding Guaranteed Energy, Water, and Wastewater Savings Projects

Guaranteed Energy Savings Projects (GESPs) involve modifying existing facilities for energy savings, with goals to save money or make money. Agencies may not know the full scope when advertising for Energy Service Company (ESCO) services. These projects offer various options and intertwine technical

0 views • 40 slides

Financial Freedom Journey: July 2023 Savings Month

Explore how to better manage your finances and work towards financial freedom in July 2023. Join us on a journey to reduce debt, increase savings, and make smarter financial decisions. Let's tackle income, debt, living expenses, savings, investments, insurance, and retirement together with Liberty G

0 views • 6 slides

Morgan National Corporation Group RRSP Wealth Enhancement Programs

Presented are the group retirement savings plans offered by Morgan National Corporation. These include Group RRSP, Deferred Profit Sharing Plan (DPSP), and Defined Contribution Registered Pension Plan. The benefits of participating in a Group RRSP include immediate tax savings, tax-free compounding,

0 views • 27 slides

Coin Box Intervention for Health Savings in Rural West Bengal

Healthcare expenditure is a leading cause of poverty in India, impacting millions of households. With limited insurance coverage, commitment-based savings products show promise for low-income groups. A randomized experiment in rural West Bengal implemented a Coin Box intervention offering safe savin

0 views • 12 slides

Understanding Income Taxes and Contributions in Canada

This content provides an overview of income taxes and contributions in Canada, covering topics such as tax facts, tax basics, taxpayer rights and responsibilities, types of taxes, government revenues, and key messages for Canadian taxpayers. It emphasizes the importance of filing tax returns accurat

0 views • 43 slides

Energy Efficiency Savings and Practices in Various Appliances

Explore energy efficiency savings and practices in various household appliances such as microwaves, washers, televisions, dishwashers, dryers, and refrigerators. The data showcases annual and lifetime cost savings for each appliance, highlighting the potential for significant savings over time. Addi

0 views • 10 slides

Employee Benefits and Cost Savings Analysis for Preschool Programs

Explore the employee discounts and cost savings associated with preschool programs in the community, including details on tuition rates, employee savings, and neighboring district discounts. Gain insights into the impact on employee finances and overall program costs.

0 views • 17 slides

Energy Savings Assistance Program Progress Report October 2016

The progress report highlights the activities and achievements of the Energy Savings Assistance Program in Aliso Canyon up to September 2016. It includes information on homes treated, savings achieved, expenditures, rule suspensions, program delivery, technology enhancements, and progress towards en

0 views • 10 slides